rate curves

Even though wholesale rates have turned down rather sharply in the past few days, BNZ has raised its one year TD offer above any other main bank

6th Nov 23, 9:26am

23

Even though wholesale rates have turned down rather sharply in the past few days, BNZ has raised its one year TD offer above any other main bank

[updated]

Many banks now offer 6.1% pa term deposit rates for any term between 6 & 36 months, but SBS Bank's new 6.7% one year special rate stands out

24th Oct 23, 10:39am

34

Many banks now offer 6.1% pa term deposit rates for any term between 6 & 36 months, but SBS Bank's new 6.7% one year special rate stands out

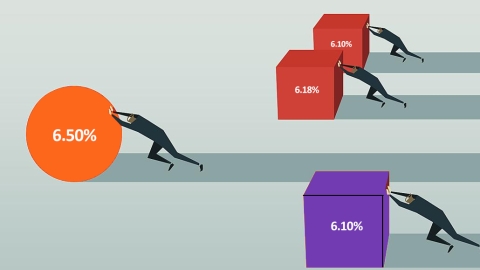

Another main bank - Kiwibank - trumps the ASB 6% term deposit offer for a six month term, pushing it to 6.05%, a market-leading level from any bank

18th Oct 23, 2:15pm

12

Another main bank - Kiwibank - trumps the ASB 6% term deposit offer for a six month term, pushing it to 6.05%, a market-leading level from any bank

A main bank moves the 6% term deposit rate offer to a six month term, and raises its three year offer to a market-leading 6.10%

12th Oct 23, 9:24am

16

A main bank moves the 6% term deposit rate offer to a six month term, and raises its three year offer to a market-leading 6.10%

[updated]

Westpac's 6% nine month TD rate shifts a main bank into the heart of where savers want to commit for term savings, and close to where challenger banks have already gone

25th Sep 23, 8:03am

25

Westpac's 6% nine month TD rate shifts a main bank into the heart of where savers want to commit for term savings, and close to where challenger banks have already gone

Another main bank, ASB, now offers 6% for term deposits of 1-year, joining Kiwibank. ASB also becomes first bank to raise key 2-year home loan rate above 7%

4th Sep 23, 9:51am

6

Another main bank, ASB, now offers 6% for term deposits of 1-year, joining Kiwibank. ASB also becomes first bank to raise key 2-year home loan rate above 7%

Six percent term deposit offers are more common now with 11 banks offering them. But Kiwibank is the first main bank offering 6% for a 1 year commitment. Some savers can enhance those returns by using PIEs

31st Aug 23, 2:21pm

19

Six percent term deposit offers are more common now with 11 banks offering them. But Kiwibank is the first main bank offering 6% for a 1 year commitment. Some savers can enhance those returns by using PIEs

A major bank offers 6% for a term deposit, as ANZ raises some key rates and adopts that rate for an 18-month term

22nd Aug 23, 7:04pm

50

A major bank offers 6% for a term deposit, as ANZ raises some key rates and adopts that rate for an 18-month term

[updated]

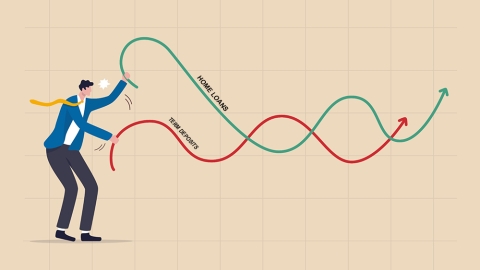

Higher interest rate offers are motivating savers into term deposits at a faster rate. And the trend may speed up if the big banks crack the 6% mark

27th Jul 23, 1:48pm

90

Higher interest rate offers are motivating savers into term deposits at a faster rate. And the trend may speed up if the big banks crack the 6% mark

SBS Bank pushes its one year term deposit rate offer to a 15 year high of 6.5% and well above every other bank. We are moving into an unfamiliar zone where some TD offers are higher than inflation

14th Jul 23, 4:30pm

30

SBS Bank pushes its one year term deposit rate offer to a 15 year high of 6.5% and well above every other bank. We are moving into an unfamiliar zone where some TD offers are higher than inflation

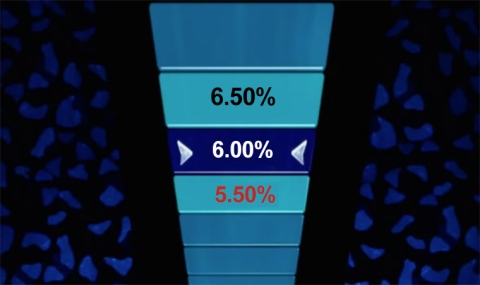

Three banks now offer 6% for a one year term deposit. That is the current peak offer point. However it isn't clear that the majors will follow

12th May 23, 5:01am

36

Three banks now offer 6% for a one year term deposit. That is the current peak offer point. However it isn't clear that the majors will follow

Term deposit rate increases are starting to filter through although they are limp new offers with banks falling further behind the OCR policy signals

14th Apr 23, 12:50pm

40

Term deposit rate increases are starting to filter through although they are limp new offers with banks falling further behind the OCR policy signals

Bank term deposit rate offers have shrunk from the start of 2022 in relation to the OCR and the latest increases don't restore those premiums

16th Mar 23, 12:17pm

54

Bank term deposit rate offers have shrunk from the start of 2022 in relation to the OCR and the latest increases don't restore those premiums

Days have passed since the last +50 bps RBNZ rate hike, but no banks have changed retail rates yet, for either home loans or term deposits. And this is despite Adrian Orr calling out the banks over low rates for savers

25th Feb 23, 9:04am

17

Days have passed since the last +50 bps RBNZ rate hike, but no banks have changed retail rates yet, for either home loans or term deposits. And this is despite Adrian Orr calling out the banks over low rates for savers

SBS Bank has launched a 6% rate offer for a 12 month term deposit, the highest rate offer from any bank in 14 years

23rd Jan 23, 3:57pm

12

SBS Bank has launched a 6% rate offer for a 12 month term deposit, the highest rate offer from any bank in 14 years