The ANZ's latest Business Outlook survey is showing falling confidence levels and some "lingering inflation challenges under the surface".

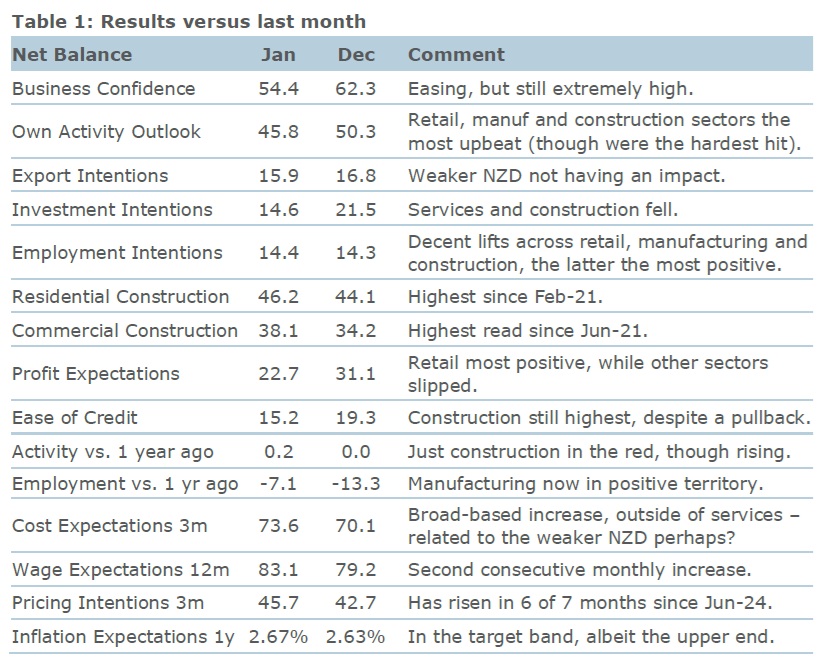

The January survey shows that business confidence fell 8 points to +54 in January, while expected own activity eased 4 points to +46 - though ANZ notes both are still very high. Past own activity (the best GDP indicator) was stable.

The survey showed that pricing and cost indicators lifted, with the downward trends that have been in place over the past year showing signs of flattening off. Inflation expectations lifted a touch but remain within the target band.

"It was a slightly less encouraging start to the New Year for businesses," ANZ chief economist Sharon Zollner said.

"Perhaps reality biting as it becomes clear that falling interest rates over the second half of last year will take time to work their magic. That’s not surprising, and the level of confidence and activity expectations remains very healthy, despite the pullback to start the year."

Zollner said a modest pullback across headline confidence and some activity indicators certainly doesn’t suggest the recovery in the economic activity has stalled, but firms may be reassessing how long they might have to wait to get back to a new ‘normal’.

"Insofar as the slowdown was primarily caused by higher interest rates, lower interest rates should be an effective cure, but it will take time," Zollner said.

"Meanwhile, another month of increases across pricing intentions and cost expectations highlights some lingering inflation challenges under the surface. The softer NZD [NZ dollar] may well be a factor here."

Zollner said it was reassuring that the December quarter inflation figures released earlier this month showed underlying domestic disinflation is intact, and in fact is easing a little faster than the RBNZ had anticipated in its November Monetary Policy Statement.

"Nonetheless, firms continue to report an environment of high costs," she said.

"While demand is recovering, the potential for supply-side constraints to still be lurking is one of the reasons the RBNZ is likely to become more cautious in reducing the OCR [Official Cash Rate] as it gets closer to a neutral policy setting."

Zollner said the survey results certainly don't stand in the way of the RBNZ delivering another 50 basis-point cut to the OCR at its next review on February 19.

However...

"...It does highlight some of the uncertainties on the horizon further into 2025 regarding just how much growth the economy might be able to deliver before inflation pressures re-emerge," Zollner said.

"For now, however, still subdued demand conditions appear to be stifling firms’ intentions to raise prices."

Business confidence - General

Select chart tabs

26 Comments

"Will take time" = rates will continue to fall.

"Will take time" = Rates have been held, too high, for too long.

Evidence?

- 6 months at target inflation ... and rates are STILL restrictive

- 18+ months since inflation started falling ... and rates are STILL restrictive

- 12+ months since the OCR should have been slowly and gently cut (i.e. Nov 2023 !!!!)

By now the OCR could have been at neutral. But it is STILL restrictive. Why?

Can't though. Political pressure will not allow restricting LVRs and DTIs further to head off the housing Ponzi.

Agree - although the RBNZ don't have an obligation (any more) to keep the economy ticking over, you could argue they were correct to ensure inflation was under control before cutting.

They need to reinstate the full employment mandate, but ensure it is a secondary target for when inflation is expected to be within target in the median term.

"you could argue they were correct to ensure inflation was under control before cutting."

Are you arguing that?

If so, Jimbo, I'd love to hear those arguments.

The use of the royal "we", Jimbo, will make a fool out of you, but not me. Kind regards.

They need to reinstate the full employment mandate, but ensure it is a secondary target for when inflation is expected to be within target in the median term.

They are conflicting mandates hence why they were doomed to cause the RBNZ to be pulled in two directions, as they would always be failing at one of them. The employment mandate is futile in a system that requires a level of unemployment to keep wages suppressed and hence inflation down. Perhaps a better way would be to start tipping the tax scale towards capital and taking some of the pressure of tax of labour so those that have hoarded assets can start paying a fair share.

Rates were held too low 2008 to early 2020’s. Embedded extremely high private debt to GDP which is the problem we have to solve in order to ‘recover’. But we think dropping rates so that private debt to GDP can remain extreme high is the solution to our problem - not realising that it is the problem.

re ... 2008 to early 2020’s interest rates ... I'd argue :

a) the absence of DTIs was a major issue

b) the preferential treatment 'residential property investors' received with regards LVR was obscene

And I'd note -

a) investors still get preferential treatment with regards LVRs and DTIs

b) LVRs and DTIs are still too high to correct NZ's 'investor' behaviour

Without the will of the public it will never change. I'd argue we need this change/tax reform to force people to change investor behaviour, but again if the masses don't want change as they all have vested interests (or are of too narrow view) then what can we do. Hopefully people realise with the ever growing wealth divide that this is the path of least resistance to growing the middle class once again.

Total inflation is within target but domestic inflation still way higher. We can expect tradeable inflation to increase & as we see local pricing expectations are up. It may be that a "neutral" OCR actually allows inflation to escape again. Whether or not the inflation target is valid is another matter.....

Higher inflation is part of our DNA for the foreseeable future

Why? You don't say.

The clue is in his username

I don't think saying that is too D&G - IMO the US government will need to inflate their way out of their huge debt - I think the long term future will be very inflationary

"inflate their way out of their huge debt" - that would need a massive change to their central bank. Otherwise inflation will just trigger higher interest rates which will make their debt cost even more.

You appear to be starting to understand the problem Jimbo.

And if the debt costs even more they may need to issue even more debt to over the interest costs in the already existing debt - and the spiral towards bankruptcy begins. (the more money they create via debt relative to their production of goods and services, they more inflation they will have and the more they will need to raise rates)

I think you will find this article quite illuminating: https://www.lynalden.com/full-steam-ahead-all-aboard-fiscal-dominance/

When so many council can put up rates 10% + in 2025, and insurance and other cost are increasing just as much, plus little competition in so many sectors of the NZ economy, lower interest rates many not make much difference. Just had another price rise notification for electricity and it is quite a hike, far more than inflation, and am already with the cheapest provider. But they are likely to lead to higher imported inflation as we pay more for imported goods due to the crashing NZD due to a lower OCR relative to Oz.

Largely agree with your other comments ... But take care with this one ...

"crashing NZD"

It is not crashing. It has found new level. We'll hover around this level until something else happens.

52 is doable, 40's would be dire, but i can see it as a possibility.

how can you grow when 360bil is tied around your neck.

robinson said grow and we did... luxon not so much now there is no reason to borrow more for any venture.

ANZ Economist = Bank Economist -> "fix longer and higher" = Greater profit for offshore banks (and ANZ economist's bonuses).

Not too hard to understand, ay?

I'm still picking the RBNZ will hold at the next review in February.

I'll take the other side of that bet. Inflation is at target. NZ economy is in the dumps. OCR is still restrictive. NZD has stopped dropping and interest rates overseas have stopped going up.

Why would they hold?

LOL.

Reality is sinking back in after the first rate cut announcement. Businesses are realising more cuts will be needed to jump start spending again.

The trouble is for many people the increased cost of living is consuming the spare cash from the cuts... there is nothing left to kickstart a credit impulse at all, and houses have not fallen enough to seem cheap... so not many will want to use new credit,

Exactly. That's my reasoning for thinking that interest rates will go much lower than is currently expected.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.