S&P Global Ratings says New Zealand public debt remains low but local councils have insufficient revenue to raise funding for their infrastructure responsibilities.

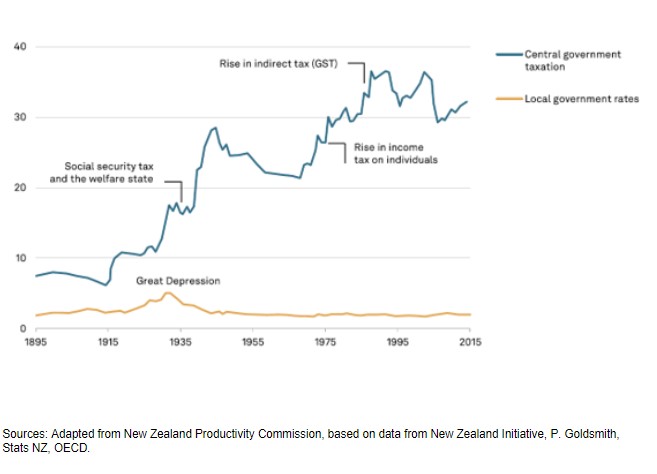

In a webinar the credit rating agency shared a chart in its presentation slides showing local government rates had not increased, as a percentage of the economy, in the past 100 years.

Meanwhile, central government taxation had risen from below 10% of gross domestic product in the early 1900s to over 30% today.

NZ councils’ debt levels are already much higher than similarly rated peers in Northern European countries—at about 180% of revenue—and more investment is needed.

Martin Foo, an analyst at S&P Ratings, said councils had been “increasingly burdened” with new central government standards such as drinking water quality and earthquake resilience.

These additional costs had not been matched by financial support or financing tools, besides a few contestable grant schemes.

“A lot of these costs are being passed down without matching funding tools or without matching revenue,” Foo said on Thursday.

“That’s leaving councilors with uncomfortable decisions to make about whether to take on more debt or whether to hike rates even higher than they already are”.

While councils theoretically have the power set rates at any level, it is politically unpopular.

Many have proposed hikes of around 10% to 25%, but there is likely to be public pushback that could result in lower increases.

That could mean councils have to let infrastructure fall further behind or take on more debt, which may mean accepting a credit downgrade.

Reformation

Both National and Labour’s proposed water reforms could help councils by shifting water-related debt off the balance sheet and creating a new revenue stream from water taxes.

Since water charges would not be levied directly by city councils, they would be less politically sensitive and more likely to match the cost of providing the service.

Foo said “almost everyone” the agency had spoken with agreed that Three Waters reform would have been financially beneficial for many councils.

He also noted it was unpopular with many voters and the Coalition Government had a mandate to get rid of it — this would please many councilors and mayors.

But it put the problem “back at square one” after half a decade of working groups, committee hearings, and community consultation.

“The negative outlooks this week indicate that credit quality could continue to deteriorate, while the government scrambles to come up with a new plan”.

Repealing the legislation was the easy part and there was still a lot more work to be done.

The Coalition Government has assembled a working group to answer some existential questions before the new water laws are introduced to Parliament sometime next year.

Will regional water Council Controlled Organisations have sufficient economies of scale?

How can the competing tension between financial independence and local council control be resolved?

And, what incentive would there be for stronger councils to join up with weaker ones?

Foo said it was possible New Zealand could be left with a handful of “orphan councils” that had high debt, poor quality water assets, weak revenues, and nobody to join with.

There were possible upsides to National’s proposed reform. Labour’s design was very complex and a revised set of laws may be able to achieve the same outcomes more simply.

Golden handshake

The wide policy gap between Labour and National left some loose ends to be tidied up when the Three Waters reform was abruptly repealed.

Two would-be chief executives of regional water entities were given $355,000 redundancy payouts, equal to six months of their annual salary, after less than a year on the job.

The pair likely walked away with about $944,000 each for their 10 months of work.

A third CEO started his new role after the coalition Cabinet had agreed to repeal the legislation and he has been transferred to a water related job in the Department of Internal Affairs.

The Taxpayers’ Union said “public sector fat cats” should not be entitled to “enormous redundancy payments”.

72 Comments

1. Overall taxation is much higher

2. "As a percentage of the economy" needs more prominence

Flatlined more for some than others. Supposedly rates are a charge for goods and services. Yet the calculation is based on value more than anything else. Regardless of the the household actual use of those goods and services the more the property is valued at, the more the amount of rates it will pay. In effect it is a wealth tax in its own right on which central government collects 15% GST because it is conveniently categorised as being for goods and services even though on that basis, it’s application is completely inequitable and that disproportion simply compounds on every rates increase.

More a charge for the cost of infrastructure, and weighting on value really reflects the betterment received from infrastructure. E.g. a property in central Auckland is served by more infrastructure overall and receives more betterment than a property right on the verge.

The thing they've probably got a bit wrong is that apartments are rated as expensively as single house lots, where they should be rated lower because they share the cost of the infrastructure to the lot. Should raise the weighting on land value, decrease it on improvements. This would benefit people because they would be more able to share the cost of infra to the land.

We essentially need to stop subsidising the incredibly expensive cost of NIMBYism, coming from it driving sprawl that costs us all 2-3 times more to maintain.

Good comment Rick. The 1980/90s reforms promoted the idea that rates were user charges for services delivers but that had a very narrow definition of who was benefiting. Whereas if they had a wider definition of beneficiary pays. Then the beneficiaries of land value uplifts that are the result of location, infrastructure provision, and community activity should pay more.

Maybe (& I certainly agree that all things equal apartment rates per unit should reflect any cost savings due to housing intensification). Conversely, apartments put more pressure on street parking in surrounding streets (minor but an effect) and also result in the property having much less permeable area or none at all which even with onsite water detention still imposes costs on downstream property during heavy rainfall.

Basically, we need a tax and rates model that assesses the costs and costs savings of regulated activities and charges the user based on the net cost and not a flat rate. I'm sure that if this model was adopted that rates would be lower for the majority of ratepayers, apartment rates and the cost of services - water, power and gas- (at least in the historical built up parts of our cities) would be lower, rates and service charges for lifestyle blocks would be much higher and low rise subdivisions on most greenfield sites located far from existing infrastructure would be shown for the uneconomic money pits for rate payers that they really are.

Exactly, to put it another way, my rates will soon be $100 a week. Each week. For ever. And they're likely to be $200 a week by the time I retire. On top of all the other costs. Councils have expanded their services to now include arts, culture, community grants etc. they are nice to have but I'd prefer councils to focus on core services.

Our household PAYE is $1500 a week. All we get from it (at the moment) is the kids education and the odd minor medical. We can't afford a house where the rates are $5200 a year.

If housing was priced at its true cost (less), and rates at its true cost (more) then everyone would be better off.

I squeezed into it 13 years ago but I couldn't afford it now. It's got silly sense then. Very average house. Councils now talking about 10-20% increases. What they will say is: don't worry, retired people can forgo rates payments and pay when their estate is settled. Like a reverse mortgage just for the council. Before I get to that point I want to make very sure I'm only paying for core services, delivered efficiently.

Exactly. Local government in NZ are like Auckland transport and have totally lost track of where their priorities lie and any responsibility to get value for money.

I hate to imagine the productivity of the staff

You've listed the direct benefits, yes.

You haven't listed all of the indirect benefits of the PAYE you (and everyone else) pay - a functioning, civil, democratic, society.

Dont forget borrowing more and more and more

Definitely need to raise rates pretty significantly.

Why's that? I thought the older folk paid taxes all their lives and helped build this country etc. D-d-d-d-did they not p-p-p-pay enough?

Oh that's right, their taxes went to their non-means tested superannuation.

no sadly, they inherited assets and f all debt, coasted on minimal rates and rates increases for 40 years through their productive years ... subdivided like crazy to get capital gains ... and NOW..... its times to ensure "intergenerational equity" by making future tax payers pay for assets (through taking on massive debt burden)

Gotta love the life and times of a Boomer

They also entered into a "social contract" as they like to call it, that their retirement would be taken care of from a portion of their taxes. Would that be the portion that disappeared when income taxes were slashed in 1989? Below were the income tax rates in 1985.

- < $6k = 20%

- $6k - $25k = 33%

- $25k - $30k = 45.1%

- $30k - $38k = 56.1%

- $38k + = 66%

Cutting taxes like that certainly meant they couldn't afford to pay for the job training and tertiary education of various sorts that was provided by their own elders for them.

It also happened when Boomers were entering their 30's, convenient timing as they move up in the working world, being promoted etc. Pay goes up, tax goes down.

- $25k - $30k = 45.1%

- $30k - $38k = 56.1%

- $38k + = 66%

Those taxes were absolute robbery by the Government at the time.

No-one should have to pay more than a third of their earnings in income tax.

(I'm excluding retirement here because in many countries it's not part of tax but a separate contribution into an individual retirement fund instead).

You can't make that statement that income tax should be limited to 1/3 of earnings without stating what level of public services are on offer. Or would you just cap it at 1/3 and then work back from there?

just cap it at 1/3 and then work back from there

Good idea

You "forgot" to mention that those income tax reductions were mandated with the policies for introduction of GST, removing import tariffs, stamp duties and death duties etc

All the taxes of a lifetime did not even fund 5years of the pension benefits as those taxes went on infrastructure and services they already used not a mythical piggy bank

If you go back 100 years land tax also made up a significant chunk of central government taxation.

The moronic drift towards taxing production rather than wealth and consumption is behind most of our current problems - widening inequality, housing shortages and low productivity growth.

Time to restore the balance with higher local rates, central government rates on land values, higher taxes on consumption of natural resources and, most importantly, much lower income tax.

If you go back 100 years land tax also made up a significant chunk of central government taxation

In a world where the money supply has exploded through private bank creation for bidding up land prices, taxation is a way of balancing the largesse - effectively destroying the money created. This is partly why land is not necessarily a 'store of value' when it is one asset that can be easily targeted by the state. Many people haven't really worked that out yet. In the case of Nu Zillun where property trading has been the primary game in town, the threat is very real.

The pair likely walked away with about $944,000 each for their 10 months of work.

Subtract 4-6 weeks for setting up and unsetting their offices, and you're left with about 7 months of work.

Jokes aside and in reality, anything of this scale and complexity is not like turning up for a project management gig - get it done, get out. Very little would have been achieved in those 10 months.

As the saying goes, good gig if you can get it. Can't really blame the bosses. They're just collecting the money.

Lifestyle blocks within close proximity to a main center of employment will be a haven in future to avoid these tax increases. Do-it-yourself 3Ws have never looked a better long-term tax minimization scheme!

Why? Lifestyle blocks can be taxed just like any other land. There could be an argument that the ruling elite may jig the rules for some property classifications (to work in their favour and the favour of their mates).

But they provide their own services (water, wastewater and stormwater) and so won't have any of these new/higher direct taxes/user charges levied on them.

If you live rurally, most of your rates bill is the General Rate (which should be made up of pure public-good services, such as democracy/governance; district planning, libraries, etc.) - all these other goods and services are normally (or should be) charged separately (i.e., by connection to the network and/or via user-pays/targeted rates).

Some years ago we went from 99 acre LSB (12km from town) - to an 800m2 property (in town) and our rates went from $1,200 to $3,500pa respectively. It's cheaper to live in the country from a local government perspective.

Gotcha. And it makes sense that the less burden you are on local government, the less necessity to contribute. Methinks that the Ponzi will ultimately have to be targeted based on its impacts on wealth generation. It's inevitable.

Depends, re the split of water use charges vs. general rates.

The big cost is the laying of the pipes to the piece of land. Putting too much onto water use charges and off rates would thus not be very fair in the case of large blocks of land to which long pipes are laid, but which use little water.

I can see the attraction for some of having more on water use, though: make the renters pay more of it.

The fairest balance would probably be rates paying for the cost of the infrastructure, and water use charges for the operational costs of managing the operations of rainwater collection and distribution.

Kate - but you still need to factor in your own capital, depreciation and maintenance costs for these services, even if overall the cost is less than services in urban areas. And with water, there is often a risk of drought. Nevertheless, townies also are installing tanks, which helps with water charges.

Yes, agreed those do need to be factored in.

I have often wondered if townies installed tanks and then disconnected from town supply whether they could thus avoid the associated fixed charges for that connection. I'm somehow doubting it, but certainly if possible it should be taken up as an option (an option that avoids all costs including volumetric charges).

I'm self sufficient for my own water and waste, don't get kerbside rubbish collection, and are pretty far from any council amenities. There's been half a dozen potholes just outside my drive for 10 years.

Still pay more for rates than the same sized house in town.

What local authority area are you in? Some are more pro rural (meaning far lower land value rating for rural) than others.

The fixed charge is for the waste water connection. Mains water is charged by volume only, so if you dont use any, no charge.. That's how they do it in auckland anyway.

Yes, AKL is a bit different given Watercare is a CCO. Many councils just have an annual fixed charge per connection to services and if they've installed water meters a separate volumetric charge for use. Watercare on the other hand (as I understand it) front loads the connection charge on new connections - some outrageous number last time I looked to initially connect to their services.

I don’t think Waiheke has any drinking, stormwater or wastewater (sewerage) systems apart from an emergency source of drinking water and one small wastewater treatment plant for public toilets. I think that is reflected in their rates.

Many Waiheke residents are opposed to any systems being brought in as they as they don’t want the influx of new development this would enable.

I don’t know about individuals disconnecting entirely from existing systems in order built up urban areas. It may not be possible due to potential for public health problems like disease or pollution.

I doubt u could get consent on a septic tank for a 5 bed townhouse on 400m2 section with 10m2 that isn't slab or driveway

When more tax / rates are paid by folk they have less to spend. And very few have a surplus to cover the gap.

Just saying.

We have developed a need for first world services. But we have not developed first world incomes.

Borrowing to bridge the gap does not work. Other than concealing then magnifying the discrepancy.

So what's the real solution? A or B. ?

- earn more

- settle for less

Yes. Sadly.

The Wellington bureaucrat class won't give up their power or money.

"Of every dollar of government spending, more than 90c is controlled by central government in Wellington. Across the developed world, only Greece and Ireland are more centralised than New Zealand. The OECD average for central government’s share in government spending is only about two thirds – much lower than ours."

https://www.nzinitiative.org.nz/reports-and-media/opinion/unlocking-reg…

So many central government politicians seem instinctively to grasp and centralise...

Yeah look at Simeon Brown, demanding that Auckland Council only spend its remaining fuel tax funds on things that Simeon wants. Stuff what Auckland and its ratepayers want to spend their tax on, he knows best.

NZ has a very "entitled" head office professional management class of politicians and civil servants. They chase status and high incomes yet avoid accountability. There is a proliferation of organisations, stakeholder meertings etc. Yet when things go badly, which seems to be the default setting. This unnecessarily complicated centralised system results in finger pointing and an avoidance of responsibility.

NZ is getting very poor outputs. Look at the rate of unrepaired potholes, leaking pipes, newly built railway lines that are too narrow, and the world record cost to build the simplest of infrastructure kit. The publicity of problems seems to be endless. I genuinely worry that NZ is sliding into 3rd world status because standard governance solutions that modern developed countries use seem to be beyond us.

Central govt taxes are more cash in, cash out on an annual basis.

Councils, at least until recently, were around managing long life assets and planning for their replacement - but that was the classic 'my roof can last another year' model.

I also blame the accountants for not requiring replacement cost accounting for monopoly assets meaning the gap between old worn out assets and the cost of new assets was hidden until the 'oh shit' reckoning day. Which is now.....

Mark

Wow that says it all. And think of the extra costs councils have these days - you can't just pump the poos out to sea, the playgrounds aren't just a slide and swing with concrete underneath, the rubbish isn't one bin that goes to landfill, the roads have many times more cars and trucks on them, a bit of giardia in the water is no longer acceptable, etc.

I think a big issue is that rates are charged quarterly, so it feels like a big bill. But in fact our rates are less than our power bill, and the power company only has to provide one service not 20+ like council does. Councils should start by making their bills monthly by default.

Excellent point, that last!

“And think of the extra costs councils have these days - you can't just pump the poos out to sea, …a bit of giardia in the water is no longer acceptable, etc”

JJ - in the past our waterways were clear of Guardia but we have collectively decided even now we don't want to invest in decent stormwater and sewerage treatment systems. Nor have we ensured our agricultural system adequately minimises the levels of agricultural runoff and animal faeces into our beautiful rivers.

Now we need to worry about swimming in our rivers and our seas, and the realisation our legacy to our children and grandchildren are likely to be dead and dying oceans and waterways.

Thoughtful comment kiwiana. Though I am not sure what a solution will be.

My rates are over 3x my power bill.

And the "extra costs councils have these days" are primarily because 20 years ago Helen Clark decided to change the law to permit them to focus on other "cultural" things besides providing the basic infrastructure needs - & successive Govts have continued this.

Exhibit A Wellington

- Town Hall music venue $340 million

- Rebuild central library rather than use existing ones – $189 million

- A $13 million carpark building

- Cycleways $226 million

- Convention Centre $169 million

- $32 million corporate welfare for Reading Cinemas

- $139 million on the Golden Mile (removing cars)

- $236 million on food recycling

Nothing will change unless only ratepayers can vote in local elections - & no, tenants don't pay rates.

This is more a function of power bills declining over the years than anything else.

In 2012 the average power bill was 2.5% of household income, today its 1.7%. Real power bills are hundreds of dollars a year down on their peak, meanwhile average incomes have risen significantly.

Why don't you take the weekly direct debit option? Perfect if u have revolving credit and drip feed the rates to concil instead of quarterly upfront to sit in councils bank account

3 Waters probably would have got more support if it had not included co governance. Co governance was not necessary to the reforms financial and infrastructure purpose and merely muddied the waters.

People would rather have bad water infrastructure than let Maori have a say...

3 waters would have set up regional oversight groups with equal membership drawn from mana whenua and councils. Since when did 17% of the population, who currently have the same say as all the rest, need 50%?

17% may as well be 0%.

Russell

Co- governance was because water is a key Treaty matter, and the Treaty is an agreement between two equal parties (the Crown, represented by the governor, and Iwi/hapui. Co-governance would not be put in place for non-Treaty services.

The representative group would only appoint the entity’s board, which was not to be co-governed, and this would in turn appoint executives for the entity’s day-to-day running. So it applies only to the highest level of oversight.

I was fairly comfortable with that as a Pakeha. I was willing to give it a go at the very least.

A completely false reimagining of the treaty there kiwiana.

John Key reckoned they hold a special status and have an interest in all policy and legislative matters.....

The statement in support of the declaration:

- acknowledges that Maori hold a special status as tangata whenua, the indigenous people of New Zealand and have an interest in all policy and legislative matters;

https://www.beehive.govt.nz/release/national-govt-support-un-rights-dec…

The same press release stated unequivocally that Maori would not have a veto.

And UNDRIP is not binding.

JimboJones Perhaps people would rather have bad water infrastructure than lose equality of suffrage...

JJ - agree. Sad but true.

Co-governance actually did contribute to balance sheet separation. Probably not essential to financial aspect but was helpful.

Also definitely what made it unpopular.

I feel like seniors have a much bigger issue with rates than everyone else. I guess because they tend to have expensive houses that incur big rates bills, and because it is a lot of money on a small income.

In our household rates is lower then PAYE, mortgage, petrol, power, insurance. So we don't tend to get our knickers in a twist over it, and we would prefer to pay a bit more and have better services / transport / pipes / events / parks / stuff.

I feel like seniors have a much bigger issue with rates than everyone else. I guess because they tend to have expensive houses that incur big rates bills, and because it is a lot of money on a small income.

They have an easy way to solve that problem, though.

Yes on the senior's issue, but then to alleviate that concern (i.e., of the asset rich, cash poor) regulations came in to allow seniors to defer rates payment until the asset was sold (be it by the owner themselves or their estate). But, that didn't seem to solve the disquiet/problem. So I always wondered whether seniors just didn't want higher rates - period.

Tell me who wants higher rates Kate. But folk pay willingly what they can afford and balk when they can't. Or don't think it reasonable.

It's quite realistic to think, for some, good water will cost say $15K pa. A number that will make some cry. Totally impossible.

Fighting over who pays don't help. Borrowing ridiculously unrealistic.

Maybe we have to give something up.

No such thing as cash poor asset rich, just poor allocation of capital. Trying to live beyond their means.

Yep, plus you can borrow against your property to pay expenses (including rates), a reverse mortgage.

The thing that's going to encourage local authorities to tax more is simple, just stop bailing them out.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.