Here is today's statement issued by the Reseve Bank of New Zealand.

You can compare the one issued today, December 10, 2015, to the last one issued on October 29 to help assess how the RBNZ's thinking has changed since then.

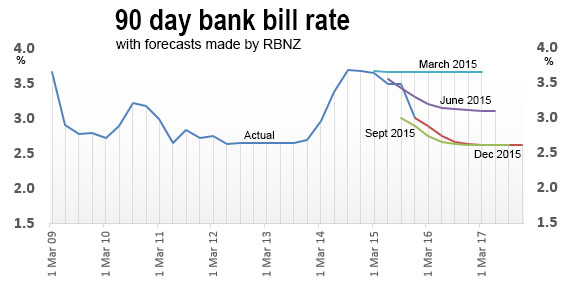

(See below for graph charting the RBNZ's 90 day bank bill rate forecast accuracy.

| Today, December 10, 2015 | Previous, October 29, 2015 |

|

The Reserve Bank today reduced the Official Cash Rate (OCR) by 25 basis points to 2.5 percent. Globally, economic growth is below average and inflation is low, despite highly stimulatory monetary conditions. Financial markets remain concerned about weaker growth in emerging economies, particularly in China. Markets are also focused on the expected tightening of policy in the United States and the prospect of an increasing divergence between monetary policies in the major economies. Growth in the New Zealand economy has softened over 2015, due mainly to lower terms of trade. Combined with increases in the labour supply from strong net immigration, the slowdown has seen an increase in spare capacity and unemployment. A recovery in export prices, the recent lift in confidence, and increasing domestic demand from the rising population are expected to see growth strengthen over the coming year. The New Zealand dollar has risen since August, partly reversing the depreciation that occurred from April. The rise in the exchange rate is unhelpful and further depreciation would be appropriate in order to support sustainable growth. House price inflation in Auckland remains high, posing a financial stability risk. Residential building is accelerating, and recent tax and LVR measures are expected to reduce housing pressures. There are some early signs that Auckland house price inflation may be moderating. CPI inflation is below the 1 to 3 percent target range, mainly due to the earlier strength in the New Zealand dollar and the 65 percent fall in world oil prices since mid-2014. The inflation rate is expected to move inside the target range from early 2016, as earlier petrol price declines will drop out of the annual calculation, and the lower New Zealand dollar will be reflected in higher tradables prices.

There are a number of uncertainties and risks to this outlook. In the primary sector, there are risks that dairy prices remain weak for longer, and the current El Niño results in drought conditions and weaker output. Risks to the domestic outlook include the prospect of net immigration staying high for longer and of household expenditure picking up on the back of strong house prices. Monetary policy needs to be accommodative to help ensure that future average inflation settles near the middle of the target range. We expect to achieve this at current interest rate settings, although the Bank will reduce rates if circumstances warrant. We will continue to watch closely the emerging flow of economic data. |

The Reserve Bank today left the Official Cash Rate (OCR) unchanged at 2.75 percent. Global economic growth is below average and global inflation is low despite highly stimulatory monetary policy. Financial market volatility has eased in recent weeks, but concerns remain about the prospects for slower growth in China and East Asia especially. Financial markets are also uncertain about the timing and effects of monetary policy tightening in the United States and possible easings elsewhere. The sharp fall in dairy prices since early 2014 continues to weigh on domestic farm incomes. However, growth in the services sector and construction remains robust, driven by net immigration, tourism, and low interest rates. Global dairy prices have risen in recent weeks, contributing to improved household and business sentiment. However, it is too early to say whether these recent improvements will be sustained.

House price inflation in Auckland remains strong, posing a financial stability risk. While residential building is accelerating, it will take some time to correct the supply shortfall. The Government has introduced new tax requirements and the Reserve Bank’s new LVR restrictions on investor lending come into effect on 1 November. CPI inflation remains below the 1 to 3 percent target range, largely reflecting a combination of earlier strength in the New Zealand dollar and the 60 percent fall in world oil prices since mid-2014. Annual CPI inflation is expected to return well within the target range by early 2016, as the effects of earlier petrol price falls drop out of the CPI calculation and in response to the fall in the exchange rate since April. However, the exchange rate has been moving higher since September, which could, if sustained, dampen tradables sector activity and medium-term inflation. This would require a lower interest rate path than would otherwise be the case.

To ensure that future average CPI inflation settles near the middle of the target range, some further reduction in the OCR seems likely. This will continue to depend on the emerging flow of economic data. It is appropriate at present to watch and wait. |

1 Comments

"..as earlier petrol price declines will drop out of the annual calculation, and the lower New Zealand dollar will be reflected in higher tradables prices" - Oil prices just tanked a couple of days ago, so as the low prices a year ago drop out theyll be replaced with even lower prices coming up.

Lets hope auck house prices finally start coming off to allow rates to get down to 2% so the rest of the country can get going

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.