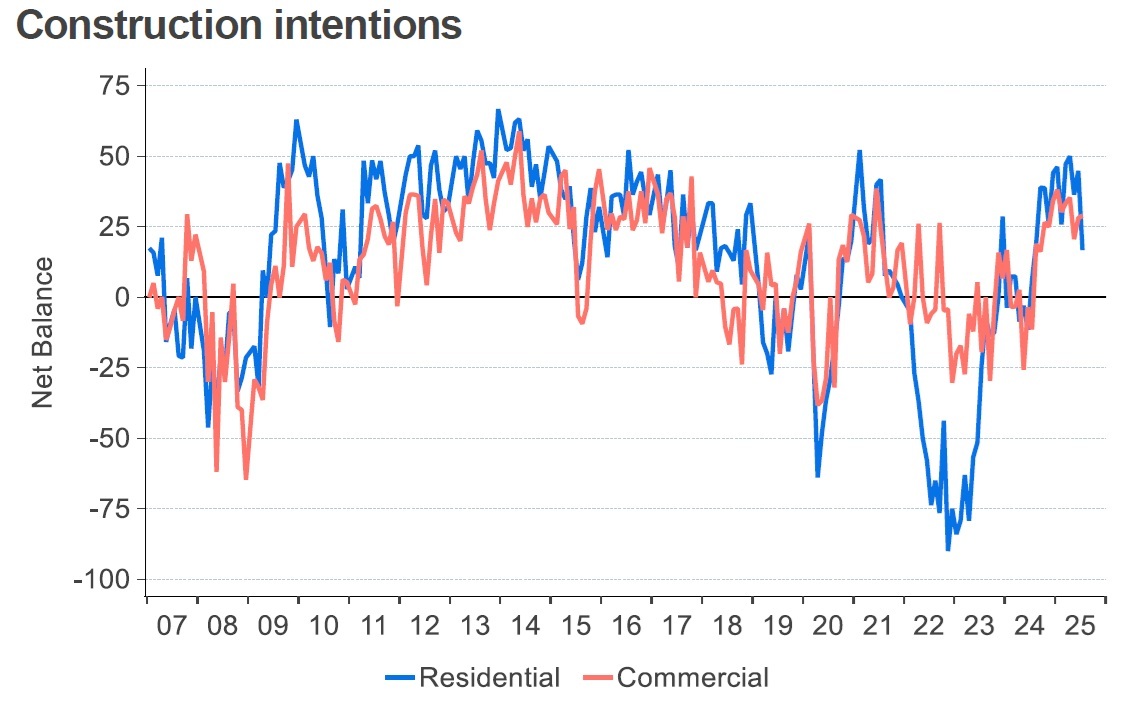

The 'tanking' of residential construction activity expectations to the lowest level in a year was one of the noteworthy moves in the latest ANZ Business Outlook Survey.

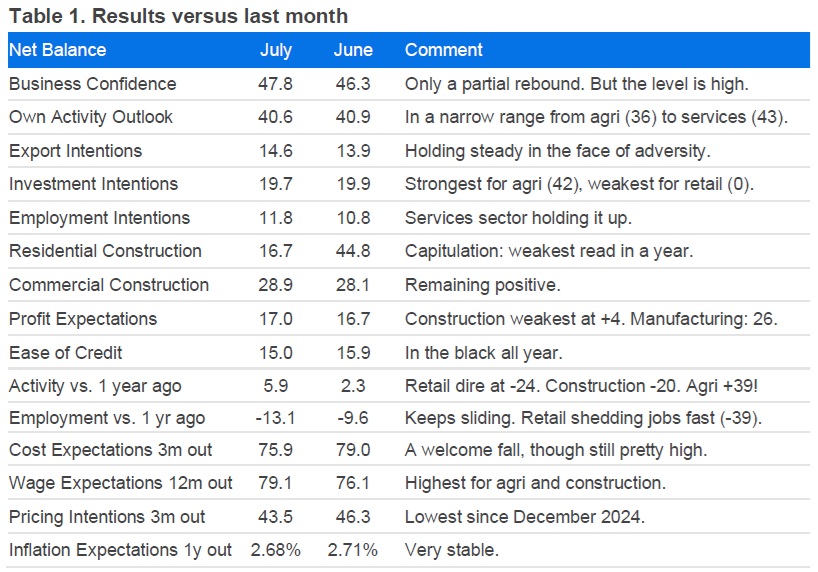

ANZ chief economist Sharon Zollner said the current environment "continues to be tough going for many firms", with most forward-looking activity indicators in the survey seeing little movement in July.

"The past activity measures show a very wide range of experiences across different sectors, with agriculture storming ahead but construction and retail reporting a significant renewed slump," Zollner said.

"It appears residential builders are giving up on a recovery any time soon, with a sharp drop in construction intentions this month, to the lowest level in a year."

Zollner said inflation indicators in the survey were "benign", with both expected cost and pricing expectations, and the net share of firms expecting them to increase, easing this month.

"We continue to expect that the RBNZ’s inflation concerns will gradually pivot from medium-term inflation being too high, to it potentially being too low, paving the way for more monetary easing than is currently envisaged by the Reserve Bank or the market."

At the moment the Official Cash Rate is at 3.25%, but the RBNZ is widely expected to drop it to 3.0% at the next review on August 20.

In terms of the latest ANZ survey as a whole, business confidence lifted 2 points in July to a net 48% expecting better business conditions, while expected own activity was flat at net 41%. Past own activity rose 4 points to +6, but past employment fell 3 points to -13. "Both are very subdued," Zollner said.

Inflation indicators fell: the net percent of firms expecting to raise prices in the next three months fell 2 points to 44% and those expecting cost hikes fell 3 points to 76%. One-year-ahead inflation expectations were flat at 2.7%.

"Economy-wide, firms continue to experience soft demand: reported past activity lifted 4 points but remains negative for retail, construction and manufacturing.

"In contrast, reported past employment is in the red for every sector. We expect HLFS employment fell in Q2.

"Pricing and cost expectations, as measured by the net percent of firms expecting increases, eased slightly. Inflation expectations remain very stable.

"Firms on average expect costs to rise 2.4% over the next three months (vs. 2.5% in June), while they expect to raise prices by 1.4% over the same period, versus 1.6% in June. Past and expected wage growth is just 2.5%."

Business confidence - General

Select chart tabs

8 Comments

Nobody wants to pay world-leading construction prices in a declining market, with declining numbers of people, where buyers are now being told that houses should not be considered "an investment"?

A feather knock me over with.

You'd have to have a very special section in a very special location to build in this market.

Along with this, a refreshingly realist Govt, putting measures in place to have land, materials and homes becoming much cheaper to deliver, in the future.

Time to Short ANZ and its increasingly underwater, mortgage book.

I'm sure Dr Micheal Burry is on it already.......

CBA offers a bigger prize but you need bigger balls.

That's good news. I've just today requested a preliminary new build proposal for a dual home+income in Canterbury. Pencils should be sharper...

Anyone else wondering why the RB has paused on rate cuts?

No not really. Global long term inflation expectations aren't dropping.

US 10 year bond yield is flat as a pancake.

There is no one steering the ship?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.