Food prices fell for the third consecutive month in November - the first time there's been three consecutive falls since December 2023.

Rent prices have had their lowest annual rise since at least 2010, with a 1.4% increase in the 12 months to November, down from 1.6% in October.

The above two facts put together - given that food and rents make up well over a quarter of our Consumers Price Index (CPI) inflation - bode well for the December quarter inflation figures due to be released on January 23.

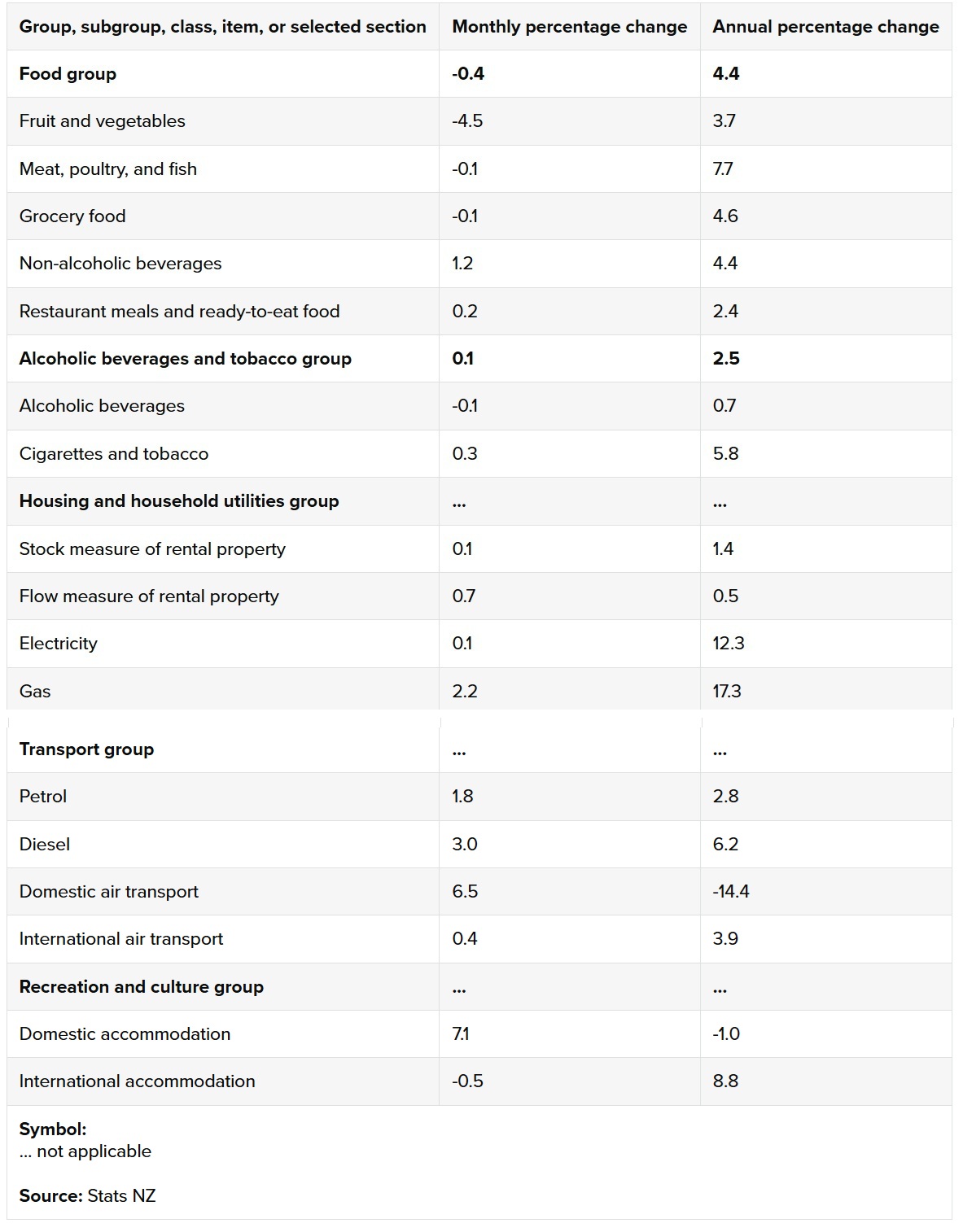

Statistics NZ's latest Selected Prices Indexes (SPI) information shows that food prices fell 0.4% in November, while annually, prices increased 4.4%, down from an annual rate of 4.7% in October.

The monthly SPI data contains about 47% of what makes up the CPI - so, it's a good early indicator of what the CPI is doing.

This is the second, middle, month contributing to those CPI inflation figures for the December quarter. And the December quarter CPI figure will be a key input for the Reserve Bank's first Official Cash Rate decision of 2026 on February 18.

The annual rate of inflation as at the September 2025 quarter pushed up to 3.00%, right at the top of the RBNZ's targeted 1% to 3% range. However, the RBNZ, in its November Monetary Policy Statement (MPS) forecast that inflation would drop to 2.7% for the December quarter.

Such an outcome would be important in allowing the RBNZ to leave the OCR at 2.25%, which is its current intention, with Governor Anna Breman, in her first major monetary policy communication this week, saying "if economic conditions evolve as expected the OCR is likely to remain at its current level of 2.25% for some time".

Breman's pro-active statement came as wholesale interest rates had risen sharply, plus some mortgage and deposit rates in the wake of the RBNZ's November OCR communications, which had clearly indicated the central bank saw itself as having finished cutting the OCR - while the markets had expected it to signal there may still be more cuts ahead.

Given what has happened in the markets, the RBNZ would probably enjoy the flexibility of being able to suggest in February that the door was still open to further OCR cuts - but it would need inflation to co-operate. The current indications are that inflation will co-operate.

The latest food price figures were given a big downward shove by seasonal patterns - with fruit and vegetables dropping 4.5% in November.

Stats NZ said a range of seasonal produce, including tomatoes, strawberries, cucumbers, and lettuce, contributed to this decrease.

In terms of the the annual food price increase of 4.4%, Stats NZ said higher prices for the grocery food group, up 4.6%, contributed the most. This was followed by meat, poultry, and fish, up 7.7% annually.

Across the 12 months the average price for:

- milk was $4.91 per 2 litres, up 15.8% annually

- porterhouse/sirloin beef steak was $45.39 per 1kg, up 26.7% annually

- white loaf bread was $2.13 per 600g, up 53.2% annually.

The average prices for milk and bread represent the cheapest available options for each.

"Bread is a staple food for many households," Stats NZ's prices and deflators spokesperson Nicola Growden said.

"It now costs 74 cents more for a loaf of white bread than this time last year."

Here is the detailed SPI information for November as supplied by Stats NZ:

7 Comments

Rents up, food prices down.

The goldilocks zone!

🥂

Didn't you comment rents were stabilising yesterday on the article noting this?

That's right, but now we know tenants are paying less for food, so can continue to pay more for rent.

That is an utterly sickening comment, and underlines why so many despise landlordism. You see someone has a little spare cash and instead of being happy for them getting some relief, you wish to snatch it right out of their pockets immediately. It is this mentality that is what is wrong with society, and a clear and definitive reason why reducing incentive for property investment is overdue in NZ.

white loaf bread was $2.13 per 600g, up 53.2% annually.

It's almost like the gas exploration ban wasn't a good idea.

Mon, 1 Dec 2025, 7:31am

"Repeatedly low wheat prices are driving more farmers to turn to dairy."

Citi touts February rate hike in a bold call for the RBA

The investment bank is the first major forecaster to tip two rate hikes in 2026, arguing that the RBA needs to act fast to get inflation under control, or risk losing credibility.

"...food prices dropped... "

Complete nonsense - walk into any supermarket in NZ, observe the prices, and you can see how utterly false this narrative is.

Notice too, how they print your docket on fax paper, which becomes illegible within a few weeks - there is an obvious reason why.

The key to this scam lies in the very title itself - SPI - (SELECTED Price Indexes).

The bread and circuses show must go on, as the fiat money system continues to implode, and NZ chooses to ignore the inevitable looming trainwreck whilst we witness our infrastructure deteriorating towards Third-World levels.

Tinkering around the margins won't cut it. Until we return to a hard-backed monetary system, created as a public utility, we will descend further into economic chaos. All we do with the current policies, which ALL of the incumbent parties endorse, is enrich the corporate plutocracy and penalise the working classes and the needy.

This is the Western so-called "capitalist system". The tragic joke is that it's not capitalism at all - it is an obscene form of reverse socialism. Printing money out of thin air, for the sole benefit of the global oligarchy, is the most blatant mass con job in the history of our species.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.