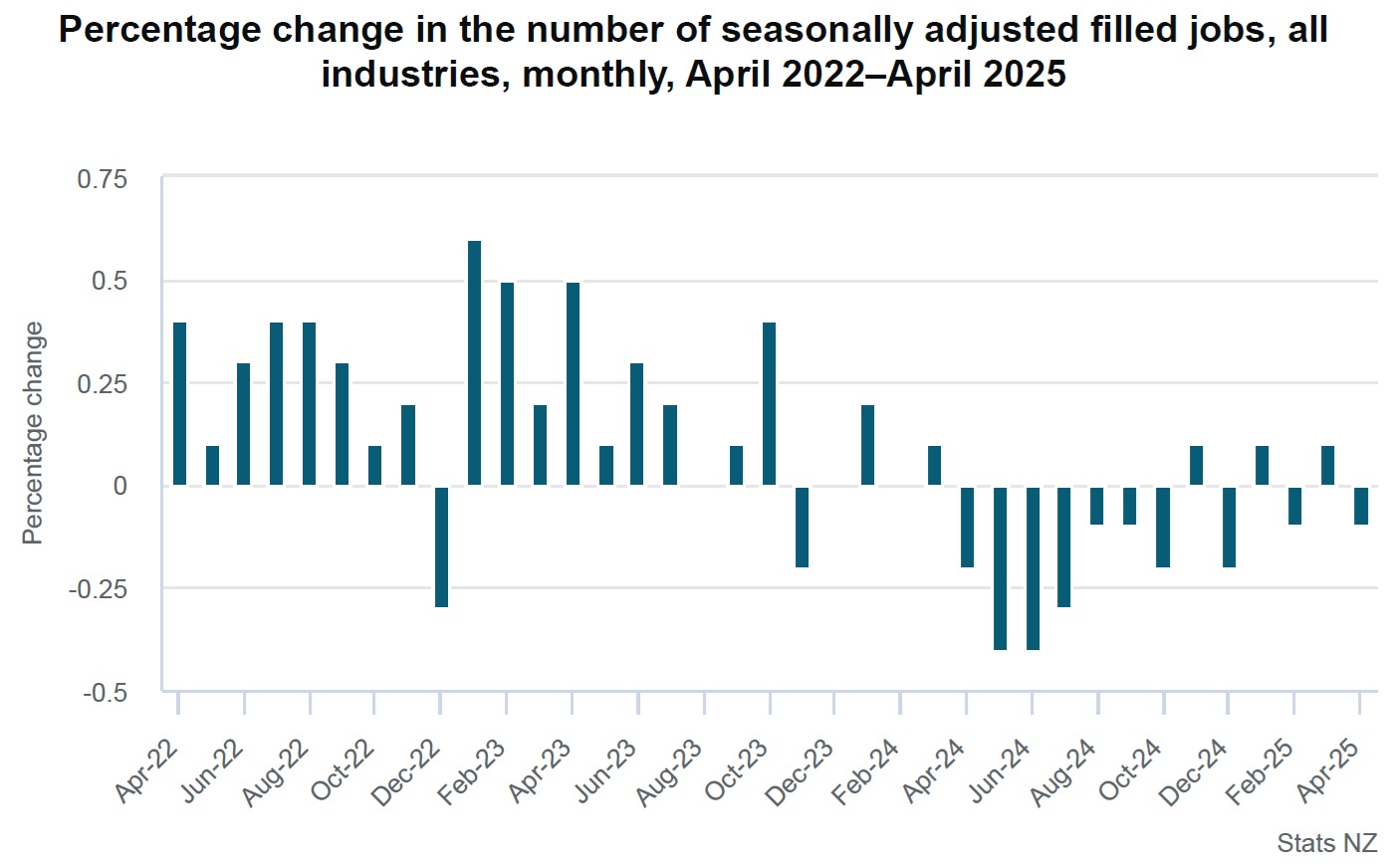

The labour market has taken another turn for the gloomy, with filled jobs falling last month, while the figures for the previous two months have also been revised down.

ASB senior economist Mark Smith says the pullback in April hiring is "symptomatic of an economy struggling to cast off its recessionary shackles".

The latest figures from Statistics NZ's Monthly Employment Indicators (MEI) show that in April, on a seasonally adjusted basis, there was a reduction of 2246 jobs (a 0.1% fall) taking the number of filled jobs to 2.35 million.

The not great news is that this series often sees downward revisions to the numbers in subsequent months.

Indeed, the figures for the previous month, March, have now been revised down to a 0.1% rise, compared with a 0.2% rise at time of original announcement, while the February figures, originally announced as flat, now show a 0.1% fall.

In terms of the detail of the April 2025 figures (all seasonally adjusted compared with March 2025), Stats NZ said:

- all industries – were down 0.1% (2,246 jobs) to 2.35 million filled jobs

- primary industries – up 0.1% (108 jobs)

- goods-producing industries – down 0.3% (1,393 jobs)

- service industries – down 0.1% (1,081 jobs).

The official unemployment figures for the March quarter as measured by Stats NZ's Household Labour Force Survey showed an unchanged 5.1%, while the Reserve Bank had forecast 5.2%, which it thought would be the peak. The unemployment rate was just 4.0% at the start of last year.

The MEI figures are not directly comparable as they are sourced quite differently - coming from Inland Revenue data - but they have tended to be quite a good indicator of future trends. At one stage last year the MEI recorded seven consecutive months of falls, a sequence only broken by a small rise in November 2024. The latest figures and revisions suggest that the unemployment rate may not yet have peaked.

ASB's Smith notes that hiring tends to lag (and not lead) the economic cycle, with continued downside historical revisions suggesting weaker underlying momentum.

"The primary sector has continued to outperform, with gains in the sector welcome in an economy looking for good news stories," he said.

He said while employment is "likely to remain patchy", low growth in the labour force – likely reflecting moderate net immigration and lower workforce participation – is likely to temper the peak in the unemployment rate, which should remain in the low 5’s in the first half of this year.

"Recovering base economic momentum later in 2025 should see a pick-up in hiring and then see the unemployment rate recede before year end. Labour cost growth is expected to continue to cool as firms seek to contain the wage bill and this should dampen underlying CPI inflation," Smith said.

In terms of the actual, unadjusted MEI figures compared with April a year ago, Stats NZ said filled jobs were 2.36 million, down 38,463 (1.6%).

Again, younger people have borne the brunt of the reduction in jobs, with 13,732 jobs fewer (down 10%) among those aged 15-19.

By industry, the largest changes in the number of filled jobs compared with April 2024 were in:

- construction – down 6.5% (13,522 jobs)

- administrative and support services – down 6.7% (7,547 jobs)

- professional, scientific, and technical services – down 3.3% (6,257 jobs)

- manufacturing – down 2.3% (5,475 jobs)

- retail trade – down 1.5% (3,184 jobs).

By region, the largest changes in the number of filled jobs compared with April 2024 were in:

- Auckland – down 2.1% (16,826 jobs)

- Wellington – down 2.4% (6,343 jobs)

- Waikato – down 1.0% (2,403 jobs)

- Bay of Plenty – down 1.5% (2,268 jobs)

- Manawatū-Whanganui – down 1.7% (1,903 jobs).

5 Comments

Imagine if - back in 2024 - one of NZ's largest and most important employers and investors in the local economy decided that it needed cut back on current and future planned projects. Imagine if the total lost potential investment into NZ ran into the hundreds of billions of dollars over the medium term.

Imagine if, at the same time, this major NZ company decided to reduce charitable donations by hundreds of millions a year - money going to NZ NGO's and public house building etc. - as a result, imagine all the private sector jobs that are culled in the process - across multiple sectors.

Let's say it was Mitre 10, Spark or Fletchers and let's say they decided to trim current and future planned projects and donations by billions of dollars and lets say they also decided to lay off 7.5% of their employees and freeze new hiring.

A year or more later, would you expect the NZ economy to have grown and created more jobs and prosperity?

This isn't rocket science. This was well understood by economists 90 years ago and has been forgotten.

Imagine if you were a farmer

And you lived like every harvest was going to be bountiful.

We could have more resilience, but we'd also need to consume less, when times are good.

I'm not surprised at all. I had 2 staff out of 8, away for 6 weeks (leave & ACC injury), and we haven't missed them at all, workload wise.

Mortgage rates with a 3 coming soon to a town near you.

Not this (2025) year.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.