Costs for businesses are continuing to go "through the roof" according to the preliminary ANZ Business Outlook survey results for November.

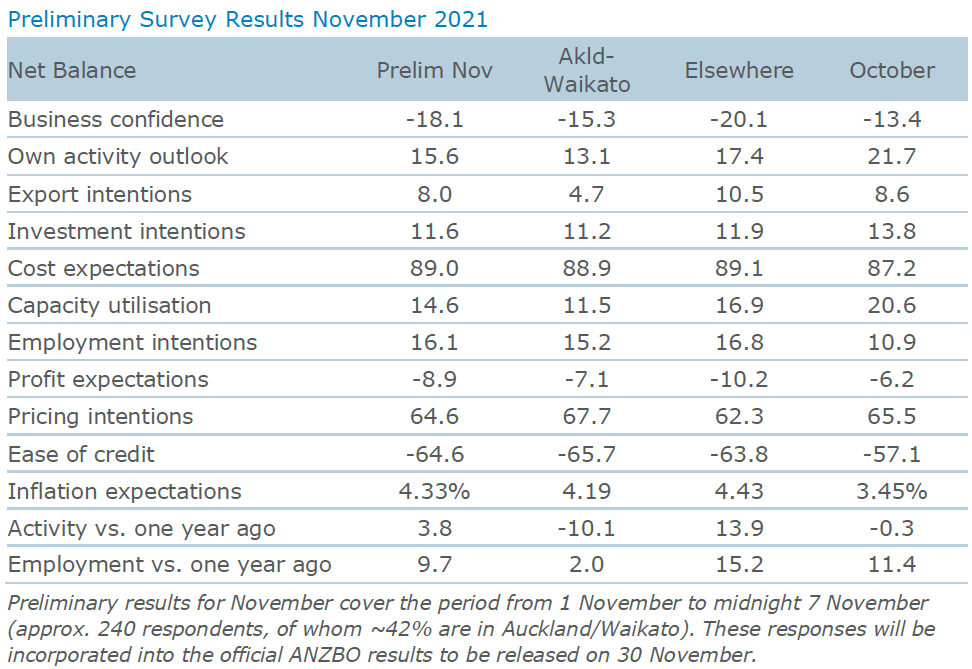

The net percentage of firms experiencing higher costs has now hit a stratospheric 89%, up from 87.2% in October.

12-month-out inflation expectations soared to 4.33% following the recent release of actual inflation figures showing a 4.9% annual rate.

The number of firms expecting to hike their prices remained at around two thirds.

ANZ chief economist Sharon Zollner said the latest survey results saw nearly all forward-looking activity indicators ease.

Business confidence fell 5 points and own activity expectations were down 6 points.

Investment intentions fell 2 points, while employment intentions bucked the trend and rose 5 points.

Expected profitability fell 3 points with a net 9% of firms expecting lower profits ahead.

"That is likely related to extreme cost pressures, with a net 89% of firms reporting higher costs, up 2, while only a net 65% are intending to raise their prices," Zollner said.

Capacity utilisation fell 6 points to 15%.

A net 10% of Auckland/Waikato businesses reported lower activity than a year ago, while a net 14% outside of these areas reported higher activity.

A net 10% of firms are reporting higher employment than a year ago (2% in Auckland/Waikato, 15% elsewhere).

"Auckland/Waikato firms had lower own activity expectations, capacity utilisation and export intentions than elsewhere, but higher (though still net negative) business confidence and profit expectations, and employment intentions continue to hold up well.

"The questions about expectation compare to today, with Auckland/Waikato firms looking forward to easing restrictions while most of the rest of the country is waiting for the COVID hammer to fall," Zollner said.

"Overall, the survey shows an understandable wariness as we move into a COVID-endemic world.

"The one certainty is that costs are through the roof."

23 Comments

75bps here we come.. Come on Orr, do it!

He won't raise the OCR, most Reserve Banks are saying inflation is just a mirage. Why wouldn't he follow the others? To do anything else would require him to engage his brain.

He should do it, but he will raise by only 50 bps. Swap markets are leaning towards a 50 bps increase, and nobody is really betting that 75 bps is a realistic possibility.

Yep, fully agree with you on the 50bps move. A shock of +75bps is what's really required to just 'pause' things for a while.

What goes up can also fall , I will be interested to see how we go once covid gets going I see a pretty ugly picture of an overwhelmed health system and huge disruption DGM yeah I know but I can't help looking at countries like Denmark, Singapore and the Netherlands and seeing them with massive problems hitting third or fourth wave scenarios and comparing their health systems to nz which I believe is underfunded and poorly run by comparison . This will have substantial impacts on business here possibly lead to an abatement of inflationary conditions here .

Who cares.. house values are up, this is all that matters. The price graphs on the homes website are beginning to go parabolic. Cha ching!

Will Orr continue to fiddle while housing's burns and crushes non house owner. Cant believe I'm watching this unfold.

Believe it - it's been happening for decades. ALL the warnings have been ignored for decades too.

It's unfortunate for my generation, unfortunately my generation is populated by turkeys voting for Xmas.

Anecdotally. Warehouses all over Auckland are full to the brim with inventory imported at huge expense. Will it sell? Is the demand spike real or a media beat up? Do people actually have money and the confidence to spend it?

Those being frightened by continuous media talk of "Inflation!" might spend. The rest? We are about to find out.

Not sure what I could spend on. Don't need more junk. Will spend on food and necessaries but...I fail to see the merit of adding more things to my house. Seems pointless.

be a goodcitizen and keep consuming please. 5 am in front of kmart tomorow morning .

"Anecdotally"? The only inventory sitting anywhere has been imported at high cost.

It will sell, even then the poor suckers who haven't already bought their xmas pressies might get disappointed. Lockdown might just have stretched inventory out to Xmas. Transport issues are still massive, I just received the chair from LaZboy that I bought my mother last December. Had to be made and imported, arrived in October........Bought a bedside table from a shop before the Auckland lockdown, still not available yet although it would be there in "2 weeks"

I run a business which imports raw materials for our manufacturing, most materials 65 days late in arriving, and at 5 times the freight cost. The only thing we can do is pass it on to the consumer, so our pricing has lifted 30%, and that is on a staple grocery item.

Suppliers of everything from milk, to water, to engineering supplies have lifted prices from 8-30%, electronics by 130%. This is all going on to the consumer in terms of price increases because at this moment in the COVID economic cycle, no business can carry the extra cost.

"Costs for businesses are continuing to go "through the roof" according to the preliminary ANZ Business Outlook survey results for November."

is this not Inflation going through the roof. $$$$$ = Venezuela = New Norm

Only comfort that even US has similar problem / situation but not to forget that USA is Big And Diversify Economy unlike NZ which is tiny and only economy is concentrated in housing market

but not to forget that USA is Big And Diversify Economy unlike NZ which is tiny and only economy is concentrated in housing market.

This is true. The growth retail sectors in the U.S., Europe, and Japan are discounters such as Dollar Tree. These businesses cannot exist in NZ or Australia because of lack of market scale. Even in the UK, an Eastern European retail chain is taking on Aldi and Lidl and promising up to 30% lower prices.

Why is this important? It helps consumers stretch their wallet further. In the 'Land of the Big Fat Bubble', people don't have the luxury of discounters. Another reason to be wary of what's happening in NZ.

Costs up? √

Business confidence falling? √

Expected profitability falling? √

Investment intentions falling? √

Best businesses start sacking 'surplus' workers. Just before Christmas is always a good time. All good for wage rises to underpin rising mortgage costs....(sarc/off)

(NB: Guess what Adrian is going to do? Nothing.)

"(NB: Guess what Adrian is going to do? Nothing.)"

I disagree; Labour have and will continue to provide subsidies to make matter worse.

Subsidies to increase to protect the property market?

https://www.oneroof.co.nz/news/40472

Ha Tony Alexander calling out the Reserve Bank.

Interesting how bank economists have become more negative towards the Reserve Bank over recent times. Blame shifting? Divert any focus away from their own parasitic nature.

Pot, kettle comes to mind.

Or the crack addict blaming their dealer.

Employment intentions and cost expectations are up but investments intentions and profit expectations are down.

Looks like the low unemployment rate is starting to turn out to be a short-lived blip.

The dream of wage increments are dashed.

I automatically switch off on anything Zollner says.

Disingenuous and nowhere near as clever as she thinks she is.

I run a business and am keeping costs to an absolute minimum right now, even if it is a long term mistake.

We are heading for more disruption and based on Arderns joke of an Auckland visit the government has no idea how to navigate it.

Funnily enough this is being called record confidence in the media, when in reality it is only the least worst business confidence reading for some time

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.