This is a re-post of an article that first appeared the the March 2008 RBNZ Bulletin. It is here with permission.

------

By Gillian Lawrence*

The financial system enables ‘real’ activity – that is, the processes of production and trade of goods and services – to take place smoothly.

Financial activity is thus part and parcel of economic growth and improvement in overall living standards.1

Money itself is not a modern innovation. Records of money date back 5,000 years to the Babylonians, who distinguished legally between ‘exchangeable goods’ and ‘non-exchangeable goods’. Exchangeable goods included precious metals as well as certain commonly used goods such as oil and wine. It is likely that these exchangeable goods were used as means of exchange. The origins of money probably go back even further than this – beyond written history, with the use of cattle around 10,000 years ago.2

Over time, money has taken different forms. It has ranged from objects of inherent value, such as precious metals (commodity money), to tokens backed by reserves of a defined object of inherent value such as gold (for which the tokens may be redeemed), to the ‘fiat’ money in the form of the notes and coins in circulation today.

Unlike commodity money, fiat money has no intrinsic value. Neither is it backed by something else of value. Fiat money is established as money by government or official order or decree.

Its effective use as money derives from its acceptability as payment for goods or services. Items other than fiat money can also be used in practice as money if both parties agree to a different sort of payment beforehand. Recognising this economic function of money, we consider money today as generally comprising both physical fiat money in the form of notes and coins, and electronic records of claims on financial institutions (such as banks) that are transferable to others and that are usually accepted as payment for goods and services.

Money and credit are so fundamental to our economy that we do not generally consider how money is created.

This article looks at money creation in more depth. Section 2 discusses the concept of money, Section 3 describes money and credit creation in the banking system, Section 4 looks at the pricing of money in the banking system and its role in the implementation of monetary policy, and Section 5 concludes.

2. What is money?

Money is commonly described as a medium of exchange, a unit of account and a store of value. These three functions of money together are said to distinguish money from other financial assets such as shares and bonds, and goods with an ‘investment’ function such as art or real estate.

The medium of exchange function derives from the fact that money is the item that a buyer gives a seller in exchange for a good or service, with the seller typically using that money to make other purchases. The use of money in this manner overcomes the inefficiencies of the barter system, where two individuals with exactly corresponding needs have to come together to transact. Defining liquidity as the ease with which an asset can be converted into the economy’s medium of exchange, money is the most liquid asset in the economy.

As a unit of account, money is used to measure the exchange value of a commodity or product. It is the yardstick that people use to price items and record debts.

Money has a store of value function because, unlike physical assets such as machinery that depreciate over time due to wear and tear, the face value of physical money does not change. Of course, inflation reduces the ‘real’ (or exchange) value of this form of money over time.

Once money is held in the banking system, interest-bearing accounts may be used to impart a better ‘store of value’ function to money. Take, for example, an amount of money that is invested with a bank for a period of time. If the interest earned on that sum is comparable to the rate of inflation in the economy over that period, then the purchasing power of that quantity is the same at the start and completion of the period. The real value of this money is thus unchanged.

3. The banking and payment system, and how money and credit are created

In a modern economy, money can be created either by the central bank (the Reserve Bank, in New Zealand’s case) or by private sector institutions – in practice, mostly registered banks.3 Section 25 of the Reserve Bank of New Zealand Act 1989 gives the Reserve Bank the monopoly right to issue physical money (notes and coins), which enters public circulation through the private sector institutions to which it is issued.

A private sector institution can also create money by issuing claims on itself (ie, by accepting deposits) that may be transferred between, and are generally accepted by, members of the public as a means of payment. For that matter, any institution that can maintain the public’s confidence that its liabilities will be generally accepted as means of payment, can create money. Such an institution will, in practice, also be in the business of creating credit, which implies the issue of a greater value of claims on the institution than the value of Reserve-Bank-issued money the institution itself holds. In practice, by far the largest share of money – 80 percent or more, depending on the measure (discussed below) – is created by private sector institutions. For simplicity, in what follows, we use “bank” to refer to any institution that creates money or credit.

We illustrate this process of money and credit creation below, by tracing through example transactions in a hypothetical banking system.

A simple economy

Let us first consider an economy without banks. The only money available would be notes and coins issued directly to the public by the central bank (currency). In this economy, currency is the only object that can be used easily as a medium of exchange and a store of value.

Consider now, the inclusion of one bank, Bank A, into the economy. Individuals holding currency are faced with three options. They could:

• use up all of their currency in exchange transactions;

• save some of the currency and ‘keep it under the mattress’; or

• save some of the currency and deposit it at the bank, on the expectation that the bank will repay them the currency when they want it.

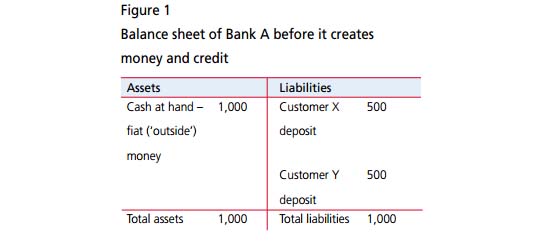

If, at a point in time, two individuals, Customers X and Y, each deposit $500 into Bank A, the balance sheet of the bank will be as follows:

In this case, Bank A has enough cash, at all times, to meet all possible withdrawals. Its assets are all in the form of fiat money issued by the central bank. This is labelled ‘outside’ money in the balance sheet, reflecting that this form of money is a liability of the central bank created ‘outside’ the economy.

If Bank A’s customers make payments to each other with cheques or via EFTPOS and internet transfers, there will be a change in the balances in their accounts at Bank A, but the total amount of deposits at Bank A will remain unchanged. In this case, the bank would not need to retain the cash deposited by these customers. However, typically, a small amount of payments will be made by cash, in which case individuals will withdraw cash from the bank against their deposits to make the payments. If Customer X makes a withdrawal to pay Customer Y, it is likely that Customer Y will re-deposit most or all of the cash back with Bank A – out of concern about theft, for example, or for convenience.

If, say, 10 percent of deposits are typically withdrawn for cash payments weekly, and this amount is re-deposited with the bank, then Bank A only needs to hold $100 in cash at hand to support likely withdrawals on its total deposits of $1,000. (In practice, Bank A will not be certain about the 10 percent ratio, and there is a risk that there may be greater withdrawals. Bank A is therefore likely to hold a safety margin of cash at hand, in case withdrawals turn out to be greater than expected, or re-deposits of cash turn out to be less than expected.)

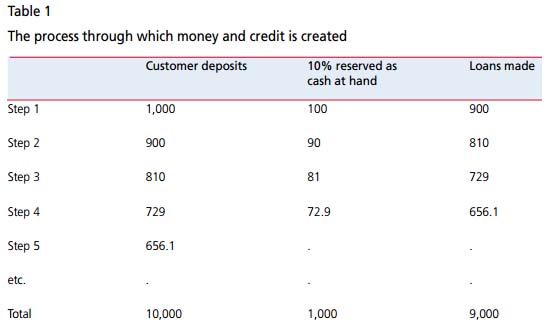

Bank A can thus lend out $900 to its customers. They can then use this $900 as payment for goods and services. The $900 will likely be re-deposited. This is the first step in the process of money and credit creation by Bank A. So far, it has created $900 of money, and it has created credit to the same value.

This credit might be used by Bank A’s customers to purchase capital assets, and thus contribute to growth in this economy. In producing credit, the bank performs a useful function in dedicating resources to determine potential borrowers’ creditworthiness (a process that is costly), which the bank can do more efficiently than its customers could each do individually if they were to lend to each other directly.

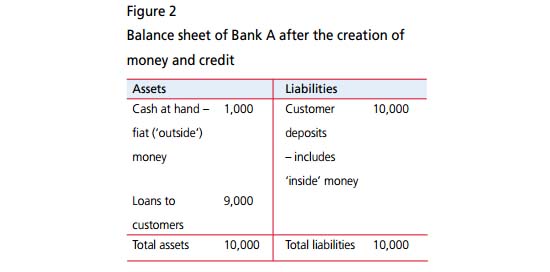

Turning back to the money side, in our scenario, only $90 of the $900 in new money is likely to be withdrawn as cash, with other payments being possible through electronic transfers of account balances. Bank A thus has a further $810 to lend out. As this process continues, the ultimate outcome is that the initial $1,000 in deposits can be used to create new deposits (money) and credit (loans) to the value of $9,000. This new money is generally termed ‘inside’ money to reflect that it has been generated by the private bank ‘inside’ this economy. Bank A’s balance sheet has grown from $1,000 to $10,000. This is shown below:

Bank A’s balance sheet would then be as follows:

Since the depositors of the $10,000 can spend or transfer the amount, as they could with the original $1,000 issued by the central bank, Bank A has created money worth $9,000 and added this amount to the supply of money in the economy. It has also created credit to this value. Because the value of inside money created is necessarily equal to the value of credit created, the net worth of the private sector remains unchanged.

Adding more banks

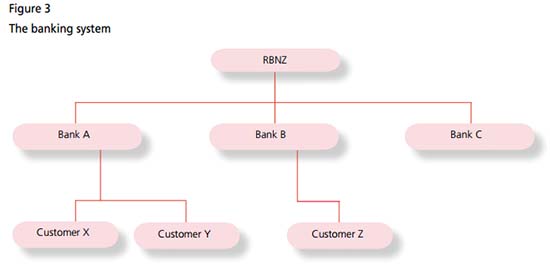

When more banks are added to this model economy, it is no longer the case that cash payments will necessarily be re-deposited with the same bank, though the logic of the money and credit creation process in the banking system as a whole is the same. However, in this setting, with more than one bank, there is a need for an interbank payment system to manage the payments that need to be made across banks on account of their customers’ payments activities.4 The interbank payment system in New Zealand (which is a typical case) is built around deposit accounts the banks have at the Reserve Bank. This system can be illustrated as below:

Consider Customer X and Customer Y again, who have deposit accounts with Bank A. When Customer X pays Customer Y electronically, Customer X’s deposit account is debited and Customer Y’s account credited accordingly. Bank A’s deposit with the Reserve Bank remains unchanged. Now consider a Customer Z who banks with Bank B. When Customer X or Y pays Customer Z electronically or using a cheque drawn on Bank A, an interbank transaction needs to take place. In this instance, besides the individual accounts of the customers at Banks A and B being affected, the deposit account of Bank A at the Reserve Bank is debited and that of Bank B is credited accordingly.

4 The money supply, inflation and monetary policy

Measuring the money supply

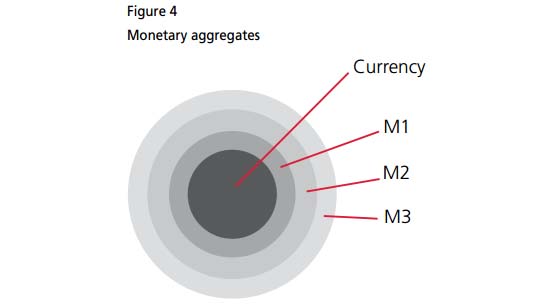

While money can be issued by the central bank or created by private institutions, as illustrated above, in the vast majority of circumstances there is no practical difference between these two forms of money in terms of the medium of exchange function. In measuring money, the Reserve Bank constructs money aggregates based on the varying levels of liquidity of the various types of money, rather than on who has issued or created the money (see Collins et al. (2001) for more detail on the Reserve Bank’s approach to measuring money). These aggregates are listed below.

• The stock of currency not in bank tills is the narrowest measure and refers to the notes and coins issued by the Reserve Bank that are held by the public. This measure averaged $3 billion in 2007.

• M1, the next measure, includes notes and coins held by the public plus balances in accounts on which cheques can be written. M1 averaged $23 billion in 2007.

• M2 is a broader measure still and encompasses M1 plus all other business or personal deposits that are available ‘on demand’.5 All EFTPOS accessible (non-cheque) funding is included in this aggregate. M2 averaged $70 billion in 2007.

• M3 is the broadest measure of money. It represents all New Zealand dollar funding of most registered banks and three other financial institutions.6 This aggregate consists of M2 plus term funding of those institutions. M3 averaged $192 billion in 2007.7

Diagrammatically, the different measures of money can be represented as the concentric circles shown below, decreasing in terms of liquidity as they broaden out.

The implementation of monetary policy

As shown above, the Reserve Bank’s operations in supplying ‘outside’ money are central to the banking system’s money creation processes. These operations are also central to the Reserve Bank’s implementation of monetary policy in pursuit of its primary function of maintaining price stability, as required by section 8 of the Reserve Bank of New Zealand Act 1989.

Since 1999, the Reserve Bank has performed this function by adjusting the Official Cash Rate (OCR) to target inflation.8 The OCR tightly and directly controls the price of outside money as supplied to the banking system through the interbank payment system set out above.

At first, it may seem odd that the implementation of monetary policy is conducted through the price of money rather than the quantity of money. Indeed, the ‘monetarists’ of the late 1960s and 1970s applied the Quantity Theory of Money – in which the price level is determined by the balance between nominal money supply and the demand for real money balances (determined by the level of activity in the economy) – and concluded that the only way to control inflation would be to control or ‘target’ the money supply.

The historical experience of implementing monetary policy based on this approach was not favourable, because of rapid financial innovation. Central banks thus reverted to interest rate targeting. Modern monetary policy now assesses the expected paths of inflation and output as a consequence of the control of interest rates by the central bank. There will be a resulting path for the money supply and that path may provide useful information on the state of the economy, but policy deliberation no longer focuses on trying to control the money supply. (For more discussion of the evolution of the use of money and credit measures in monetary policy over the past few decades, see the article by Bloor et al. (2008), “The use of money and credit measures in contemporary monetary policy” in this issue of the Bulletin.)

Under the current OCR operating arrangements, the deposits in the accounts that the banks hold with the Reserve Bank – represented as the pink boxes in Figure 3 – earn the OCR as interest.9 If Bank A or B does not have sufficient money in its Reserve Bank account to meet its interbank payment obligations, it can borrow either from other banks or from the Reserve Bank. If the bank in deficit borrows from other banks (for example Bank C), it will generally be at a rate close to the OCR. This is because the Reserve Bank itself undertakes to lend (against certain approved collateral) an unlimited quantity of money to registered banks overnight at a rate of 50 basis points higher than the OCR.10 The effect of the undertaking is thus that the Reserve Bank sets the price of money prevailing in the banking system, and enough money is provided to the system to ensure smooth settlement of interbank transactions to support customer payments.11Currently, this amount is around $7 billion.

As noted above, the Reserve Bank moves the OCR to maintain price stability, raising the OCR when economic developments are tending to push inflation up, and lowering it when inflation pressures subside or when inflation is tending to fall. Changes in the OCR modulate inflation pressure by influencing the interest rates banks charge and offer, and thus influence demand and supply in the economy. These channels are referred to as the transmission mechanism of monetary policy.12

For example, the Reserve Bank would tend to increase the OCR in response to an increase in inflation pressure. The rise in the OCR would tend to flow through to higher bank interest rates, which would offset the pressure by shifting preferences from consumption to saving, because the cost of borrowing has increased, and the return from savings is also higher. This translates into a lower demand for consumption and investment goods, easing the inflation pressure in the economy. When the OCR is raised, it also results in an appreciation of the New Zealand dollar because the demand for New Zealand interest-earning investments increases. As the demand for the New Zealand dollar increases, the value of the dollar appreciates. The higher dollar dampens exports and increases the demand for the relatively cheaper imports, also lowering demand and thus the inflation pressures.

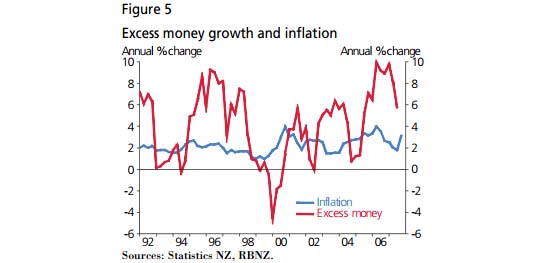

As set out above, the Reserve Bank supplies money ‘on-demand’ to the banking system at the OCR. Banks may then create money and credit at a volume depending on their customers’ own demand for money and credit. In practice, the public’s demand for money fluctuates significantly, and the volatility of ‘excess’ money growth (that is, the rate of growth of the ratio of the money stock to real GDP) is considerably larger than that of inflation (see figure 5).

5 Conclusion

In this article, we have explained the manner in which money is created by the Reserve Bank and by private sector institutions. While the Reserve Bank creates fiat money, in practice, a much larger share of money is created by registered banks and other private institutions. In the process of creating money, these private institutions also create credit, which by enabling the funding of investment, contributes to the economy’s ability to grow. Payments are settled between these money-creating institutions via the interbank payment system provided by the Reserve Bank, using deposit accounts that the institutions hold with the Reserve Bank. The Reserve Bank’s operations in the payment system are the means by which the Reserve Bank sets the price of money – the OCR – in its pursuit of price stability.

References:

Bloor, C, C Hunt, T Ng and H Pepper (2008) “The use of money and credit measures in contemporary monetary policy”, Reserve Bank of New Zealand Bulletin 71(1), this edition.

Bollard, A (2005) “New Zealand Payment System”, speech to the Institute of Finance Professionals New Zealand, 11 August, accessed at www.rbnz.govt.nz

Collins, S, C Thorp and B White (2001) “Defining money and credit aggregates: theory meets practice”, Reserve Bank of New Zealand Bulletin 62(2), pp. 5-23.

Davies, G (1996) A history of money from ancient times to the present day, University of Wales Press, Cardiff. Drew, A and R Sethi (2007) “The transmission mechanism of New Zealand monetary policy”, Reserve Bank of New Zealand Bulletin 70(2), pp. 5-19.

Morgan, E (1965) A History of Money, Penguin Books Ltd., Australia.

Nield, I (2006) “Changes to liquidity management regime”, Reserve Bank of New Zealand Bulletin 69(4), pp. 26-31.

Reddell, M (2001) “‘That private banks should create almost all New Zealand’s money supply’”, speech delivered for the Victoria University of Wellington New Zealand Banking Reform Debate, 27 August, accessed at www.rbnz.govt.nz

Reserve Bank of New Zealand (1999) “Monetary policy implementation: changes to operating procedures”, Reserve Bank of New Zealand Bulletin 62(1), pp. 46-50.

Notes:

I would like to thank Phil Briggs, Tim Ng, Ian Nield and other Economics Department colleagues for their helpful comments on earlier drafts of this article. All remaining errors and omissions are my own.

1. See Reddell (2001) for a discussion.

2. Refer to Morgan (1965) and Davies (1996) for further detail relating to the origins of money. 26 Reserve Bank of New Zealand: Bulletin, Vol. 71, No. 1, March 2008

3. Besides the registered banks in New Zealand, certain institutions such as building societies, credit unions and finance companies also create money in the sense discussed in this article. There is no legal restriction on the type of institution that may create money in New Zealand.

4. A detailed description of the payment system in New Zealand can be obtained from Bollard (2005).

5. More formally, these deposits refer to call deposits, which are accounts that comprise overnight money and funding that can be accessed without break penalties.

6. A complete list of institutions in M3 can be obtained from the Reserve Bank website.

7. M3R is the ‘resident’ M3 aggregate and represents New Zealand dollar funding from New Zealand residents only. This aggregate is the same as M3, less funding sourced from non-residents. M3R averaged 159 billion in 2007.

8. Refer to Reserve Bank of New Zealand (1999) for the rationale for moving to this system of monetary policy implementation.

9. More information can be obtained from Nield (2006).

10. Prior to changes to the Reserve Bank’s liquidity management regime in July 2006, the Reserve Bank’s undertaking to lend was at a rate of 25 basis points higher than the OCR (rather than 50 basis points higher), but the interest rate paid on accounts banks held with the Reserve Bank was 25 basis points lower than the OCR, rather than exactly equal to the OCR as now. Nield (2006) discusses the reasons for these changes in detail. The changes had no consequence for monetary policy, but improved the functioning of the interbank payment system.

11. If one bank, Bank C, tries to charge another bank, Bank B, a rate higher than that charged by the Reserve Bank, any profit earned by Bank C will be ‘arbitraged’ away by other banks offering to supply Bank B at a lower cost of borrowing than that offered by Bank C. This supply would be funded by a loan from the Reserve Bank until the profit opportunity disappears. Figure 5 Excess money growth and inflation

12. See Drew and Sethi (2007) for a detailed explanation of this process.

Gillian (Lawrence) Thornton is a senior economic analyst at the Reserve Bank of New Zealand. This article was first published in March 2008 in the RBNZ Bulletin. It is here with permission.

76 Comments

Is 'price stability' still the best main aim for the RB?

What about the protection of its citizens and the protection of its small businesses and family farms & allowing them fair access to money given the corporTe large business competition?

It's interesting observing NZ Over the last 40 years that the increased 'financialisation' of organisations has/is leading to poorer performance, undermining of of integrity, and in many cases their destruction. Universities, hospitals, state owned enterprises, govt departments, schools, etc that used to provide services for the good of citizens are forced to comply to the authority of the dollar.

Meanwhile SMEs cannot get the finance they need at reasonable terms.

And so we progressively hand over all our public good assets to the financial/large corporate sector to conform to the ideology.

Added to this is the debt trap / 2 income trap that households have been tempted into - to the detriment of family life (if a family is affordable).

So allowing the financialisation of all aspects of NZ life has not really benefited most NZers.

Worldwide problem. The rich are draining every last bit of wealth from the middle class. They have all the money and all the influence.

I was going to say that this is pretty old news, but then I checked the date for this article, originally published in '08 when we all had a crash course in how, and I quote "The financial system enables ‘real’ activity – that is, the processes of production and trade of goods and services – to take place smoothly."

except that isnt how it really is ie " real activity". For me anyway I consider that the financial part of our economy is now in control of a substantial part of our real economy and quite a bit of it actions strikes me as parasitic in nature ie damaging to the real economy.

This is a great article.... back in 2008 , I pulled it apart in coming to my own understanding .

One point I'd make is that the Author starts off , in the very first sentence, using the distinct terms money and credit...

Central Banks create "Money".

The private banking system creates "Credit".

Credit is an IOU note... It is a claim on "Money".

then the author uses the term to describe both,which confuses things,... yet they are 2 different kinds of money. ( We have come to accept credit as money )

Credit is looked on as"money", because we have come to accept it as "money"... It is fungible....It spends like money ...we can't tell the difference in our electronic banking world.

So... by seeing that the Modern Banking system is just a sophisticated version of the Goldsmiths of old lending out more gold notes than there was gold.....( and gold notes were accepted as money ) one can see how precarious Banking systems are... and how inequitable they are ..

The only thing that makes it all look sound is the necessity of never ending credit growth....

The banking system is inherently unstable.... It is only with having a Central Bank that the system seems stable.... Lending out IOU notes.... borrowing short term to lend out long term ( playing the yield curve).... and acting like leemings in boom times... can make it easy for Banks to run into liquidity and solvency issues in the blink of an eye..

In NZ ,a severe Real Estate downturn would probably lead to these issues..

The fact that our economic system requires lower and lower interest rates to stimulate the economy out each recession ..... is a sign of sickness.... a sign that we are moving towards our own Banking crisis at some point.... a sign that the musical chairs of never ending credit growth does have an "end"... does have limits...

So there are 2 forms of "money" in our Monetary system... Inside money and outside money...AND yet... credit money is distinctly different to Central Bank Fiat money.... and yet there is no difference as we accept them as being the same thing... and we call both..."money"..

There....take that... I've added to the confusion :) :)

Understanding credit and how it is used as money is really useful in understanding and making sense of the the economic world we live in.... especially in the current times we are in.... the so called deleveraging process the world is trying to go going thru.

except of course...People create Money.

CB creates credit - thats why private banks are forced to buy credit from the CB, with Money.

...and good lord are they STILL harking the medieval goldsmith paradigm. fiat cash and proportional money have been around since Rome and even early Persia. Back when it was realised ursary limitations would have to be implimented to control it [created money].

CB creates credit - thats why private banks are forced to buy credit from the CB, with Money.

Can u elaborate on this..??? i don't understand what u are meaning...?? thks.

A great article. This should be compulsory learning in school. I'm still amazed that the mass populous has no idea how money/credit is created especially when it underpins the entire global economy!

go have a chat with some school kids - find out how and what they learn...

far more problems getting basics taught properly, first time, to students own learning method first, before even a hope of doing such things.

Articles like this should be mandatory in our education system!! Or is it a great convenience to have a State run education system that never teaches about the State run banking system???

People's eyes actually glaze over and the human ability to switch the ears off at the same time kicks in at the mention of money creation!!

Great piece, excellent primer, thanks for reviving it.

There is a, IMO, very good 4 part lecture on “How Money Works” by Dirk Bezemer on YouTube.

It explains matters better than any other doc I have seen, and I reckon should be shown in every high school.

Dirk Bezemer - Debt: The Good, the Bad, and the Ugly

http://ineteconomics.org/ideas-papers/blog/dirk-bezemer-debt-the-good-t…

Of course there is the other documentary also worth watching “Money as Debt”

https://en.wikipedia.org/wiki/Money_as_Debt

Often there seems to be confusion about money and currency and the difference between the two.

Currency is the fiat stuff we use daily, but according to J.P. Morgan:

Gold is money and nothing else.

Disagree. Gold is a mineral, which used to be used as a form of 'money' but is now a relic of the past. It is a mineral useful for jewellery and some industrial use. Beats me why central banks continue to hold it. Cryptocurrencies will turn out to have more practical use, completely replacing the 'money' functions gold used to have in the pre-industrial world.

Disagree - Ray Dalio, the founder and CEO of Bridgewater Associates - the worlds largest hedge fund, had this to say regarding gold:

"If you dont own gold...there is no sensible reason other than you dont know history or you dont know the economics of it..." Link to video below:

http://www.zerohedge.com/news/2015-05-14/ray-dalio-if-you-dont-own-gold…

While I see little advantage to cryptocurrency (too easy to print new currencies, to vulnerable to strikes on on information infrastructure - eg anti-satellite warfare or legislation or fees)

they [cryptocurrency] is far more useful than gold as bullion. the gold is only worth its stored value, and if no-one wants it for trade then it is worthless. Gold evolved as a currency because nothing else was better (limited to print, had good shelf live, wasn't directly consumable, was completely fungible).

since the invention of paper currency, especially modern methods with protections, gold is redundant. It only has held value as a pin back to it's legacy in earlier times.

Economics as a science has also made considerable progress, so the principles of currency are much more mature than when such things were a dark and somewhat random art (ie vs barter, we had barter for metal or coin that relied on rarity to hold value).

Should economic collapse come, a hoard of copper and iron and energy harvesting would do you more good than the entire worlds collection of gold...just ask the Aztec.

There really is no real difference between crypto-currency and the electronic bank credit you hold in your savings account except the bank credit you hold in your savings account has a fixed exchange rate to notes and coin of 1:1. Crypto-currency can never replace gold.

(1) Cryptocurrency isn't limited or controlled by the bank or any central body. They can't "close" your cryptocoins or say "sorry the government said you owed them" and steal them.

(2) Cryptos are limited. There is effectively One coin (the max number of "coins" to be mined). It is known pre-mine fixed number. Although the types of coins isn't limited. The inflate to nothing effect is harder for interests to do.

1. It would be only a matter of time before the government either worked out a way to take them or closed the exchange all together (on the basis of tax evasion). Then in the end you 'own nothing'. Just virtual digital units of account. Because its electronic - don't be fooled, it can be shut down. Because it may move from smart phone to smart phone it can still be tracked just like a text message or phone call. Exchanges can be regulated by government (and probably will be, not entirely a bad thing).

2. Their use is limited and unproven. Being limited doesn't mean their value in terms of purchasing power is constant either. You don't have to inflate a 'currency' for it to be worth nothing. Governments could just make it illegal and shut it down. Eg China. Many fiat currencies have come to nothing, most not due to hyperinflation.

3. It's not a proven store of wealth. It would take hundreds of years for it to even come close to being universally considered as such.

cowboy i think a cupboard full of groceries will do you more good in an economic colapse than a shed full of copper wire.

Maybe we should ask the Greeks

Ray Dalio says "Gold is a currency" but Ben Bernanke says "Gold is not money". I think Ben is the authority on money.

Gold is money.... provided some one will trade it for something of value. (property or services).

That's why _people_ make money...by giving something value in trade. No trade? then you have no money.

Wrong. What you're proposing is illegal because no tax would be collected on that trade. So gold is not money, its an ugly looking yellowish metal that used to be considered classy but now is tacky thanks to all the American 'gangbanger' music 'artists' using it for new teeth.

GST isn't payable on gold for the same reason it isn't payable on money, it is money.

Edit: Economist makes the same point below.

I agree with Ray Dalio.... Gold can be a currency.. In times of great uncertainty and a loss of confidence in Fiat money ...investors perceive gold as a store of value currency..

Having that view , fits in with how the gold mkt behaves... ( it is more than just a commodity... at times )

As an investor... if it was a choice between the academic knowledge of an economist or the practical knowledge of a really smart investor .... I know what I'd choose..

I'd choose the law and the law says gold is not money.

No, the law doesn't say that OU. Why don't you read the law? Then you would know that the IMF membership enacted by our Parliament clearly states gold is money. Why don't you actually look it up rather than make off the cuff comments that you think are true but are not? That's also why there is no GST on gold, because pure gold is neither a good or a service, its money.

The law actually says the opposite to what you say that it says.

You could start for example, by reading the Articles of Agreement of the IMF (that all member countries are required to enact into law) - Article V, Section 12, paragraph (d) "The Fund may accept payments from a member in gold instead of special drawing rights or currency in any operations or transactions..." ... Mmmmm sounds like gold is money to me....

Also Article VIII section 5 .... again sounds like gold is money to me...

so are stamps , thats why you dont pay GST on them because they are legal tender

Well if the really smart investor is Peter Schiff, well no.

XD

Ray is just stating a known fact. Ask any large bank currency trader.

Ben is lying. It's what central bankers must do from time to time. Don't worry though, Ben has your best interests at heart.

Tin foil hat time

if you took your tin foil hat off for a moment you might learn something

Of course a tin hat will work much more effectively with a gold foil lining.

For the simple reason: - It is not a commodity because it is not consumed. It is instead a means of exchange, a currency, which unlike fiat currencies is no one else’s liability. Read more

currency can be printed where as gold bullion is scarce. How safe is your currency in the bank?

http://www.interest.co.nz/news/77085/surging-auckland-house-prices-lead…

how safe is your gold in the bank? or even under your bed?

http://www.telegraph.co.uk/finance/personalfinance/investing/gold/99684…

banks hold it as it represents an international store of value. Property fluctuates, the banks aren't supposed to hold stocks or bonds in markets that their customers buy. so it limits what is viable for international investment holdings.

David, considering not one fiat currency in the history of mankind has survived intact for any great length of time, whereas gold for centuries has been treated as money and a consistent store of wealth, yours is a really big call - and thats even if you aren't of the view that the latest QE experiement is currently in the long slow progress of unravelling yet gain

fiat ties to governments and countries. historically those have been unstable. This has been bad for trade, just look at all the Africans and north Africans (arabs, jews, etc) killing each other still - how can that be good for anyone. all that waste, destruction. the resources they waste in oppressing each other and abusing women and children could make a luxury world - but no, they see only opportunity, power, and chances to murder each other. the sooner they wipe their genetics from the face of the planet the better for anyone with sentience.

sure it doesn't have anything to do with the Western powers constantly meddling in the affairs of the nations and peoples of the region in a bid to secure the flow and influence the value of the resources there? btw. And yes, this is no conspiracy theory, the latest episode of this Greek tragedy is the former head of America's Defense Intelligence Agency admitting on Al Jazeera that his agency aided and abetted the rise of ISIL, which had been facilitated by its allies in the Gulf States and Turkey.

'Gold is money!' 'gold isn't money!' 'Gold is money!' 'Gold isn't money!' 'I approve of genocide!'

... well, that escalated quickly...

Well by your logic, peace has never held for very long but war has always been used to settle differences. So lets not bother with peace and only indulge in war.

DC nice. Great fable. Your comments would be true, except for the facts of course....

1. '... gold is now a relic of the past...' Ah - not really. Gold is now traded more than at any time in known history, so much so its treated as a currency on trading desks of the big international banks. In fact more gold now trades than actually exists.

2. '...it is a mineral useful for jewellery and some industrial use...' No - its use as money far far far outweighs this commodity use, many many thousands of times over.

3. '..beat me why central banks hold it...' Its because gold is money. See below.

4. '... crypto-currencies will replace gold...' If anything crypto-currencies will replace fiat (which has really become a crude form of this type of currency anyway, but not gold.

David, it is not

Cryptocurrencies will turn out to have more practical use.

It is the method that makes it all work which is the "Blockchain"

Re-stated

The blockchain will turn out to have more practical use.

The blockchain allows anything of value to be exchanged easily and cheaply.

See

Bitcoin might fail but the blockchain is here to stay - Full WIRED Retail talk

https://www.youtube.com/watch?v=jbu6I-8mNUo

You assume an ever more complex world which means you obviously believe in a flat earth as such wouldnt work on a finite planet. Since we live on a finite planet and are exhausting its affordable to get minerals life has to get simpler and less complex, ergo cyrpto-currencies will disappear as will all the ones and zeros.

So the only Q remains is when.

i like the word "product".

Can i put a printer in my garage and be a 'producer'?

Gold is at the heart of the international finance system. THATS WHY CENTRAL BANKS HOLD IT. The US and others recognise its money which is why their central banks list it as part of their monetary reserves. The IMF recognise gold as money which is why they accept repayment of debt in gold.

Gold is the real reserve currency of the world. It has always been so. The USD was accepted as a reserve currency only because it was backed by gold. It was gold that gave it that status. It was not military might, nor political pressure, it was real gold. Back in 1971 the USD in a sense never came off the the gold standard, it just was moved from fixed to floating. You still needed USD to purchase gold on the international market, ie to purchase gold you needed USD as all gold was priced in USD (as the US had the lions share of gold reserves). To find the gold price in NZD you need to know the price in USD then know the conversion rate from NZD to USD. The USD just floats against gold. That's why oil is priced in USD. Its why oil and gold never flow in the same direction. The BIS places gold where it is most needed. Basically the West needs cheap energy to grow. The paper gold market came into being to give the west this supply of cheap energy. Without gold this system doesn't work. CB will always hold gold and Germany will never see the return of its gold in any meaningful way. Its far far to valuable to give back. Gold is really the only true money the world has ever known, everything else is debt.

You must have walked the trail at FOFOA's...?

All currencies now compete with one another, not for value but for usage. Its easy to understand the currency that prices oil will get used and would always win this game. The USD must survive if other paper currencies have a chance to survive. Their value is linked to the USD.

Will CBs put out a proposal to sell all their gold? It will never happen. It would be the end of the international financial system.

Far better to use their gold to support the paper gold market and ensure cheap energy and therefore economic growth for their societies. How far do you think an IOU would go if you didn't have gold in the background to back the deal?

The article seems to state a money world encompassed by balanced ledgers and yet ASB, most recently claim.

Total loans increased $4.7 billion, or 8%, over the year to $65.4 billion. Total deposits grew faster, by $5.8 billion, or 13%, to $50.1 billion.

The asset ledger being ~$15.0 billion greater than the deposit base begs for an explanation in an integrated, interrelated world, in so much as one believes:

My liabilities are your assets; my income is your expenditure. That means that my action changes the parameters of your choice set, making possible an action that changes the parameters of my choice set. Read more

Moreover, When a price goes up, there is a redistribution from buyers to sellers, but it is not obvious in standard economics that this redistribution has aggregate effects. If buyers now have less to spend, then sellers now have more to spend. Kindleberger repeatedly questions the symmetry of this effect, and hence the lack of net effect, usually on dynamic grounds. In the back of his mind, so it seems to me, he has what I have called the survival constraint, or reserve constraint, an inherent asymmetry in payments system between deficit and surplus agents. Read same

Show me the money.

The implication that New Zealand banks reserve vault cash at a 10% rate in a manner similar to the deprecated fractional reserve banking system the US Federal Reserve operates is irrational.

US M2 data (M3 discontinued) records an outstanding amount of ~$12,076 billion, whereas FRB reserve vault cash - (table2) is recorded at ~$59 billion. Similarly, NZ M3 stands at $296.3 billion while the RBNZ circulating cash liability is recorded at ~$5.4 billion.

One more time, all together now.

"Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits" … "In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money 'multiplied up' into more loans and deposits." Read more

Like most government diahorrea this is an incredibility long and complex article, most of which should be in an appendix. It's mainly about how money might work in a different system.

Money in New Zealand is primarily created by banks lending it out against property, it then recirculates back to the banks as interest and principal repayments. The money tends to be lent out faster than it is recycled which creates asset bubbles.

The banks are the primary beneficiaries of this system. The management of the payment system and limited services to depositors are provided to legitimise, obfuscate and enhance the privilege granted in being able to create money for themselves to lend out. The only limit to money creation is the banks willingness to lend. Their service is not subject to Goods and Services Tax, nor do they appear to pay anything to society for the privilege that society grants them. Perhaps a percentage royalty fee on turnover as used in natural resource extraction would be appropriate.

The only limit to money creation is the banks willingness to lend.

I think you are wrong...

Explain to me why Banks require offshore wholesale funding..??

Interesting point, I assume its to keep the bank capital requirements up?, ie the leverage. In effect though I'd assume the money borrowed could also be exactly the same, ie leveraged with most created when the loan comes into existence? so its all make believe....????

To fund 40 years of accumulated current account deficits?

They obtain such funding as they need in order to be able to lend as much as they choose. Funding is only ever a constraint in a crisis, normally finding suitable lending opportunities is the limiting factor.

This does not explain your assertion that Banks can .."create money without constraint. "

If they can "create money without constraint" ... then why do they require funding in order to lend..??

They have to have some capital reserves as the leverage? 10 to 1?

Can you just run that past me again ? What is money, and this "capital reserve" it breeds ?

That's where some of someone else 1s and 0s are kept in reserve to backup the 1s and 0s you just invented also out of thin air.

XD

NZ banks have capital adequacy rules....

There are other constraints to how much Credit Private Banks can create.... I think the biggest one is Prudence and solvency related....., which is imposed thru the "payments system"..

Each day Banks have to settle the IOUs' that they wrote ( credit created) and which have been cashed in and used by the borrowers..

This is done thru the payments system , thru their accts with the Reserve Bank...

Even thou Banks create credit out of thin air.... they do so within common sense constraints... in the same way we prudently manage our own personal finances...

The theory that they can create credit/money without constraint.... is false.... ( If anyone could create credit , without constraint, at no cost.... then it would make sense to buy up everything... don't u think.???? )

Study of the Bank of England's comments may be of help.

In summary ex the G:In other words, everything we know is not just wrong – it's backwards. When banks make loans, they create money. This is because money is really just an IOU. The role of the central bank is to preside over a legal order that effectively grants banks the exclusive right to create IOUs of a certain kind, ones that the government will recognise as legal tender by its willingness to accept them in payment of taxes. There's really no limit on how much banks could create, provided they can find someone willing to borrow it. They will never get caught short, for the simple reason that borrowers do not, generally speaking, take the cash and put it under their mattresses; ultimately, any money a bank loans out will just end up back in some bank again. So for the banking system as a whole, every loan just becomes another deposit. What's more, insofar as banks do need to acquire funds from the central bank, they can borrow as much as they like; all the latter really does is set the rate of interest, the cost of money, not its quantity. Since the beginning of the recession, the US and British central banks have reduced that cost to almost nothing. In fact, with "quantitative easing" they've been effectively pumping as much money as they can into the banks, without producing any inflationary effects.

http://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-ba…

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin…

as mentioned before the limit (aside from managing the float) is finding any that can fog a mirror.

P.S. in answer to your last question, some say yes, and people are...

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=115…

not saying he is a borrower... Young landlord's 11 rentals in 5 years

Gary Lin says he started buying houses only so he could play World of Warcraft on his computer all day every day.

Now he's a multimillionaire who owns 11 rental properties in the soaring Auckland market. The 32-year-old - originally from Guangzhou in China but a New Zealand resident since he was 13 - started buying property in June 2010 with a $200,000 wedding gift from his father. He and his wife Cindy bought one place for as little as $173,000. Now his portfolio is valued at $6.5 million, which earns about $275,000 in gross rent each year.

of the 275k my some be derived from here?

http://www.workandincome.govt.nz/individuals/a-z-benefits/accommodation…

interesting to hear how he is determined to put rents up

but the smucks who do the borrowing get to actually make real thing and do real work to pay back their debts.

Amazing isnt it....which is why I call the bankers financial parasites.

and milk? "So the excess could take years to work through." this is production / output and not a stock of. So just how it will only take a few years to work though without the return of demand mystifies me.

From this, the only conclusion I can arrive at is that this will take is manufacturers/miners etc going bankrupt taking supply off the market and take many years. Then there are the iterations, of course. eg When someone, presumably the least efficient goes out of business their company is sold at a firesale price and that new owner can now compete very cheaply even with the well run companies as they have huge debt to service who in turn will probably go toes up, rinse and repeat.

Huge destruction of wealth....massive...

Even if they go bankrupt, there is just someone new entering the industry at a lower cost.

Indeed, hence the iterations, however the wealth, probably job destruction and ultimately economic well being seem questionable, to say the least.

Roelof, maybe some are not playing by the observations of your last paragraph. The genesis of the problem we have with some economies perhaps ?

Central banks like to claim the role of keeping the financial system on the rails – as if they were impartial regulators, working on behalf of all participating in the financial interactions of society. It’s not so simple. Central banks have the role of protecting and enhancing our system of capitalism. (The merits or otherwise of capitalism are another issue.)

The point is that the running or delivery of our system of capitalism is largely in the hands of retail banks - which are, in essence, no different from any other retailers. Their interests are merely private profit. To meet these goals, banks like plenty of available credit or debt. It’s their product. The more the better. And globally the central banks have obliged. Thus central banks in short time find themselves propping up and working for the interests of banks.

Retail banks are just that - retailers. They sell debt, for profit. An economist working for a bank is like a category manager employed by Harvey Norman. Both can tell you roughly – which means as far as their employers need to know – what the consumer market looks like. The job is ensuring the efficient peddling of product – so, to a point, they need to know what the market wants or will stand.

The relationship managers in the banks have the same jobs as floor staff in Harvey Norman. The job is closing sales, which means encouraging desire and managing doubt in the mind of the customer. The only difference is scale – millions in debt or a 40-inch screen. Harvey Norman would love to be ‘your partner in home living’; the banks traffic in the same line, as ‘your partner in farming, business, etc’. You are merely a likely source of profit or, at worst, prey.

Moreover, because retail banks are fundamentally ignorant of business, they prefer to lend on things they can actually see and that don’t move – a farm, a house. Thus, as they all pile into the same sectors, they create bubbles, from which the compliant central banks rescue them. And so the whole system slides further and further into a muddle of partiality, compromise, intervention and greater and greater debt.

The job is ensuring the efficient peddling of product – so, to a point, they need to know what the market wants or will stand.

Hmmmm

Under the current OCR operating arrangements, the deposits in the accounts that the banks hold with the Reserve Bank – represented as the pink boxes in Figure 3 – earn the OCR as interest.9 If Bank A or B does not have sufficient money in its Reserve Bank account to meet its interbank payment obligations, it can borrow either from other banks or from the Reserve Bank. If the bank in deficit borrows from other banks (for example Bank C), it will generally be at a rate close to the OCR. This is because the Reserve Bank itself undertakes to lend (against certain approved collateral) an unlimited quantity of money to registered banks overnight at a rate of 50 basis points higher than the OCR.10 The effect of the undertaking is thus that the Reserve Bank sets the price of money prevailing in the banking system, and enough money is provided to the system to ensure smooth settlement of interbank transactions to support customer payments.11Currently, this amount is around $7 billion.

Is this the underlying contributing factor for the, intended or otherwise, mid rate interest rate premium embedded in NZD/USD forex tom/next swap/roll pips?

(((((0.5498 + 0.2902) / 2) x 365) / 6553) x 100) + 0.36510 = 2.7045%

This asymmetric buyer versus seller return bias is persistently ignored by the RBNZ.

Good question, SH. The interrelationship between central and retail banking is built on an assumption that the private sector (having a profit motive, being accountable to its market, etc) is the most efficient monetary distribution system.

The objectives of each both align and diverge. The central bank is, in effect, a producer and wholesaler. Producers and wholesalers seek to protect and manage their product value. And this, similarly, is the policy framework within which a central bank operates. But like any producer and wholesaler, it must also sell or distribute its product. This is the growth imperative of our 'free', capitalist economies at a conceptual and policy level. A central bank always seeks to stimulate sales and thus enhance 'growth' activity. It must do, or 'the economy' stalls.

But in sales and distribution, of course, a central bank works through its accredited retail banks. This is the point of intersection of public and private concepts and entities. And the inclination of retailers - having a private profit motive - is always to flood the market, or to make whatever sales are possible in as short a time as possible. This accordingly drags the central bank into all sorts of supply and price management issues, as gung-ho retail activity tends in time to devalue the product. But the point is, always, that a central bank will incentivise its retailers. They deliver the product. They drive economic activity. Impartiality, in this linked relationship, is a falsehood.

I think there's another key issue to unpick, which is the role of capital gain in this picture as a driver in economic activity. Because the retail banks understand fixed assets more than intangibles, they concentrate lending in these sectors. (Yet we know that intangible value - brand, leadership, IP, opportunity, etc - outweighs tangible value in most contemporary stock valuations. It is a key business asset value.) Concentration on fixed assets produces rising asset prices, providing security to the lender and (I know all this is obvious) incentive to the borrower. But this activity is never sustainable.

It is much harder to focus on operational efficiency, revenue and profitability in business - but this is what produces longer term wealth. Capital gain is always a brief ride - it is focused on an end-point, a trade. We have an institutionalised focus on capital gain as a primary means of wealth creation - on a series of short-term (and shortening) rises and collapses, rather than on any sustainable economy. Here too, i would say that central banks, in their policy and operational frameworks, are complicit in economic instability and its recurring social costs.

Workingman....... I have a couple of issues with your analogy....

You say that the central bank is a producer and Wholesaler and that the Private Banking sector is the "Retailer"...

Money is defined by 3 qualities,....... unit of account, store of value and medium of exchange....

It's not really a product... It's qualities define it's function...

It's a very unique thing.... Fiat moneys' cost of production is ,practically, nothing.. 0..

The truth is that it is the Private Banking sector that actually creates credit.... and retails that. ( and credit makes up, by far, most of our M3 money stock )

Central Banks, were created to provide stability and liquidity to the Private Banking system.... which had a history of boom and bust... causing economic dislocation..

Private Banking system existed before Central Banks ever did.... I think..

In a philosophical sense , this process of credit creation might be compared to "counterfeiting".. in my view

Going from a Micro to a macro view... it's not too hard to see how counterfieting appropriates wealth and distorts prices...AND ..its not too hard to see how it does this...

In economics there is the term.... 'The Cantillion effect" http://azizonomics.com/2012/08/07/the-cantillon-effect/

Over the last 50 yrs.... excessive credit growth has driven the growth of the FIRE economy, to what it is today.

I believe this process has been one of the underlying causes of what seems like a growing inequality in the distribution of wealth....

All just my own view on things...

You're right, Roelof, my analogy doesn't stretch to the whole truth. W

The new year has brought some great comment streams out. Heck this one has seen Cowboy return to the fold. Did they let you out Cowboy, or did someone leave their computer lying around. (just kidding my friend). We just need The Count and GBH to chime in now.

To answer the question of unlimited money creating by retail banks, it is my (albeit inebriated) theory that this is correct. It is facilitated by the function of the clearing house, and connection of the clearing house to the central bank. Wholesale funding is just an international link in this process. The international nature of this process is confirmed by Bill English himself, the facebook wall of Iain Parker today has a great letter of admission from the minister himself over the international interconnectedness of the money supply.

The clearing house works to smooth the balance sheets of the retail banks overnight. All the banks create money through lending, but they don't all lend the same amount each day. But over a week or month they will generally match in the amount of money they create. The clearing house smooths over the day to day discrepancies an helps the system run. The central bank provides liquidity to cover the shortfalls of one bank to another( there will be a transfer of deposit or payment between banks in the sale of a property).

PS. Can you consider letting Iain back into the fold, he still works tirelessly to educate about the money system.

If we have a finite amount of money and a compounding growth in population and gross output, won't we either get an ever increasing cost of money unless more money is created? Just wondering...

If I perform a service and invoice that service to someone, who is late paying and i charge penalty interest, have I created money out of nothing? The money as a fiat for human energy expended,

As Davis said above the system might create money but the banks have to work on old fashioned arithmetic. In that respect Don Brash was correct

Money...oodles of it...is created...every hour....

http://positivemoney.org/how-money-works/how-banks-create-money/

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.