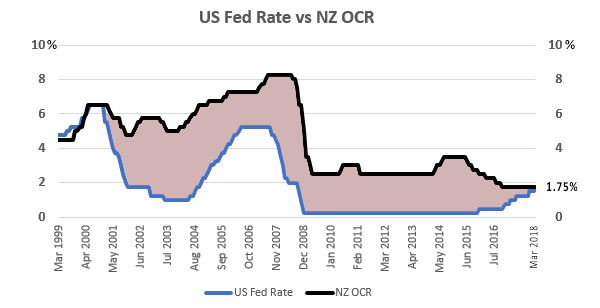

The raising by the US Federal Reserve of their Federal Funds rate by +25 bps to 1.75% today (Thursday) is notable for a number of reasons.

Firstly, that is their highest official rate in 117 months, since October 23, 2008.

Secondly, it is the first time since December 2000 that the NZ Official Cash rate or its equivalent has been the same as the benchmark American rate.

From here out, it is very likely that the New Zealand official rate will be less than the American rate. It is not clear how long that can be sustained, although the current expectation by economists is that it may last some considerable time.

The American central bank has indicated that there will be at least two and probably three more +25 bps hikes in 2018 and more after that. That means that the US benchmark could be 2.50% by the end of the year.

Most local economists think the NZ OCR will stay where it is through all of 2018. In that senario, we will have the largest discount to the US, ever.

But more than the official rates are shifting.

Here are today's yields:

| 8am March 22, 2018 | US | NZ | difference |

| yield per annum | % | % | % |

| Fed Funds / OCR | 1.750 | 1.750 | 0.000 |

| 90 day bank bills | 1.800 | 1.930 | +0.130 |

| Govt 1 year | 2.055 | 1.780 | - 0.275 |

| Govt 2 years | 2.332 | 1.925 | - 0.407 |

| Govt 5 years | 2.723 | 2.380 | - 0.343 |

| Govt 10 years | 2.931 | 2.865 | - 0.066 |

| Sovereign CDS spread bps* | ~17 | 16.80r | - 0.20 |

* last public quotes, not necessarily March 22, 2018

Given some of these relationships are now at 25 year extremes, it is an open question how sustainable New Zealand yields can stay at discounts to the American levels. Some eurozone economies have achieved that (Germany, for instance), but New Zealand and Australia are not Germany. Market forces may be unfriendly if they perceive these new relationships can't be justified. New RBNZ governor Orr will need to be very wary of unintended consequences.

46 Comments

Crikey. Who would have thought.

I've only been saying it for more than a year. With our low rate you would think we were in a dire economic situation, oh yeah, we had 9 years of a National Government. Yet it's far worse in the US their default rates are rising across the board and were really bad a year ago.

There's a lot of potential excitement with further US stock market devaluation on the way and no doubt margin calls that will be made. The headline should be edited to say: Party!

Please tell me more Dictator

When’s the DOW imploding ?

Bank interest still way higher in NZ than here regardless hence money goes into the market here or into NZ banks which lend at higher rates than here

In short no they can't. Where has NZ borrowed money from? Where have the NZ/AU banks borrowed money from? Those costs go up and they will passed onto the consumer, irrespective of what the RBA or NZ does.

I believe that the NZ banks have been borrowing a higher proportion of NZ direct deposits and Kiwisaver cash deposits in recent times. They would love it if this increasing domestic trend continues. given that they pay so little to depositors in NZ.

Solidname & Uninterested make pertinent points. David Chaston, do you have data showing how much funds NZ banks are borrowing from overseas and if these funds are increasing or decreasing?

Thank you

Well Japan was always a source for Aussie banks' wholesale funding. Correct me if I'm wrong. But if the OCR is moribund in Japan, why has JPY been strengthening against USD?

The only implications I can really think of is that if there were an external economic crisis tomorrow, AUD and NZD would be punished.

The OCR is set to reflect the RB's view of the state of NZ's economy and not external OCR rates. Ergo it can stay or even go lower even as the Fed raises as it supposedly recovers. Meanwhile the NZ banks will indeed have to come out from hiding behind the OCR and take the flak they deserve IMHO.

Can you please explain what you mean by "hiding behind the OCR"?

Nothing Solid about you Solidname you are correct in your summation

Squeaky bum time for bloated asset prices incoming. The era of cheap money is drawing to a close.

You hope

If you can't afford it, you shouldn't have bought it...

There is no need for hope. Anybody with an I.Q. over that of a real estate agent can grasp the relationship between interest rates and asset prices.

The FOMC are doom and gloom merchants supreme for 2018 and 2019. It's probably why so many here are desperately trying to talk things up while they unload.

The FOMC are doom and gloom merchants supreme for 2018 and 2019. It's probably why so many here are desperately trying to talk things up while they unload.

Unload what and why?

Extremely overvalued illiquid assets pumped to the stratosphere by a decade of "emergency" interest rates.

The rate projections speak for themselves.

Well that all depends. The cost of money is one thing; but the prophecies being bandied around the BBQs and water coolers across the nation are likely to suggest otherwise.

You are the first person to make me laugh today :)

You are the first person to make me laugh today :)

I'm serious. People tend to shift their narratives based on what they want to believe. Therefore, if the cost of credit increases, they will be less likely to talk about as a primary driver of asset prices.

Since when has water cooler talk been a binding restraint on a consumption bundle?

Truly astute investors base their investment decisions on what they overheard at the water cooler.

If the water cooler happens to be at the RBNZ and the investor is a currency investor... insider trading....

If the water cooler is in a large publicly traded company and the people being overheard are the directors, would shorting / buying that company’s shares be considered insider trading or astute? I’d lean towards astute so long as the person doing the overhearing isn’t employed by the company in any way shape or form.

Depends if those directors were just screwing with the dumb plebs at the water cooler I guess...

The elephant in the room is that for some reason the USD isn't being bid up along with the Fed hikes. So a stronger NZD is insulating us from inflation pressures. There's a faction somewhere who thinks the Fed has it wrong or are waiting to see some real upward movement in PCE numbers.

Yeah. Why USD is NOT on the rise ? Is it because the main buyers of US treasury bonds(china,Japan..) are not interested to add up further ?

The patient (US debt laden economy) is still ill, yet the doctor (Fed) says "no more prescription", how will the patient be in 12 months?

Yup, it's an interesting one for sure, add in Trump's tax cuts and that enormous national debt will balloon within his term time, sure there'll be some repatriation of company profits in the short, but is it enough to do anything more than put a sticky plaster over it?

Wasn't the point of the prescription to induce every sector of the US economy to take on debt? This is what we get for trying to solve major structural issues with short-term solutions.

The US economy is NOT ill. It’s doing well.

Are you being sarcastic or is that your actual opinion Bobster?

Unemployment is at 4%. The economy is growing strongly. Wage growth is limited but given the other factors I wouldn’t regard this as a sign of weakness. The recent jobs numbers have been v good. Household debt is relatively modest. You are living in the past, the US has moved on. Get with the programme. The Fed will NOT save us from ourselves anymore.

Sheesh, you can be doomy and gloomy when it suits you....

See New York Times today:

“Americans have spent much of the past decade wondering when the economy would recover from the crippling Great Recession. Now, they are considering another question: When, and how, will that recovery end? .... Next month....the current recovery will become the second-longest American economic expansion on record.”

Again, the Fed is more likely to sink us than save us.

Unemployment is at 4%. The economy is growing strongly. Wage growth is limited but given the other factors I wouldn’t regard this as a sign of weakness. The recent jobs numbers have been v good. Household debt is relatively modest. You are living in the past, the US has moved on

So by that analysis, Japan must be doing well too.

Mate, go and do some reading. Their economic growth right now is good. About to be the longest economic expansion in their history. Then come back and try again...they ain't "ill"

what about the $20 trillion debt? Does that going to stay as the norm/base for years to come ??

Bobster, you say "Unemployment is at 4%. The (US) economy is growing strongly."

Have you considered this is the RESULT of the low rates of the past few years? and that agressively raising rates now, in an environment saturated with debt, will have the opposite outcome in the future?

The low rates have been there for a long long time. The economic news has got better and better lately. Obviously the fed doesn’t agree that the low rates is a precondition to this growth...cos it just raised them. The US is not “saturated” with debt, household debt is not unusually high, the corporate sector is highish.

The US has gone through their deleveraging post 06, and it sucked. Now WE are the ones with the economy “saturated with debt”. sorry, but we don’t get a vote at the fed, they’ve done their hard work on deleveraging, we haven’t even started. The pre GFC party never stopped for us, but I think we are now officially out of road on that one

The USD20T debt will never be paid back in current value terms and neither will our govt debt, unless you believe in fairytales.

Interesting; I understand there is a debt-serviceability factor to be added in annual budget,right ? So that would be one of the reason some people say, the interest-rates will not go higher to historic high levels ?

Sorry ; I'm just trying to understand these terms and process or manipulations

Due to the way that the US measures un-employemnt since Bill Clinton arguably the better data is participation rate. If you look at the 10 year ie since 2008 GFC the best you can say is the drop has flattened out.

https://tradingeconomics.com/united-states/labor-force-participation-ra…

Oh as for NYT that is one columnist's opinion.

In terms of expansion just consider it started from a big low, and now it maybe peaking? hardly awe inspiring if so.

Totally agree on the Fed killing us.

So all the What ifs............. ? spring to mind

What if investors move to US$ in the perception that it is less risky putting pressure on our BOP

What if the NZ$ weakens by a big sum , and there is a flight back to US$?

What if the currency traders decide to short the Kiwi $ ?

What if US Banks start offering more attractive rates to depositors ?

What if inflation rears its head here ?

What if this coalition Government comes up with a budget that requires deficit borrowing and puts pressure on the currency ?

What if the budget deficit above leads to Government borrowing crowding out of private sector borrowing ?

What if ...........

It won’t be about the NZD. The USD will rally hard because the Euro is going to die and there is no other currency to go to apart from the USD, so the kiwi will go to 0.50 or below...probably around the same time that interest rates double. This will be catastrophic for our economy and any sane govt will be slashing taxes to help the struggling worker and business person. However, you can bet they will do the opposite just to give us a real kick in the guts...

With 2 more interest rate rises by the US Fed expected the the end of the year, that will take Fed funds rate to 2.25% (and raise the 3M US Treasury Bills rate from its current rate 1.75%). Will the OCR be maintained at 1.75%, or will the NZD FX rate weaken against the USD?

Any USD denominated income investor, would potentially repatriate funds in NZD to USD for higher yields. Many have been attracted to NZD due to higher interest rates in recent years, but with USD interest rates rising, the yield differential is now becoming unattractive ...

So with a falling NZD, unhedged US ETFs would be a buy?

Jock Silver,

That would depend on what the underlying assets the USD denominated ETF holds. For example, the USD denominated ETF could hold US listed shares, US listed Treasury bills, US corporate bonds, or even other non US assets.

For example, USF.NZ listed on the NZ Stock Exchange holds shares of companies in the US. The share prices of these US companies could fall, and negate any benefit of the NZD weakening against the USD currency.

Best for you to talk to your financial adviser so that you understand the underlying risks involved.

You're absolutely right CN, thank you for your insightful reply.

Meanwhile, some kooky presidential type decided now is a good time for a trade war: https://www.bloomberg.com/news/articles/2018-03-21/asian-stocks-face-mi…

I guess the one certainty is that we are heading for a period of significant market volatility.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.