Premier

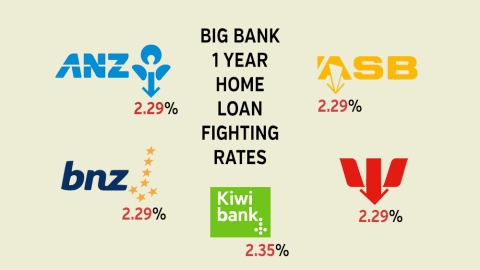

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

22nd Jan 21, 8:37am

42

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

Another big bank has cut a key home loan rate, signaling that a new round of mortgage rate cuts are on their way. The RBNZ's FLP gives them the low cost funds to do this if they apply

19th Jan 21, 6:22pm

26

Another big bank has cut a key home loan rate, signaling that a new round of mortgage rate cuts are on their way. The RBNZ's FLP gives them the low cost funds to do this if they apply

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

11th Jan 21, 8:18am

159

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

HSBC pushed fixed home loan rate offers lower yet again, with some market-leading low levels for their Premier product. They have cut TD rates as well. Meanwhile other banks are offering cashbacks more liberally

6th Nov 20, 10:27am

30

HSBC pushed fixed home loan rate offers lower yet again, with some market-leading low levels for their Premier product. They have cut TD rates as well. Meanwhile other banks are offering cashbacks more liberally

Just when many thought sub 5% rates were disappearing, HSBC has launched three new fixed home loan specials at 4.99%

26th Feb 13, 5:51pm

3

Just when many thought sub 5% rates were disappearing, HSBC has launched three new fixed home loan specials at 4.99%

Want to be covered for ‘everything’ ? – then be prepared to pay the price

12th Dec 09, 3:43pm

Want to be covered for ‘everything’ ? – then be prepared to pay the price