Business confidence has climbed off the floor, but expectations of future inflation still remain "far too high", according to the latest monthly ANZ Business Outlook Survey (ANZBO).

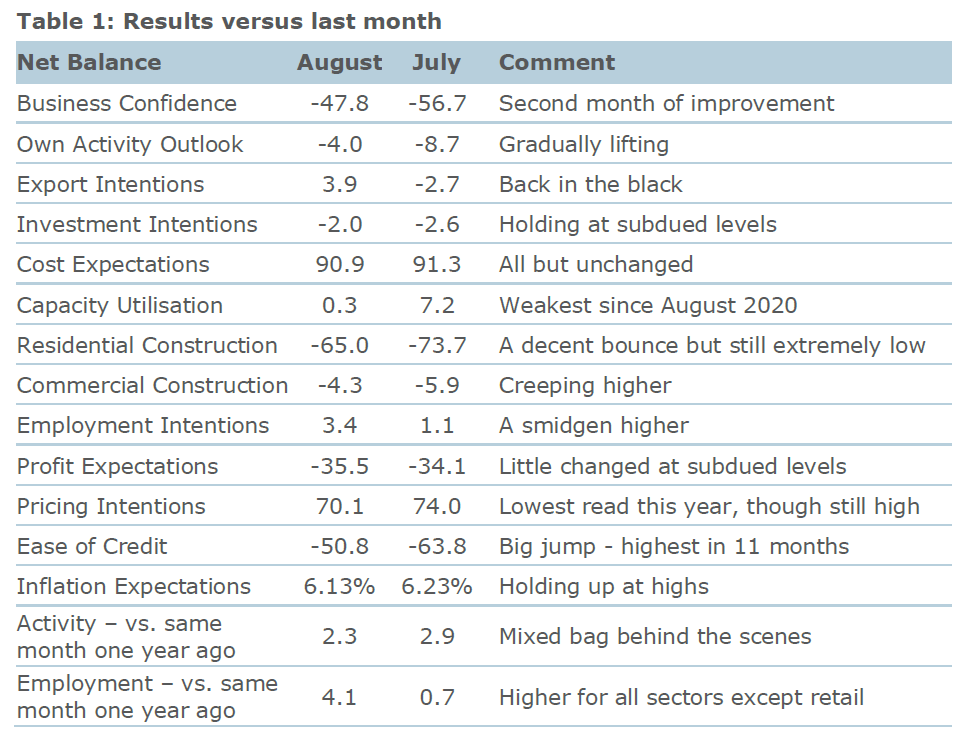

ANZ chief economist Sharon Zollner said overall business confidence lifted 9 points in August to -48, while expected own activity rose 5 points to -4.

"Most activity indicators lifted for a second month, with capacity utilisation a marked exception," she said.

"Inflation pressures remain intense. Inflation expectations were all but unchanged at their highs, and the net proportion of firms expecting higher costs was steady."

Among some of the outcomes in the latest survey, there was a modest bounce in sentiment in the residential construction sector - after this sentiment had plunged. Cost and inflation expectations are down from their highs - but not by a lot.

Zollner said the key themes of the August survey were:

- Activity measures generally lifted modestly, including business confidence, own activity, export intentions, investment intentions and construction intentions. The exception was capacity utilisation.

- The services-led fall in pricing intentions is encouraging, but inflation expectations eased only slightly. The strongest pricing intentions were in construction and retail.

- A mood lift is evident amongst manufacturing, agriculture and services firms. Retail firms continue to get more pessimistic.

Zollner said while mildly rebounding activity indicators were ostensibly good news, the latest survey "was not particularly encouraging" for the Reserve Bank (RBNZ).

The RBNZ has been busily forcing up interest rates through the Official Cash Rate - hiking it by 50 basis points at each of the last four reviews - to fight inflation.

"Business inflation indicators have been very reliable in terms of predicting where inflation is heading," Zollner said.

"They are a smidgen lower at best, but remain far too high. And firms outside of the retail sector seem to be feeling more confident about the activity outlook."

Zollner said the risks are tilted towards the RBNZ having to continue on with OCR hikes next year to cool the economy sufficiently to feel comfortable they’re getting on top of the inflation problem.

Business confidence - General

Select chart tabs

2 Comments

Improving employment intentions coupled with persistently high inflation aren't what the RBNZ want to see. This might be more evidence to them that they need to keep raising the OCR to destroy aggregate demand from the economy - crazy times. Especially noting the other article about credit creation contracting quickly.

Oddly for those who want to maintain endlessly high house prices relative to productivity/incomes, they need to pray for bad news like high/rising unemployment and/or deflation so that the RBNZ can come and rescue their investments with cheap and easy credit conditions once more. So strangely, to keep house prices high, one needs bad news for the economy, not good news for the economy. What a strange world we find ourselves living in.

And in a weird twist of fate, housing investors need to pray for doom and gloom to save the housing market - because if conditions improve, central banks will continue to raise rates and cause house prices to fall even further! The irony of the situation makes me laugh...who really are the DGMs in society?

... an improving housing market will lead to more building and big-ticket spending (equity withdrawal), buoying the economy. This goes to show that the whole rockstar economy was always a one-hit-wonder. It's all housing (...debt). It's all fake.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.