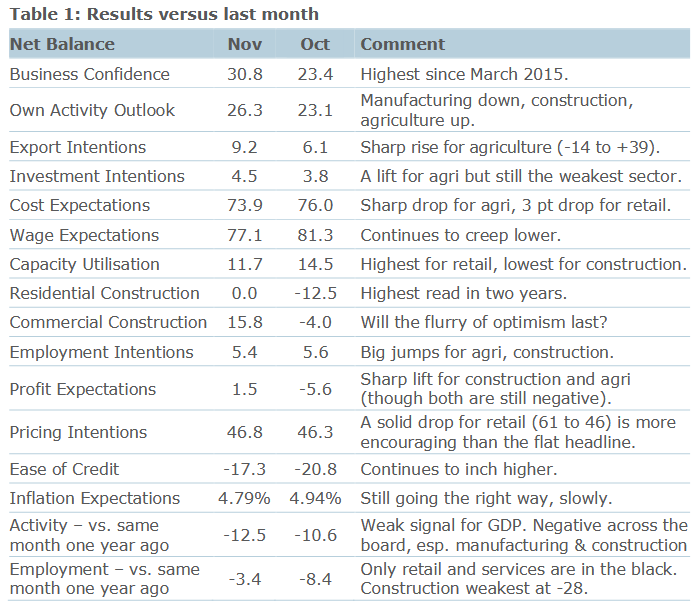

Indications of future inflation were a "mixed bag" in the latest ANZ Business Outlook Survey - but the new Government's honeymoon has very much continued, with overall business confidence hitting its highest level since March 2015.

ANZ senior economist Miles Workman said that in the latest survey inflation expectations eased from 4.94% to 4.79%, while retailers’ pricing intentions eased from 61% to 46% of firms intending to raise their prices in the next three months.

"But moves in other sectors were much more mixed. Economy-wide the proportion of firms intending to raise their prices has been flattish for the last five months, which is threatening to look like a stall," he said.

He said the same is true of the numerical estimates of how much firms intend to raise their prices in the next three months.

"These were unchanged at 2.1%. But again, more encouragingly for the RBNZ [Reserve Bank], there was a sharp fall in the retail sector, and the downward trend here looks well intact."

Overall business confidence lifted another 8 points to +31 in November, taking confidence levels to the highest since March 2015 - and higher than during at any time during the Labour led Governments first elected in 2017.

Firms' expected own activity rose 3 points to +26. Workman said for much of the sample this is their first survey response since the election.

Westpac senior economist Satish Ranchhod said while business confidence is up, the ANZ survey points to a more sobering picture of economic activity.

"Most businesses (a net 12.5%) actually reported that trading activity has slowed over the past year. There’s been particular weakness in the manufacturing and construction sectors. That’s consistent with the feedback we’ve also received from businesses around the country and matches our expectations for a downturn in growth through the latter part of this year.

"Overall, while confidence is up, the more important take out is the continued easing in the backwards looking activity indicators. The RBNZ will also take some comfort from signs that inflation pressures are softening in some parts of the economy, though there is still a long way to go before inflation is back in line with the RBNZ’s target," Ranchhod said.

ANZ's Workman said there was another lift across most activity indicators in the survey this month, "though less marked than the first post-election read last month".

"Political uncertainty persisted through the month to the extent that only a tiny number of responses came in after the coalition agreements were announced."

Workman said the proportion of firms reporting that they had lifted wages in the past 12 months ticked up and the magnitude of reported past wage increases also rose.

“The proportion of firms expecting to raise wages in the next 12 months fell, led by falls in retail, manufacturing, and services. The expected average wage increases over the next 12 months fell from 4.0% to 3.6%, with retail the lowest. These results may be related to anticipated policy change around industry-wide pay agreements and minimum wages.

“Lower wage expectations also fed into lower cost expectations which landed on about half what it was 18 months ago, though still high in an absolute sense.

“Overall, the headline inflation indicator suite continues its trek down the mountain, but there’s still a long way to go and pricing intentions have stopped for lunch.

Workman said he would characterise this month’s survey as corroborating the narrative that the economic "soft landing" is in play, but that the question of whether the slowdown will be sufficient to bring inflation all the way back to the RBNZ's 1% to 3% target in an acceptable time frame remains an open question.

"Markets are itching to price in imminent cuts to the Official Cash Rate, but with some inflation indicators threatening to stall, and activity indicators generally far from recessionary levels, it seems likely to be some time before the Reserve Bank is seeing the world the same way."

Business confidence - General

Select chart tabs

2 Comments

Business confidence higher than at any time of the Labour Government, a clear statement from the Business sector of their distrust of Labour.

I feel so grateful there are people like Luxton and Willis prepared to commit their time and energy.

No matter what happens even WP playing up it's soo good to have got rid of the other lot for soo many reasons.

Housing. What about the slow creep in house prices? This will soon turn into a fast walking pace and then sprint. Then the OCR will have to stay above 5%-6% to kill inflation growth.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.