By the Westpac NZ economists*

New Zealand’s economy has continued to strengthen as domestic growth has become increasingly broad-based. What’s more, some of the big negatives that were on the horizon have diminished in recent months. Although we don’t think the economy will maintain its current pace of growth indefinitely, the eventual slowdown is now likely to be a little later and slightly more moderate than we anticipated three months ago.

Humming along

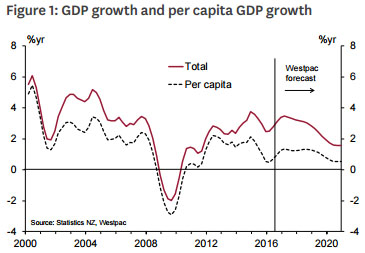

The New Zealand economy is humming along nicely. Annual GDP growth hit 3.6% in June, and the economy appears to have maintained this commendable pace of growth through the second half of the year, with 2017 also shaping up well. International events, however, still clearly have the capacity to surprise. It’s not difficult to identify potential catalysts for a deterioration in the global economic backdrop, increased volatility in financial markets and more challenging international trade conditions. Uncertainty arising from a Trump presidency and protracted Brexit negotiations are just two contenders. For now, the New Zealand economy looks set to maintain a steady course. But further down the track, slower population growth, the wind-down of the Canterbury rebuild, higher borrowing costs and high debt levels will combine to slow growth.

As we outline in our Agricultural Outlook section, dairy prices have improved substantially in recent months. So much so that, instead of facing a third consecutive season of negative cashflows, most farmers will be headed firmly back into the black this season. However, this doesn’t mean we expect to see a big rebound in farm-related investment and spending. Most farmers will have taken on additional debt in recent years to carry them through the period of low prices, and this will need to be repaid. Instead, any additional spending in the near term is likely to focus on maintenance and operational spending that was deferred when times were tough. Some farmers could also be looking at additional spending on feed and fertiliser to help lift production to take advantage of higher prices. So while we’re certainly not back to the heady days of an $8 plus payout for the sector, the outlook is certainly more optimistic than we feared last quarter.

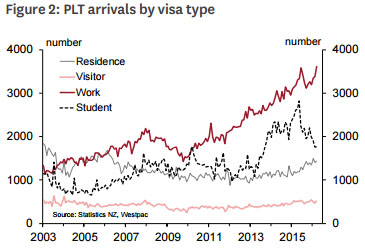

Also in contrast to expectations, annual net migration has continued its record-breaking run, rising to a new all-time high of almost 70,000 in September. Although student arrivals have continued to track lower (down almost 40% after peaking late last year) reflecting tighter enforcement of entry requirements, this has been partially offset by ongoing growth in people arriving on work visas (up 16% in the last 6 months).

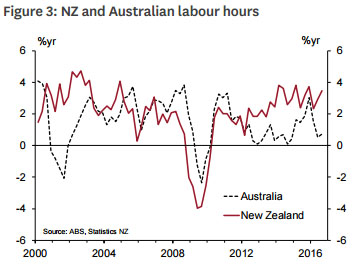

At a glance, simply comparing unemployment rates suggests New Zealand’s labour market is outperforming. But in reality, New Zealand’s outperformance is even more marked. Australia’s unemployment rate has been declining against a backdrop of falling participation, and a shift toward part-time work. That’s in stark contrast to the situation in New Zealand. Consequently, the very weak net outflows of New Zealanders to Australia is a trend we’re likely to see continue for some time yet.

However, we do expect this situation to eventually reverse. At the same time as the late in the decade slow down in the New Zealand economy is expected to lead to rising unemployment and slower wage growth here, Australian employment prospects are expected to be improving. In addition, we expect the growth in temporary arrivals to be echoed by a rise in departures in coming years. Combined, this should see the net inward flow of migrants slow. But, with net migration currently at record levels, even this slowdown will mean net migration remains at historically high levels for some time yet.

The tighter labour market, in tandem with rising inflation and inflation expectations, should eventually see wages squeezed higher. Already there are signs of this in some sectors (e.g. construction), with employers reporting difficulty finding the right people.

With more people we need more houses

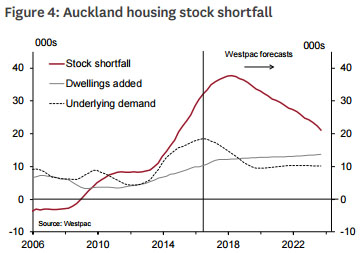

Very strong net migration has lifted New Zealand’s total population growth above 2% - the fastest pace since 1974. And this is putting pressure on housing supply, most notably in Auckland. We estimate that there is currently a shortfall of around 35,000 dwellings nationwide, almost all of which has accumulated in Auckland. And with population growth expected to remain strong for some time, we expect this shortfall to get worse before it gets better.

The shaky isles, still shaking

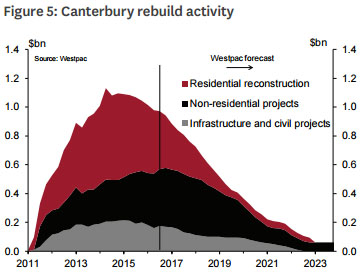

In Canterbury, the post-quake rebuild continues to progress. In aggregate, the peak period of rebuild activity has now passed, and a gradual wind-down has started. Yet within this, the composition of activity is undergoing considerable change. Most notably, residential reconstruction has slowed while commercial reconstruction is still ramping up. And, six years after the first earthquake, we’re seeing the return of business as usual building activity (until recently squeezed out by the rebuild).

More recently, the country has been hit by another series of severe earthquakes, this time centred near Kaikoura in North Canterbury. While the regional location of these quakes means we haven’t seen the same scale of damage wrought by the Canterbury quakes (which occurred near New Zealand’s second largest city), there has been major damage and significant disruption especially to infrastructure such as roading and rail in the affected areas. It’s too early yet to judge the costs of disruption and recovery (which will in part reflect policy choices by the government). The forecasts in this Overview do not make any explicit allowance for the economic impact of these quakes, though we don’t expect it will become a dominant theme in the same way the Canterbury earthquakes did.

Aside from earthquake reconstruction and the Auckland housing shortage, the other factor that has been supporting residential construction nationwide has been low interest rates and buoyant house prices. And while Auckland house prices continue to command a big premium compared to those in other parts of the country, the region is no longer leading the pack when it comes to the pace of house price inflation. Instead, house prices have been growing faster in property hotspots such as Waikato, Bay of Plenty and even Wellington. On a nationwide basis, we expect annual house price inflation to slow from 14% this year to 5% in 2017.

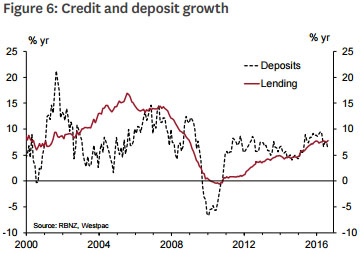

The Reserve Bank remains uncomfortable with the rising risks in the banking system due to the associated rapid build-up in mortgage debt. Its most recent round of macroprudential tightening, which broadened restrictions on investor lending to areas outside of Auckland, started to affect lending from July this year. As expected, at this early stage, the impact has been lower sales volumes and some slowdown in price growth. While the RBNZ is looking into further lending restrictions, recent developments have made it more likely that house price growth will cool of its own accord.

Demand for credit running strong

It remains to be seen how this plays out, but the upshot is that borrowers are likely to face higher interest rates in the period ahead, even if, as we expect, the RBNZ sits on its hands and leaves the OCR unchanged for an extended period.

Low interest rates, strong population growth, the buoyant housing market and an improving labour market have all supported a lift in household spending. We expect continued strength on this front over the year ahead. The other factor that has been supporting the retail and hospitality sector has been ongoing strength in tourism. Visitor arrivals are up 13% in the year to September, and looking ahead to 2017, the sector will get a further boost from events such as the Masters Games and Lions tour. Although the latest earthquakes could potentially put some visitors off, a key challenge for the sector will continue to be capacity constraints, with accommodation particularly stretched. This is likely to see increased activity in traditional shoulder seasons. The anticipated decline in the NZ dollar should help support spending going forward.

One notable beneficiary of the stronger domestic economy has been the government accounts. Tax revenue has been running well ahead of forecasts. Looking ahead, ongoing growth in household spending and more tourist arrivals should boost the GST take, while the improving labour market points to higher PAYE, and expanding business activity will contribute to stronger corporate tax. An improved tax take leaves the government well positioned to deal with emerging demands on the public purse. Although the costs associated with the recent earthquake are uncertain, the damage to infrastructure means much of the cost will fall to the government. In addition, stronger-thanexpected population growth may require the government to top up spending in sectors such as health, education and superannuation, as we saw with the additional $1bn spending announced earlier this year.

It won’t happen overnight... but it will happen

The stars may be in alignment for the NZ economy for now, but we don’t expect this situation to persist indefinitely. The pace of population growth will eventually slow, additional household debt taken on in recent years will need to be repaid, the wind-down of the Canterbury rebuild will reduce construction activity, and house prices won’t keep heading north at their current eye-watering pace forever. What’s more, with credit conditions getting tighter, retail interest rates are likely to head higher from here, even if the RBNZ leaves the OCR unchanged for an extended period. All this means we continue to expect the economy to slow in the latter part of this decade. GDP growth is forecast to slow from 3.4% this year, to below 2% by the end of 2019.

This article was prepared by the full Westpac New Zealand economics team. Michael Gordon is the acting chief economist at Westpac New Zealand. This is the first chapter of their recent publication "November 2016 Economic Overview", and is here with permission. The next four chapters will be re-posted here, in turn.

10 Comments

Great news

Convincing Cantabrians (or indeed others) to relocate to Auckland is a not an easy task, especially when there are opportunities in other high growth areas like the Bay of Plenty.

Convincing Aucklanders to move to high growth areas is probably a more achievable task.

I am probably the only commentator to say this and I am prepared to cop a lot of flac, but I say it is thanks to John Key, well done to our Prime Minister

I totally disagree.

The growth is mainly down to high immigration, and a housing bubble.

Neither are sustainable paths to a strong, sustainable economy.

And at what economic and social cost?

Yes afraid I humbly disagree too...it's all an illusion but with real consequences.

I can double the household income of my house by moving another family in but it's not going to be sustainable or increase my standard of living...

Any "benefits" we have enjoyed from the recent credit fueled binge on housing debt and the long-term costs and declining standard of living (esp in Auckland) due to crowding from the immigration policy will be short-lived.

The facts are GDP per capita is stagnant and New Zealand's household debt level is one of the highest in the developed world compared to the size of our economy.

Westpac senior economist Michael Gordon said. "Strong net migration has lifted population growth to around 2 per cent over the last year, which means that per capita GDP growth has slowed to not much more than ZERO."

"As a percentage of GDP, New Zealand's household debt level was 91.3 per cent in the three months to September 30, 2015 - ranking us seventh highest out of 42 economies in data collected by the Bank for International Settlements"

In other words - we're borrowing endlessly to keep feeling wealthy but actually running to stand still whilst eroding our NZ way of life..

I've been very fortunate to travel to Asia, Europe & the USA this year. I can state for sure that NZ is doing very well indeed compared to most coutries around the world (that's why there is high migration into NZ). The current government has been in power for 9 years. In my opinion, any government that has been in power for that tenure has a significant impact on how well the country is doing

So have I - what relevance does that bear to us though?

I'm not interested in being "not as bad" as an overcrowded, polluted Asian or European City.

The reason that there is high immigration is that we're naive and easy to get into.

Facts are Facts - GDP growth per capita is ZERO DESPITE the immigration!

Also based on your logic the Helen Clarke Govt was one of the best we've had too?

So million dollar question - why is our economy not growing????

"additional household debt taken on in recent years will need to be repaid"

This is going to put a major damper on GDP growth in the future. As the interest rates climb the leverage of all the household debt is going to suck a huge amount of money out of the economy, and it's not going to take much of an increase for things to get bad.

The PM did a bad job by pretending the housing bubble didn't exist and not addressing it earlier.

Fritz - its cricket and egg. What's the econonmic and social cost if you don't have Govt focused upon growing the country's income - start looking other OECD countries and you'll see the answer to that - massive debts (i.e. The current poor sitution will only get worse without major reform), 10% unemployment etc

Agree - you have to grow the economy but what sort of "plan" is simply adding more people.

The facts from treasury show - growth of GDP per capita is ZERO.

You grow by being more productive - not jamming more people in as they come with a cost attached (infra-structure, health costs, education, societal....)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.