Investing

Here are the key changes to know about in the New Zealand equity market; Contact, Stride Property, Mercury, and Investore Property the main gainers as Gentrack, Ryman, Serko, and Mainfreight are the main decliners

4th Feb 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; Contact, Stride Property, Mercury, and Investore Property the main gainers as Gentrack, Ryman, Serko, and Mainfreight are the main decliners

Here are the key changes to know about in the New Zealand equity market; a2 Milk, F&P Healthcare, Briscoes, and Vista Group lead the gainers; SkyCity casino, Kiwi Property Group, EBOS, and Summerset are the main decliners

3rd Feb 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; a2 Milk, F&P Healthcare, Briscoes, and Vista Group lead the gainers; SkyCity casino, Kiwi Property Group, EBOS, and Summerset are the main decliners

Here are the key changes to know about in the New Zealand equity market; Skellerup, Chorus, Channel Infrastructure, and Scales top the gainers to start the week while Fletcher Building, Kathmandu, NZX, and Gentrack are the main decliners

2nd Feb 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; Skellerup, Chorus, Channel Infrastructure, and Scales top the gainers to start the week while Fletcher Building, Kathmandu, NZX, and Gentrack are the main decliners

A crazy January makes it timely to reassess your tolerance for risk and the way you are building your retirement nest egg

1st Feb 26, 12:09pm

9

A crazy January makes it timely to reassess your tolerance for risk and the way you are building your retirement nest egg

Here are the key changes to know about in the New Zealand equity market; Argosy Property, Infratil, SkyCity casino, and Tower take the lead in today's market changes; Freightways, Stride Property, Kathmandu, and Ryman are the main decliners

30th Jan 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; Argosy Property, Infratil, SkyCity casino, and Tower take the lead in today's market changes; Freightways, Stride Property, Kathmandu, and Ryman are the main decliners

Here are the key changes to know about in the New Zealand equity market; Tower, Meridian, Hallensteins, and Spark are the top gainers as Investore, Tourism Holdings, Fletcher, and Stride Property are the main decliners

29th Jan 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; Tower, Meridian, Hallensteins, and Spark are the top gainers as Investore, Tourism Holdings, Fletcher, and Stride Property are the main decliners

Here are the key changes to know about in the New Zealand equity market; Stride Property, Hallensteins, Contact, and Vista Group lead the gainers while Briscoes, Goodman Property, Tourism Holdings, and Kathmandu are the key decliners

28th Jan 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; Stride Property, Hallensteins, Contact, and Vista Group lead the gainers while Briscoes, Goodman Property, Tourism Holdings, and Kathmandu are the key decliners

Here are the key changes to know about in the New Zealand equity market; a2 Milk, Chorus, Vector, and Skellerup lead today's gainers, while SkyCity casino, Summerset, Mainfreight, and Scales are the main decliners

27th Jan 26, 3:00pm

Here are the key changes to know about in the New Zealand equity market; a2 Milk, Chorus, Vector, and Skellerup lead today's gainers, while SkyCity casino, Summerset, Mainfreight, and Scales are the main decliners

The 'Sell America' trade ramps up with defensive risk action heavy as the US loses its way and financial markets brace for impact

26th Jan 26, 3:08pm

25

The 'Sell America' trade ramps up with defensive risk action heavy as the US loses its way and financial markets brace for impact

[sponsored]

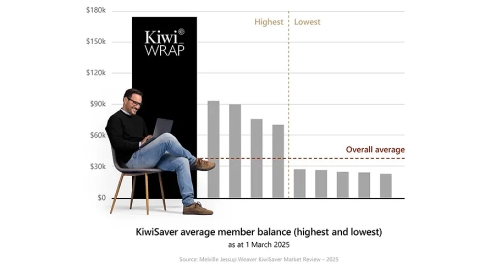

Why bespoke solutions like KiwiWRAP are reshaping the way serious investors think about retirement savings

24th Jan 26, 7:30am

Why bespoke solutions like KiwiWRAP are reshaping the way serious investors think about retirement savings

Michael Spence assesses venture capitalist Ronald Cohen's argument that a purpose-driven 'revolution' is underway

19th Jan 26, 10:34am

Michael Spence assesses venture capitalist Ronald Cohen's argument that a purpose-driven 'revolution' is underway

The World Gold Council sees the sharp rises in precious metal prices as quite divergent. Silver and platinum are responding to short supply, while gold to risk. Gold may be more resilient in the long term as politics skews the economic cycle

10th Jan 26, 3:36pm

2

The World Gold Council sees the sharp rises in precious metal prices as quite divergent. Silver and platinum are responding to short supply, while gold to risk. Gold may be more resilient in the long term as politics skews the economic cycle

Desmond Lachman identifies the main risks that could drag down the US president's favourite economic indicator

9th Jan 26, 9:25am

2

Desmond Lachman identifies the main risks that could drag down the US president's favourite economic indicator

Erin Lockwood parses the confusion over the winning bets on Time's Person of the Year and explains why it matters

9th Jan 26, 9:04am

Erin Lockwood parses the confusion over the winning bets on Time's Person of the Year and explains why it matters

Ross Stitt notes Australian retirement savings now exceed AU$4.5 tln, and these investors got better average returns in their super funds than the market average, bolstered by rising house prices

4th Jan 26, 9:04am

5

Ross Stitt notes Australian retirement savings now exceed AU$4.5 tln, and these investors got better average returns in their super funds than the market average, bolstered by rising house prices