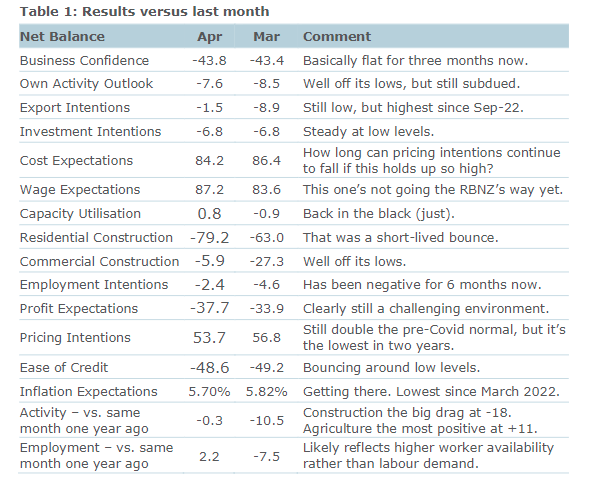

ANZ's latest Business Outlook Survey shows "falling inflation signals", which is consistent with the Reserve Bank gradually gaining traction with its inflation-fighting efforts, ANZ economists say.

ANZ's chief economist Sharon Zollner said business confidence and expected own activity results were all but unchanged in the April survey.

"April saw fairly flat activity indicators but falling inflation signals on the whole, consistent with the RBNZ gradually gaining traction," she said.

"That said, it’s far from 'job done' with the proportion of firms experiencing high costs and intending to raise prices still problematically high.

Zollner said there were question marks around how far pricing intentions can fall if cost expectations remain so elevated. Pricing intentions have been consistently lower than cost expectations for the past 12 months.

"Wage growth is a key driver of non-tradables inflation, and the news for the RBNZ on this front was more mixed. The proportion of firms reporting raising wages in the past 12 months bounced back up in April, though there is likely to be seasonality in this data that we cannot identify until we have a longer data series.

"Reported past wage settlements were little changed but expectations for the next 12 months eased. Overall, firms are anticipating to raise wages by considerably less in the next 12 months than they did in the last, though time will tell if this turns out to be the case."

Zollner said the RBNZ will be encouraged to see the ongoing fall in the inflation indicators in the survey. While there’s still a way to go, inflation is set to continue easing over the year ahead, as they and we are forecasting.

"It’s important to note that the data does not represent a ‘surprise’ for the RBNZ; rather, it’s what they will be expecting to see if their forecasts are to come to fruition, with the OCR [Official Cash Rate] able to top out shortly.

"There are risks on both sides: inflation could get 'stuck' north of the target band, or global markets could deliver a side-swipe, for example.

"But the overall message from this month’s survey is 'on track'," Zollner said.

Business confidence - General

Select chart tabs

5 Comments

Everything is happening as I have foreseen it.

- Emperor Palpatine

We're about to become a lot poorer and worse off. Govt demands you to just accept it.

Bank of England's Chief Economist tells Columbia University podcast that people need to accept that they're poorer and worse off, and to stop trying to do anything about it because they're getting in the way of central bankers attempting to fix a mess they can't seem to fix. While they're afraid of a wage-price spiral there's no evidence they should be afraid of, the costs of the past few years are coming due in a much worse way.

the modern equivalent of "Let them eat cake!"

Residential construction abysmal

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.