Cost pressures on Kiwi businesses remain "extreme" according to a preliminary reading of the October ANZ Business Outlook.

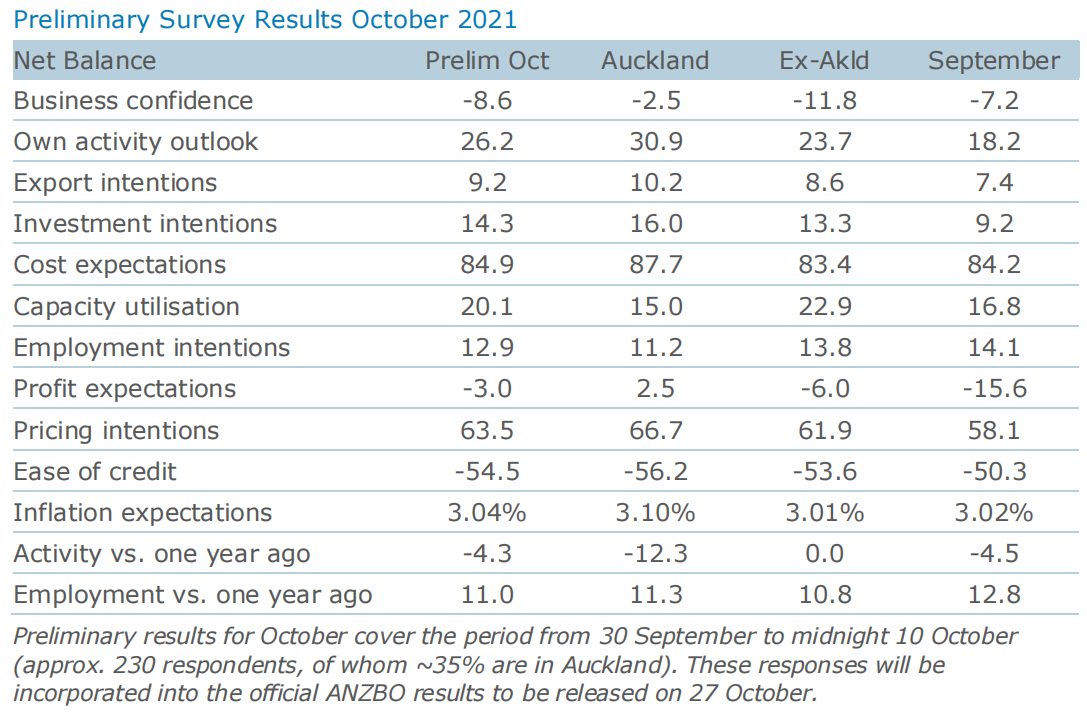

ANZ chief economist Sharon Zollner said a net 85% of firms (up one percentage point) were expecting higher costs in the next 12 months.

This is against a backdrop of huge global supply issues. New Zealand's September quarter inflation figures are out next week and expected to show annual inflation rising above 4%.

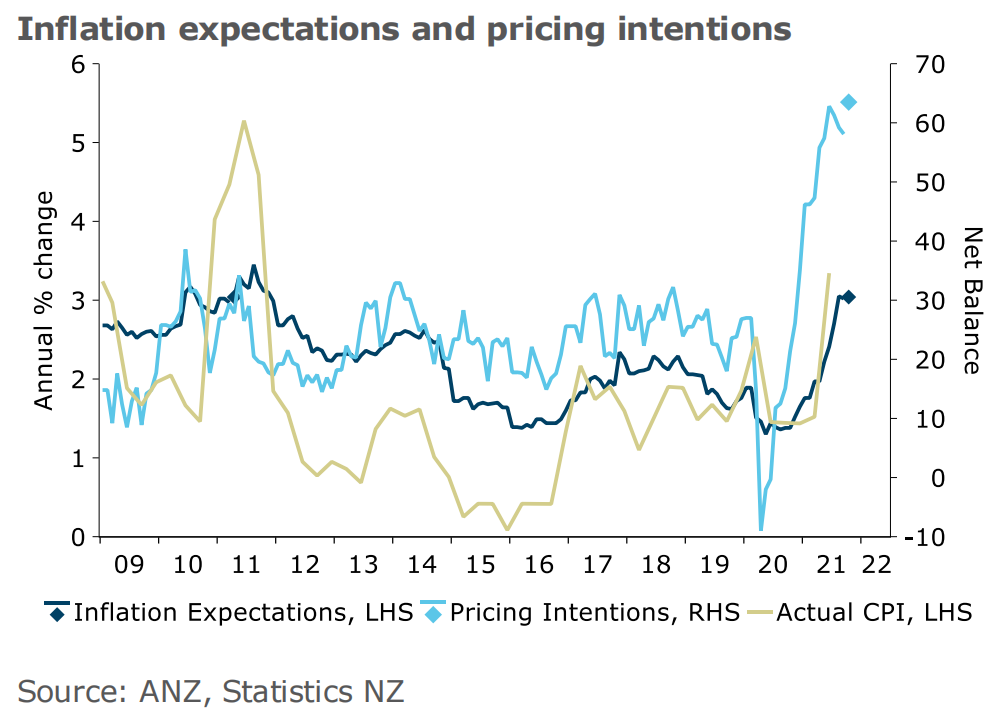

Zollner says the latest Business Outlook Survey shows that Inflation pressures remain "intense", with 12-month-out inflation expectations still above 3%.

The Reserve Bank targets inflation within 1% and 3%, with an explicit target of 2%.

The latest ANZ survey shows that businesses are matching their inflation expectations with intentions of raisng their prices.

Now, a net 64% of firms (up from 58%) are expecting to put their prices up.

In terms of overall business confidence, this eased 2 points to -9, but "own activity" jumped 6 points to 26.

Zollner said Auckland firms are showing "real fortitude", though notes that this early reading of the monthly survey results isn’t a large sample.

"The preliminary ANZ Business Outlook data for October saw most forward-looking activity indicators hold up or improve." she said.

"Auckland firms reported higher business confidence, own activity expectations, investment intentions, export intentions and profit expectations (and cost and inflation pressure) than elsewhere, and employment intentions are holding up well.

"One possible explanation is that the expectation questions implicitly compare to today. If Auckland firms expect restrictions to ease, they’ll expect more activity.

"But that reasoning doesn’t apply to investment and employment intentions in quite the same way, as these wouldn’t have tanked like current activity.

"It’s encouraging, but we’ll put more weight on the full-month results."

Some of the key results, compared with September:

- Business confidence eased but own activity expectations rose 6 points.

- Investment intentions jumped 5 points, while employment intentions eased 1 point.

- Expected profitability saw a 13pt bounce, with just a net 3% of firms expecting lower profits. That’s despite extreme cost pressures, with a net 85% of firms reporting higher costs, similar to last month.

- Capacity utilisation, which normally correlates well with GDP, lifted from 17% to 20%.

- Only a net 4% of businesses reported lower activity than a year ago. A net 11% of firms are reporting higher employment than a year ago.

- Inflation pressures remain intense, with inflation expectations still above 3% and pricing intentions rising from 58% to a net 64% of firms expecting to lift their prices in coming months. Cost pressures are extreme, with a net 85% of firms expecting higher costs, up 1 point.

26 Comments

Just got a quote to deliver a 6 people spa for $10'900 (cost of spa NOT included)

I wonder how raising OCR and mortgage interest rates will bring that 10.9K down.

If the cost keeps rising, more likely the orders will be cancelled.

This is what happens when simple tries to control cost pushed inflation by increasing interest rates; the tempering of inflation works by destroying businesses.

That is exactly how it works - raising the OCR is going to increase costs, reducing demand.

Your understanding of economics is pre-school.

Go learn some AS curve. Even my grandkids understood how that works.

Let's half our food intake and stop going to work to lower food and fuel prices- you're a genius.

Bit cutting there mate with the comments. Maybe a glass of red wine will settle you down.

CapitalNone is correct, increasing OCR takes the heat out, and businesses need to compete for the demand

Keeping OCR at this ridiculously low emergency level is a recipe for the type of inflation that erodes everyones standard of living and spending power. The only positive from a govt perspective is that it inflates away the debt.

For the country as a whole it is bad!!!!!!!

Raising OCR helps to increase the cost of borrowing, attract more deposit, in a way to influence consumers to spend less and save more so that we can achieve reducing the demand to bring inflation down. Business owners will be less encouraged on expanding to prevent overheating our economy further. So it's necessary to raise OCR in the current economy setting.

Except it’s supply shortages that is primarily driving costs up… the major drivers being fuel, raw commodities, power, food. These are necessities that are demand inelastic

That's why we are also facing stagflation risk. Either way OCR needs to be raised to deal with demand side and improve NZD value while waiting supply to catchup. Our economy desperately needs a restructure. More investments need to go to productive industries.

We just got nailed 23k in freight for a 20ft container ex china. Admitedly these are chemicals.. Last year this was 2500. Price rises on some product has exceeded 20% yoy. We are soaking a lot of this up in the hope that it settles next year.

Still, there is a huge mark up on that pseudoephedrine once landed.

Why did the CPI spike to over 5% in 2011? Was that related to the EQ in Chch?

Auckland is indeed the powerhouse. Despite being locked down compared to the rest of the country, its business confidence is almost 5 times higher than the rest of the country.

Can never go wrong buying in Auckland.

I heard it's one of the world's great cafe centers.

And the city centre is vibrant with great shopping and beautiful food.

Actually that’s how it once was. It’s now a crime ridden desolate place.

There's still some gems - High Street, Britomart, Commercial Bay.

But yes much of it is quite desolate now, especially south of Victoria Street. CRL hasn't helped.

I imagine it will be pretty grim once things open up, surely quite a few cafes / restaurants will shut down (or have already).

High St is hardly a gem anymore either.

Imagine if we had an institution that had just one job - to control inflation.

Then imagine it was too busy commissioning overpriced woke artwork and doing it's Maori virtue signalling homework that it forgot why it actually exists.

The RBNZ 'promotes' inflation by enabling the commercial banks to lend into existence for non-GDP qualifying purposes.

I'm going to be blue in the face by the time the sheeple understand this.

Mr Orr will see this as transitory and decline to counter with sufficient interests rate hikes.

The goal is to monetise the debt through inflation. i.e rob the poor to pay the rich.

Dead right Rastus but cannot understand why the poor especially females still think ardern is amazeballs and continue to support her, perhaps they are sheep Baaaaaa.

"Latest ANZ Business Outlook Survey shows a net 85% of businesses are expecting higher costs"

Not to forget that many businesses would not have been a part of the survey that are not operating due to lockdown.

Just a reminder that inflation expectations are a terrible indicator of anything... The US Fed published a hard-hitting paper on this last month (https://www.federalreserve.gov/econres/feds/files/2021062pap.pdf)...

Abstract: "Economists and economic policymakers believe that households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.

Pseudoscience would be a kind way of describing this rubbish!

Close business buy property..

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.