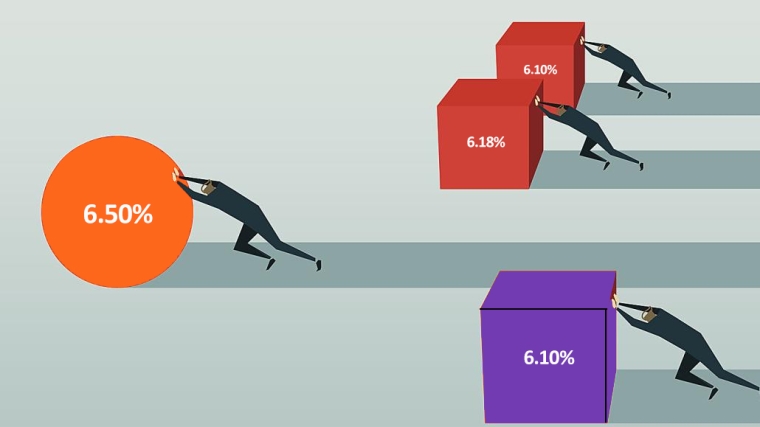

A new 15 year high has been reached for term deposit offers.

Until recently, 6% for one year was the gold standard rate from a bank and after SBS Bank first reached that milestone in January this year, a number of challenger banks stepped up as well.

There has been some relatively minor rises from there by a few - Bank of China now offers 6.18%, and both Heartland and Kookmin Bank* have inched up to 6.1%.

These are good offers in the perspective that most analysts expect June CPI inflation to come in at 5.9% when the data is released on Wednesday, July 19, 2023.

But jumping out front we now have SBS Bank who have launched a 6.50% one year rate offer. It will be available from Saturday, July 15, 2023.

Term deposit savers haven't had an offer that high from any bank since November 21, 2008, nearly 15 years ago.

Another feature of the evolving term deposit rate structure is that 6% rates are shifting to some terms shorter than 12 months. Heartland Bank has a 6% rate for a nine month term. And the Bank of China offers 6.08% for nine months now, the top rate in New Zealand for that term. It is quite on the cards that some bank may offer 6% for 8, 7 or even 6 months soon. We have no inside information but it does seem possible at present.

The reason main bank 6-9 month rates are all very similar is that banks know that is where the money is. Kiwi savers are conservative and rarely go longer - new data from the RBNZ has been an eye-opener about how reluctant savers are to go for even a one year rate. Or even change from a main bank. It is each savers choice of course, but that leaves quite a bit of income avoided. (And don't forget, all banks are investment grade here.)

Among the challenger banks, it is the Bank of China that currently has the highest offers in the 6-9 month range.

The appetite for short rates may change of course if bank rate offers turn significantly higher than CPI inflation, as today's SBS Bank one does.

Adding to the landscape is that with HSBC withdrawing from retail banking, their retail clients will be looking for a new home for their savings.

One risk savers should watch is the cost of wholesale money and you can do that looking at swap rates. You can do that here. Earlier this week the one year swap almost touched 6.0% again. It did that first in May. We have had a long almost-3 year run up in background money costs. The OCR rises have been part of that. If this trend reverses for any reason, the pressure on rates to savers will ease making those who locked in longer rates look good. If it continues, taking shorter rates now may seem sensible, but only if you switch to longer ones when you think the recent rising trends are over.

Almost all banks are pricing longer rates lower than their one year offers, and perhaps that inversion is growing.

An easy way to work out how much extra you can earn is to use our full function deposit calculator. We have included it at the foot of this article. That will not only give you an after-tax result, you can tweak it for the added benefits of Term PIEs as well. It is better you have that extra interest than the bank, especially if you are in the 39% tax bracket - PIEs are taxed at 28% flat.

* Kookmin Bank's 6.10% one year offer is for deposits of $100,000 and more. For a $10,000 minimum it is 6.00%.

The latest headline rate offers are in this table after the recent increases.

| for a $25,000 deposit July 15, 2023 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 4.30 | 5.65 | 5.65 | 5.80 | 5.50 | 5.50 | 5.25 |

|

AA- | 4.20 | 5.65 | 5.65 | 5.85 | 5.75 | 5.70 | 5.60 |

|

AA- | 4.30 | 5.65 | 5.70 | 5.85 | 5.50 | 5.30 | 5.15 |

|

A | 4.20 | 5.65 | 5.65 | 5.75 | 5.10 | 4.90 | |

|

AA- | 4.30 | 5.65 | 5.65 | 5.80 | 5.40 | 5.30 | 5.20 |

| Other banks | ||||||||

| Bank of China | A | 4.70 | 5.88 | 6.08 | 6.18 | 5.80 | 5.50 | 5.30 |

| China Constr. Bank | A | 4.80 | 5.85 | 5.90 | 6.00 | 5.85 | 5.50 | 5.40 |

| Co-operative Bank | BBB | 4.20 | 5.65 | 5.65 | 5.85 | 5.65 | 5.60 | 5.50 |

| Heartland Bank | BBB | 4.00 | 5.90 | 6.00 | 6.10 | 5.35 | 5.30 | 5.30 |

| HSBC | AA- | 3.90 | ||||||

| ICBC | A | 4.70 | 5.65 | 5.90 | 5.90 | 5.70 | 5.35 | 5.30 |

| Kookmin Bank | A | 4.40 | 5.60 | 5.70 | 6.00* | 5.20 | 5.20 | |

|

A | 4.60 | 5.85 | 5.90 | 6.00 | 5.85 | 5.40 | 5.40 |

|

BBB | 3.90 | 5.50 | 5.40 | 6.50 | 5.35 | 5.35 | 5.35 |

|

A- | 4.25 | 5.30 | 5.40 | 6.00 | 5.40 | 5.30 | 5.20 |

Term deposit rates

Select chart tabs

Term deposit calculator

30 Comments

For the foreseeable future, saving FHB's are the winners here. While relative to inflation, house prices are falling big time, its a no brainer for the FHB to bide their time, watch as their deposits grow. It also means when they buy, they'll own a bigger share and pay less dead money in interest over the duration of the mortgage. No need for FOMO. Although, with SBS being rated "BBB", if I was a saving FHB, I probably would opt for a lesser rate and lodge my life savings with say ANZ or Rabobank just to remain on the safe side.

If they're wanting to buy a house before they start a family, how long should they wait do you think?

And that is the tragic consequence of what we've done, not only here but across the Developed World. Population replacement rates have plunged, in no small part because the costs of providing a family home has tripled and more vs household income over the last few decades. Perhaps we'll realise that when 80% of the population is living in retirement and just 20% is left to do the work to keep the whole 100% going.

(Anecdote: My wife's daughter is 33. She has no children at the age her mother had 2, her grandmother had 4 and her great-grandmother had 6)

And a growing small chunk of that 80% in retirement are in homes dribbling incoherently being neglected by migrant care workers, while the rest of their cohort continue to lambaste the younger generations like they have for the last 30 years for "putting nan in a home".

But they had no choice, both adults must work full time to service the mortgage and pay tax towards non-means tested super on an average life expectancy of 90. If they're lucky they aren't yet chipping in for the care home fees, thanks temporarily to the reverse mortgage on nan's old place. "Those rotten kids won't get a cent of my inheritance" Nan jokes.

In Jeremiah 31:29 it says, “In those days they shall say no more: the fathers have eaten sour grapes, and the children's teeth are set on edge.”

Just put Mum into care, $1530 pw, when Dad goes in soon it will be 3 grand a week.

in no small part because the costs of providing a family home has tripled and more vs household income over the last few decades

That's a really small part, because the birth rate has dived worse in places like Japan and Italy where house prices have flatlined or receded. The birth rates dropping is a consequence of people living in cities and females having more options than baby makers.

The current crop of kids is looking even worse, teenage pregnancy is almost nil and virginity in your late 20s not uncommon. We're living in the film "Children of Men" except the cause is cultural.

Interesting piece of anecdotal evidence bw.

No doubt that high home prices contribute a little bit to the lower birth rates across the developed world, but not much at all in my opinion. It's probably a small reason compared to others such as:

1) We have invented better contraception methods, so we've prevented ourselves from having kids when we don't want them.

2) Women are no longer stereotyped as "mothers", so many choose to pursue other goals, such as concentrate on their careers, etc.

3) People are living longer so they choose to have kids later.

4) More people care about the negative effects of population growth on the environment so choose to not have children at all or adopt children rather than have their own.

and so on.

Wait Wait Wait - It's just that easy. Do nothing and save heaps.

With Interest Rates Going To 10% This Year, Guaranteed, you can bet your Bottom Dollar Deposit Rates are going even Higher !

Home Price Crashing - Savings going Higher. Thats a Fantastic Combo.

In Jan 2018, I took out a large TD with Rabo for five years @ 4.25% (int paid monthly) which matured Jan this year. I managed to largely avoid the 1% rates. Now I have several TD over the next 12-months ranging from 5.75 - 6%. While I'm certainly not complaining, its not all about me.

What do you call a large TD ? So you don't own a house so I'm assuming the TD is far smaller than what it cost to buy a house or that would make zero sense.

This year is fast disappearing and we're nowhere near 10% rates. Are you still going to be spouting the same comment come December?

I would opt for a lesser rate too with an "A" rated bank to remain on the safe side, also, at least one of the big 4, offer better than their advertised rate, once you log in to view, as a current customer.

Tasty.

"We are moving into an unfamiliar zone where some TD offers are higher than inflation"

It just shows how distorted the last 15 years, and more, have been when interest rates below Inflation appears unusual. That's how it's supposed to be! That's what stops emergency rate rises to control Inflation being necessary in the first place. When the OCR is above the CPI, then and only then, can we think about what the appropriate margin between the two is. And the same margin as the targeted Inflation rate of 2%-3% look about the right.

e.g. CPI 3.5% = OCR 5.5%, so still someway to go.

Time to dust off the Corporate Finance text books that had to be put away in 2009!

Wow... that's some rate...

If this is not a direct outcome from the latest mpc.. I would love know why else

I think in the next 6 months we could see others with similar above the odds offers. There are reasons why this happens at this stage of the cycle with the shall we say tier 2 lenders. If the deposit guarantee scheme had started I would be into this, but then again they would probably not need to offer above the odds if that were the case.

Yeah, might be worth asking why SBS needs to offer so far above market rates. Guess they really need their coffers topped up in a hurry.

.

SBS need to bolster their balance sheet. Pure and simple.

That 33% tax rate is annoying. I just got my TD statement through....there is an opportunity for incentives right there!

Do the PIE fund. Save another 5%

Thank you Nguturoa. I'll check it out

I second the PIE TD.

Kiwibank is 5.85...

Risk management is my guess.... plenty of uncertainty ahead in lil ole NZ... lol.

I never knew - but this is me. ".........Kiwi savers are conservative and rarely go longer - new data from the RBNZ has been an eye-opener about how reluctant savers are to go for even a one year rate....."

Will have to have a think about my revolving constellation of six month TDs.

Any rates have only become worth bothering about in the last year or so. But will I lift my game? The extra interest on longer than six months does not seem more attractive than the 5.8% I get from Westpac currently.

Most kiwis with TDs are pretty unsophisticated. They tend to be older ... ;-)

Reading the comments above and the spruikers are out in force.

Wow! Just wow!

There won't be a return to FOMO. Nor will house prices rise much more than inflation (and they may actually fall.)

Once again - the MDRS and NPS-UD and various local government initiatives have ensured there will be sufficient dwellings for 20, 30 years or more. I.e. supply is increasing.

FHB should NOT rush out and buy our still overinflated houses! The writing is on the wall. In large letters!

If you disagree - prove me wrong! ... Nobody has yet. And I've been saying this for months!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.