By David Chaston

It's time to review KiwiSaver fund performance again.

You can find your fund analysed using our regular savings method, and disclosing its after-all-fee, after-all-taxes performance here.

Our analysis covers 158 funds, so your one is sure to be included.

This article covers the overall results, identifying the funds with the best track record.

Track record is only one thing. What you really need to assess, and something we don't do, is whether you are in the best fund for the future. Track record is backwards looking.

And the future will almost certainly be different to the past.

Regular readers will know that we have the view (and it is only an opinion) that we near the end of a long, prosperous period, growth is topping out, and a correction is now more likely than it has been for some time.

We think you can see that in KiwiSaver fund performance.

The funds who have done well in the past are still doing relatively well, but returns in the past three years are starting to sag. It is a rarity now where past three year returns are better than since inception returns.

There are many reasons for this, but the easiest way to view it is from the economic cycle perspective. Things just don't go up all the time. There are corrections, there are recessions, there are times when asset values and earnings dive as the economic system cleans itself up. Restraining that process are public officials and regulators, the fiscal and monetary authorities who have an essentially political purpose to pull levers to prevent harm to voters. But perhaps the more they put off a correction, the steeper it will be. The US economy has the most influence in the world and the recent rush to debt-fund tax cuts has probably removed much ability to respond if there is a downturn.

You are probably on your own if you think the good times will go on endlessly.

So, rather than looking at track record when making a KiwiSaver choice, now might be a good time to dive a little deeper and think about how your fund is invested and whether in the future that will weather any downturn better than some other strategy. You probably have a bit of time - maybe a year or two, but unlikely more, and possibly not that long.

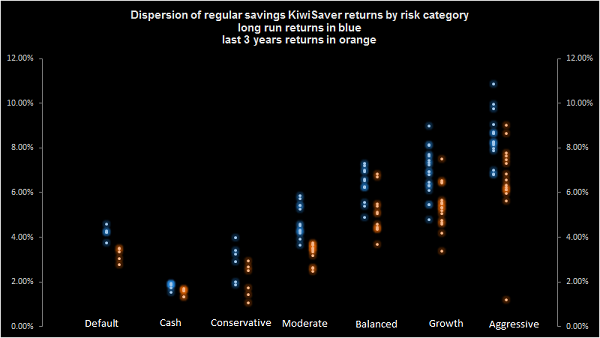

You can see the way returns are starting to sag from these category charts. The first one is a view of all KiwiSaver returns, since inception in blue, over the past three years in gold, up to March 31, 2018.

The next one is the same analysis up to December 2017.

There has been quite a shift lower in just three months. Our expectation is that this market shift to lower growth in 2018. There will still be some great outlier performers, but generally the sagging will extend.

Time to prepare. You saw it here first.

Our March 2018 reviews of the Default, Conservative and Growth funds can be found here, here and here. Our December 2017 reviews of the Default, Balanced Growth, and Aggressive funds can be found here, here and here.

Top of the list

We award our special 'star'

This is the list of the top funds at March 31, 2018, based on our regular savings return model. For comparative purposes, we have only used those managers who have been in existence for the entire analysis period of April 2008 to March 2018.

1. The Conservative Fund data in the table includes cash funds.

2. There are now nine default funds, however, only five have been in existence for the full period of our analysis.

3. Insufficient number of funds to provide data.

For explanations about how we calculate our 'regular savings returns' and how we classify funds, see here and here.

The right fund type for you will depend on your tolerance for risk and importantly on your life stage. You should move only after receiving appropriate advice and for a substantive reason.

11 Comments

Very useful graphs!

Bear it in mind that the blue dots are slowly dropping as well.

Financial advisers would say that with each passing day its getting better and better to buy into the aggressive funds....(as they drop).

Would be interesting to see the comparative performance between fund types on an annual basis from 2007 - 2010 to see how they weathered the downturn last time. I know in theory conservative should have outperformed / performed least worst during the downturn but would be interesting to see if that actually played out.

I guess Cash Funds can only go up from here.

I totally agree. In the event of an OBR, a Kiwisaver cash fund with TDs spread amongst all "AA" rated banks is the ultimate safety net. I have taken up this opportunity up already. Outside of Kiwisaver, a TD with Rabodirect with a grandparented Netherlands based parental guarantee, covers the remainder. I suggest that in a serious downturn, those funds that lose least, win most.

Due to the govts sheer slothfulness, as yet there is no de minimis amount of money in NZ banks that would be safe from the tyranny of OBR.

Under OBR (invoked when the RBNZ puts a troubled NZ bank into statutory management) the RBNZ will at that time decide how much of transaction and on-line accounts will be available to the bank's customers to be able to be used for every day transactions (like buying groceries). There is no stated level for the de minimis allowance which would be a dollar amount that is protected from the allocation of losses and would remain fully available to the account holder when the bank reopens the next business day following the appointment of a statutory manager. This is only for on-call and transaction accounts - no term deposit amounts will be available under OBR - at least not in the short term.

OBR will obviously have a major impact on all customer's of a failed bank and is bound to have severe consequences for the whole NZ financial system - especially if it is one of the main banks.

I dont believe it. Would never happen. Too deflationary. When puah comes to shove the government would bail out the banks, if they're big enough.

My initial comment was more around the returns on Cash Funds - currently low but maybe will rise.

However re KS Cash Funds - would these be quarantined as investment funds in the event of OBR or GFC2?

I have been reliably informed that house prices do go up forever.

Mine is 100% in cash and bonds , waiting for the sharemarket correction and the buying opportunities

I’m not saying it won’t happen, but I’ve made so much by doing the opposite, I can weather pretty much any correction Mr Boatman

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.