The 'dovish pivot' by the Reserve Bank last week doesn't seem to have immediately perked up confidence overall in the business community - but there was a big lift in sentiment in the residential construction sector.

This is according to the latest ANZ Business Outlook Survey, which took in responses from businesses both before and after the RBNZ latest Official Cash Review on August 20 at which the central bank lowered the OCR from 3.25% to 3.00% and indicated it may go as low as 2.50% before the end of the year.

The 'tanking' of residential construction activity expectations to the lowest level in a year was one of the noteworthy features of last month's survey. But that somewhat turned around in the latest month's survey.

ANZ chief economist Sharon Zollner said there "wasn’t widespread evidence of a lift in the mood in the late-month responses" that came in after the RBNZ decision.

"Business confidence and expected own activity were both lower in the late-month sample," she said.

"However, there were a couple of encouraging data points: the retail sector’s reported past activity and residential construction intentions were both markedly higher in the late-month sample, though we’re not willing to take a strong signal just yet."

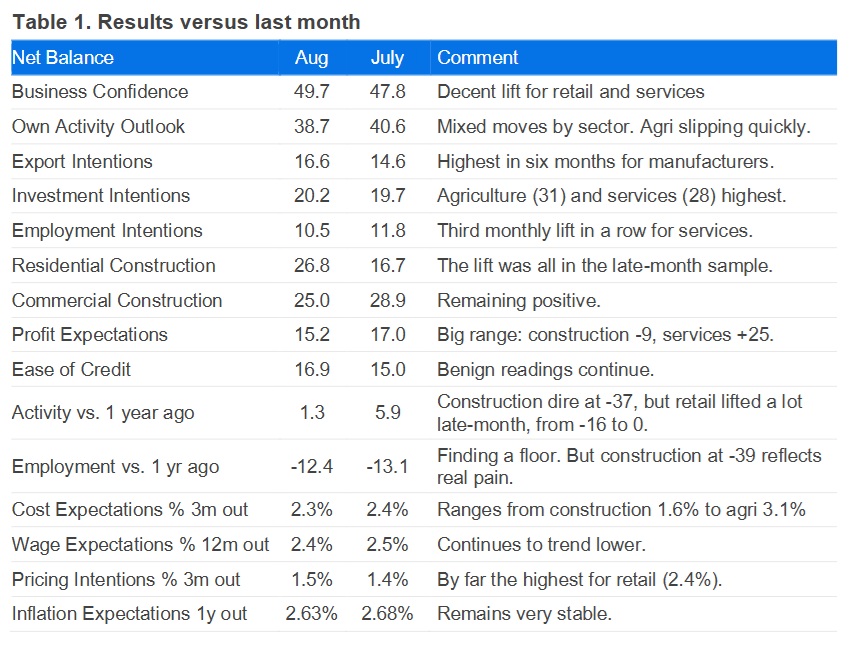

In terms of the general results, business confidence lifted 2 points in August to a net 50% expecting better business conditions, while expected own activity fell 2 points to a net 39%. Past own activity fell 5 points to +1, while past employment rose 1 point to -12.

Inflation indicators fell: the net percent of firms expecting to raise prices in the next three months fell 1 point to 43% and those expecting cost increases fell 2 points to 74%. One-year-ahead inflation expectations eased slightly to 2.6%.

"Forward-looking activity indicators saw a mix of rises and falls in August," Zollner said.

“Reported past activity (the best indicator of GDP in the survey) eased further and remains negative for retail, construction and manufacturing."

Zollner said the latest survey was "consistent with the RBNZ’s updated view that the economy needs a little more support to head off downside risks".

“It’s too early to judge the confidence impacts of this month’s [RBNZ] shift in stance, but our view is that it will shore up the recovery that is now underway."

Zollner said, however, "the pain" from previous weakness continues to percolate, showing up this month particularly in the sharp drop in reported employment in the construction sector.

"The recovery will unfortunately not come soon enough for some."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.