This week’s guest Top 5 comes from Jarrod Kerr, chief economist at Kiwibank.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

One: we need fully funded, forward thinking councils

The Government’s new Housing Acceleration Fund is a great step in the right direction.

Unfortunately, the initial $3.8 bln is merely a drop in a leaky bucket. It isn’t enough.

Accelerating infrastructure to develop land for housing is desperately needed. But the fund falls (well) short of dealing with the existing infrastructure problem.

Decades of neglect and underinvestment has left us with infuriating traffic congestion, burst watermains during a drought, and potholes that look like images taken from the Mars helicopter Ingenuity.

We pride ourselves on our Kiwi ingenuity. Just not at the council level.

As we “accelerate” further expansion, we must also maintain what we have. Because we have had record breaking population growth, up until last year…

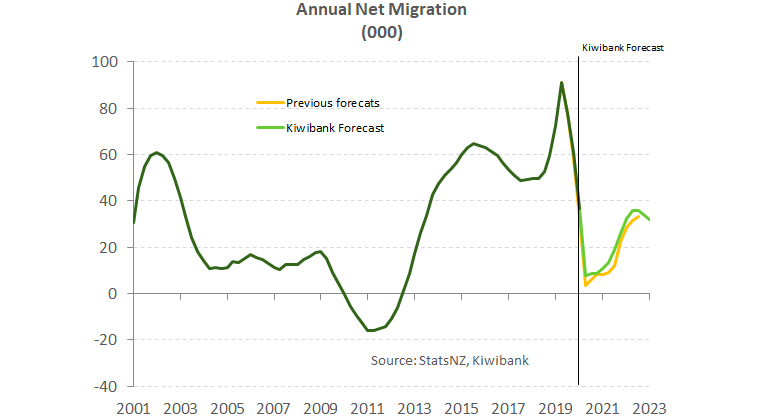

In the 7 years before Covid, we witnessed the greatest migration boom in a generation. And we’ve found ourselves bursting at the seams. We had also seen a surge in migrants over 2000-to-2004. Investment in key infrastructure and social services did not keep up, and declined on a per capita basis. We have a bulging infrastructure deficit as a result.

Councils need access to more funding. And the Acceleration Fund is part of the solution, if only it can be scaled up to meet the challenge.

We’d love to see the Fund prove itself over the next year. And for the Government (and future governments) to gain the confidence to boost its funding. Ultimately, we need the fund to also attempt to deal with the chronic state of our existing infrastructure.

Two: we must tackle the housing supply problem, without more demand suppression

Underinvestment in infrastructure and public services has created the biggest, most embarrassing challenge of our time: unaffordable housing.

We have a chronic housing shortage of at least 67,000 affordable homes - a shortage the size of the Hawkes Bay.

Better planning, consenting, and coordination would boost supply. We must break the high cost, low quality, “bespoke” housing ideals in favour of higher density, sustainable dwellings. There is only one way to tackle a housing shortage, and that’s to boost supply. Hobsonville Point is a great example. I’d like to see Hobsonville Point times 10. It works.

We can supply high quality, affordable homes in a nice area.

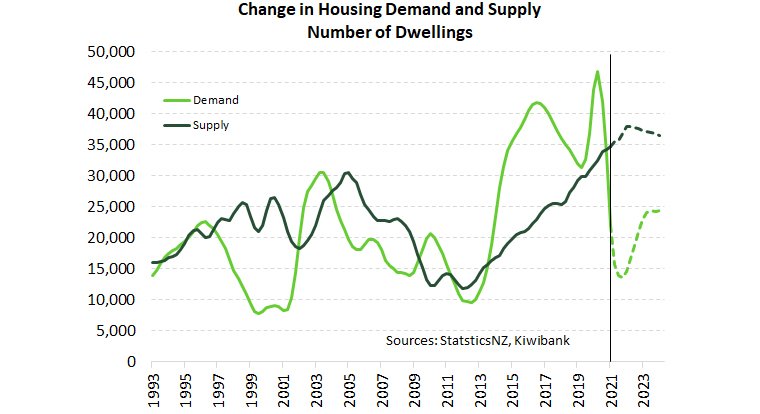

A more evenly balanced housing market is critical in the path to a more equitable society. The good news is we’ve seen a significant lift in dwelling consents. And the Government is committed to cutting red tape, although more can be done to encourage sustainable development. A much-needed lift in supply over coming years could see the estimated 67,000 shortage evaporate by 2025.

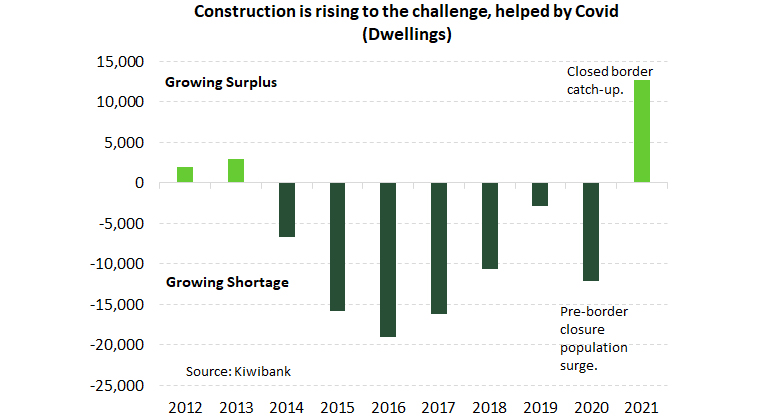

For now, we’ve got a window of “opportunity”. We estimate that for the first time in eight years NZ has managed to produce an annual surplus of around 13,000 homes. But before getting carried away, the surplus in the 12 months-to-March just eats into our massive housing shortage. Last year we estimated the shortage at 80,000 homes, we now estimate the shortage to be 67,000 homes.

There is a sad irony to the 2020 housing surplus. It took one crisis (Covid-19) to help alleviate another (a chronic shortage of houses). The closure of the border over 2020 occurred as residential construction was fast gathering pace. Nevertheless, we look at the silver lining here. Covid-19 has provided a rare opportunity to make a meaningful dent in our housing shortage. It’s an opportunity that still presents itself. We expect NZ’s border to remain closed – bar a limited number of quarantine free travel bubbles – well into 2022.

Based on our projections, NZ’s accumulated housing shortage will fall further this year and next. More importantly, we estimate that housing supply and demand could finally balance some time in 2024-25. Should this happen, and how it happens (more higher density sustainable dwellings), could be a monumental step towards improving living standards.

On the demand side, the temporary drop in net migration has alleviated some pressure.

And investors are being targeted by both Government and RBNZ officials. Tight LVR restrictions have been reinstated. In addition, tax deductibility of interest expenses is to be removed from the 27th March. These demand side measures will have a meaningful impact on investors. The hurdles for investors include a 40% deposit coupled with the possibility of a firm DTI restriction, laced with evaporating interest deductibility and a 10-year bright-line test, although we are encouraged by the exclusion of new properties. Nudging investor demand into new builds will help boost supply.

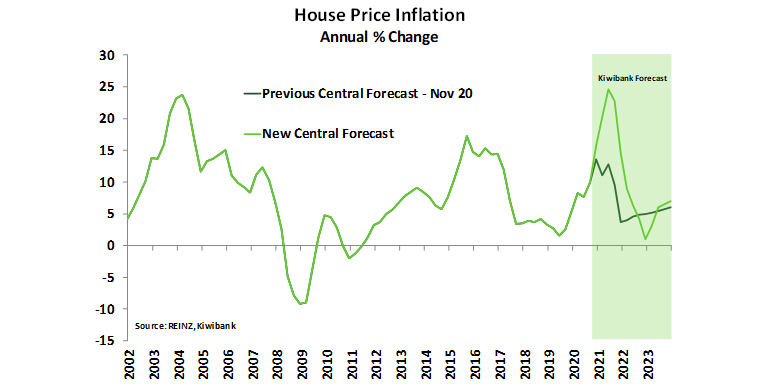

House prices have accelerated at a blistering pace, up 24% in the last year alone! And we’re likely to hit 30% by mid-year, before cooling off.

Investor portfolios have benefitted. It’s easier to come up with a 40% deposit for your next investment property, when your existing properties have surged. Requiring more equity may not be as much of a limitation as previously seen over 2013-2016, when the LVRs were first introduced. That said, the removal of interest deductibility will weigh on investor demand. And investors using interest-only loans are also in focus.

Another step the RBNZ could take is to reprice the risk associated with mortgages. Applying a higher risk-weighting on interest-only and investor mortgages, forces banks to hold more capital against those loans, and ultimately price them differently. Interest-only investor loans are riskier.

Interest rates on interest-only and investor mortgages will increase, and enable lower interest rates on first home buyer and owner-occupier mortgages.

Re-pricing risk strengthens financial stability.

Variable mortgage rates should be looked at with a simple "please explain?". Variable rates are simply too high. Lower variable rates not only benefit households, but SME business using property as collateral.

Three: We need to encourage and fuel innovation and Kiwi ingenuity

There’s much the RBNZ can do to stimulate lending outside of housing.

SME business lending risk weights need to be lowered, actually slashed, to help stimulate real investment in the economy.

Let's reprice SME loans lower.

Let's fuel Kiwi innovation. And lets think of ways to open up investment markets outside property.

We need to get Kiwis into other investments. Think of investing in innovative business, not another tax advantaged property. The Government should also be engaged, with grants for SME businesses. SME’s are the lifeblood of the Kiwi economy. We see assistance for first home buyers. We’d like to see assistance for first business owners.

To encourage investment, SME business need the confidence to expand. Confidence is returning, and we should now encourage finance.

The RBNZ could slash the risk weighting on SME debt to both increase the finance available, and lower the cost (interest rates) of SME investment.

From the Government’s perspective, reallocating resources into exciting new areas could be done via SME grants. Policies aimed at SME businesses are important. SME grants may be a cost-effective way to encourage new businesses. And it’s a cost effective way to direct resources (smart minds and smart money) into areas of concern, like housing, health, and climate change. SME grants would enable Covid-affected businesses to pivot online, or evolve for a new client base.

Ultimately, we need to redirect disrupted employees into new employment opportunities. Lost retailing jobs could be redirected into new and exciting roles in protecting the environment, education or revamping health. SME grants could be targeted at lowering the cost of hiring additional workers, or upgrading technology. Let’s fuel our entrepreneurs.

While we’re focussed on SMEs, we need to incubate our tourism industry.

Australia once feared the threat of ‘Dutch disease’, a disease an economy develops with an ultra-high exchange rate. The idea is tourists and students stop coming, decimating affected service industries, because the currency makes it too expensive.

It’s a disease I’m not convinced the Dutch even had. You see, Australia’s currency went through parity with the US dollar over 2010-2013, and became very expensive. Tourism and education were hurt, for a time. But the Aussie dollar eventually declined, and tourism and education came roaring back. Covid is no different. We have an Aussie travel bubble!, and eventually we will have more bubbles to play in. Tourists and students will return. And New Zealand’s international brand has improved during the Covid pandemic. New Zealand is, and should always be, a tourist attraction and bucket list destination. Our gorgeous mountains haven’t gone anywhere. But we must incubate the industries that enable budding travellers and students to experience New Zealand first hand.

Four: the greatest challenge of this generation, could be climate change

Not only do we need to slash our carbon emissions, and pollution in general, we may need to adapt to the rising tides.

Rising sea levels present a momentous challenge for a country comprised of small shaky islands. Moving back from the seashore will be costly, and devastating for some. Insurance companies, banks, Government and most Kiwi businesses must consider climate risks. Key infrastructure and many Kiwi dwellings may be impacted. Some areas may become injudicious to insure, impudent to invest, and impractical to lend.

Covid-19 lockdowns have helped the fight against climate change, should be stick to the new ways.

Many Kiwis were forced to work from home, and many preferred it. Lockdowns provided proof of concept. A decent chunk of the Kiwi workforce can work successfully from home, eliminating the daily commute. A shallower peak in traffic reduces pressure on clogged transport infrastructure and reduces carbon pollution. The need to re-engineer parts of our economy is also throwing up opportunities to tackle climate related issues. The Government has the ability to fast track progress in environmental areas, with access to ample, cheap funding. We have our ‘once in a generation’ chance to clean up our act.

Five: Adaptation always involves harnessing the latest and greatest technology

One of the best ways to lift well-being and living standards is to embrace better technology.

The more tech-savvy we are, the better prepared we will be for the amazing advancements in technology to come.

Driverless cars, trucks and trains could rid Auckland’s rundown streets of traffic congestion, reducing the need to own a car. And they’d all be electric, reducing emissions.

High-spec prefabricated homes could improve affordability, and reduce electricity and water consumption.

Wearable technology could enhance our health and well-being, by encouraging us to exercise or to see a doctor when needed.

Most of the ‘foreseeable’ life-changing innovations involve artificial intelligence. It’s inevitable that many low-skilled jobs will be disrupted. Innovative education is critical to enabling an adaptive workforce for tomorrow.

Embracing technology solves problems. We already have many of the solutions. We must adopt these solutions. And policymakers must always focus on enabling (not restricting) such change.

74 Comments

Bankers eh

Lots of talk, but they always default back to housing ponzis

‘None will be easy’....lol, just suppress interest rates and lend out an endless flow of money to people selling houses back and forth to each other. There is no other plan.

Question please. Whats your rule or protocol regarding name?

Looking at the summary page that links to this article, has as the headline

"The Top Five Adaptations to Accelerate Aotearoa"

When do you use Aotearoa and when do you use New Zealand?

The article above refers to "NZ" and "Kiwi".

Go you Aotearoans go. Uh, is that right, is that what we are now? Who decided?

New Zealand is a colonial name and does not represent indigenous people of this land.

Aitearoa is the true name for this cou try and has been for hundreds of years before white people came here.

The use of Aotearoa to refer to the whole country is a post-colonial custom.[11] Before the period of contact with Europeans, Māori did not have a commonly-used name for the entire New Zealand archipelago. As late as the 1890s the name was used in reference to the North Island (Te Ika-a-Māui) only; an example of this usage appeared in the first issue of Huia Tangata Kotahi, a Māori-language newspaper published on February 8, 1893. It contained the dedication on the front page, "He perehi tenei mo nga iwi Maori, katoa, o Aotearoa, mete Waipounamu",[12] meaning "This is a publication for the Māori tribes of the North Island and the South Island".

https://en.m.wikipedia.org/wiki/Aotearoa#:~:text=Aotearoa%20(M%C4%81ori%3A%20%5Ba%C9%94%CB%88t%C9%9Ba%C9%BE%C9%94a%5D,refer%20to%20the%20whole%20archipelago.

Maori didn’t have a written language until from 1814 when Cambridge University created it.

Do names only count if they're written down? Who decided that?

Standard feature of colonisation I guess, come into a country with a different culture and come up with reasons out why it doesn't count and should be replaced.

I'd be happy with a Te Reo name for my country; New Zealand is a rather stupid name. Preferably a word I (and foreigners) can pronounce easily. Was the word Aotearoa used in the treaty of Waitangi in its Maori translation? Was Aotearoa used in any legal documents or Te Reo newspapers before the example from 1893? The Victorians recorded Maori oral traditions (because they thought the Maori was a dying race); do any of these record this name? I'm nervous that we could change from one name of dubious accuracy to another of mildly dubious origin. Is it time to repeat John Key's flag choice but with our name not our flag?

No but those 2 facts rub out any sort of claim that Aotearoa was ever a name and certainly never a documented one before any colonisation.

There is absolutely zero basis for changing the name apart from modern virtue signalling or the fact people like the name more.

Some similarity then to North America colloquially, being known indigenously as Turtle Island?

‘All barr'd with long white cloud the scornful crags’

- Alfred, Lord Tennyson, 1848

All people think that New Zealand is close to Australia or Asia, or somewhere, and that you can cross to it on a bridge. But that is not so. It is not close to anything, but lies by itself, out in the water. Compliments Mark Twain. And now we have a full on woke government hell bent on the great divide.

Really. What about other people than indigenous. Who built this country, certainly not the indigenous ones

Looks like a click bait title. I thought Interest might be above this.

Key concerns for NZ: Leaky building support so people feel comfortable buying apartments, driving down the cost of apartment living so that apartments aren't more costly than houses on land and amending zoning rules so that central city nimbys can't inflict congestion and deprivation on the outer suburbs because they want to protect "character suburbs".

Wouldn't it be fabulous if NZ managed to build apartments that didn't leak! Surely this is possible... sigh.

You would think so! Or apartments that weren't millions of dollars for a decent, three bedroom option? Or a terraced house that had decent floor area for a reasonable price, instead of two bedroom upstairs/downstairs jobs that cost the same as a regular stand-alone house on a section? Or just actual affordable housing options in general? NB: A two bedroom house costing $750K is not 'affordable' even if it is under the median price - it may be cheaper, but it's still incredibly poor value.

Debate needs to focus on generic solutions for increasing supply - discouraging private sector investment in second-hand rental properties is a poor decision & will reduce the growth rate in supply of rental housing which hurts our most vulnerable.

Higher interest rates are needed & less printing of money will increase housing affordability. It is that simple.

The government needs to take responsibility for changing Reserve Bank rules to include “maximising employment”. This change in focus has resulted in interest rates getting much lower than would otherwise have been the case. Consequently housing prices have increased far too quickly & this has created undesirable upward pressure on rents & emergency housing. Penalising private sector suppliers of rental properties will only accelerate the increase in rents & demand for emergency accommodation. This country will end up much poorer as a result.

The reserve banks objective is largely to keep the currency down yet they aren't allowed to acknowledge this so low rates are explained by other criteria. Lost of central banks around the world are now tied to the US Federal Reserve in what they do.

Right, and hence the idea that this is an independent Reserve Bank is laughable in the extreme. We do as the Federal Reserve does, end of story. We have zero monetary sovereignty.

Yes exactly but we'll never admit it because that would suggest a currency war or currency manipulation, which of course isn't happening.

But doesn't it make all the wailing and gnashing of teeth about the much-vaunted 'independence' of the Reserve Bank just laughable in the extreme. This is a puppet outfit following in meek lock-step with The Fed.

Yes it does. Orr's hands are tied so when he says the property situation is up to government policy, he's right because he's not going to do anything about it because raising rates would also make NZ uncompetitive with a high exchange rate. I also think that if the government is successful with slowing the property market it makes it easier for them to go negative with rates which they've indicated is still on the cards. Overall low inflation is the culprit for this whole situation.

The issue is with the way inflation is calculated. And now we have central banks saying that any inflation will be ‘transitory’ i.e. they are just going to ignore it.

Obviously Kiwibank is woke but I find it ironic he is giving advice on how to get "New Zealand" moving when 90 percent of kiwibanks loan book is in mortgages.

Yes. At the end of the day, the banks' interests are Jarrod's interests. They're the people who pay his salary. Another 'irony' is that the banks' privilege and ability to lend money into existence is one of the problems facing NZ and many developed economies (particularly the Anglosphere). The last thing Jarrod is going to talk about it is the concept of sound money and how that fits into the Keyensian agenda.

All the economists are either directly or indirectly bought and paid for by the banks and big business. And you don’t bite the hand that feeds. Hence they are nothing more than very useful PR spokespeople for the interests they represent.

Hence they are nothing more than very useful PR spokespeople for the interests they represent.

It's definitely part of their role. Remember when Tony Alexander pushed the boundaries of what was seemed acceptable. That seemed like it possibly led to the end of his time with the bank.

Having an economist in your pocket is useful in the extreme. The CEO could never get so many ears and column inches to push the agenda: it would be seen right through as blatant 'talking own book' and laughed off, but an 'economist' (just another highly paid paid bank employee) is a conduit to getting the propganda / advertorial message out there because for some reason the media treats them as quasi-independent and hangs off their every word.

There's quite a bit in the article about changing risk weightings which would help to address that. Change the incentives and the bank's behaviour will change - it is too much to expect them to do it themselves.

I would suggest the following.

1. Reduce tax burden on companies.

2. Tax incentives for small business and hiring staff.

3. Reduce government siE by 20 to 30%.

4. Reduce council size by 40 to 50%.

Labour's scraping dhbs could be promising and sounds like they want to shake up councils.

Government spending is a waste of money. Private spending is more efficient.

The problem with your point 1 is they need to tax companies heavily to fuel the housing ponzi via accommodation supplements etc.

They just ‘leverage the Reserve Bank balance sheet’ to pay for things now. Tax is a dead idea. It’s ‘print and borrow’ to infinity or bust from here on in.

What exactly is in the 20-30% you want rid of?

https://www.interest.co.nz/news/105115/budget-202021-summary-all-spendi…

Social welfare always looks promising but 50% of that is superannuation - you want to be the one to break that to pensioners? We could cut health spending and let people fend for themselves, but I've not seen any convincing evidence that private healthcare gives better outcomes for the population than a good public system.

I think it would be an amazing result if the healthcare shakeup finds enough efficiencies to reduce spending by 5-10% of the health budget - that would reduce government spending by about 1%. A long way to go.

Auckland’s rundown streets

Auckland's streets seem quite well maintained to me.

They're really not. Large swathes of streets are in poor condition, particularly out west, where some of the main arteries are traditionally smaller routes. If we're talking more colloquially some of the suburban shopping centres are in desperate need of community input and a refresh.

Jarod writes

"We must break the high cost, low quality, “bespoke” housing ideals in favour of higher density, sustainable dwellings. There is only one way to tackle a housing shortage, and that’s to boost supply. Hobsonville Point is a great example. I’d like to see Hobsonville Point times 10. It works.

https://www.trademe.co.nz/a/property/new-homes/new-house/auckland/waita…. At 1.389million on a postage stamp

If you have it x10 I don't think that place would be $1.4m, although for hobsonville a standalone house is rare, let alone land size above 200m.

The real issue I take with his comment is that the build quality in that area in a lot of cases is poor in basic workmanship.

The author wants Hobsonville x10 so his institution can lend via mortgages. I want ZERO Hobsonvilles. 5m popn is more than enough, and too much is low waged immigrant labour. Infrastructure could never keep pace with the ridiculous levels of immigration over the last 20yrs. NZ needs mandatory superannuation contributions, medical insurance and a complete review of long term recipients of social welfare, excl pensioners. We could also do with a Justice system that has some balls instead of the emasculated version bequeathed by Little.

'higher density dwellings' are the key words, the sustainable stuff is just padding. Why would a high cost dwelling be low quality(?) That makes no sense. What he is saying is that the beneficiaries of the 'wealth effect' will live in the leafy areas where the ladder has now been pulled up, and the future generations & the upcoming waves of immigrants needed to sustain the Ponzi will be housed in high density boxes, and the more of them the better.

Except for the climate, banks lending almost free money for property has caused almost all other issues. So, how about Kiwibank man up and say: 30% of new borrowing to property, the rest to business and innovation. Time to be courageous

Would be totally irrelevant if the others didn't follow suit. Except for destroying kiwibank of course.

Yes, banks are like box factories. They have one core product and one core product only. If they don’t do what every other bank is doing they will lose market share, and fail. They are stuck between a rock and a hard place.

More woke crap you could build houses till land runs out you still going to have same situation problem is money needs to have value interest rates need to reflect that,words need to mean somthing once again,my truth or your truth means nothing it's ether true or not true simple I'm sick of educated wokes who obviously whatch CNN all day lecturing us

The woke stuff is just waffle used to pad out the article. His key message is that he wants to see no ‘suppression’ on the demand side so that the Ponzi does lose steam. Ironic that he uses the word suppression when the suppression that is truly going on is the suppression of interest rates by central banks.

The main problem is we have a culture of entitlement, government handouts and dependency. It’s been that way since forever.

A bunch of people that feel they are entitled to a cheap house just because they are kiwi.

100%. Every kiwi feels they should have a home, either owned, rented or provided by the Government. Im happy with people who have trashed HNZ stock to be living in tents and caravans.

It’s borrowers and the landed gentry who are wanting the handouts, and they have received them big time. Central bankers decided that the value of their assets would be artificially inflated via interest rate suppression and QE, and now whenever the bubbles are under threat the full might of the government and central banks comes to their rescue.

I agree, bloody landlords expecting the public to top up their unaffordable rents. Entitled - check. Govt handouts - check. Dependency - check.

Yeah they've made over 20% tax free capital gain in the last year and they cry poor and threaten rent increases because one of their advantages over first home owners is removed. I'm saddened by what lots of our society has become. Too much self interest and not enough care for society/community which leads to a loose loose over the long term.

I'm living in a country where government are cancelling the prior governments infrastructure projects a second time (a flip-flop-flip if you'd like!) No matter your party affiliation you have to admit government are unlikely to substantially contribute towards the future of New Zealand. They currently lack the fundemental capability, capacity and commitment as an organisation.

Industry must now do what government can or will not. We need leadership.

The previous government was only interested in the oil and gas industry related projects - jobs for mates.

There is a dirty little secret with EVs. When the cost is low the use goes up. With self driving we are likely see clogged streets.

I like these headline pillars. And most are intertwined. But a few comments

Councils...agree Councils need more funding. Especially those with vast areas and a low ratepayer base. But lets be real...lets get competent people in their...and lets get qualified elected officials in office vs the hick who fancies an LG salary.

Retreat from coast and housing. As NZers we need to get over house and land as a place to live. We need to go up, and build quality apartments that dont squeeze the sqm space because of inflated development greed and speculation. Introduce state sponsored social highrise housing and ownership scheme...look at Singapores HDB system as a starter and make it our own. Social housing does not have to mean "ghetto" nor equal "for homeless" On that note...rent on social housing if not on ownership path should be set at a minimum then % of income whichever is the greater. So it remains affordable, but also encourages those building their careers and earning potential to make way into private housing.

Tech? Agree. Although this again is tied into infra/council then education.

I would add..disrupt industrialised agriculture. Put caps on herd size/hectare, and do it fast. And move towards vertical farming so we can continue to re-wild / restore the land that shouldnt have been industrialised in the first place.

My number 6.

New Zealanders, homeowners and business people become owners not borrowers.

No matter how innovative and hard working you are, if you don't own it you are on the margins.

My number 7.

Stable population policy. Maximum 5 million. Although I think we would be richer and have more fun if it was much less.

Interest.co common taters seem to get that, economists can't.

My number 8.

Get school attendence back up from the current shocking low levels.

(to where if a 10 year old is on the street in school times, everybody's jaw drops.)

Dear Kiwibank, please find a way to lend to businesses at a reasonable interest rate without the owners needing a property as security. Until our banks can do that, you and your opinions are an entrenched part of the problem.

"Two: we must tackle the housing supply problem, without more demand suppression"

What is he actually telling government ?

Not to curb speculative activity / demand as need speculators to sustain the NZ economy = Housing ponzi.

From now till RBNZ announcement, will be lot of articles and discussion to dissuade government/rbnz from acting against interest only loan. Some so called experts / Lobbyist will be direct and some subtle like the point number two that Jarrod Kerr is suggesting / advising that just hide behind supply as has been the norm till now and not to target speculators.

Many for vested biased interest forgets that supply will take ages ( even than will always be short of demand) so demand specially speculative demand has to be targeted as economy is demand and supply and cannot just address one ignoring the other.

If I interpret what you're saying, the idea that you can have bubble house prices and 'affordable' house prices in the same market doesn't really make much sense.

I agree.

The whole thrust of his article was that the demand side is not to be curbed, and the rest was just waffle, a vehicle for his key theme. To not curb demand means that interest rates stay low forever, mass immigration continues unchecked, and measures introduced to curb demand get rolled back. He also talks about housing underpinning small business, and states that some interest rates are too high. All in all a remarkable article illustrating the desire to insulate and defend the Ponzi at all costs.

Tom Valen, Check point number three

'Three: We need to encourage and fuel innovation and Kiwi ingenuity'

Contradictory....innovation and kiwi ingenuity can only be fueled as suggested only if the housing ponzi is contained and for that has to target Speculative demand but just before in point two - suggests that government and RBNZ should not to do anything to targets any demand including speculative demand. How can one be an expert and yet be ignorant of the role that speculative demand have in housing ponzi unless is blinded by biased vested interest.

If housing market is giving a double digit return on a monthly basis without slogging from morning till evening 7 days a week or even 5 days a week with no hassel of government formalities and compliance, why would one look elsewhere. Also perception created by Jacinda Arden that will never allow it to fall come what may and supported by action / inaction from rbnz, one would be a fool to look elsewhere when have opportunity for fast and easy money.

Mr Orr stands exposed by his policy of 'least regret' when it comes to supporting the ponzi and now when it has gone out of control instead of following the same policy of least regret is going for 'Wait and Watch'.

Agreed, but they are trying to enmesh the Ponzi in everything, saying it is necessary for small business survival. The Ponzi is the vampire squid with it's blood funnel stuck in a river of taxpayer and saver cash. With interest rates so low for a over a decade, how much has been siphioned away from savers? How much of our current national debt is as a direct consequence of taxpayer support to prop up the Ponzi?

And how much of our wealth is being siphoned off in cabon tax scams John Kerry the climate change Jesus just been caught out holding multimillion dollar stocks in petroleum energy companies...crooks

How about not giving away hundreds of millions of dollars to overseas film companies every year?

"Four: the greatest challenge of this generation, could be climate change"

Four!!!!???

Could be!!!???

Well, there goes your credibility

There was no conviction there was there. It was all just padding to fill up an article.

"Applying a higher risk-weighting on interest-only and investor mortgages, forces banks to hold more capital against those loans, and ultimately price them differently. Interest-only investor loans are riskier"

Maybe Jarrod should call his mates in the accounting department and ask whether a higher-risk weighting would drive an increase in prices - the level of excess reserves held by the banks (impact of QE) is off the chart.

You don't manage borrowing risk by fiddling with weak instruments - Govt / RBNZ (one and the same) just need to decide what loans are riskiest and regulate. The 'free market' is an illusion anyway.

This article or suggestion is just a lobbyist trying to influence and nothing more.

A thought provoking article.

In short reply:

1. Shortage of housing: need to define shortage of rented stock from private. This is never done

2. Affordability is not simply related to OO and rates of interest. It primarily impacts renters whose median wage is too low for ever increasing rents that rise faster than wages pa

3. Under-investment for last 35 years is due to low tax base and governments refusal to tell electorate that higher taxes are needed, especially on property , land and wealth.

4. "shortage" of housing articles need to define how they reached a figure.

5. Local government is not competent to do what it is charged to do and is not funded adequately for investment needed. Gov refuses to address this, or admit it to electorate.

6. Global warming means more flooding and this means lots of folk on coasts will have to move. No one really wants to admit this or do anything about it either.

I see "woke" is now word of choice for dismissing any argument or policy suggestion which a person cannot be bothered to address in factual or analytical terms. Same as "boomer" as an insult. Easy use of woke is for Right wingers who feel all media and pinkos and that they (mostly over 65s with money) are hard done by and ignored.

Phrase "demand suppression" is questionable.

Gov and CB engage in interfering with any concept of a 'free" market and then when they overdo it their efforts to contain the mess are seen as "suppressing demand?" Bit like lighting a fire and then trying to put it out whilst denying you lit it in first place. The only time since 2001 when interest rates in fact were justifiably reduced was 2008-09 and 2020. Rest of time it was unjustified and done simply to prevent house prices dropping and dependence of economy on the housing market from leading to recession. Recession is no longer allowed as part of normal cycle of investment. because politicians do not want to lose office when people vote them out, blaming them for failing to manage the economy. Politicians should stop claiming credit for when economy goes well and denying blame when it goes badly, as they have little influence on either in an age of free capital flows.

Kiwibank is the worst bank in New Zealand

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.