New Zealand corporates are "persistent" and say the economic recovery is "just around the corner", according to financial services company Forsyth Barr.

The research team at Forsyth Barr have just conducted what they believe to be the biggest survey of kiwi businesses.

They say the fifth and largest iteration of the Pulse of NZ Business survey paints a clear picture.

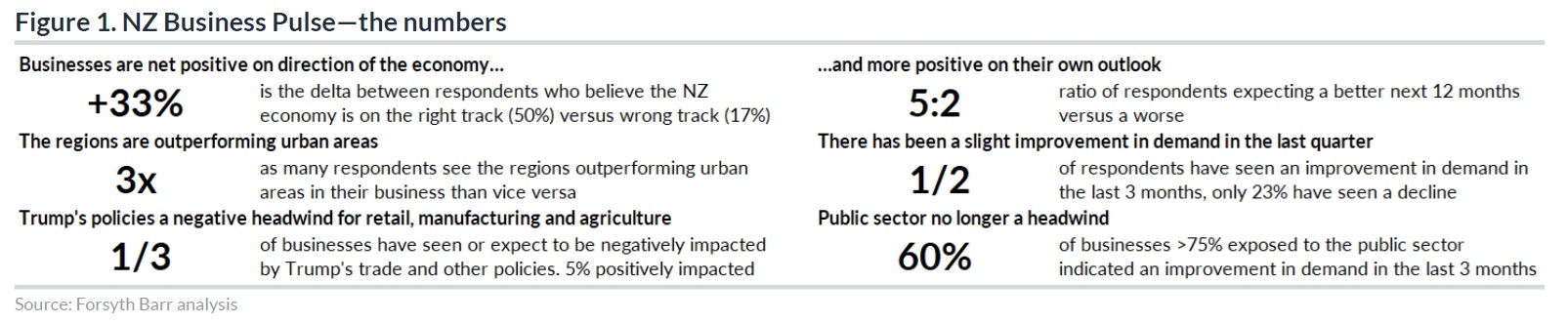

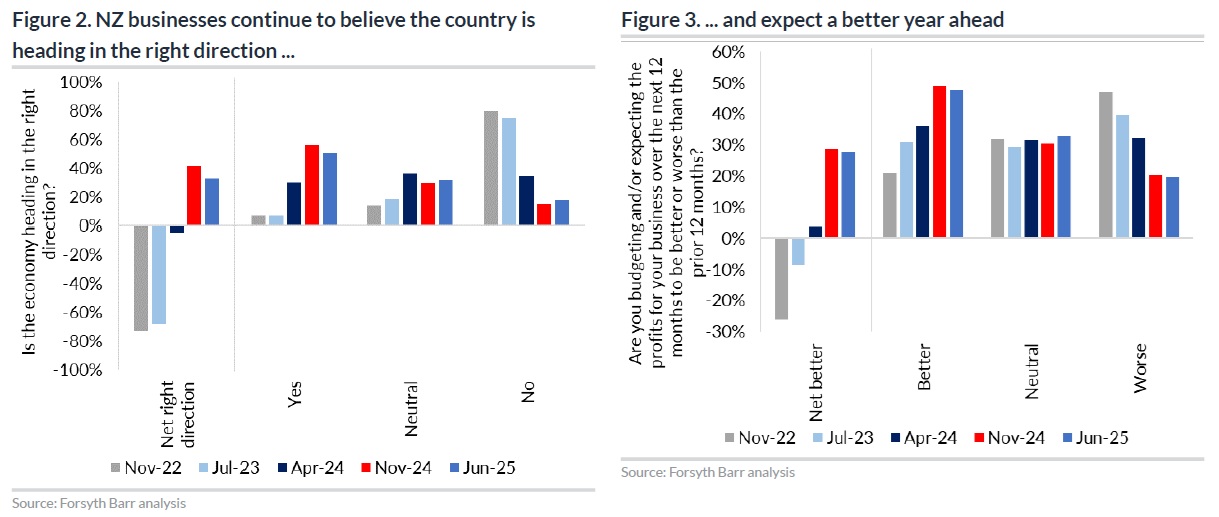

"New Zealand businesses expect the year ahead to be better than the one just finished and have seen an improvement in demand over the past three months," the researchers say.

The survey was conducted between June 3 and June 22, 2025. Feedback was received from more than 1,400 owners, directors, managers, employees, and contractors from businesses of all sizes. Respondents were asked the same 14 questions, including their views on key issues. The last survey before this one was conducted in November 2024.

The Forsyth Barr researchers said the "relatively optimistic view" of businesses is broad-based.

"...With the exception of construction and retail, all significant sectors have seen a notable improvement. Overall, businesses remain of the view that the economy is heading in the right direction. Given the substantial scope and high response ratio of our survey, this is clearly a positive sign. That said, the answers are similar to those in our last survey, conducted seven months ago."

Both when asked about New Zealand as a whole and when specifically asked about their own business performance, New Zealand businesses are positive, the researchers say. Fewer than two in every 10 respondents think the country is heading in the wrong direction, while about half think it is heading in the right direction.

They said the "least surprising" finding of the survey was the relative strength of the regions. Of the respondents that had seen a difference in demand between the three main urban areas (specified as Auckland, Wellington, and Christchurch) and the rest of the country, those seeing the regions doing better outnumbered urban by a factor of 3:1.

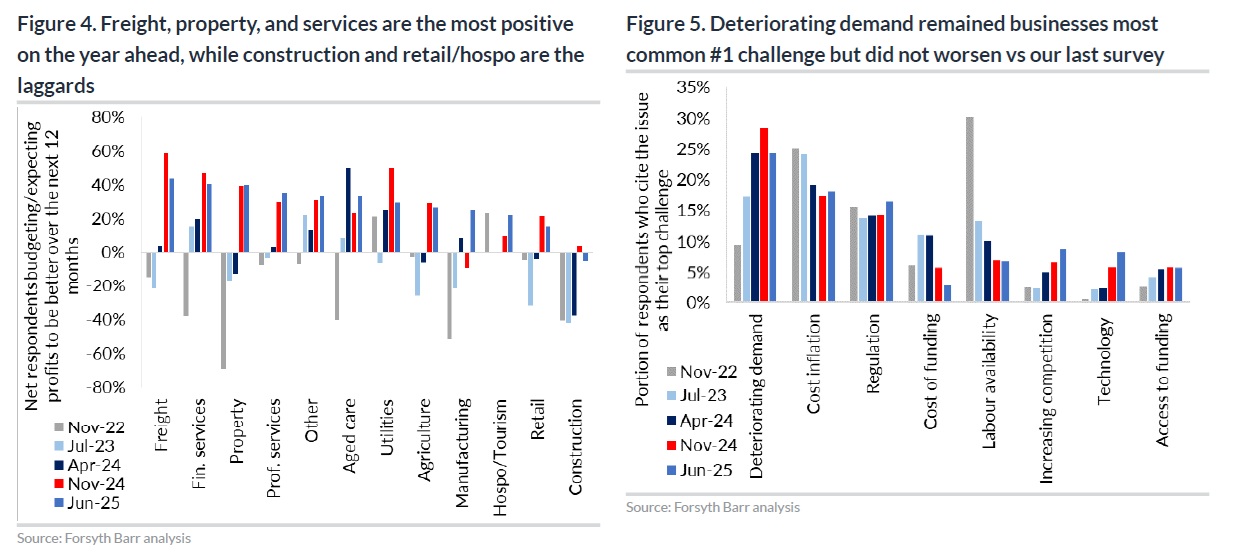

"This lopsided nature of the recovery is further supported by looking at sectors that are doing well. Freight, agriculture, and aged care are sectors that are less dependent on urban areas, whereas retail and, to some degree, construction (by value) are more dependent on urban areas."

The top three challenges facing NZ businesses continued to be: (1) deteriorating demand, (2) cost inflation, and (3) regulation, "all largely stable since our last survey".

Outside of these top three, the researchers highlighted three notable trends:

Adapting to new technology is an increasing challenge: Quickly emerged as a top five challenge, potentially driven by AI. Over half of professional and financial service respondents cite this as a challenge, far exceeding all other sectors.

Increasing competition: Nearly all sectors have seen this become a more common challenge, but the largest increases have come from retail and construction (where end demand has reduced) and aged care (elevated industry supply levels).

Decreasing cost of funding: An expected outcome with interest rates falling. The portion of respondents seeing this as a challenge has halved since April 2024. Access to funding has not improved, with a similar ~15% also citing it in each of our previous surveys.

The researchers said that overall, the contours of the survey "suggest to us that a recovery is taking shape".

"Firstly, public sector–exposed companies appear to be pointing to a meaningful improvement. While this may not be a meaningful positive driver, we believe it was a meaningful negative driver previously.

"Secondly, the regions are coming through strong, supporting anecdotal evidence that, outside of the doom and gloom in the main metropolitan areas, NZ is staging a recovery.

"Finally, cyclical sectors like construction and retail—which we knew from public announcements were weak—are also coming through weak, while other cyclical or partly cyclical sectors like freight and professional services are coming through strong.

"In short, if we indeed are at the early stages of an economic recovery, we believe our survey responses would look very much like they do," the researchers said.

6 Comments

It should be no surprise that regions are more positive

Yes, job ads are stuck at levels last seen for any time in 2011. The recovery is just round the next corner, like the end of a long, endless hike when you're cold, lost, and hungry.

Wow - the phrase - the economic recovery is "just around the corner" - has real ring to it. It was first stated back in early 2024 and it's been repeated since with decreasing conviction.

The government sets the tone and behavior in the rest of the economy and the setting that Willis is shouting to NZ's private sector is - withdraw, contract, spend and invest less and lay off employees.

Until that setting changes the NZ domestic economy will stay flat even if exports lift.

Why did the researchers not investigate resource and energy stocks?

The real counts?

And why is the media not pulling them up, for surveying sentiment (bootstrappingly self-generated) rather than reality?

New Zealand businesses expect the year ahead to be better than the one just finished and have seen an improvement in demand over the past three months," the researchers say.

Expectation or hope?

If a rational person did not have hope they would shut the business. One has to have hope against all odds (we call this phenomenon risk) to keep pushing forwards.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.