Realestate.co.nz's report for October showed 'spring passed the market by' as new listings fell in a "stagnant, buyers market that could last for months."

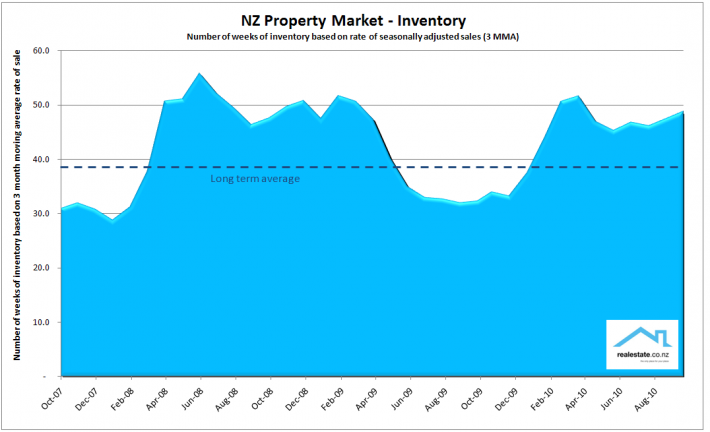

There were 11,911 properties listed in October, down 12.1% from the same month a year ago and 1% lower on a seasonally adjusted basis from September. The inventory of unsold houses rose to 48.8 weeks from 47.5 weeks in September and was up from 46.1 weeks a year earlier.

The data is the first from the market nationwide for October. Barfoot and Thompson will release its figures later this week, with QV to follow that and the official REINZ figures on November 12.

"New listings in October failed to provide the usual Spring lift in the property market, indicating a stagnant climate that could last for months," Realestate.co.nz said in releasing the report, which is available in full at unconditional.co.nz.

The combined total of properties listed in August, September and October (the traditional Spring lift period) was 32,274, marking a 12.5% fall from the same time last year.

“If property hasn’t listed by now, it’s unlikely that it will before the Christmas period," Alistair Helm, CEO of Realestate.co.nz said.

"With sales slow and listings not coming on, the market clearly reached a plateau in October, and it’s not getting any better. At this point it’s fair to say that Spring has passed us by,” Helm said.

The sluggish sales activity is failing to eat into the high number of unsold houses nationwide, he added.

"Based on these inventory levels, New Zealand remains a buyer’s market," he said.

"The overriding issue in the market is the level of unsold houses, which continues to offer buyers choice, but is challenging for sellers competing with so many alternative properties. The theoretical impasse to this situation would normally be a weakening of prices. This is certainly not shown by the latest month’s expectation of asking price which rose again."

The truncated mean asking price for property listed in October rose to NZ$420,451 from NZ$411,745 in September and NZ$403,423 in October a year ago.

"The key factor in the market continues to be the level of sales which is the reason for the significant high levels of unsold houses on the market, which is now edging ever closer to a full 12 months worth. Sales over the past 4 months have been stuck within a very tight range of 4,300 to 4,400 with no appreciable seasonal movement," Realestate.co.nz said.

"These sales levels are very comparable with the same period in 2008 when this situation went on for over 10 months until the market saw activity as prices eased and inventory was cleared," it said.

'No need to adjust asking prices'

"In terms of asking price expectation, sellers are certainly indicating that their view is that property prices do not need to adjust, rather the opposite having seen a further rise in asking price in October. The key issue is that with the high levels of inventory the strength in asking price is counter to the market trend which was seen in 2008 when prices softened. The current asking price is now closer than ever (just 2% behind) the peak of the market back in October 2007. "

Here is more detail below from Realestate.co.nz on regional variations, lifestyle blocks and apartments. See the full report here.

Wellington listings up

The majority of the 19 regions showed overall increases with 8 showing increases of more than 5% as compared to recent 3 month average.

Particularly large growth in asking price expectation was seen in Wellington where the truncated mean asking price rose 5% to a new peak of $455,422 surpassing the prior peak in Nov 2007.

The regional perspective with regard to new listings in October shows some variations with still the majority of regions showing a year on year decline indicating the potential for these markets to be deficient in new listings and therefore potentially leading to a seller’s market.

Waikato, Canterbury listings down

Notable regions showing significant declines in new listings are Waikato, Coromandel and Bay of Plenty – however all 3 of these regions though are seeing very high levels of unsold houses. The main metro centres of Auckland and Wellington show falls of 12% in Auckland and just 2% in Wellington.

The impact of the Canterbury earthquake continues to impact the property market there with new listings down 26% an identical level to last month in some ways reflecting the fact that whilst significantly impacted, the situation has not worsened with 1,312 new listings in the region over the past month. It is very clear from the regional map of inventory levels that the property market continues to favour buyers when viewed purely from the perspective of the rate of sale as compared to the level of unsold houses on the market.

Some of these levels across the country are approaching or has reached new highs. In the month of October 4 regions posted new highs: Coromandel at 325 weeks, Northland at 181 weeks, Marlborough with 87 weeks and Waikato with 67 weeks. Set against those significant highs are the only 2 regions which are showing levels below long term average – the West Coast of the South Island and Gisborne.

The main centres of Auckland and Wellington has levels slightly above average with Wellington showing this month a significant rise to 26 weeks. The Canterbury region has risen significantly this month primarily as a function of the very low sales reporting in September as a function of the disruptive impact of the earthquake at the start of the month.

Lifestyle blocks

The level of new lifestyle listings grew again in October following strong growth in August and September. On a seasonally adjusted basis the total of 1,110 listings represented a 3% growth, as compared to October 2009 actual listings are down 4.3%. The truncated mean asking price for the new listings in October was up 11% from September to $584,912.

This also represents an 8.3% increase in asking price compared to the recent 3 month moving average.

Apartments

A total of 509 apartments were listed in October. The last 3 months has seen almost identical levels which reflects in a 7.5% seasonally adjusted decline and a 21.8% year on year decline. The truncated mean asking price fell to $356,306 in October from $362,427 in September. This level is down 5.4% as compared to October 2009. It is also the lowest price since the peak of the market at $460,734 way back in December 2007.

In the Auckland market total listings amounted to 310 down 27.1% as compared to a year ago and down 23.5% on a seasonally adjusted basis. Asking price expectation also fell from $321,845 in September to $317,283 in October, this represented a 10.6% fall from October 2009 and a down 0.9% as compared to the recent 3 month moving average. Just 4 regions showed a fall as compared to the recent average with both Gisborne and Otago posting falls of 5% or more.

65 Comments

Sellers see glut and put prices up.... 'They're Dreamin' as Darryl Kerrigan said in The Castle http://bit.ly/dojIAe

cheers

Bernard

Median sale prices peak just before a sharp fall because only the really good top quality houses with the best locations are still selling and the bottom end of the market is well and truly dead. Current situation: buyers at the lower levels are unwilling/unable to obtain finance and unwilling to accept current risk/return ratios. Houses too expensive, returns too low.

Who can guess why asking prices went up.. maybe because vendors thought spring would bring increased demand? Maybe its an average of asking prices and vendors in the lower end have removed their properties from the market all together leaving only the expensive stuff? With banks unwilling to realise losses and not pressuring sales I wouldn't be surprised. Sweep it under the rug and worry about that one another day.

You've missed what's happening here Bernard - lots of old over priced listings sitting on the market with few good properties available.

Good properties that are priced sensibly are attracting multiple buyers and selling above expectations. All of a sudden buyers will be forced to pick through the stale overpriced listings as the new listings become more expensive.

Prices may not be about to soar, but they aren't on a down leg either. Upward pressure will continue to build until at some point in the (maybe not distant) future prices move to catch up on several years of real declines.

How do they catch up, Chris-J? With a boost in wages? An increase in interest rates? ( I see the banks are lending up to 90% again, but that's if 8%-9% can be afforded by the borrower in future cashflows. That tells me where the banks see variable rates going). And where do the buyers come from? Most of them are 'sellers' in-waiting; for an opportunity to move, for one reason or another. That's a logjam of sellers building up, day by day; job move by job move; divorce by divorce; downsizer by downsizer, with aging etc.

Yep, and the vital "source" of rollover in the market, the first home buyer, HAS to be priced right out of it somewhere along the line. That is one reason why these bubbles HAVE to burst. The bigger they get, with financial innovation and young people acting like suckers, the bigger the mess.

Time decay will take its toll. Whagaparaoa Road property listed May 2009 $1,075,000 finally sold 4 weeks ago for $850k, off...21%. I guess time was up!

There's a house in town here - big house, big section originally put on the market just over 12mths ago for around $1.5m. Now being listed as $995,000 and 'would consider exchange with cash difference'.

CBD apartments in a complex here where developer is in receivership are being advertised for '$295,000, lower than replacement value.'

The amount of emotion and irrationality regarding houses and their price gains in past decade has meant tons of deluded people buying in after 06 and they still can't wake up to reality. So much of the value of houses in nz is directly related to the greed emotion where no one wants to miss out on big gains. I know people with zero financial knowledge buying 5 houses, pretty much as many as bank would allow, just because they were certain in 2006 that prices would keep climbing. Remove this greed u remove a ton of demand from the equation and all the fake value houses in nz have gained will be lost, and then some as same emotional drives turn to fear and work against logic on the downward leg.

People buying multiple houses on credit, is another factor in how big the mess is when the real crash comes. The more "multiple leveraged owners", the bigger the mess.

Where are the incentives to change our culture and concentrate on real productivity, when economists like Bernhard and other NZbusinessmedia constantly and daily come up with NZProperty Ltd and Mr Real Estate ?

In my opinion - bloody useless !

"Marlborough with 87 weeks" supply.....it's way worse than that to be honest.

" Higher excise costs next year could be the difference between survival and failure for some wineries, says an industry body.

New Zealand Winegrowers chief executive Philip Gregan said the industry faced an annual excise increase related to the rise in the consumer price index for the year ending March 31, which was being driven higher by the rise in GST.

"We are going to be facing a 5 per cent lift in excise on next July 1 because that's the Reserve Bank forecast for inflation for March year-end," herald

Dead Possum walking.

Ultimately the buyer (the one with the money) can outlast the seller (the one who needs the money)

See the banks trying to hold back the forced sales.

Under international accounting rules they have to allow for potential losses in their accounts.

What they may not have to do is to front up on time if they can find an excuse. The potential lowering of general market prices by the the release of more mortgagee product is what is spooking 'em.

This is probably why they are encouraging higer income earners into 90% finance again.

(another article in the Sunday Star Times shows this)

Next question: How long can the banks hold out?

Actually, i think Bernard should setting a reporter onto that v.interesting story about the banks holding back on potential mortgagee sales as they don't want to skew the mkt down!

it's like the chinese conundrum with their american pesos..oops, dollars.

HEY BH...can you find out more from under the floorboards perchance?

And for those with 'cash in the bank', here's an observation! It's suprising how 'realistic' you get when you have to write out a cheque for X dollars to buy again, rather than just 'upping the mortgage'. Suddenly, the money becomes all too real!

Here's a thought about that cash in the bank;

Firstly your capital is not keeping up with real inflation. Even with the best interest rates, after you've paid tax, the purchasing power of your capital is being slowly eroded, except against property for the moment. All good you say.. But how long is that going to last,?

What would happen if there was a currency crisis with the US Dollar (which BTW is looking quite likely in the next few years) ?? It can only take a few failed treasury auctions, a run on the dollar and confidence will be lost in the USD$. If the US currency fails, all fiat currencies will fail, and your savings will disappear. You might loose some of your capital in property (while still getting a rental return on investment), but it could just be safer than cash in the bank.

Like someone once said, "walk in the footsteps of giants". Better to have debt that will inflated away, rather than cash that will be inflated away.

Depends of course very much on what you think might happen in the future, and depends if you believe that the world will continue to have faith in the dollar. I'd say by way of observation that many countries are quietly divesting US dollar holdings .. who's going to be left standing once the fiat currency music stops playing?

And what is your house worth if fiat currency fails, Matt? Nothing in monetary terms. It's only worth the barter value. And assuming that fiat currencies do survive, at what interest rate, if they have diminishing purchasing power? No point having a property thats worth $20 million, if you cant afford the inerest payments of 250% on the existing debt! ( NB: an example!) Income, rent, wages etc, always lags asset price inflation, and those with debt can 'die' before they get to see the asset price improvement work for them.

What your house is 'worth' after a currency crash = well you still have a house, a roof over your head, that's what its worth. . What you savings would be worth = you've lost your savings.

Look at Argentina 2001 for example, people lost their life savings, their money was worth nothing. But people who had houses, still had their houses and came out OK (although in nominal terms the price changed).

My point being, is that electronic / paper money can disappear very quickly. Houses are as safe as, well, ... houses.

The cause of a currency crash may be different, but the effect is the same. There might not be any perfect safe haven (except maybe gold), but property is actually very good.

I think your arguement supports the holding of gold rather more than property - as Nicholas says a substantial amount of property not owned outright; what happend to the debt that supports such property in situations where currencies collapse in an interesting question!

Quite, AndyH. And whilst I differ in my view on holding gold ( although I totally undetrstand your view!) what Matt doesn't see how expensive that debt will be! Ruinously expensive, as will be the cost of all other necessities....In an extreme case 'owning your house' will mean nothing, as it's a matter of who has the biggest gun.

Your comment about Argentina is not correct. Property plummeted in Argentina and the middle-class squeezed into submissions as many actually try to leave the country. Houses, property, and land were incredibly cheap in Argentina as many tried to flee. Farm prices were particularly cheap and practically given away.

Property in Argentina recovered spectacularly in Argentina, but given that much of the capital inflows were coming from the U.S., it's difficult to gauge how sustainable that will be in the long term.

Argentina is a wonderful country with a history of disastrous economic decision making. Let's hope they can deliver on their potential one day.

Absolute nonsense. In the last 5 years one year term deposit rates have been well above the rate of inflation. What inflation figures are you basing your assumptions on?

So I'm assuming that you trust what the govt is telling you to be correct when they publish inflation figures? Have you ever noticed the difference between the govt inflation statistics and your rising cost of living ?

General living expenses (food, rent etc) are currently increasing faster yes, that is to be expected. What about the cost of appliances such as computers, tvs etc. They are decreasing at a dramatic rate. Even furniture is currently tracking downward. Calculating inflation is no simple guessstimate, so yes, in this case I do trust the goverment more than your gut feeling.

I wouldnt disagree with you here Matt - government inflation statistics are often no great guide to one's personal experience of inflation.

Here is another potential 'asset' investment option for those concerned about fiat currencies; a solar PV system. The price of PV systems have come down dramatically in NZ in the last 18 months (if I compare a quote 14 months ago from the same company I note a fall from $33K to $22K for a 3kW system). Prices may of course fall further. Meridian buys excess electricity produced at a 1:1 ratio. Doing my sums and allowing for electricity price inflation of 5% I get payback in 12 years and a back of the envelope return (post tax equivalent) of 5% initially (rising to a much higher rate after year 12).

I didnt think the Govn inflation numbers were meant for personal use.....ie they are statistical numbers used to look for trends and changes in the economy by economists. Though I think CPI isnt bad. Personally I see whiteware and household goods as dropping quite a lot in price and shops like DSE and Bond and Bond are empty. Meanwhile some food is up, some is down....some wins some losses, eg for the last 2 weeks chicken brest has been $15.95 instead of $18.95....capsicums are up a lot though...

Some prices are way down.....2 years ago an alternator for my 4wd was over $900, got it for $580 brand new 2 months back......brake hoses $100+ each, now $44 each.........brake pads seem a similar price drop....

Solar PV, nice idea....if I only had $22k sitting around I'd snap it up....12 years is a bit far out though for a return...<5 a no brainer.

regards

I've got cash in the bank and am renting since selling out in 06...just wish i could find a vendor who doesn't subscribe to the "more fool " theory that if you hang around long enough , one will come along and buy your overpriced house.

the irony is that every day they vacillate they're losing hundereds of dollars.

with the banks hiding mortagee sales and the figures skewing down monthly my pick is a tipping point will be reached in the next 6 months and the floodgates will burst and lots of vendors will be rushing for the exit but too late as the deluge will just increase the choice for buyers...but what the hell....we spout this stuff everytime the stats come out monthly and we get excited by Real Estate Porn...que sera sera

Rob of the North gets a special PhilBest "wise man of the decade" award.

Ditto ROTN- I also sold Sept 06. Have been waiting and adding to my savings. Had a patch 2 years ago where houses were selling at reduced prices. Then we was what happened last year. So maybe next year our wait will be over. Problem I now have is that 4 occupants of our house want to move to 4 differents suburbs for varying reasons.

keep the ladies of the house from conspiring and saying things like " i'm sick of not having our home..how much longer do we have to wait'...everyday you wait is hundreds of dollars you're saving as the price will eventually drop....by march next years leaves won't be the only thing falling on the ground!

Pressure from the missus may well be a significant factor in the undoing of many such well-thought out plans, Rob. Sad but true.

Even one intelligent property developer who quit at the right time, has had some pressure from his missus to "get out there and keep making money like you used to".

Hopefully vindication comes sooner rather than later. It must be difficult.

From hereon in Real Estate Porn sessions to be known as " the missus factor" !!!!

What in the hell's name is a 'truncated mean'?

Sounds like a mean that's had some inconvenient numbers cut out of it.

FYI, the latest in Aussie house prices - http://www.businessday.com.au/business/house-prices-hit-a-wall-20101101…

Based on my own experience; we have been looking for a bigger house for the last 12 months. Hardly anything decent out there - Any good home we came across all ended up with multiple offers and not that cheap either.

Could it be that there are no decent houses to buy, because people who own one aren't selling ~ as there's no 'decent' alternative to buy? (Chicken and Egg, situation) That could mean there will be a flood of 'decent' properties to the market when it does show signs of movement as those who are 'decent-bound' look to move both ways? It just depend on whether they are going up in size/quality (you) or down. ie: aging population cashing in, affordabilty etc. My view is...down.

may be or may be not - who knows...

But then that kind of prediction got all of us in trouble in the place!

houses come on when people,transfer, die, move to rest homes , move to australia etc but you're right, nicholas, when you contend that maybe there aren't any decent houses to buy...well priced and presented houses are selling v.quickly which is a message vendors need to get.....here's a comment today from a Bayley's agent friend of mine in the provinces re the real situation:

"I absolutely agree with you here. I have “fired” a couple of vendors whose property just sat on the web due to outlandish pricing. Why bother? I’m having trouble with a property, he is realistic but she is not! She wears the pants!I "

Nicholas Arrand is right about the "decent houses". One of the legacies of urban planners pushing land prices up, is that ghastly old homes stay around and little or no "replacement" of stock occurs.

Besides median multiples being what they are, "value for money" between a decent free market and a planning-strangled one, makes the great rip-off of the Kiwi buyer even worse.

Look at Britain after several decades of this nonsense. Look at the "house" that Susan Boyle "lived" in. It probably is valued at about half a million pounds, too. That's how your grandkids will be living if we do not put a stop to it.

The market is being kept as near to the bubble position as the banks govt and RBNZ can manage. We live in the can being kicked down the road by the puppet masters. The best action to take is to get out of debt...and as fish in a small pond, stay well away from the baited hooks of the banks.

Surely by now the public will understand this economy has been buggered by debt...a situation it cannot earn its way out of...the game was to grow the public and private debt levels so high that escape was impossible and from that point on the whole economy would be feeding disposable income to the banks....That is where we are. It is where we will remain. Any light at the end of the tunnel will be a banker carrying a torch and a rate increase demand for stupid kiwi.

For this, you can thank your very own bunch of brainless progressive socialists, the banks, the banker's National Party puppets and yourself for being so bloody greedy and as thick as two planks.

Hurry now to the bathroom, Wolly, and open the cabinet and pop one of those large ,white pills in your mouth as you're showing signs of the meds wearing off...and stay off the pooter for 24hrs until the meds kick back in...conspiracies, paranoia...sometimes i envy your mental landscape as it sounds like more fun than bungee jumping?

Bravo Wally, that hits the nail rightly on the head. It has been a global strategy to ensure the lifeline of the revenue streams to the banks will be perpetual. However in doing so they have also added massive risk through the destabilization that the debt burden has created. Should this burden break nations completely, then the revenue streams to the banks will break too. We saw this with Greece as an example of what can and will continue to happen. The only serious question really is, "how long can the house of cards be held together for by all those involved"?

The second issue, is how do you get messages such as these though to the morons who make up the vast majority of the greedy, ignorant public? Very hard thing to do I suspect, because reality is not something that most are prepared to contemplate.

My suggested solution. Monetary easing should occur VIA business taxes owed to the IRD. The Reserve Bank should apply the "official cash rate" to business taxation money owed to the IRD. Keep the OCR lower and more businesses keep the money at a low interest rate and use it usefully. Raise the OCR and some businesses will start paying it back.

What's not to like about it? The "easing" occurs at the right place in the economy - in businesses that are making a profit - hence the taxes owing - and who will "produce and employ".

The banking sector has forfeited its "right" to be the sole conduit into the economy for monetary easing, as far as I am concerned, after what they have done all over the first world with home ownership.

Of course its being kept in the bubble.....just consider the leaky homes mess alone that depedns on present valuations....ie we have say $400,000 homes that say need $200,000 in repairs and could drop to $200,000 in value even if in perfect condition...so that means the home is now worthless....and that doesnt consider the mortgage on the property....what would that do to home owners? banks? and the Nats chances of re-election? Key of course was hoping the repair cost would be inflated away but here comes deflation....so now how can that happen? So what was that leaky home bill? some Billions?

Then there are all the PIs who probably tend to vote National and whos capital could get decreased by 50%....nice lot of votes lost there as well.......

Then the farmers who over-paid for land.....60% drop? nice vote loss for National that.......

Then the commercial building owners....50% drop? 75% drop?

Developers?

Construction industry?

DIY industry (ie placemakers, kitchen companies etc)?

All these have price structures and business models based on the present value of housing....and that its increasing....y on y.....

rates? since those are relative I assume they dont drop, however would the council have to write off losses on its buildings? (would that matter?)

and finally of course the banks who backstop all of this.....if its looking bad I wonder if they will hop back on the Govn Guarantee scheme bandwagon?

Nice losses for us the voter....

Blame the socialists? no, this is as you say blame the so called free market mantra where greed is good.....HClark etc were too afraid to do a thing....despite being told.

Welcome to the 2nd Long Depression.....

regards

Typical blinkered analysis leaving the council urban planners out of it. Thank goodness for the examples of sane land markets in freedom-loving parts of the USA, with which to illustrate the point. They remind me of that little Gaulish village, still holding out against the invaders.

the housing market will take off again as soon as a steady stream of buyers appear on the market.

can anyone identify how or where these buyers will turn up and who will they be?

The rich farmers Rob...plenty up your way we are often told..seems they are all going to splurge their massive profits from the wool and meat and milkfat on sections...in Northland too.

You keep an eye on the road out the window at the old folks home there Rob. Mind you don't miss out on the soggy Weetbix special or the Breadpudding. Yell out when you see them wealthy farmers flowing past. Careful you don't blow your teeth into the garden.

Rob

Thats a very good question, who will they be.

Lets go through potential candidates:

1. First home buyers in the 20s / early 30s: Limitted potential there, property is too expensive relative to what they earn, big student loans etc.

2. Property Investors :generally speaking the majority of properties now on the market are poor investments. Prices will have to drop significantly to provide sufficient yield to be attractive. In a world of limitted capital gains, and taxation changes, 5% really doesn't cut the mustard I'm afraid

3. Baby boomers with kids - many will be bunkering down now and staying put

4. Immigrants: Immigration has slowed significantly, and many I have worked with in the last couple of years turn to renting, at least at first. Lots of poms I have met in the last few years think housing is pricey here now - that was certainly not the case 6-7 years ago, when a frequently heard phrase was "boy your houses are cheap here"

Vendors are still dreaming.

We will see another 1-2% drop over the next few months, and things are going to be flattish for at least a couple of years

So ,Matt, essentially there is no cavalry coming if we can't identify a buyer on the horizon..not even the chinese horde?

So why are these vendors carrying on as if there is one coming?

what myth or reality is keeping there staunchness alive?

it can only either be agents feeding them bulldust about the market but for what gain?..or they're just financially illiterate.

i suspect some look back to last year when it was sliding fast and then it hiccuped around this time last year for a few months and went back into decline...so vendors think this can happen again 'cos property always goes up ( excuse me here but i have to) maaaaaaaaaaate!

yes, I think that's quite common. Far too many people believed the hype during the boom years and then got in trouble. They are now total slaves to mortgages

So we are just going to get this stand off between sellers and buyers for quite some time. But it will slowly edge prices downwards because some of the sellers will just have to give in.

I mean spring is usually the strongest season, but its damn weak! that's telling....

I reckon we will see prices drop another 2% before next winter, then another 1-2% over winter. Then things will flatten and maybe slightly rise again.

But I think we won't get back to the 2007 peak until about 2013-2014, by which time REAL house prices would have fallen about 25-30%

ctnz, human beings are good at denying the truth. What is the truth. The truth is there are now more vendors than buyers all over the country and the market is falling little by little each month as it goes by and will do for years to come as all the people who accumulated too much debt during the 2002/07 years including house debt,hp debt and credit card debt get stuck into paying some of it off and getting some control back in their lives. Some vendors will crack and just bite the bullet and get rid of the burden even though it means the house or asset has gone and they still owe the bank money. As the market continues to fall in value each month more and more people will panic and push the buttton and sell no matter what the consequences are. They will wake up one day and just want to get rid of the financial burden on their shoulders. Some will not face up to the reality they are in and the bank will make the decision for them and sell it themselves.

Wilco Agent Wolly..i live just north of Auckland so it'll be no probs. to position the rea lestate agents to wait with snipers as those rich cockies slide on by?

Oh you must be up on the old gumfields then...out of lava range are we?

drink at the puhoi sometimes but rangitoto is in view

Just bought at under replacement from distressed seller, been watching for a year and made several offers to vendors with rocks in their heads as they paid too much circa. 2005-2007.

Latest rise in asking prices is due to real estate weasels talking up buyers and justifying marketing budgets with expected rise in asking price. Watching one or two in this space and there has been no interest.

She's the big sideways slide from here on in as boomers hold out until they really have to move which will keep market lower as boomers want to downsize into mid market places and there will be limited market moving upwards into the larger houses.

God knows what will happen at the bottom of the market.

Expat I hope you did not borrow any money for your purchase as you would need to have rocks in your head to be buying for investment at the moment and it is even sillier if you are borrowing to do it. The market is not going sideways, rather it is going down little by little as each month goes by. In the meantime costs such as rates insurance and maintenance are going up(inflation). When you add up the little drops each month over 12 months it does add up to more than we would like to admit. Spoke to an agent in New Plymouth today who admitted the open homes were going really bad at present. Normally in spring they improve but this time they are more deserted than during our horrible NZ winter. What is going to happen at the bottom of the market? We are nowwhere near that at present. It is years away as the average NZer is going to be gun shy for sometime as they get rid of the debt they already have. I do not think there will be dramatic bottom of the market as the current small but steady drop in values are just going to keep going and happening until people feel their financial situation is improving. For that to happen we need wage and salary increases for NZers and regular ones so people get more confident to spend and borrow.

Hi ex-agent,

No, its a cash buy for a family dwelling. We've been renting since selling in sept '07 and doing the maths it has been a better option than buying/holding and watching capital loss so totally agree with you mate. With the other land we own I'm now overweight on real estate but can afford to be, with some reservations.

Personally I'm picking bottom somewhere around here, +/- , so if you have the balance sheet and cashflow and timeframe and cajones...the people I feel sorry for are the younger buyers and to some extent the boomers who didn't get out at the top.

And obviously I'm feeling strong empathy for the real estate crowd ;)

Expat don't feel sorry for the agents as we made a fortune over the 2002 to 2007 years. People really overdid it especially the ones who were sucked in by the richmastery types who conned people into buying a lot of rentals with near total debt on them. You could put a real dump on the market and people were climbing over each other to get it and the best cash offer got it. I sold all my rentals over the 2007/2008 period and kept my house as I like it. The people who needed to sell then are the amateur investors who had no equity when they bought and who have big cashflow problems now and need to sell but cannot as the dogs they bought no one wants. The trouble is they did not have the nouse to sell or the ability to do it without making a loss. I still think you should have kept up your strategy to rent as the market has some distance to fall over many years. Too many people in this country with too much debt including hp debt which needs to be paid off or at least reduced and the incomes in NZ are pathetic. Property will contine to fall back in value bit by bit as people crank up the paying off of existing debt rather than taking more on. Bernards 30% will occur over a long period of time and maybe more with inflation.

Yeah, the problem is renting around my neck of the woods is limited to 80% shitters and 20% good places with our desired locale being out of town a bit making the universe of rentals even smaller.

If I was 5 years younger then I'd be renting all the way but as things are we've got a bargain so can't complain too much.

Wouldn't want to be buying on finance though.

The simple reason we have so many "shitters" around, is that we haven't been building "replacements" at anywhere near a fast enough rate since the urban planners forced land up in price.

Median multiples actually do not tell that story. Not only are they higher, but we are getting "shitters" for our money; while decent free markets are getting new and near new homes for the same money.

Britain has been going this way for decades. Susan Boyle's house is just a typical example of Pommie housing stock, probably priced at hundreds of thousands of pounds - all in the land of course. The shitbox itself is worth nothing, or even a negative value.

Bernard - it would be good to get another piece by Rodney Dickens sometime. I really rate that guy and would be interesting to get his take on the market right now.

Cheers

MIA

I presume you get his regular reports, Matt. Are you following his argument that housing drives the economy, rather than the other way around? Really serious implications.

Bayleys Manurewa agent admits "the New Zealand housing market is 20% over-inflated and this reflects in the number of sales being the lowest for the past decade.

We are now heading towards the 4th year of the recession and could possibly be just over half way through."

http://unconditional.co.nz/manurewa/2010/10/29/now-is-your-last-chance-to-sell-before-christmas/

In Nelson sales over the last few months also seem very slow like the rest of the country. Every week around 5-10% of houses in the Property Weeking have "Reduced" / "New Price" on them. It is interesting that Bernard's housing stress index based on discounting terms like these in house adverts has just hit an all-time high http://www.interest.co.nz/charts/real-estate/housing-stress-index

Our local Kiwibank mortgage manager thinks the market here is a lot worse than it was at the same time last year.

We've looked at around 10 open homes in the last couple of weeks and on average there are only 2-3 groups attending each open home which has been very surprising. The last time we looked for houses back in April/May this year average was closer to 10 groups per open home.

So I'm really happy to keep renting for a while longer ... I guess by April / May next year a lot of people will be getting more desparate to sell before winter and prices will be adjusting down rapidly.

thats a refreshing change from the Manurewa agent....I wish him well, and hope karmic forces reward him generously!!!!!

I wouldn't want to be having to sell (especially if I bought after 2006). Other than that if you sell now and you've owned for 10 years then it's no biggie is it? You've made decent coin on the property, had a roof over your head for 10 years and if moving to another property, buying low.

I wonder about two groups, people selling to move to oz & baby boomers coming into retirement and want to free up some cash out of there assets. Any of these groups out there care to comment? Off to ozzie rent out the kiwi house and rent in oz? Boomers staying put?

Anecdotal evidence concerning immigrants and returning Kiwis:

They look at house prices, look at the last few years trend, and rent and wait for the crash. They've seen enough of the world not to participate in the stupidity. This is especially the case with people who've been in a country where they never had a bubble (Germany) or in a country where they had one and it burst. (USA)

Even without that first hand experience, people who change country generally are better informed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.