government debt

Nicola Willis 'won't overreact' to forecast fiscal changes as ANZ economists say ‘substantial policy change’ is needed to tackle the likes of ageing population costs

16th Dec 25, 6:59pm

6

Nicola Willis 'won't overreact' to forecast fiscal changes as ANZ economists say ‘substantial policy change’ is needed to tackle the likes of ageing population costs

Delay in economic recovery has led to ‘small deterioration in the fiscal forecasts’, Treasury says in its Half Year Economic and Fiscal Update as it expects a widening fiscal deficit and forecasts surplus to return in 2029/2030

16th Dec 25, 1:15pm

12

Delay in economic recovery has led to ‘small deterioration in the fiscal forecasts’, Treasury says in its Half Year Economic and Fiscal Update as it expects a widening fiscal deficit and forecasts surplus to return in 2029/2030

Brian Easton looks at the options for a Government that's hit its borrowing limit but would still like to spend

8th Jul 25, 8:20am

2

Brian Easton looks at the options for a Government that's hit its borrowing limit but would still like to spend

Brian Easton on why Government borrowing is limited

The Coalition Government will not balance its budget within the forecast period, as Treasury forecasts a weaker economic recovery

17th Dec 24, 1:05pm

203

The Coalition Government will not balance its budget within the forecast period, as Treasury forecasts a weaker economic recovery

In the latest episode of our Of Interest podcast, Steven Hail gives the MMT perspective on the monetary system, inflation, climate change & more

27th Jul 24, 9:14am

43

In the latest episode of our Of Interest podcast, Steven Hail gives the MMT perspective on the monetary system, inflation, climate change & more

Treasury forecasts show weak economic growth will keep the Crown accounts in deficit until 2028 and add $50 billion to the national debt

30th May 24, 2:01pm

41

Treasury forecasts show weak economic growth will keep the Crown accounts in deficit until 2028 and add $50 billion to the national debt

Finance Minister Nicola Willis admits New Zealand’s current debt levels are prudent but says they shouldn’t be allowed to rise

11th Apr 24, 12:28pm

101

Finance Minister Nicola Willis admits New Zealand’s current debt levels are prudent but says they shouldn’t be allowed to rise

Budget Policy Statement shows the Coalition Government needs to rethink its fiscal plan to prevent deficits from stretching past 2028

27th Mar 24, 3:48pm

49

Budget Policy Statement shows the Coalition Government needs to rethink its fiscal plan to prevent deficits from stretching past 2028

Government debt manager to issue $4 billion 30-year bond after attracting massive interest

21st Feb 24, 2:44pm

9

Government debt manager to issue $4 billion 30-year bond after attracting massive interest

Finance spokesperson Nicola Willis said covid had contributed to the Government's difficult financial position and that it could not be fixed in the first year

26th Sep 23, 3:16pm

74

Finance spokesperson Nicola Willis said covid had contributed to the Government's difficult financial position and that it could not be fixed in the first year

How does New Zealand's economy compare to nations we typically like to compare ourselves with?

23rd Jul 23, 8:08am

60

How does New Zealand's economy compare to nations we typically like to compare ourselves with?

New Zealand politicians are putting fiscal responsibility at risk by being unwilling to talk about tax, Dan Brunskill says

16th Jul 23, 8:00am

214

New Zealand politicians are putting fiscal responsibility at risk by being unwilling to talk about tax, Dan Brunskill says

Weak corporate profits has flowed through to lower tax revenue for the Government and added $2 billion to the deficit

5th Jul 23, 3:17pm

140

Weak corporate profits has flowed through to lower tax revenue for the Government and added $2 billion to the deficit

[updated]

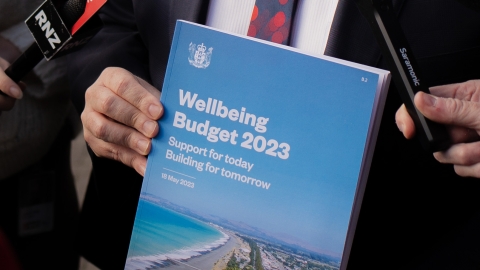

Budget 2023: New spending on childcare, health, transport & energy costs, plus more state houses & increased trustee tax rate

18th May 23, 2:05pm

152

Budget 2023: New spending on childcare, health, transport & energy costs, plus more state houses & increased trustee tax rate