Is the "worst" over?

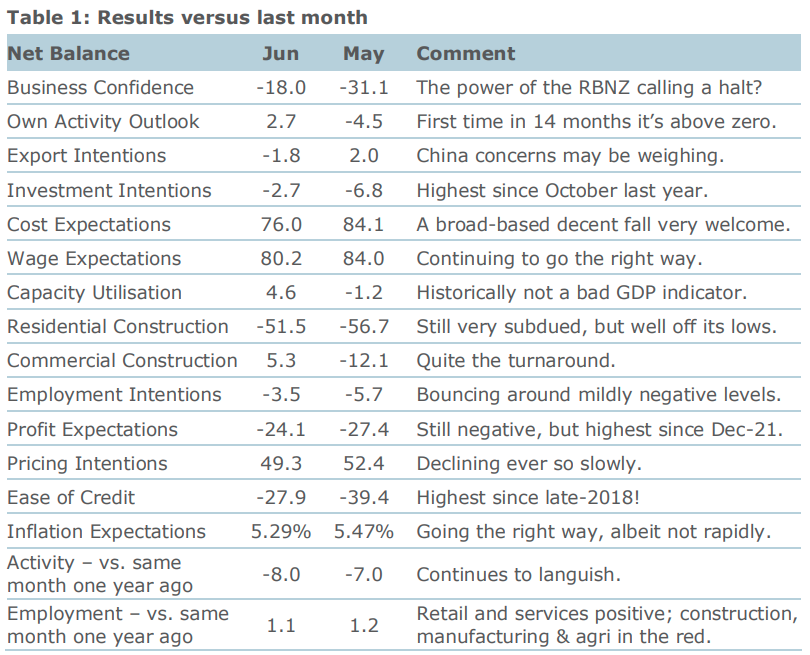

ANZ's latest monthly Business Outlook Survey has shown a marked improvement in overall business sentiments, while cost and inflation expectations have dropped.

ANZ chief economist Sharon Zollner said business confidence leapt 13 points in June, the highest read since November 2021. Expected own activity jumped 8 points; "hardly strong, but the first time in 14 months that it’s been in the black".

"June saw activity indicators lift in a reasonably broad-based fashion. While the levels of many are still subdued, firms appear to be cautiously optimistic that the worst may be over."

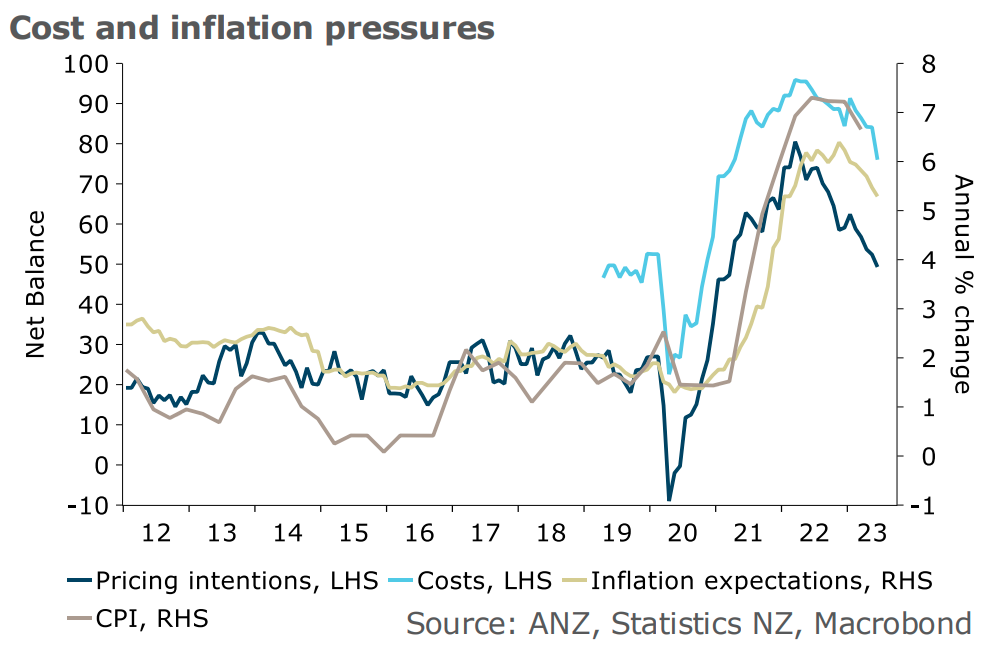

Zollner said headline inflation and pricing indicators continue to slowly ease. Inflation expectations have the steepest downward trend, "but are still extremely elevated". The fall in the net proportion of firms expecting higher costs was "particularly marked" this month.

"Firms’ views of their own selling prices in three months’ time were slightly lower versus last month at 2.8%.

“Encouragingly, a general downtrend continues to be evident in firms’ expected costs in three months’ time relative to today. The data imply that on average, firms continue to expect margin compression, given costs are expected to lift more than prices."

Zollner said wage growth was a key driver of the persistence of non-tradables inflation. She said in the latest survey reported past wage settlements ticked slightly lower and expectations of wage settlements for the next 12 months "continued to trend lower in a broad-based fashion".

“Overall, firms are anticipating they will raise wages by considerably less in the next 12 months than they did in the last."

In the latest survey, respondents were asked what their firm's biggest problem was. This is something that the survey asks every three months.

Finding skilled labour continues to be the largest "issue" for firms, but it is now "not the extreme outlier it was a year ago". Problems related directly to inflation – wage and non-wage costs – continue to rate highly. Interest rates have increased as a concern. Low turnover remains well down the list.

"Times remain very uncertain for businesses, and pressure on profitability from high costs and in some cases, lower turnover, persists. But there are positives too – firms appear to have taken heart from the RBNZ calling a halt to hikes," Zollner said.

"Increasingly widespread expectations that the housing market has found a floor appear to be offering glimmers of hope for the residential construction sector, and finding labour has clearly become much easier as workers have poured in through the border, alleviating a significant source of stress for businesses.

"Of course, capping any upside is the fact the RBNZ is wanting to see subdued demand for a period.

"But for now, cautious optimism appears to be emerging that the worst could be past – but it's conditional on those inflation indicators continuing to fall”.

Business confidence - General

Select chart tabs

12 Comments

Pull that graph of Business Confidence back to the turn of the century, and it seems to indicate that Confidence was really only high during the period of artificially low interest rates. That, is not a good sign for the future of business in this country. Worse. It's a sign that we have been living off the proceeds of debt backed, speculative assets.

That has to change if we want a viable future here. Productive Business deserves all the assistance we can offer. Speculative Endeavour needs to be clubbed into submission. If that RBNZ has one practical role - that's it.

Govt accountable too - instead of tax breaks on speculation, why not tax breaks on innovation? We have a R&D tax break of 15%, boost that up and go back to businesses having dedicated teams innovating in industry. Oh wait, we offshored our industries too.

Oh wait, we offshored our industries too

That statement should be in present tense. Ideologically driven policies are scaring away investments from NZ's O&G sector. Like it or not, global demand for fossil fuels isn't going away anytime soon, so this battle can end in our reliance on imported fuels further increasing and our grid becoming more exposed to renewable intermittency.

Alternatively it correlates pretty well to what colour party is in power

Pull that graph of Business Confidence back to the turn of the century, and it seems to indicate that Confidence was really only high during the period of artificially low interest rates. That, is not a good sign for the future of business in this country. Worse. It's a sign that we have been living off the proceeds of debt backed, speculative assets.

Well articulated bro

T Alexander's title of his TView today "FOMO's back"… we shall see by the end of the year...

T Alexander's title of his TView today "FOMO's back"… we shall see by the end of the year...

He knows what his audience likes Dr Y. If his narrative strays too much and the audience starts to get agitated, time to pull out Freebird.

Works everytime.

This guy's credibility is in the toilet. What scale is he using to measure FOOP or FOMO? 'Out of the 5 people surveyed...3 said they had some FOOP with a bit of FOMO'. People will believe any old crap!

Median FOOP index is up 3% seasonally adjusted quarter on quarter from Jan quarter 2021, where FOMO index average spurred a 6 month rally on the internally combusted debt speculation survey out of 10 and three quarters of the bank of Mum and Dad after I asked my mates what they reckon.

If you use enough buzzwords, nobody can tell wtf you're saying, and therefore cannot be proved wrong 😎 slam dunk economythst.

"Economythst" I like that one!

The path to a hard landing will briefly look like a soft landing at first. People who pick bottoms end up eating poo.

Given we import pretty well everything, and that many our trading partners' central banks are still hiking rates, or holding them high for an unknown time to come, maybe there's a way to go yet.

And what will be the effect of the reimposition of the full fuel tax?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.