The Reserve Bank is anticipating a "significant work programme" over several years to implement the new prudential framework for deposit takers once the Deposit Takers Bill, currently before Parliament, is passed.

The Bill will create a single regulatory regime for all banks and non-bank deposit takers (NBDTs) and also introduces a Depositor Compensation Scheme that will protect up to $100,000 per depositor, per institution in the event of a failure. (There's more detail here on deposit insurance in our Of Interest podcast).

In its Statement of Intent 2022-26 released on Thursday the RBNZ said it would begin "building our capability" for the implementation of the Bill from 2023.

(Separately, the RBNZ also issued a Statement of Performance Intentions, which is a new requirement under the Reserve Bank of New Zealand Act 2021).

"The Depositor Compensation Scheme will be prioritised ahead of the remainder of the Bill coming into effect and is expected to be operational, at a basic level, in 2023-24," the RBNZ said.

"We are also exploring the expected significant resources required to establish and operate a depositor compensation scheme for New Zealand." Here's details on what the scheme will involve.

The Bill was introduced to Parliament on 22 September 2022, and is expected to come into force after receiving Royal Assent in 2023.

"The reforms will provide us with new enforcement tools to help us manage emerging issues, and an enhanced crisis-management framework to respond effectively to any failures and minimise the impacts on the financial system, the economy and society," the RBNZ said.

After the Deposit Takers Bill comes into force, there will be a transition period to allow both the Reserve Bank and regulated entities time to adapt to the new regime.

"A significant work programme over several years will be required to implement the new prudential framework for deposit takers."

The RBNZ says the "parameters" of the deposit insurance scheme may evolve during the parliamentary process and will also be shaped by regulations that will clarify important aspects such as the scope of protected deposits.

"During the passage of the Bill we will continue to consult our stakeholders on the implementation of the scheme, including the design of the regulations, how the levies to fund the Scheme should be applied and how the Scheme will operate in practice."

In discussing the role that monetary policy plays, the RBNZ says it "contributes to public welfare by reducing cyclical variations in employment and economic activity while maintaining price stability over the medium term. We use monetary policy to create the conditions to promote full employment and maintain the purchasing power of money into the future".

"We recognise the importance of understanding the effectiveness of monetary policy and the channels through which our policy actions affect the economy. Ongoing research in this area ensures our actions are targeted and contribute to economic wellbeing over time."

The RBNZ said the Covid-19 pandemic has affected the New Zealand economy "in unexpected ways", and this now calls for a renewed research focus on the best way to achieve economic objectives in a changed world.

"Supply constraints have altered inflation dynamics in the economy.

"Similarly, labour market behaviours have changed as workers and employers have adjusted to the effects of the pandemic. As a result, both inflation and maximum sustainable employment must now be understood in a new light.

"We are further developing our tools for estimating the impacts of additional monetary policy tools on our policy objectives, and the secondary impacts of these on income and wealth distribution and our balance sheet. We will publish this research in stages over the next 18 months."

On macroprudential policy, the RBNZ says this is used "to reduce the risk that the financial system will amplify a severe downturn in the real economy".

"Unsustainable booms in credit and asset prices can result in unfavourable situations that can create losses for banks, businesses and households, which can reduce the ability of banks to continue lending during a downturn.

"The main macroprudential tool applied to date is loan-to-value restrictions on residential mortgage lending. Following our recent consultation, we are now proceeding to design a framework for debt-to-income restrictions on mortgage lending as an additional macroprudential tool.

"We intend to have the framework finalised by late 2022, so that restrictions can be introduced by mid-2023 if required. Over the next 12 months, we will also undertake a review of our long-term framework for macroprudential policy, including a consideration of our decision-making process when making adjustments to macroprudential policy settings."

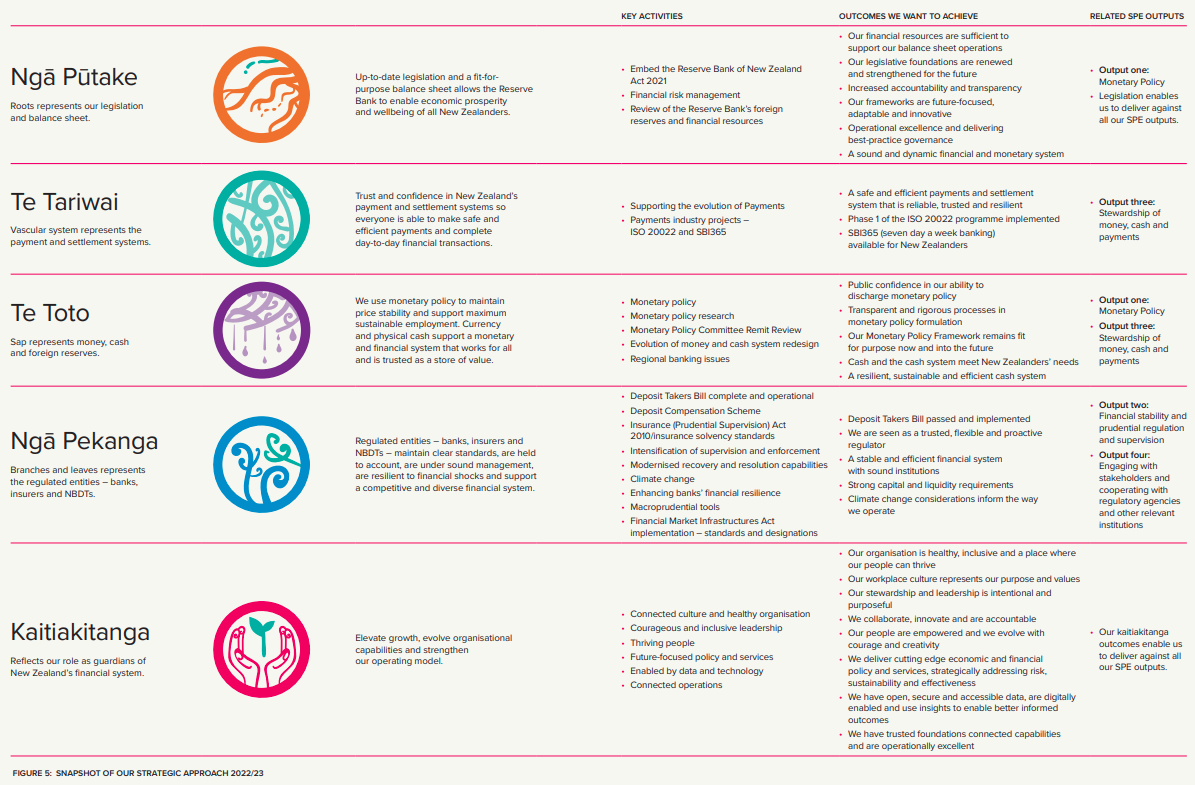

The Statement of Intent also included (page 40-41) the below summary of key activities:

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

25 Comments

So pretty useless for the current shitshow then?

Should have happened years ago.

if its going to take that long it should be inflation indexed,100k is already sounding inadequate.

All pretty pointless, and designed to give psychological comfort to those who lend their cash to a retail bank. If one ever goes down without forced rescue, then we have more problems that just getting our 'deposits' back.

An alternative answer is staring us in the face.

Simply allow any New Zealand citizen to open a simple call account (money in from a retail bank, money back out the same way - that's it) with the RBNZ. It's already guaranteed by us; our taxes. Allow the credit interest rates to be set at OCR minus a margin if you like. Just like the retail banks already have.

Anyone who wants more than what the RBNZ account offers can 'risk-up' and lend their money directly to a retail bank at whatever rate they offer. And all commercial activities - loans, current account - whatever, are still the domain of the retail banks.

Also, return credit creation to the RBNZ. If the banks can't attract enough deposits to lend out, and have to go to the RBNZ to borrow them from those who've put their guaranteed funds with the RBNZ, then that's how it should be. And the RBNZ determines how much it lends to them, and so control debt creation in line with economic conditions.

bw - your suggestion sounds a lot like KiwiBonds

It's not perfect, but it will at least be an improvement on the existing OBR framework (which would have caused multiple bank runs/financial chaos shortly after any bank got into trouble and people realized their cash in all the other banks elsewhere was vulnerable to any subsequent OBR action).

Amazing. Whatever happened to personal responsibility. And the private sector.

We now get government insurance for job loss, money back if banks fail, obviously ACC for accidents, no need for car insurance etc.

Not saying its all bad. But i suspect would be cheaper if left to the private sector with some minor help for needy. Plus adding more responsibility and workload to an already struggling rbnz that is already failing to achieve its most basic objective seems a bit crazy.

Best solution. Inform people thay banks and other investments go up down and can fail so please spread your investments in lots markets/banks/countries to minimise risk or u can lose it all. Job done.

lets hope they dont follow the ACC model for dealing with claims,I put a claim in on 20th sept and finally got a letter back today with a form to fill out and assurance they will have a decision by late january.

If banks aren’t secure or carry risk would depositors be inclined to put that cash elsewhere? Housing? And around goes the cycle….

Thats the point really. Housing isnt secure either, the kiwi dollar can fall, banks can go under. Pension fund carrybrisk

Educating people and letting them decide what to do is the point. I am not keen to pay deposit insurance ( via tax or a fee to banks) for people too lazy or ignorant to think or learn for themselves..

Government job is not to do our thinking and manage our risk.

It's all pretty daft, innit. For those worried, there's always cash in the mattress. For everyone else, risk of losing your deposit is just part of life. We ought to be responsible for ourselves, and the more the government takes that away from us, the more it erodes the principle elsewhere.

If one is being responsible for themselves by storing their savings in a bank, not chasing return on but simply expecting return of, why should losing their deposit be part of life? Are you saying they should be storing their savings in safer places like property or riskier ventures because they should be growing their money?

Humans have always been required to be responsible for themselves but they've always had to rely on other people and organisations at various stages of life and in certain circumstances too.

Should we remove education, health, fire and police services etc and tell everybody to be responsible for themselves?

Humans are herd/social/community animals and there needs to be a certain level of trust amongst and of other members, and some sense of responsibility to the community. Not everyone has been taught an appropriate or healthy sense of self responsibility.

The ram raiders are being responsible for themselves and taking risks. Is that what you want?

When you deposit the money in a bank, it is not technically your money anymore. The money is a banks liability and you become in essence an unsecured creditor to your bank. Its ok in the good times, but not so great in the bad.

That's supposedly why you get paid interest on the deposits I guess.

Yeah we know that, but most people don't. And most people don't have much choice but to deposit their money in a bank. Isn't there a saying something about "as safe as banks"? They've abused their power and been enabled by the institutions that are meant to regulate them, and now we pay the price. And the ignorant masses are none the wiser.

Apparently it's responsible to blow asset and debt bubbles, and those buying in are just as responsible, literally creating financial instability but putting in measures to negate this is taking away peoples responsibility. Doesn't make a lot of sense.

The Reserve Bank is anticipating a "significant work programme" over several years to implement the new prudential framework for deposit takers once the Deposit Takers Bill, currently before Parliament, is passed.

Banks don't take deposits and they never lend money. They are in the business of purchasing securities. When one gets a bank loan, the loan contract is a promissory note. The bank purchases that contract from the borrower. Now the bank owes the borrower money and it creates a record of the money it owes, which we call deposits - source

Good luck with your term deposits...

Reads like someone purged of any discipline to ever have one.

You are what your worth 🔽 minus what you owe🔼🔼

Why would it take so long?

They managed to pretty quick put tax payers on the hook for SCF etc.

Important rural folk in Canterbury were affected. They have powerful friends.

So are RBNZ back pedaling on increased capital ratios now that the deposit scheme will be put into place?

" "We are also exploring the expected significant resources required to establish and operate a depositor compensation scheme for New Zealand." "

Is that code for another 100 or so civil servants with at least 5 managers earning +175k and no subordinate earning less than 90k. How long to implement? Not less than 3 years I bet.

$200k is the new $100k. A paltry $100k isn't that much compared to house prices.

Maybe the banks should be offering some form of security as they expect/demand from borrowers? But we're not really lending to the banks are we, many are just looking for somewhere safe to store their surplus money. Maybe banks should go back to being storehouses or intermediaries and not creators of debt? Given our dependence on banks, maybe they shouldn't be 'free market', profit driven, private enterprises?

We do like to tinker around the edges though don't we, rather than face up to the likelihood that the original structure may no longer be fit for purpose.

Looks like DTIs mid 2023.

DTIs......timed nicely to lock in the low property prices of the currently unfurling property crash!

So will the DTI be 3.5 to 6x?

Looks more and more like the Irish property crash outcome and pearl clutching scorn of "never again" -as they enacted an Irish DTI of 3.5x.

This will be the best way to prevent property from again massively detaching from the average earning capacity. Good.

Nice work for some we know..... I imagine they will be investing most of the "fees" offshore in US Treasuries... I wonder how big this fund may get?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.