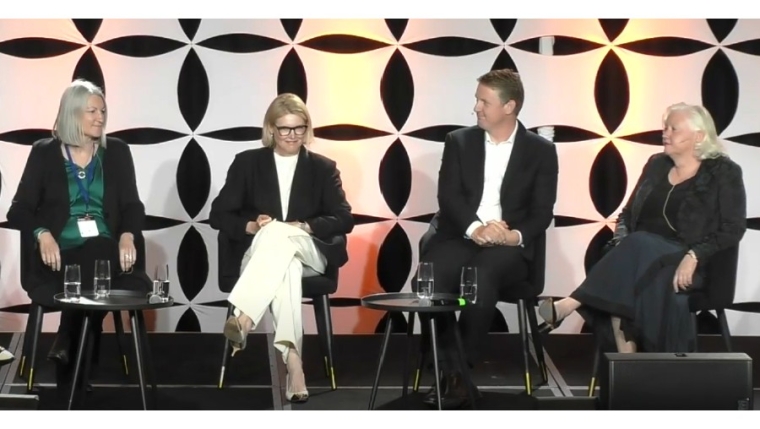

Given they seem to agree on most things, publicly at least, what don't the big bank chief executives agree on? This was a question put to a panel of the big four bank CEOs at the annual Institute of Finance Professionals New Zealand (INFINZ) conference last week.

Westpac NZ CEO Catherine McGrath and ANZ NZ CEO Antonia Watson were both quick to highlight lending to petrol stations, promptly switching the spotlight to BNZ CEO Dan Huggins.

It'd be fair to say Huggins telling MPs at the parliamentary banking inquiry last December that BNZ planned to scale back lending to petrol stations caused something of a furore.

At INFINZ Huggins said the view is based on believing BNZ was over exposed in lending to petrol stations over the next 10 to 20 years, meaning its credit risk is too high. And if a suburb or town has five petrol stations now, how many will survive?

"With efficiency of cars and a movement towards electric vehicles, you're [still] going to need petrol stations but you might only need two not five. And it's very difficult from a credit perspective to determine which three are not going to be there, and therefore I'm going to take credit losses on, versus which two are [still going to be there]," Huggins said.

"Therefore my position has been the bank has been a bit over exposed and I didn't want to lend more to petrol stations. Others have got different starting positions and disagree with that view and say; 'no actually that's not right at all, actually petrol stations are going to be able to move over to electrical charging, or other things,' and therefore they're a business they're willing to bank. That's a perfectly legitimate position, I just have a different one to others."

In a written submission BNZ told MPs it had $132 million of lending exposure to petrol stations as of September 30 last year.

The bank also told MPs; "The reference to amortisation by 2030 reflects the term of most commercial loans rather than an end to all support for petrol retailing. BNZ assesses each transaction on a case-by-case basis and we are particularly supportive where petrol retailers are looking for opportunities to diversify."

As of March this year BNZ had total gross lending of more than $109 billion.

"Dan's probably touched on the most disagreement, [which] is our lending appetite," Watson said.

Watson then moved on to have a crack at NZ First's so-called woke banking bill, actually the Financial Markets (Conduct of Institutions) Amendment (Duty to Provide) Amendment Bill, which all the major banks are aligned in opposition to.

"There's this thing called the woke banking bill that's sitting around at the moment. Do I care if it gets passed? There'll be some compliance I'm sure, so yes I sort of do. But it's not going to change anything because we don't make decisions based on wokeness, we make decisions based on our risk appetite to provide credit to the economy," said Watson.

"And sometimes you find yourself [over exposed]. ANZ found ourselves over exposed to dairy in the 2010s and so we had a particular appetite. So you will see disagreement and that [lending appetite] tends to be probably the most common source of it."

At that time Watson's predecessor David Hisco said; "I wouldn't want you to underestimate how hard Graham [Turley ANZ's managing director of commercial and agri banking] and his team have worked in exiting people that we don't want to be with next time we get into a downturn, which is now."

ASB CEO Vittoria Shortt cited climate adaptation as an area where there are different views.

"I don't think that the banking industry's aligned, I don't think the insurance industry's aligned, I'm not sure that local government is aligned. I would say that climate adaptation is probably an area where there's the least alignment on any topic. So that's something I think New Zealand has got to really tackle differently," said Shortt.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.