Times are tough for some households and I sometimes forget that as I go about my day-to-day. I recently had a sobering reminder as I looked at a letter from our bank regarding part of our mortgage rolling off a fixed rate.

Almost $150,000 of our mortgage is moving off a two year fix of 2.29% to a floating rate of 7.99% – that’s a 5.70% jump or around $8,500 extra per year in interest. Now this isn’t a sob story from me – we are in the lucky minority of households with plenty of discretionary income – but it did stop and make me think about households who are much less fortunate.

A 26% lift in mortgage arrears

Recent data from Centrix highlights that more households are under financial distress. Rapidly escalating living costs, coupled with sharply higher mortgage rates, are squeezing many household budgets to the limit. And many people are getting behind in their debt repayments as a result.

The proportion of households behind on their mortgage repayments in March was up 26% on last year, with 19,300 accounts past due. Car loan arrears were also up 3.6% year-on-year, while 10.5% of all buy now, pay later loans were in arrears. Although loan arrears are still well below their Global Financial Crisis level, the sharp increase in households getting behind in debt repayments is a worry.

Stress test rates were too low

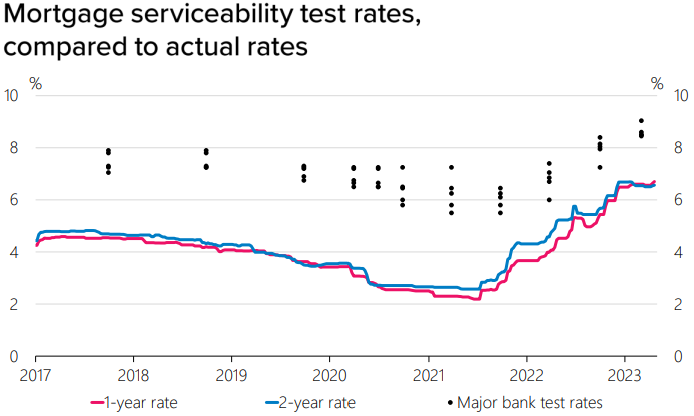

The Reserve Bank’s recent Financial Stability Report also pegged my interest. The report showed households who borrowed during the period of very low interest rates between late-2020 and late-2021 were stress-tested at rates below what they are today. This is a red flag that some borrowers with high debt-to-income levels will struggle to meet their repayment obligations as they reprice onto the higher rates, and makes the Centrix data no surprise.

What irks me about bank stress testing is banks were only stress testing borrowers in the 5% to 6% range a couple of years ago. These sorts of mortgage rates were above the 2% rates that were prevailing at the time, but still well below the 9% to 11% mortgage rates we saw not that many moons ago in 2008. In my opinion, banks’ narrow focus on short-term profitability has set some households up to fail. No one should have been borrowing if a lift in mortgage rates to a level seen in recent history was going to push them into arrears.

This economist stress-tested the s**t out of his family balance sheet

And this isn’t just a hindsight lecture. I am one of the households who have just been hit with a sharp lift in my mortgage rate, but that is water off a duck’s back. And the reason is that when we bought a new home two years ago, I personally ‘stress tested’ our household at scenarios many percent above where mortgages are currently and tailored our borrowing to suit.

At the time, our lending advisor probably thought I was a condescending kook. Well, I will happily wear that kook badge and only wish the Reserve Bank made more of a song and dance about realistic long-term stress testing of households. Such a move would be less about systemic financial stability and more about the financial wellbeing of individual households.

*Benje Patterson is an economist with a passion for New Zealand's regions. This article first ran here and is used with permission.

91 Comments

Your personal story of your mortgage rate increasing dramatically soon, is a perfect example of the long LAG that I keep warning about.

Yes the NZ economy is fine for now...but it will deteriorate. There is just no way that such large increases in interest expenses will not affect the whole of NZ

And when it's over (if we have any sense, we'll do the job once, and properly) the economy should be in a better position to face the future.

No one knows what that is, but being (overly) prepared is far better than sticking our heads back into in the speculative sand and assuming whatever the future holds will be the same as the (abnormal) recent past.

It won't affect savers, which after all are not such a small minority. Furthermore, current interest rates are just a normal level in historical terms, and actually they are still stimulatory in this current high inflation environment.

The NZ economy will deteriorate a bit in the short term, but then it will progressively adapt to this level of interest rates, which is just a normal level.

"It won't affect saver". Sure higher interest rates are better for savers, but that's shortsighted, the plunge in the economy will affect everyone, yourself included!!

That is the plan though Yvil.

We over splurged as a reserve bank, a govt and (some) individuals for too long. Inflation is now out of the box and to get it down again unemployment needs to rise and spending needs to fall.

Its a bust cycle after a prolonged boom cycle so it will likly be deeper and longer. but it is the natural order of economic events - and understanding that it happens is freely available to people who research economic history. To expect this time to be 'different' is like expecting the sun wont rise tommorow.

the key learning for people who feel pain - is to change career to something more recession proof, reduce their borrowing risk or change the profile and so on.. basically to prepare for it. there isnt another way out of this that to feel pain... some will feel more than others.

This is the era of savers - people like retirees who have savings but have been bled with no interest for 8years+, for people who saved instead of buying properties for the last few years, for kiwi's overseas who have cash and can come back and buy a house at a better price, for people who didnt invest in property for retirement, for renters who dont own a house and so on.. lots of potential winners

Total loans to households: 256 billion (https://www.rbnz.govt.nz/statistics/series/registered-banks/banks-asset…)

Total on deposit by households: 229 billion (https://www.rbnz.govt.nz/statistics/series/registered-banks/banks-liabi…)

Overall, particularly after tax, rising interest rates takes money out of households, but it's not quite as one way as you may think.

That includes non interest bearing deposits?

Yes, there is an overall breakdown of savings vs non savings accounts, but not on a household level. Even if every NZer had 5k on deposit in a non-interest bearing account (likely a big overestimate) it would only be 25 billion, around 10% of that amount, so I'd assume most is in interest bearing accounts.

Who has money sitting on deposit with the banks? Old people. Who spend less in the economy? Old people.

Who has the mortgage debt? Young people. Who are the main drivers of spending in a consumption based economy? Young people.

Do you see the potential problem?

Late 20s with multiple 6 figure TDs reporting in, where's the problem?

That would be exceptional for most late 20s people.

Your spending assumptions are at best unqualified, and at worst, way out of date

When interest rates rise, old people just keep spending at the same rate as they usually have little or no debt, whereas young people's wallets snap shut as they often have new mortgages and are paying a significant portion of each mortgage payment on interest. You also seem to be implying old people spend little. Not so. Many old people have significant wealth and they spend like drunken sailors.

First interest bearing deposit interest rate, especially after tax is fare less mortgage rates so even the amount deposited equaled amount borrowed people would be worse of overall. Also $5,000 is not at all a large sum of money to have no call account, the average wage in New Zealand is $1093 (according to https://www.stats.govt.nz/topics/income) so around 3,775.84 monthly after tax that includes beneficiaries as well. $5000 isn't even 2 months salary. At 3% interest you are earning $8.38 per month after tax hardly worth moving the money.

Banks make it unnecessarily difficult to earn interest and have access to your account, for example ASB does not allow you to link your eftpos card to your interest earning account, and for $8 a month why even bother especially if you go overdrawn the will hit you with fee.

And inflation will affect both savers and borrowers. Which is probably why OCR will keep going up. Inflation is the thing that needs to be controlled, and borrowers are collateral damage.

Controlling the temp of a room for example where the heater is something like a furness located in the basement that takes an hour or so to reach the temp sensor in the house above.

Rbnz still have furness on full bore 55 mins in as the temp sensor hasn't moved much yet.

In 5 mins it'll overshoot and the room will be 40 degrees and then they'll be shutting it down and opening all the windows.

The best yo-yo rbnz we've ever seen.

Chiropractors in for a boom with sore necked economists watching the numbers

We're barely above the neutral range of the OCR. The furnace needs to be stoked because some left the windows open

Doesnt the RBNZ think the neutral rate of the OCR is around 3%? We are quite a bit above that

3% is far to stimulatory for debt obsession NZers have

RBNZ is clueless about its lag, as are many commentators on here who simply want the RBNZ to raise through the roof and f everyone.

When they don't have jobs, then they will come back on here whining about how nobody saw it coming.

Some things your parents should have told you. Don't borrow more money than you can comfortably pay back. Save money for a rainy day. Make hay while the sun shines, but also make sure your sun won't get shaded for too long.

What does "pay back" mean? If you say "when interest rates are 5%", then why not "when interest rates are 100%"? The answer is loaded with context.

Its everyones personal judgement.

Historically interest rates can be anything from 2-18% or so.

They and inflation can be influenced by local events, wars, economic melt downs... you name it...

So if we assume 5-8% is normal (i am not entirely certain but would seem right) and 0-5% and 8-18% are the outliers...then you need to plan for what you would do in each situation.. accounting for what career you choose (is it safe in a recession) and the fact that to fire sell assets at hugh prices is possible at low rates and really hard at high rates. And so on.

You might choose that 18% is impossible.. but then not long ago one would have thought 2% (0% in some countries) was impossible too.

Correct, so you are talking about retail rates, not OCR. Currently we are at 6-9% retail rates in most cases, for business lending 9-15%.

These current rates are generally OK, taking the OCR up further is inviting a serious recession/depression.

Interest rates are generally less than 100% and normally more than 5%. I'd like to elaborate but I don't want to overwhelm you

Some people are born into families who are financially illiterate, or financially irresponsible. Others are born into cultures with little financial literacy, or financial habits that could lead to undesirable financial outcomes.

These people should be aware and learn the necessary lessons to become financially literate so that they have financial decision making frameworks that lead to favorable outcomes.

Did you know that when NZ educational standards authorities suggest we need more and better financial education in high schools both the right wing political parties and the banks poo-poo the idea. It's almost as if they want financially illiterate customers.

What is the desired goal of schools and educational standards?

1) vocational skills

2) life skills

Some people think it is 1) only, while other think it should be both 1) and 2)

Regardless, individuals need to learn vital life skills if it is not taught to them in their environments (schools, families, etc). Otherwise their decision making frameworks can lead to undesirable outcomes.

On the other hand, all those investors who are sick and tired of being Labour's whipping boy and who sell up their properties now, will have a very comfortable lifestyle with their tax free profits sitting in the bank earning 5.5%. They'll be out spending up large now that they've gone from being cashflow negative to being cashflow positive.

People were calling them a joke 2-3 years ago too, claiming they were too high.

There could well be a Royal Commission into this if things get bad.

The US and Ireland had government inquiries when house prices fell dramatically and their financial system had issues.

Interesting reading.

We'll have trouble finding a wet bus ticket as it's all digital nowadays.

People that were paying attention had plenty of time to break a refix for 3 to 5 years at least. RBNZ gave at least 12 months notice that rates would be rising, everyone could see it moving its just a number of people were living in hope it would peak and come down again before the 2 year expired.

2.29% mortgage rates were actually the joke, it should have never got this low to start with.

Weird, the banks and institutions with billions of dollars and hundreds of staffers who exist in this exact space had every chance to do better too, and didn't.

Your final sentence is the actual issue. Ascribing blame at an individual home-owner level for that kind of failure is exactly how we repeat this mistake all over again in the future. We need to change the bit that actually went wrong, not fragment it over an entire population.

You are correct. The chorus of spruiking from the banks, business leader, the PM, the MSM and RE industry was so in tune it looked to be choregraphed.

Plenty on Int.Co called it out but our institutions were too intoxicated by the 'wealth' creation they did not do their job.

The public has a right to be angry.

You got it. It's all well and good calling the empty bag holders idiots, but they were only making decisions based on the information available to them at the time. One of those pieces of information is the rate of interest, which is a risk premium, and at 2-3% is basically telling you there's no risk involved.

Unfortunately for the empty bag holders, rates were only that low because they were being held there artificially. Risk was much higher than what we were being told, because ever since QE took off after the GFC, we've lost the ability to correctly price risk. In certain other contexts this would be called "misinformation", but for some reason in the property market, the phrase used is "caveat emptor".

One of those pieces of information is the rate of interest, which is a risk premium, and at 2-3% is basically telling you there's no risk involved.

That seems a bit of a stretch. Misinformation? How does it follow that taking out a 30 year mortgage is somehow risk free just because the interest rate for the first few years is 2-3%?

You don't take out a 30 year mortgage, at least not in this country. That rate of interest only applies to whatever term you happen to fix at, and that is the term to which the risk premium is applied.

I agree and the “misinformation” being given to home buyers was in fact the only financial advice that some were getting … it came from bankers, brokers and RE agents. Buying a home is for most the only financial “ investment” they will make in their lives ( I put this in brackets as I don’t believe NZers will think of housing as an investment again for a long time, much like how many changed their minds about the share market after 1987). I hope if there is an inquiry that we will look at the financial advice that has been given to buyers and perhaps put some boundaries around what can be said by whom. I would especially like to see the FMA or some similar body have a role in looking at how financial advice is given to buyers from RE agents.

Yeah. Remember that prior to Rogernomics in the early/mid 80s, property was seen as a pretty boring investment. A very safe investment, since you weren't likely to lose any money, and it provides you with a roof over your head. But a boring investment, since you weren't likely to make much money off of it either.

Then the sharemarket - where all the "exciting" investment was happening - crashed, financial markets were deregulated, and everyone started piling into the "safe haven" of property with their tails between their legs. The rest, as they say, is history.

Also didnt help that a wealth tax on unrealised gains was whacked on overseas shares, which meant New Zealanders were excluded from investing in any of the world's best global enterprises, like Apple/Microsoft/Google. If people had been encouraged to invest in overseas shares we would be a far wealthier country, and far less reliant on property as the only avenue for wealth creation. [and don't mention the NZX, its too small, has far too few quality investments available, while anything decent quickly gets taken over by an offshore buyer or it delists and decamps to the ASX)]

It's all well and good calling the empty bag holders idiots, but they were only making decisions based on the information available to them at the time.

There are plenty of people who didn't pick up those same bags because they looked at the same information available to them at the time and decided it was a bad bet. Now those people who are holding the empty bags are trying to blame everyone else for their flawed decision making, as if they bear no responsibility. You say they shouldn't be called idiots, but it also didn't take a genius to see this as a possible or even probable outcome.

"We need to change the bit that actually went wrong, not fragment it over an entire population"

How do you propose to do this?

I.e. what specific steps should we do to prevent humans working together in a system, to avoid corruption and acting in short sighted self interest?

100% agree. As was lowering deposit requirements. The writer of the article pointed out this was great risk in assuming 2% was here to stay. He acted according and stress tested himself at higher than required rate. Smart.

The smart speculators all bailed at record prices, with buyers stupidity masked by ever cheaper debt. The new debt holders and the interest only stackers are waking up to the fact they are about to be roadkill.

Did it to themselves.

The higher payments going forward will definitely be taking the toll. Additionally though, if you've bought your house in the last few years, your hard-earned deposit that you spent 9 years saving for or taken out of your kiwisaver has been wiped out with the property prices slump.

Just imagine that, you sacrificed and penny pinched and saved up for a house deposit for 9 years and then after buying your home, within two years, falling property prices have laid waste to all that.

What a wasted decade...

So let's not do that again.

Someone always pays the top price; buys the last drinks or goes 1kph too fast. That's how Change happens.

Experience is the best teacher etc.

Anyone who says it does not matter is an idiot, A 200k fall means you are paying interest on that until the end, what 12k per year before tax....

It's an international holiday foregone every year....

You could have bought cheaper and paid off faster, way faster

You could have bought a bigger house so no move fees in 5 years time....

Be Quick has left egg on Spruikers face

Put your best foot back in your gumboots, trudge through the mud and wait Auckland, bargains are coming

Is it really banks fault?

Are the households in this country so poor in their basic calculations that they do not know what they are getting into when borrowing?

Is our education system to blame too? Or is pure greed to step over the neighbour and get to the front.

We reap what we sow and the time to reap is coming thick and fast.

Each borrower chose to borrow money. This is a result of the decision making process that each person used at arriving at that decision to borrow money.

They should do their own calculations.

Otherwise they are setting themselves up to fail.

People are free to choose, however people are not free to choose the consequences of their choice.

When thinking about this argument, I like to run two scenarios. What would happen if there were no home buyers, and what would happen if there were no home loans.

The necessity for borrowing does not come from the mortgagee, it's invented on the bank side. In reality, FHB make a decision that's more akin to "Do I want to pay of my own mortgage for 30 years and hope that it inflates away, or do I want to pay off someone elses mortgage for 30 years and pay inflated rent?"

If we took away the necessity to borrow, what would happen to house prices? Would they be a sound investment still?

Nobody is forced to take on a mortgage. Each person who took on a mortgage chose to take on the debt. The borrower chose to sign the loan document.

I spent a bit of time in a third world country with basically no mortgages recently. The answer is, people build their own homes in a piecemeal fashion. Save up for the land and basic structure, and improve it as you go. Maybe next year we add windows, the year after we get a wooden door, then an extension etc. Lots of half-built structures with families living in them.

I don't think there is much of a market for buying and selling completed properties.

Without the ability to borrow and bring that completed structure forward in time, we'd presumably do something similar.

I think it’s been a driving culture. I tried to dissuade our son and his partner from buying in mid 2020 saying at that stage I thought Wellington property was likely to fall, he thought I was mad. Property is (was) apparently the main topic of conversation at morning tea and lunch with his yo-pro workmates, many of them owning rentals. I think the culture has changed and a few have been forced to buy down in recent months.

I don’t understand what you mean by "forced to buy down".

Could you please clarify?

Sell up. One I know details of has sold up Wellington central property and bought in Featherston, much much cheaper housing, 1 hour commute on train or over the Rimutakas.

The author seems to have the naive idea that stress testing borrowers is to protect them. It is not, it's to protect the banks from making to many non-performing loans. We are all grown-ups, if we borrow money, it's our responsibility to do our own maths to see if we can comfortably afford the mortgage or not. Let's take some responsibility and stop always blaming others!

100% agree. Too many victims and not enough personal responsibility. Get a second job. Bleat when you work 50hrs/week, make smart decisions and still struggle. But piss off when you are still buying your takeaway coffee and have payments on your new car. Hint-never borrow money to buy a depreciating asset ergo’car.’

Hint-never borrow money to buy a depreciating asset ergo’car.’

Also never borrow money to buy an OVERVALUED asset.

Although I agree and have been telling people for some years that the housing market is in a bubble you never know how it’s going to turn out. I was starting to think I was wrong. Families buy for a place to live and I guess as know one knows the future they buy because the prices have been grinding higher for years. It’s just bad luck for some people. It could have doubled from here and the recent buyers would have been thankful that they got into the market when they did. If anyone is to blame it is the RB and the govt.

Yep, people seem to be removing the human context. If you want to have kids the only way to give them a sense of actual stability is to own your own house because of how shit renting is here.

For women especially you only have a limited window when you can have them, and waiting isn't always an option and comes with its own set of risks. It's all well and good saying "They shouldn't have bought and just waited" but many were probably waiting for years and getting increasingly distraught as prices just kept going up and up and up and the governments of the time seemingly doing nothing to combat it, in fact encouraging and incentivizing it.

It's a hard situation it should have never been allowed to get as out of control as it did.

I so agree with your comment E46. I keep harping on about young families ( or couples) being able to afford a modest home of their own. I am really hoping that prices will continue to wind back to get to a point where this can happen. A family home should not be an investment, it should be a family home.

"A family home should not be an investment, it should be a family home."

It comes down to government priorities and government policies.

Singapore focuses on encouraging resident owner occupiers and less on multiple owners, non residents with their tax policies.

1) Property taxes (which we call rates)

note that they differentiate between owner occupied and non owner occupied,

and they are on progressive rates - the higher the inputed rent, the higher the rate to determine property taxes (which we call them rates in NZ)

https://www.gov.sg/article/property-tax-on-residential-property

https://www.iras.gov.sg/taxes/property-tax/property-owners/property-tax…

Imagine bringing in a progressive rate system in NZ.

2) Stamp duty is differentiated between

1) citizens vs residents vs non residents

2) first, or any property beyond their first property

https://www.propertyguru.com.sg/mortgage/calculators/stamp-duty

Hint-never borrow money to buy a depreciating asset ergo "real estate in Japanese towns or villages."

Did individuals make bad decisions? Yes. But this doesn't obscure the fact that many individuals were put, as a result of deliberate policy decisions over decades, in a position where the only decisions available to them around housing were bad ones, and there was every indication at the time that those in power were likely to continue to ensure that was the case. We can talk about both.

Agree Yvil.

Reminds me of the book 'Self Reliance' by Ralph Waldo Emerson.

"Nothing can bring you peace but yourself. Nothing can bring you peace but the triumph of principles"

My warnings on this site have been based upon these views and watching out for the wolves in sheep's clothes who were trying suck people in with no care for the risk and/or damage they might cause that individual - be it false promises being made by politicians, bankers, real estate agents, mortgage brokers.

One of the principles people need to learn here is that people will delude themselves wtih greed. And that greed, we have witnessed went from the lowest parts of society right up to the very highest - that is from property investors trying to make a quick capital gain, right up to the Prime Ministers making false promises that they had no control over nor intention to keep.

When this happens, you have to be self reliant and stick to what you know to be true (based upon historical principles).

If you wanted to protect borrowers then you would give them 30-year fixed loans so they know their costs for the remainder of the loan. But that would be less profitable.

Haha yeah right... Who can predict where/how they'll be in 15 years time let alone 25. It's all a house of cards, sound money standard needed asap.

Auctions in Auckland this morning looking reasonably healthy. Some high prices being achieved for good quality properties.

The emphasis going forward will be "Good Quality" properties. Take out all the leaky homes, then take out all the flood prone homes, take out all the areas you don't want to live in and it severely cuts down the options. More than ever, quality homes will fetch top dollar, after all that land it sits on and the position its on is now taken. In some places its not simply a question of building a new place somewhere else anymore as everything turns into a long distance commute.

Commute?

Zachary Smith, can you post some links to said examples - thanks

Not much happening at Barfoots this week...... normal most no bids, a few bids then passed in an d a couple of v average homes sold, nothing 2 mil market.... that end of town is dead.

IT GUY, your points are verifiable.

66% of properties got bids today while only 22% sold. The ones that sold got good prices, at least they didn't lose money. Some passed in properties got some seriously good bids.

Funny how we can look at exactly the same thing and come to different conclusions. But first ...

This lost money: https://www.barfoot.co.nz/property/residential/manukau-city/hillpark/84…

Sold for $830k today - its CV from memory. Last sold Nov '21 for $850k. Shame. Nice house. Nice spot. Hope it went to a FHB.

My read of many of the other properties that received bids but passed in is they were opportunistic bids by just one buyer and way, way below previous recent sale prices or collective valuations. That ones that did sell were around CVs and marginally above collective valuations - and all were nicely presented. The 1 or 2 developable sites were passed in.

Overall - a pretty lacklustre showing.

I didn't consider that a loss as QV data said they bought it for 305k.

It is fairly lacklustre but there are more buyers out there looking for a bargain...which means they think house prices will go up eventually, like most reasonable people do.

Agreed, I had a quick peek in and the first property I saw on the list had sold for 65% of its CV.

https://www.qv.co.nz/property-search/property-details/263322/

Perhaps the metric has changed. It used to be that a property selling for its 2021 CV was a bad price. Now it’s shifted to anything selling for less than someone paid for it being a bad price?

and only wish the Reserve Bank made more of a song and dance about realistic long-term stress testing of households. Such a move would be less about systemic financial stability and more about the financial wellbeing of individual households.

It seems like everyone is at fault but the borrowers, yet they are the only ones that can protect themselves against poor decisions. Out of anyone, the idea that for-profit *lenders* are going to do this is a bit optimistic, to say the least.

If you're determined to borrow too much, you'll find a way. If you don't meet banking lending criteria, then you can find non-bank lending at a higher interest rate.

Some people are choosing to put the blame on someone else.

Regardless of their choice whether to blame someone else, those who chose to borrow large amounts of debt are finding out the consequences of their choice to borrow large amounts of debt.

I mean,

The idea that 'bank's stress-testing is focused on short-term profitability and now some people are in trouble oh no' really doesn't leave much agency for the borrower does it?

Benji, can you say with certainty that the banks were irresponsible in where they set their stress-testing rates?

Have you looked at their models for instance, and seen that they set stress-testing rates lower than they otherwise would have over this period, relative to the number of standard distributions away from central estimates these currently experienced rates are?

Without this sort of analysis, this article is basically just a 'I reckon'

.

$150k is small, you look fairly young.

I fixed for 5 years and doubled my repayments.

Fine choice sir

As someone who has been a lender at a bank for over 20 years I can absolutely sympathise with the predicament that you and lot of people are finding themselves in. My contra-argument though, is that it is all very well being critical of banks once you have a mortgage along with the associated security and risks that it provides - but people applying for a mortgage are the first to complain about how strict and hard it is to get a mortgage and on the housing ladder no matter what part of the economic cycle we are in - even when interest rates were really low. Add to that the CCCFA changes and stories in late 2021 and early 2022 where people were being declined for mortgage applications for excessive coffee drinking and what-not. A responsible lender should discuss the impact of higher interest rates and the possibility of rate changes and increased repayments - regardless of the current interest rate environment - be it 1% or 11%. Rates can always go up or down - and do just that. What we have seen in the last 2 years has been (and I hate this word now!) "unprecedented" so pointing the finger at banks for something that was entirely unexpected is a bit harsh. If you want to rewind the tape 15 years to pre-GFC levels at 11%, why not also re-wind it even further to 1986 when rates were 26%? Where do you stop and what is a reasonable rate to test a new customer on? If you can't hack the repayments then you sell the property, which creates the cyclical flow of the housing market.

Almost everyone, journalists, economists, 99.9% of commenters on stuff/fb/twitter/etc, and the RBNZ were predicting interest rates to stay low for a long time. In the end, we fed on cheap debt, and and just basically overcooked everything. Housing market went bonkers, unemployment way too low, excessive demand everywhere.

I don't think we can blame the majority of people who fell into this, because everywhere they looked, it was the same. "Interest rates are going to stay low for a long time". Honestly, it went on for so long, that it really just started to seem normal, or everything was so ridiculous for so long I was desensitised to it.

... and that is how house prices can get to extreme price levels.

As they say, the bigger the party, the bigger the hangover.

While I harp on about the RBNZ's obsession with bludgeoning the whole economy with that horribly unfair tool called the OCR ...

Let us not forget that the RBNZ threw very cheap money at the banks through their Funding for Lending Program which kept running until way after the RBNZ had started hiking the OCR up.

Honestly! Can this Governor and MPC be any more hopeless!

Your personal story of your mortgage rate increasing dramatically while you are among the "households with plenty of discretionary income" simply reinforces to me how useless the OCR is as a tool. For example, taxing you to get that $8,500 per year into the health and/or education systems would be of far, far more benefit, would it not?

Would I be right in guessing that your mortgage is 50% or less of the value of your home right now? Might I also surmise that the mortgage is quite old and you bought quite some time ago? If so, yet more fuel to support the fact that the OCR is a fiercely partisan tool that hammers the younger and newly mortgaged.

Benje, thanks so much for the story. I am in a similar position. How about a story pointing out that the OCR is a crap tool and that central government's must help the RBNZ when it comes to inflation fighting?

I'm in a similar-ish position is that I am living reasonably frugally, and putting as much on the mortgage as I can. Rate rises for me then do not have the effect of changing my spending now, they just have the effect of prolonging the end date of my mortgage. Net result is the main effect of these rate rises on my spending will be felt in 10-15 years time (I am planning on postponing any non-necessary house improvements like a new kitchen etc til the mortgage is paid). I am (relatively) young though, and my mortgage is relatively new (I bought end of 2020).

Non recourse loans could avoid much of the centralised influence and error. Expose the banks to the risk of irresponsible lending and they will make sure their borrowers are safe.

Fill the inevitable gaps with state loans for first home buyers and low income earners. Again non recourse and defaults on those can fill the public housing stock.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.