Air New Zealand well and truly had its wings clipped by Covid - but it's absolutely flying now.

According to Forsyth Barr head of research Andy Bowley and associate analyst Paul Koraua our national airline, 51% owned by NZ taxpayers, has had "a phenomenal start" to the June 2023 financial year, "with elevated passenger yields and strong forward bookings accelerating its return to above average levels of profitability".

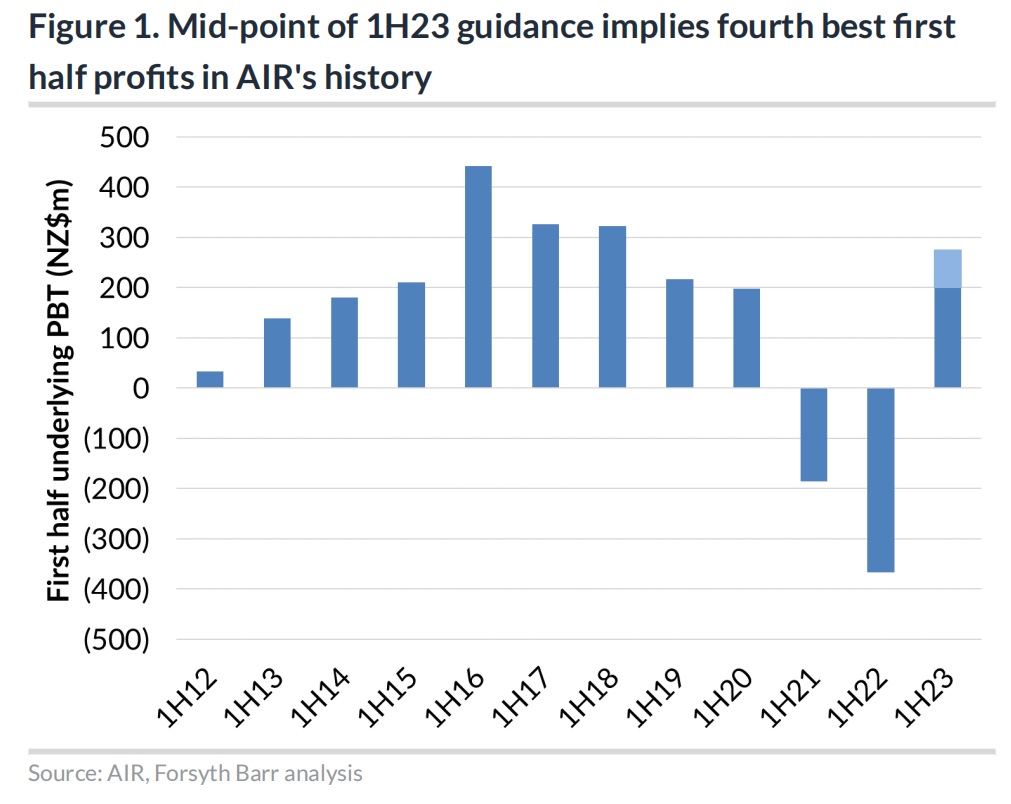

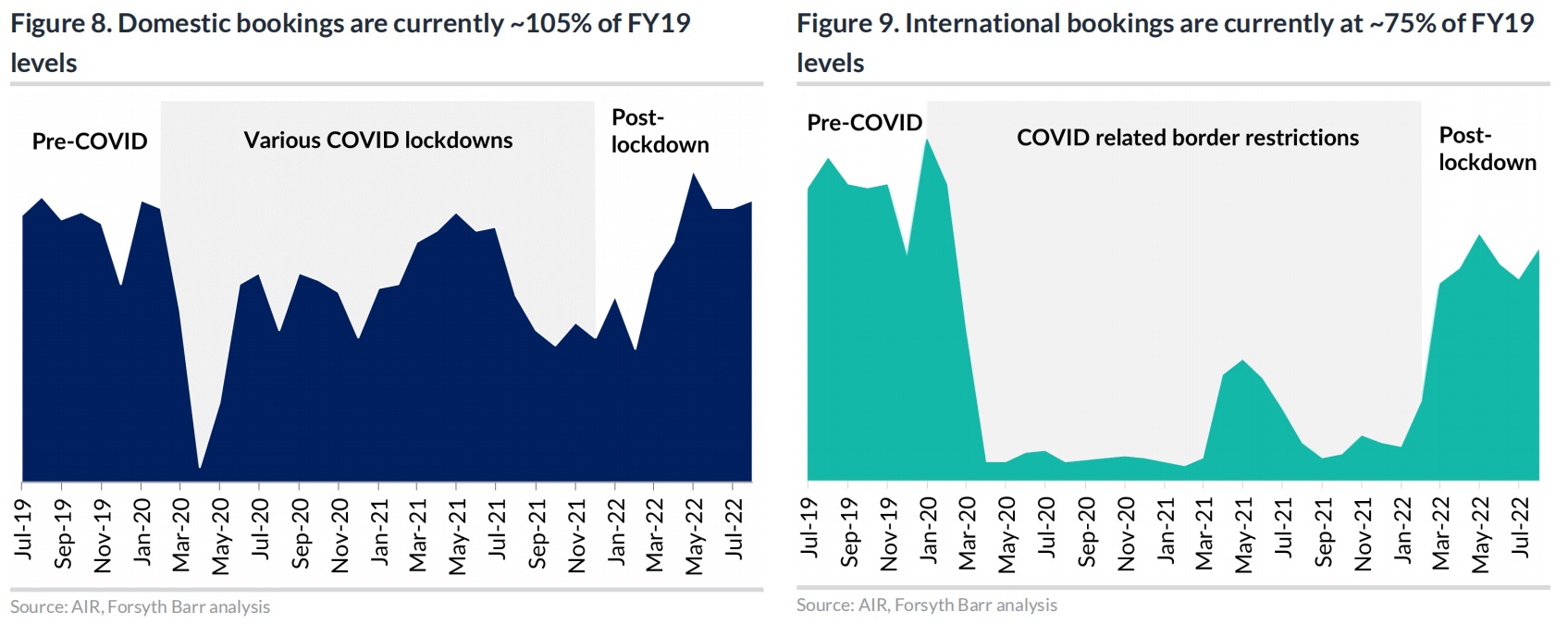

They think Air NZ might have its fourth best-ever pre-tax profit in the first half of the current year, based on what the airline has officially forecast. And they say that domestic bookings with Air NZ are now actually above pre-covid levels, while international bookings are at about 75% of what they were before the pandemic started.

However, they do caution that the very high yields the airline's currently enjoying will drop in future as more passenger capacity becomes available - and they still rate the Air NZ shares as 'neutral', although they've raised their 12-month 'target' price for the shares to 72 cents from 66c.

Air New Zealand recently provided profit guidance for the first half of the year and forecast underlying earnings before tax of between $200 million to $275. The company did strongly caution against "extrapolating" the first half results to the whole year.

The Forsyth Barr analysts reckon Air NZ will do a bit better even than its currently forecasting and they have underlying pre-tax earnings of $280 million for the first half - and they forecast that the airline's pre-tax earnings for the full year will be $474 million.

Bowley and Koraua say "robust" demand and constrained supply have created an "enviable yield backdrop" for airlines.

"So much so that [Air New Zealand's] current revenue generation is back to pre Covid-19 levels on reduced capacity."

They say the airline's revenue per available seat km (RASK) was up by about 40% in July/August for long haul services compared with 2019 levels, while for short haul services it was up about 31%.

"We understand that [the airline's] RASK is particularly strong on Tasman and North American routes, where its market positions have been temporarily strengthened and industry capacity is constrained."

But the analysts say airline yields are heavily influenced by industry capacity.

"We expect overall industry capacity, on both short and long haul international services, to remain constrained through FY23 but should gradually increase through the year and into FY24."

This means Air NZ will be exposed to increasing yield pressure over the next 18 months and RASK will "trend back towards pre-Covid levels over this timeframe".

The analysts say the fact crude oil and jet fuel prices have fallen "materially" in recent weeks provides a near term earnings benefit for Air New Zealand.

"The aviation market recovery has been phenomenal, yet despite scope for further near term earnings upgrades we expect current levels of profitability to be short lived, as yields will fall as industry capacity returns."

The analysts say that notwithstanding the improved financial position, they don't expect Air New Zealand to resume paying dividends before its previously announced guidance of no earlier than 2026 financial year.

"This view reflects a higher capex pipeline in light of recent NZD weakness."

The analysts are forecasting that in 2024 Air NZ will have pre-tax earnings of $378 million and $488 million the following year.

5 Comments

Domestic flights are crazy expensive so no surprise really.

They really need to look at some kind of higher speed train system because flying is too expensive unless you happen to fluke a deal and driving is becoming expensive too. These days where you can use devices I think people would rather sit on a train browsing interest.co.nz than having to drive.

Funny how very high flight prices leads to high profit ...

Price gouging on domestic routes, where they make all their money.

Breaking even on international business.

So Auckland - NY subsidised by Gizzy to Welly.

Might work right now, but next year they will be back to BAU.

ie bailout by taxpayers.

Hopefully Jet Star for all its warts cuts Air NZ down to size.

They are rorting kiwis who are stupidly loyal to the brand coupled with their degree of monopoly or exclusivity over certain routes. From a loyal 25 year Koru member

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.