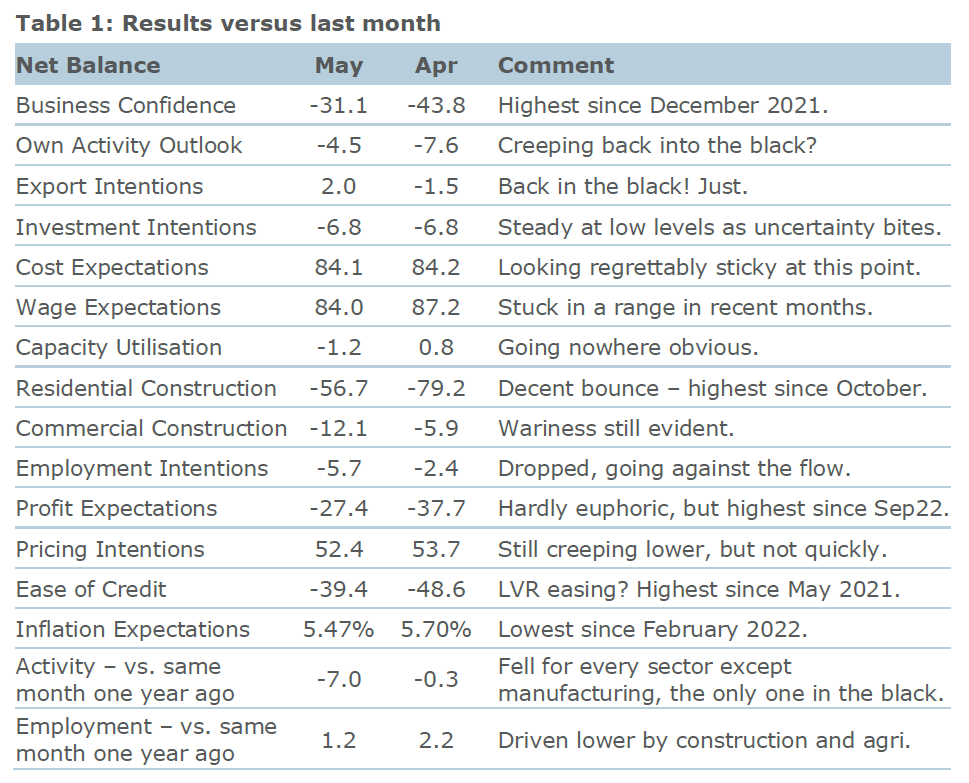

ANZ's latest Business Outlook Survey is showing increased confidence and expected activity levels - and lower inflationary pressures.

ANZ chief economist Sharon Zollner said the May survey had "brought a bounce in a number of activity indicators".

"On the other hand, employment intentions eased. This may not all be due to smaller desired staff numbers; it may partly reflect that some long-running vacancies have now been filled as labour supply has increased.

"Most inflation indicators eased. Inflation expectations inched a little lower, and the proportion of firms expecting to raise their prices and wages also fell. However, the proportion of firms expecting costs to increase in the next three months remained stubbornly high," she said.

Zollner said the Reserve Bank (RBNZ) perceives "widespread sogginess" across the economy, "making them more relaxed about the extra stimulus being provided by super-strong net migration and more fiscal spending this year than anticipated".

"We aren’t so sure. Things are patchy, certainly, but most activity indicators are well off their lows and rising, while cost and price indicators are inching lower, rather than plunging.

"Even the most interest-rate-sensitive sector, construction, is much less downbeat than previously.

"We continue to expect that the RBNZ will be back at the [interest rate] hiking table by the end of the year."

The RBNZ last week raised the Official Cash Rate (OCR) to 5.5% and signalled that it was done with hiking at least for now. The RBNZ has hiked the OCR by 525 points since October 2021 as it battles to get inflation back into the targeted 1% to 3% range. Annual inflation as measured by the Consumers Price Index (CPI) was 6.7% as of the March quarter.

ANZ's economists believe that the RBNZ will be forced to start hiking again - and have pencilled in a 25 point hike in November into their forecasts.

Zollner said, regarding the survey, that wage growth is a key concern of the RBNZ currently.

"The proportion of firms reporting raising wages in the past 12 months remains high at 83%, similar to the proportion expecting to raise wages in the next 12 months.

"Overall, it’s a push to say there’s any downward trend evident in past wage settlements yet, with every sector except services lifting this month."

She said there is a downward trend in expected wages, however, with the economy-wide measure inching down.

"Firms are anticipating raising wages by considerably less in the next 12 months than they did in the last year."

In terms of firms' expectations of where their own selling prices will be in three months’ time, this eased or was flat for every sector except agriculture. It fell most sharply for construction.

"The economy-wide measure continued lower, which is going the right way for the RBNZ.

"We also survey firms’ expected costs in three months’ time relative to today. A general downtrend is clear here too.

"Expected profitability remains under pressure, with every sector in the red."

Business confidence - General

Select chart tabs

18 Comments

Honestly, that data - in terms of confidence at least - is completely at odds with what I'm seeing 'out in the field' when meeting with clients and businesses, but I guess survey data is more valuable than anecdata.

Most of the businesses I deal with are noticing a slowdown in leads/pipeline/sales and a general feeling of unease about what the future looks like. This is particularly prominent amongst businesses with heavy exposure to construction, or where customers have traditionally relied heavily on credit (e.g. one client sells products into big box retailers who usually sold via in-store credit, Q-Card etc and that has taken a big hit)

I can't comment so much on the inflation expectations element as that's outside the remit of my work, but in terms of "are we going to sell more or less widgets more or less profitably", the outlook is typically negative.

That 7% drop in activity compared to last year might account for that... seems the most important indicator there to me?

In my little corner of the world, we have seen a 20% drop in sales this FY. Over the covid years every man and his dog piled into our building related sector, so more suppliers scrambling for less pie. There's only one way prices are going... down, along with profits, employees etc...

Some seem to be pinning their hopes on a govt change. I'm not convinced that would do anything. The whole deck of cards is stacked against housing.

The desperate gambler will always think they can win it back with one more go

Honestly, that data - in terms of confidence at least - is completely at odds with what I'm seeing 'out in the field' when meeting with clients and businesses, but I guess survey data is more valuable than anecdata.

McKinsey told me that 70% of Bangkok consumers intend to use online grocery shopping in the next 3 months. I asked my business partner in Thailand what they thought. Given that less than 30% of the Bangkok population uses modern trade supermarkets with online grocery delivery, this is logically unsound.

Everything should go through a sense check, whether it's validated or not.

Maybe there's a disconnect between what they deem to be a consumer vs a regular citizen.

Rate hikes in November!!! Wishful thinking from an economist that works for a bank that receives $2.5 million per day in interest from RBNZ (paid at OCR).

'Rate hikes in November!!! Wishful thinking" I was going to write something similar, agreed 100%

Residential construction- ‘decent bounce’.

But still bad.

And Let’s see what the result is next time when the uncertainty on MDRS is factored in.

Everyone falling over at the moment is doing so off the back of 36 months of high volume but low margin, now that the waters are muddy to trade out of their position.

No. Not another one.

That one failed a while ago. This is just reporting on the mopping up exercise.

Anecdotally I have a friend who said May has been the best month for car sales at his employers dealership network this year. They are still struggling to get manufacturers to restock inventory but if it's available stock it gets sold quickly.

The wait on built to order cars is long which disparages people from committing to purchase.

Completely logical as a car is going to hold it's value a lot better than cash in the bank, at least until real rates return to +2% - which will be never.

That's an astute observation.

We had a slow April but May has been our best month in a year. Was in central Auckland today and it was bustling with tourists and activity. If we are heading for a dark economic winter....It doesn't feel like it.

My observation is that higher interest rates defer spending but don't actually curtail it. RBNZ might end up having to life rates much further to achieve the same impact.

What a croc! Every graph they present shows activity and sentiment has been trending down since peaks in '21. And yet they say:

The RBNZ perceives widespread sogginess across the economy, making them more relaxed about the extra stimulus being provided by super-strong net migration and more fiscal spending this year than anticipated. We aren’t so sure. Things are patchy, certainly, but most activity indicators are well off their lows and rising, while cost and price indicators are inching lower, rather than plunging. Even the most interest-rate-sensitive sector, construction, is much less downbeat than previously. We continue to expect that the RBNZ will be back at the hiking table by the end of the year.

Let's be clear sentiment is still negative. It has not suddenly bounced back to positives. The trend is still clearly downwards and contracting.

So what's going on?

Are the retail banks - in this case ANZ - helping the RBNZ keep the pressure on? Or - as I expect - based on ANZ's own charts (rather than their spin) - they don't want anyone to know that the RBNZ has done enough and they want you to re-fix at higher rates for longer (thereby ensuring maximum gain for the retail's banks shareholders)?

When the data say's one thing and an economist says another .... Trust the data!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.