The Institute of International Finance's latest quarterly Global Debt Monitor says corporate debt has increased significantly this year, and is fast approaching US$100 trillion.

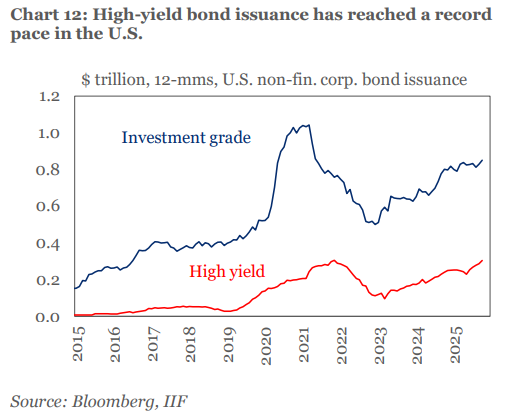

The rise is especially noticeable in China, France, Germany, and the United States, with corporate junk bond issuance in the latter reaching a record high, the Institute of International Finance (IIF) says.

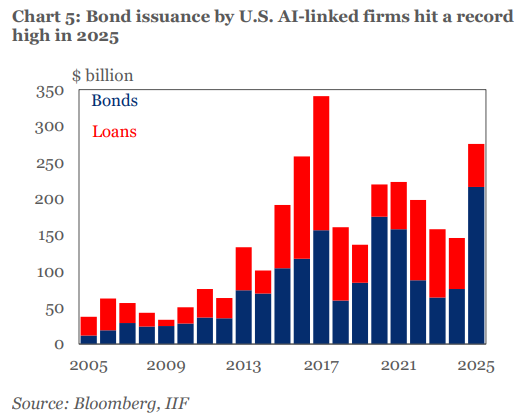

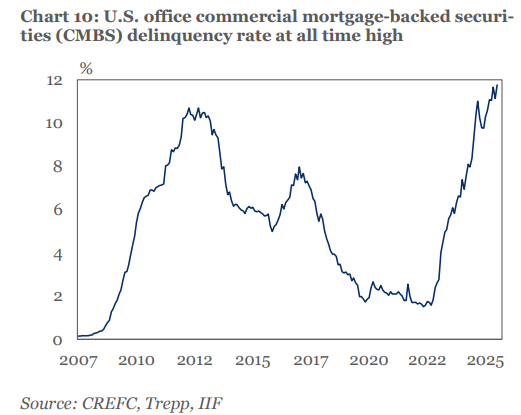

"With rising office CMBS [mortgage backed securities] delinquency rates underscoring ongoing stress in the US commercial real estate sector, the construction boom in data centres, and the associated borrowing, warrants close monitoring. In fact, the surge in borrowing has been particularly notable among AI-linked firms. A similar pattern was evident across clean-tech firms, where the increase in market borrowing has been driven largely by Chinese companies, followed by Brazil and [South] Korea," the IIF says.

"In short, growing leverage in the AI, clean tech and defense sector borrowing should shape credit markets over the next several years. While many AI and tech firms have traditionally financed investment through internal cash flows, and defense firms’ access to capital markets has historically been limited, there is now a clear shift toward more active use of bond markets, expanded bank borrowing, including securitization of bank loans, and greater reliance on private debt."

A recent episode of Bloomberg's Odd Lots podcast, featuring Paul Kedrosky of US venture capital firm SK Ventures, discussed "the AI bubble" as being "like every previous bubble rolled into one." Kedrosky cited a real estate aspect, a technology aspect, "exotic financing structures" to fund it, plus talk of government bailouts and backstops.

Private credit momentum expected

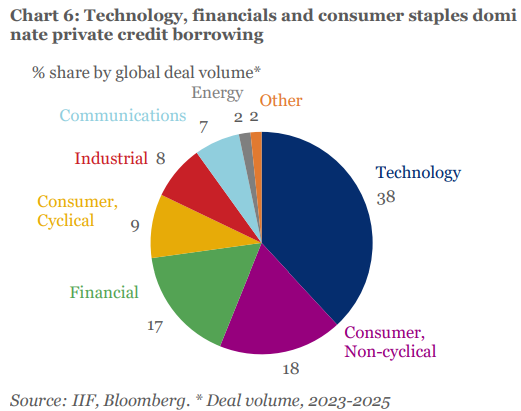

Meanwhile, the IIF notes the private credit/debt market has grown rapidly, from US$500 billion in 2004 to nearly US$1.8 trillion in 2023. It adds that while the rapid growth has drawn increased investor and regulatory scrutiny, private debt markets still represent a small slice of the almost US$500 trillion global financial system.

"There is no single agreed upon definition of private credit. Some use the term narrowly for direct lending and asset backed finance, while others take a broader view that includes non-bank, non-traded debt such as private placements, specialty finance, and distressed strategies. This ambiguity makes it difficult to map private credit within the financial system and often leads to the false impression that all non-bank financial institutions provide private debt," the IIF says.

Some people argue the term "private credit" has in effect replaced "shadow banking."

"Looking ahead, continued easing by major central banks, and the renewed search for yield, should add momentum to private debt, which has come under pressure in recent years as higher Treasury yields have crowded out investor appetite for the asset class," the IIF says.

In its November 2024 Financial Stability Report the Reserve Bank said private credit funds typically provide loans to mid-sized companies too risky for banks and too small to get funding from public debt markets. Data on the size of private credit investments in NZ is limited, the Reserve Bank added.

"Private credit firms have some similarities to the traditional non-bank non-deposit taking sector...but they also differ in some aspects. Many private credit firms operating in New Zealand are overseas based entities. Also, private credit firms often rely more on funding from large institutional investors."

"Market participants have suggested that the private credit market in New Zealand is smaller than the private equity market. In some cases, private credit funds compete with banks for lending. At other times, they lend jointly with banks through syndicated lending to corporate borrowers," the Reserve Bank said.

Earlier in 2024 the Reserve Bank told interest.co.nz private credit was on the rise in NZ and it was monitoring developments.

In the financial stability report it said financial stability risks from private capital in NZ are limited, with private equity and private credit markets at an earlier stage of development than in other countries, with the scale of investments low.

"In addition, banks in New Zealand have a simple business model for transacting with the private capital industry. New Zealand banks lend primarily to companies invested in by private equity or private credit funds but have little direct exposure to the funds. This reduces the risk of ‘leverage on leverage’ highlighted by UK and euro area regulators."

"While lending to private capital funds is not currently common in New Zealand, banks’ risk assessments should consider the overall level of leverage involved," the Reserve Bank said.

It noted also that in NZ most private capital investments are restricted to institutional investors and wholesale investors, with very limited investment in private capital by KiwiSaver funds compared to investments by Australian superannuation funds.

"The limited investment so far may partly reflect that the KiwiSaver industry is in an earlier development phase compared to the Australian market," the Reserve Bank said.

Aotea Asset Management executive director Will Carnachan spoke to interest.co.nz in this episode of the Of Interest Podcast about the NZ private credit industry.

The Washington DC-based Institute of International Finance describes itself as a global association of the financial industry. Its members include commercial banks, investment banks, insurance companies and investment management firms.

*The charts below come from the IIF.

*This article was first published in our email for paying subscribers early on Wednesday morning. See here for more details and how to subscribe.

4 Comments

If you want a written explanation of this bubble, here's yet another good one: https://newsletterhunt.com/emails/205961, the gist of it being:

- big tech has big beautiful credit ratings

- they don't want to spoil them

- they create companies which build data centres

- offer them long term contracts promising to rent the centres

- there are investors who then throw money at those companies, because they have contracts with big tech

- somehow the auditors are happy this is not big tech debt

- the amounts are what's staggering. It's all built not on the promise of revenue from AI, but on cost savings from not paying wages anymore. In whole industries

The article hints to The Big Short with Enron flavours, not added, but somewhat multiplied

Isn't is crazy how through capitalism we have developed tools that will likely, in aggregate, do a reasonable percentage of people out of jobs in the name of profit, and completely disregard the societal impact this will have. But hey, profit is blind right?

Yikes, CMBC delinquency higher than after the GFC? The next crash is going to be a biggun' isn't it.

Yes AI and WFH big impact on RE loans, and likely auto as well.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.