The 33 basis points jump in ASB's first half-year net interest margin came during a period where it has "been really difficult to manage margins," CEO Vittoria Shortt says.

On Wednesday ASB reported a 10% rise in interim net profit after tax to a record $840 million highlighted by the 33 basis points net interest margin rise to 2.52%.

The bank's results announcement was rich in rhetoric about "supporting" and "caring" for customers against the backdrop of rising interest rates, cost of living challenges and floods. Interest.co.nz asked Shortt whether there were any concerns ASB could look hypocritical talking about wanting to help customers, especially home loan borrowers, during tough times whilst recording a significant net interest margin increase.

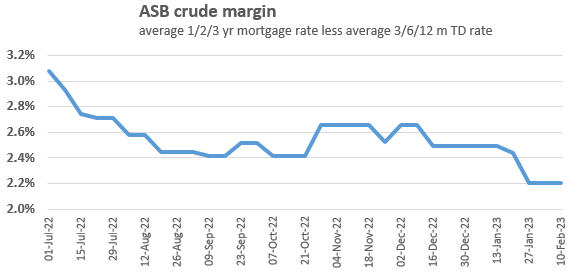

"We've just been through an extraordinary period where we've had a fast decline in OCR [Official Cash Rate] to record low interest rates followed by the fastest increase in OCR, and it has been really difficult to manage margins in that environment. Particularly when you would've seen swaps [swap rates] have moved around all over the show," Shortt said.

"We've got two impacting factors in our margin result. The first one is there has been an increase in deposit margin. We saw a decline in our deposit margin because interest rates were declining, and we've seen the opposite in our home lending where margins have been incredibly challenged. So really this six month period has been a function of those factors."

Shortt said ASB has been "thoughtful" with its pricing, "passing on pricing movements faster and in greater quantum" on term deposits than loans. She also highlighted cash backs for home loan borrowers and recent fee reductions with ASB scrapping monthly fees on everyday business and personal accounts.

The net interest margin is the difference between income generated from credit products like loans and mortgages, and payments made to deposit savers and others the bank borrows from.

In terms of ASB's home loan customers, Shortt noted about half are now on an interest rate above 5%, but it'll be about another 12 months until they're all on a rate above 5%. All the bank's carded, or advertised, fixed-term rates are currently well above 6% and its floating rate is 7.99%.

"There is still quite a delay in terms of monetary policy transmission. The upside of that is that it gives people time. So for those 50% of customers they have time to try and save some more or reduce some debt," Shortt said.

ASB said 0.22% of its home loans had been in arrears for at least 90 days as of December 31. That's up from 0.19% a year earlier, and 0.21% at June 30. Shortt said the bank's not seeing any material signs of shift or stress. Its mortgage serviceability test rate is now at 8.50% and ASB increased its total loan provisions by $49 million to $592 million.

ASB's December 2022 half-year net interest margin of 2.52% was up from 2.19% in the December 2021 half-year, and 2.26% in the June 2022 half-year.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

9 Comments

We're lucky to have a government so aggressively looking after the financial interests of New Zealanders.

Banks, supermarkets and building suppliers are getting torn into by the commerce commission along with our government. It will be a wonder if any of those businesses survive.

As long as they err on the side of profit.

Exactly, record result after record result. They never seem to misjudge on the side of the books which will reduce their profit, which is what you would expect to see 50% of the time if she was to be believed.

She is telling absolute porkies and everyone knows it.

its too easy for them.wednesday was a sunny day in whangarei,CBD was bustling and all the shops were busy,except ASB main branch was still closed and sandbagged.

How is it difficult? Just mark the rate to the current swap. Seriously, what a weak excuse for excess profit.

Mr. Market clearly expected CBA group to do far better, the share price took a real kicking yesterday.

Not sure why customers stay with them? KiwiSaver performance very poor versus others, customer service below par and there are better cheaper banking options elsewhere.

Same reason people stay on more expensive power and phone contracts than they should be on: ignorance of the shit deal they're getting and inertia, for the most part.

Shortt was the bank CEO who said FLP was not about the banks but an "investment in NZ." All the cynics roll their eyes.

If you can see through all the virtue signals, you will realize that it's all about their own self interest. What's more, if you look at the language Shortt uses, it's framed to suggest that banks are 'financial intermediaries.' Of course the wise people at interest dot co know that's the biggest con that most people have yet to properly understand.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.