By David Chaston

In 2017 KiwiSaver members contributed almost $3.2 billion to their funds, their employers tipped in another $1.9 bln, and the Government added $763 mln mainly for the member tax credit. All up, that totaled $5.9 bln in new contributions to all these schemes.

These growing contributions, which now total $40.5 bln), plus fund earnings took the total value of all KiwiSaver funds to a massive $47 bln by the end of 2017.

Barring a big market correction, the value of all KiwiSaver funds will exceed $50 bln some time in 2018.

KiwiSaver investments grew +19% in 2017. Most of that was the rising tide of contributions ($5.9 bln) but 'earnings' (or the growth in the fund values over and above the contributions) touched almost +$2.4 bln in the year.

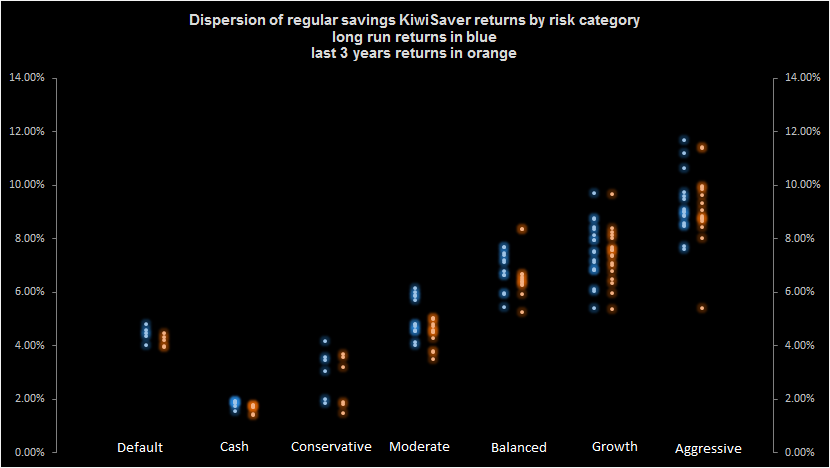

Who shared in these after-tax, after-all-fees gains varies widely. Much depended on the risk you were prepared to accept.

And within the various risk categories, the long term track record of the various fund managers is becoming clearer.

Track record isn't everything (they are no guarantee of future results), but they are something that members can inspect and should be aware of. Long-run poor track records are noteworthy just as long-run above average performance is noteworthy.

Now that KiwiSaver has been going more than ten years, these long run trends can be inspected.

There are many ways to do that, but for investors (KiwiSaver members) the key metric should be after-all-fees and after-all-taxes.

(Many funds industry measures are before taxes, some only include some fees. And others think that fee levels alone indicate who will give the best long-term results. We think these approaches are inadequate in the New Zealand environment).

The tables below show the best performers in each category. The chart indicates the range within each risk category over all funds, although this time we have limited that view to only those funds who have been active and available over the full 10 year business cycle.

Overall, returns over the long term remain strong across the leaders. Members and managers with KiwiSaver funds in the bottom quartile will not be so happy as their returns continue to lag. The longer time goes on, the more clearly the track record is revealed. The gap between the top and bottom in each sector is still wider than you would expect from a competitive market. This is shown graphically in the chart below, all up to December 2017:

Among the Default fund managers, Mercer has extended its lead over the others, even those that are close to its performance. Mercer have held this advantage for some time and it will be reassuring for its members that its relative performance is improving.

Our December 2017 reviews of the Default, Balanced Growth and Aggressive funds can be found here, here and here. Our September 2017 reviews of the Default, Moderate, and Growth funds can be found here, here and here.

Top of the list

We award our special 'star'

There are only two funds that are both best-in-class on an all time basis, and over the past three years. That is one more than we found in September.

This is the list of the top funds at December 31, 2017, based on our regular savings return model. For comparative purposes, we have only used those managers who have been in existence for the entire analysis period of April 2008 to December 2017.

1. The Conservative Fund data in the table excludes cash and default funds.

2. There are now nine default funds, however, only five have been in existence for the full period of our analysis.

3. Insufficient number of funds to provide data.

For explanations about how we calculate our 'regular savings returns' and how we classify funds, see here and here.

The right fund type for you will depend on your tolerance for risk and importantly on your life stage. You should move only after receiving appropriate advice and for a substantive reason.

14 Comments

“Barring a big market correction, the value of all KiwiSaver funds will exceed $50 bln some time in 2018.”

Here comes that correction David,

Dow returned nearly 30%, s&p over 20%. Top kiwisaver funds only around 10%. Does hedging really takes half the gain? Why such a massive difference?

Thank you for sharing such information. I hope this data will help others and me as well.

Money heist costume

Thanks for sharing this post. I am digging deep and utilizing information regarding this.

baseball jackets

Jackets Junction is a leather hub for celebrity inspired outfits. We have thousands of happy and trusted customers around the world. All the costumes are made with high-end quality material. These outfits are based on Cosplay costumes, Celebrity Jackets Junction outfits, video-game characters, and cool superheroes.

Thankfully! This is absolutely astonishing and delightful post. This post is much similar to the Yellowstone Jacket article. I’m pleased to share the appreciated information.

This website provides the best and useful information. I just looked for these type of articles like the Akira Jacket article.

I really appreciate this wonderful post that you have provided for us. I assure this would be beneficial for most of the people Click

Your article is very good but I think you will have better choices when you visit my website. To get the information better and more useful. Leather Jackets That Changed My Life

This is my first time that I here in this blog, I always found very much interesting content on your posts. keep posting, thanks for sharing with us and giving us your precious time. Beth Dutton Denim Yellowstone Jacket

[url=https://www.google.com/]best essay writing service[/url]

contact support phone number

asus number

https://www.google.com/

AVG phone numberAVG contact numberAVG support phone numberAVG customer service phone numberAVG support numbercontact AVGAVG contactAVG antivirus customer service phone numberAVG customer service phone number USAAVG antivirus customer support phone number

Bitdefender phone numberBitdefender customer service phone numberBitdefender contactBitdefender technical support phone numberBitdefender contact numbercontact BitdefenderBitdefender tech support phone number

webroot phone numberwebroot contactwebroot support numbercontact webrootwebroot technical support phone numberwebroot contact numberwebroot antivirus customer service phone numberwebroot support phone number

Trend micro phone numbertrend micro support numbertrend micro contactcontact trend microtrend micro customer service phone numbertrend micro support phone number

mcafee supportmcafee customer servicemcafee phone numbermcafee phone supportmcafee support numbermcafee customer service numbermcafee numbermcafee technical supportmcafee customer supportmcafee contactmcafee contact usmcafee customer service phone numbermcafee helpmcafee support phone numbercontact mcafeemcafee technical support phone numbermcafee tech supportservice mcafeemcafee chat support, mcafee customer support number, mcafee technical support number, mcafee contact number, phone number for mcafee, mcafee tech support phone number, mcafee tech support number, mcafee telephone number, mcafee gold support

household gloves in india

rubber gloves in india

beardhood spf 50 sunscreen in india

beardhood green tea charcoal body wash in india

beardhood beard wash in india

beardhood green tea charcoal gel face scrub in india

beardhood hand cleaner sanitizer in india

beardhood hand sanitizer in india

elements radiant glow face wash in india

on on maha bhringraj herbal hair oil in india

elements multi action fairness cream in india

elements anti dandruff shampoo in india

elements complete care shampoo in india

on on 9e5 premium energy drink in india

elements multi gard blood purifier in india

on on kavachprash in india

on on nutrilife powder in india

elements well hart in india

elements liv again liquid in india

elements uri flush 3 liquid in india

elements woman companion in india

elements antilergy liquid in india

elements wellness ayushwaas in india

elements uri flush 3 plus tablets in india

tyka tramo lower in india

new balance ck4040 cricket shoes in india

new balance ck4020 cricket shoes in india

new balance ck4030 cricket shoes in india

willcraft arid fit t shirt for men in india

on on herbal toothpaste in india

elements daily detox in india

elements man shakti man in india

on on body butter cream in india

elements champi champion taila in india

elements protein powder in india

elements melt fat in india

geografika explore the world in india

elements wellness cyclova capsules in india

elements wellness ega 12 night repair cream in india

elements wellness ega 12 day protection cream in india

elements below 37 in india

elements wellness natcium caplets in india

elements fealing iron capsules in india

elements wellness thyhealth liquid in india

elements wellness 3 in 1 face wash in india

elements wellness red herbal toothpaste in india

on on diabalife in india

on on spirulina gold in india

indiagro plant askort in india

indiagro mi spray in india

indiagro grow magic in india

indiagro tripmyte in india

indiagro fungikawach in india

indiagro white crush in india

elements wellness no vedana gel in india

symbiosis astham care syrup in india

symbiosis giloy juice in india

symbiosis trifla aloe vera juice in india

symbiosis trifla churan in india

willcraft ts10 tracksuit in india

tyka cricket pullover in india

willcraft wg7 wicket keeping gloves in india

willcraft bg10 batting gloves in india

willcraft bg30 batting gloves in india

willcraft bg20 batting gloves in india

willcraft bg40 batting gloves in india

willcraft bl10 batting legguard in india

willcraft bl20 batting legguard in india

willcraft wg2 wicket keeping gloves in india

willcraft wg3 wicket keeping gloves in india

willcraft wg4 wicket keeping gloves in india

willcraft wg5 wicket keeping gloves in india

willcraft bg05 batting gloves in india

willcraft wg6 wicket keeping gloves in india

willcraft boundary cone marker in india

ss platino cricket batting pads in india

tyka tech bottom in india

tyka pioneer trouser in india

tyka voltage tracksuit in india

tyka class tracksuit in india

tyka pioneer cricket t shirt in india

Explore our clothing brand that's called World Famous Jackets. If you like leather jackets or you want to buy a leather jacket. so definitely you should visit our site.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.