consumption taxes

Ahead of the Government's new Tax Working Group, David Chaston casts a broad historical eye over NZ tax and how it's paid

26th Nov 17, 6:51am

47

Ahead of the Government's new Tax Working Group, David Chaston casts a broad historical eye over NZ tax and how it's paid

Deborah Russell says that for all its technical attributes that make our tax system a model widely admired, it is not serving the broader economy or society well

18th Sep 16, 7:13am

43

Deborah Russell says that for all its technical attributes that make our tax system a model widely admired, it is not serving the broader economy or society well

Huge international study matching tax approaches and subjective wellbeing scores shows that people feel better with 'distortionary' taxes, but growth is higher with 'non-distortionary' taxes: Motu

6th Apr 16, 5:35am

12

Huge international study matching tax approaches and subjective wellbeing scores shows that people feel better with 'distortionary' taxes, but growth is higher with 'non-distortionary' taxes: Motu

We have a competitive tax system and we have growth. A major comparison of tax competitiveness across all OECD countries tries to suggest they are related

23rd Sep 14, 5:19pm

25

We have a competitive tax system and we have growth. A major comparison of tax competitiveness across all OECD countries tries to suggest they are related

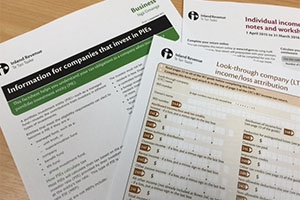

Matt Nolan looks at how taxes on consumption and capital income work, and how they differ from income taxes

25th Jun 13, 10:49am

9

Matt Nolan looks at how taxes on consumption and capital income work, and how they differ from income taxes