Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. The leverage party redux

Buffett is avoiding bonds, PIMCO's Gross says the bond rally is over. But international corporates are issuing debt fast these days. Even Apple. Someone's buying. In fact corporate junk (like Graeme Hart's) is rallying spectacularly - US corporate junk debt averages yields of only 5.3% these days. However why are those high profile investors wary?

Perhaps every investor should be wary. Fortunately there is very little junk in the New Zealand bond market, but demand for investment grade is way higher than supply. It's a real problem getting hold of any for your portfolio. Here is Roben Farzad in BusinessWeek:

"There is nothing inherently good or bad about leverage," says Michael Lewitt, publisher of the Credit Strategist. "Cheap leverage is better than expensive leverage. Too much leverage is always bad. The difference is that now companies can disguise excessive leverage because it costs them much less to service it and it is easy to refinance or extend."

"When the price of this leverage normalizes,” he predicts, “nobody is going to be saying anything positive about it. The smart ones are those who are repaying their debt now, not adding to it."

2. EU threatens France

France is about to be named and shamed for its lack of action on reform of its fiscal position and competitiveness. Apparently its inaction is a threat to the whole EU project.

But what is about to happen is much more than naming and shaming. It seems that Brussels now has teeth to enforce changes and "reverse qualified voting" procedures may mean France can't actually block enforcement.

This will be fun to watch. Apparently the system is about to be tried out on tiny Slovenia in the coming weeks. Stay tuned. More from the UK's Telegraph:

European Union studies on “macroeconomic imbalances” have been given new teeth this year under eurozone “governance” legislation that gives the commission powers, backed by substantial fines, to override national sovereignty to impose reforms.

“The macroeconomic imbalance procedure is very broad, intrusive and has, for the first time, teeth. Sanctions can be taken unless countries implement structural reforms,” a senior European official told The Sunday Telegraph. “This has moved on over the last 12 months from a naming and shaming exercise to interventions with a cutting edge for the eurozone. The commission is going to go much further than ever before.”

Under the new eurozone rules, if a country fails to address “the gravity of imbalances [it] can eventually lead to the imposition of sanctions on euro area member states” under a new radical procedure that makes it easier for the commission to impose reforms.

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

3. Electric roads

Here's an idea - make roads out of solar panels. An intelligent road surface could be used for all sorts of things, including recharging electric cars as they drive on it. It's an idea two Americans are pursuing and people are watching with interest. It's even got official seed funding. Spiegel Online has more:

"In the beginning, half the people thought we were geniuses, and the other half thought we were off our rockers," says Scott Brusaw. The electrical engineer has spent years trying to bring his wife's idea to fruition. Julie Brusaw is a psychotherapist. Roads didn't fall into either of their areas of expertise. But as the discussion in the United States about climate change intensified, the Brusaws were struck with the idea of solar roads, and the project took on a life of its own. In 2009 they received their first government grants to construct the prototypes.

The Brusaws' work was impressive enough that this spring, they are launching a pilot project, for which the state awarded them $750,000. In their hometown of Sandpoint, Idaho, near the Canadian border, the couple has built their first parking lot made from solar panels.

4. Today's raw market data ...

A quick new week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8085 | 0.8109 | 0.8498 | 0.7598 |

| NZ$1 = AU$ | 0.8388 | 0.8349 | 0.8264 | 0.7729 |

| TWI | 76.33 | 76.50 | 78.36 | 69.21 |

| Gold, US$/oz | 1,390 | 1,381 | 1,468 | 1,575 |

| Dow | 15,319 | 15,309 | 14,816 | 12,593 |

| Copper, US$/tonne | 7,240 | 7,286 | 7,079 | 7,740 |

| Volatility Index | 13.99 | 14.07 | 13.71 | 21.03 |

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

5. Big China changes signaled

Is China about to make a major change of economic direction? - one that requires a fundamental social change as well?

They could well be moving to the full capitalist 'creative destruction' model, one that will only work with strong independent civil society institutions. And patience. I wonder if they have the guts to go through with it because it will set in train some huge changes for them.

If they can pull it off it will have a monumental impact. If not, it could be a mess. Legendary NY Times China reporter David Barboza has the story:

In a speech to party cadres containing some of the boldest pro-market rhetoric they have heard in more than a decade, the country’s new prime minister, Li Keqiang, said this month that the central government would reduce the state’s role in economic matters in the hope of unleashing the creative energies of the nation.

On Friday, the Chinese government also issued a set of policy proposals that appeared to be intended to show that Mr. Li and other leaders were serious about reducing government intervention in the marketplace and giving competition among private businesses a bigger role in investment decisions and setting prices. The overhauls, if successful, could also make China an even stronger competitor on the global stage by encouraging innovation and expanding the middle class.

Maybe this is one reason.

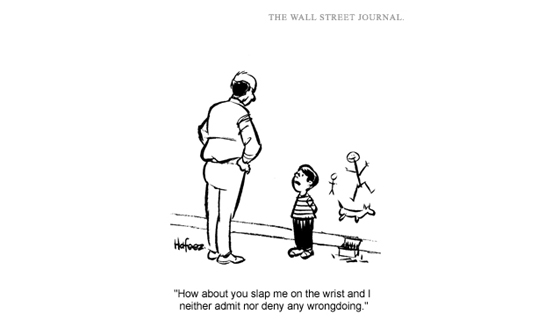

6. Not all it seems

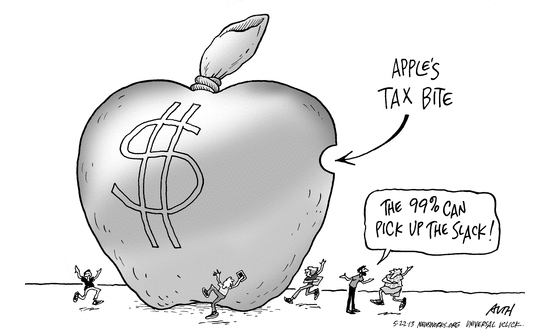

Apple only pays 14% income tax on its worldwide income. Cue outrage, from politicians and journalists alike. Corporate America is privileged and not paying its share. Kiwi companies pay 28%, why can't Americans pay the same? Think of the US deficit benefits if they did.

Well, like many things, this narrative is flawed, it seems. In the period 2007-2012, the S&P500 companies paid 29.1% in Federal, State and Local income taxes in the US, on their worldwide income. Heck, that's more than kiwi companies.

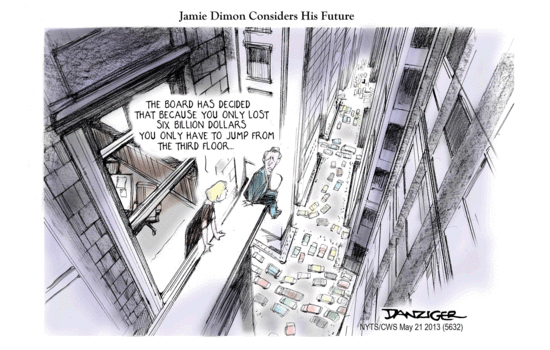

In fact, most big oil and energy companies who have vast international revenues, paid closer to 40%. Ditto their big banks (you know, the ones we love to hate).

You can see the actual data here in a fantastic NY Times interactive graphic, or click on the image below. It does raise the question that if US companies actually pay higher taxes on average than kiwi companies, should we raise our rate? Their higher effective rate doesn't seem to hurt those companies results.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

7. Suckers?

Sydney and Australian politics is agog over a corruption enquiry involving state Labor Party ministers and the awarding of coal mine contracts. All very tawdry. Now the AFR claims some of the private backers are Hollywood big-names, those usually associated with substantial funding of Democrat politicians.

But also interesting in the revelations is how many ex-Kiwis are involved. Rich-listers Ron Brierley, Neville Crichton were both big investors. Earlier in the year they tried to sue their broker for placing their funds into this highly dodgy enterprise, but have since given up that effort. A lot of this is not 'new' but the Hollywood connection is, and it is the first time I have seen a list.

8. Binge culture spreads

I am not sure he is right about the comparative. Alex Frangos of the WSJ has noticed that "Asia is going on a debt binge, just as most of the rest of the world has sobered up". You could hardly say the US or Europe are 'debt sober'. Still, a binge does seem to be underway in Asia.

Borrowing has increased all across the continent. State-owned companies and local governments in China are taking on more debt, as are motor-scooter buyers in Indonesia, washing-machine purchasers in Thailand and real-estate investors in Singapore and Hong Kong. Malaysia's government has borrowed to fund the new subway and to pay for cash handouts to citizens.

Debt loads in Asia's emerging economies—gauged by public and private debt as a percentage of gross domestic product—now exceed what they were in 1997, when Asia went into a financial crisis that lasted for several years. Much of the run-up has come over the last four years. The overall debt-to-GDP ratio rose to 155% in mid-2012, from 133% in 2008, according to the most recent data from McKinsey Global Institute, a unit of consulting firm McKinsey & Co.

9. Making denser environments acceptable

OK, apartment or condo living is not for me (yet?), but all the same no-one advocating density has yet shown that it can address the affordability issue except when the floor plans are tiny. Density fans will always stumble over that issue; if they don't solve it buyers are always going to choose "freehold single family homes on a section" and stretch till it hurts to get one.

In New Zealand density defies affordability. It never happens except at the margins and which no-one chooses willingly.

But perhaps there is a solution - modular or prefab housing. These are units build offsite and positioned onsite in a wide array of unique structures. They are being seen as a solution in one of the toughest housing markets in the world, Manhattan. Density boosters (and developers) should check out Allison Arieff's NY Times review:

More innovation in factory-produced housing, says GRO’s Robertson, “prevents the cookie-cutter sameness often associated with the process and allows for novel architectural form, nuance and variation” as well as efficiency. This is critical to moving from highly individuated single-family home design to multifamily buildings where individuality can find architectural expression.

Now that the market for housing has rebounded and indeed is booming in some cities, multifamily prefab makes sense for many reasons. The demand for rental housing is rapidly increasing as the interest in home ownership has waned post-housing bust. For the first time ever, California cities are seeing the need for more multifamily housing over single-family homes. And a recent study by Smart Growth America that examined three distinct housing development types revealed that mixed-use infill (when buildings are constructed to occupy the space between existing ones) produced 1,150 times more net tax revenue per acre than suburban development. The sort of community a growing percentage of the population is seeking takes the form of a denser, walkable urban neighborhood. Prefab can make that happen more quickly, efficiently and economically than conventional construction - and increasingly, it’s doing exactly that.

10. Today's quote

"Here’s something to think about: How come you never see a headline like ‘Psychic Wins Lottery’?" – Jay Leno

Dairy prices

Select chart tabs

11. Darwin 101

Watch to the end ...

51 Comments

Best video yet.....

Thanks David!

# 3, Electric roads, makes perfect sense to me. It is simple, obvious, doable, and solves many problems all at once. Why can't we get involved in a great idea like that here in NZ? Something visionary and really futuristic. It would be a more inspiring legacy to leave than poky machines, strip mining coal and mega brothels! (sometimes I shut my eyes and pinch myself- what are we thinking? How stupid are we???)

#3 The linked article doesn't actually talk about charging as you drive, but this would almost certaininly mean some form of horribly innefficent induction charging.

I interpreted the item to mean using all the real-estate that comprises roads and roading and car-parks to be a suitable "vehicle" in which to embed "solar generation capability" and pump straight it into the grid. Nothing to do with cars

The beauty of the idea is that we would be efficiently using all of the space presently covered with asphalt. Instead of roads destroying the earth, they could help save it. I just love the conceptual shift from negative to positive. It is "mind blowing". Really beautiful! If the government wanted to spend billions of dollars converting our existing roads or even building new roads with solar panals, I would be overjoyed. I would imagine that it would be easy to have charging stations for the cars along the way?

Solar Paint has been invented. Soon you will find the bonnets, roofs and boots of cars will be painted with it.

one of the problems is getting people to put it all in perspective. Note Bernard Hickey's reply on the other thread!

There are a majority, in this and other western countries, who start from the premise that they want their present existence to continue. They're happy to recycle, buy fair-trade, drive a more efficient car - but not give up consumption. They are perhaps 10% of a still-growing global population, who all want to consume like that too. The planet is struggling even now, with the 10%, and they have to turn a blind eye to the fact that they're screwing others for the resources under their feet - land for local food doing the fair-trade coffee, invasions of oil-producing countries, coups and sabotage of anyone who stands up to the empire, drones.... We only live as we do, as a temporary minority via repression.

And we hail solar roads? Laid over what substrate, by what machinery, over what distance, maintained over what time-scale? This is lala land stuff - trying to invent a horse because you doin't want to give up the cart.

Solar is great, and our only valid destination, energy-wise. But discretional middle-class indulgence won't be the biggest need. We needtodo agriculture/food distribution first. Takes a lot of grunt to shift a truck up the Rimutakas, on a cloudy day....

Indeed,

"But discretional middle-class indulgence won't be the biggest need."

yep so bye bye consumerism, and how much of our economy is that? 60%? 70%?

"We needtodo agriculture/food distribution first. Takes a lot of grunt to shift a truck up the Rimutakas, on a cloudy day...."

Now now....they'll start to keel over with fear, you wont win any friends by making them fill their underpants or consume large quantities of prozac.....oh wait thats "discretional middle-class indulgence" oh darn.

Interesting that the only example that has occured is Cuba....that will upset the many "freedom lovers" in here. Not that the thoughtof being told what to do at the point of a gun does a lot for me either.

regards

Solar is already well down the 'spray-it-on' track: Nanosolar have the equivalent of newspaper-speed inkjets doing precisely this, and the Integrated Building Envelope approach also uses moulded-as-part-of-production PV materials.

In fact, I could imagine laying out roads (useta build 'em, so I have inside knowledge here) with my old Lanz Bulldog (ran on melted Butter - Fonterra-fuelled), a largish Trailer, and 'lectric-run Sprayer thingoes out the back.

Coupla Sparkies to hook 'er all up and....Fiat Lux!

PDK said "solar is great and our only valid destination", so, what is not to like? All the heavy lifting has already been done when the original road was built. There is an existing substrate. Accessing the solar panals is not a problem because they are already on a roasd. You just drive down the road till you get to them. Plugging the power into the grid is not a problem because the power lines already run beside them. The land has already been aquired. It is recycling and repurposing our roads. As far as getting up the Rimatukas on a cloudy day, it would be sensible to have diesel trucks and buses running on them.- or using the electricity to electrify the main trunk railway line?

Dmitre Orlov said that the most ecological vehicle he had seen was an old Ford straight six pick-up truck in Mexico that was shifting 30 people and their animals.- I think the future belongs to using what we already have efficiently and in new ways. What is there not to like about the idea of turning out roads into solar panals, AND still having them as roads????? Can anyone think of a more efficient, cheaper, more practical way to deploy solar panels? It would be easy to find the roads that were oriented the correct way.

I still believe our future (not the future of the entire world) lies in Hi Tech, organic agriculture, fitness, good health, arts, fashion,etc

New Zealand's largest company has confirmed that its farmers offered to sell 75,223,742 economic rights of "wet" or milk supply shares in this month's offer, totalling a value of nearly $566 million. The final purchase price for the offer was $7.92. It closed on Thursday.

Fonterra chairman John Wilson said the level of demand meant the offer would be scaled, with Fonterra buying 79.7 per cent of the economic rights each farmer shareholder offered to sell.

It doesn’t appear that de leveraging is occurring

Accepted its looking at 2012 (its not like the drought offered improvement):

Very high profitability in 2011 is being followed by lower milk prices in 2012 (but volumes very good)

• However, high global volumes of supply, now forcing forward milk prices lower…. Need a lower NZD now to get milk price back up to $6.50 ish

• Reported rise of dairy farm values looks like a low volume aberration

• No reduction in gross bank agriculture lending in 2011 is a surprise

– It doesn’t appear that de leveraging is occurring

– But debt servicing easier with interest rate falls

• Large farm receiverships starting to clear the market but more to come…

• On balance it looks as if capital will flow out of the industry

– Free cash flows on farm will repay debt (and re invested by banks)

– Overhang of farm sales still to work through the system

– Increased barriers to offshore investment

– Reduced expectation of capital gain from investors

• Starting to look like commercial property….yields will have to go higher (dairy farm values lower) to attract new capital?

http://www.tdb.co.nz/documents/presentations/010312-NZ-Dairy-Industry-R…

http://www.rbnz.govt.nz/statistics/monfin/c26/download.html

Capital adequacy requirements for farm lending - frequently asked questions

http://www.rbnz.govt.nz/finstab/banking/4436523.html

and our friends also ask:

Rural debt in Australia now stands at $66 billion, according to data released by the Australian Bureau of Statistics and summarised in the attachment to this Agribusiness Bulletin. In the last decade, rural debt has doubled, with much of this growth occurring in the period 2005 to 2008 when annual growth rates exceeded 10%. In the last three years, rural debt growth has moderated and is currently around 3%. Since the turn of the century, the value of agricultural production in Australia increased from $35 billion to $46 billion. And the Australian experience is not unique - by comparison, rural debt in Canada has doubled in the last 20 years to C$70 billion, and tripled (to NZ$30 billion) in the last decade in New Zealand.

The growth in rural debt in Australia has not been evenly spread, as shown in the geography and industry analysis which is based on the ABARES recent farm survey results data:

The dairy industry, regardless of location, has consistently increased average debt per farm over the three year period, and this would be partly attributed to seasonal conditions (droughts and floods) but also to farm consolidation

http://www.deloitte.com/assets/Dcom-Australia/Local%20Assets/Documents/…

so is everything a-OK?

Fonterra units off 19 cents to $7.65.

Www.nzx.com

Henry, Down to $7.60 at 5.20pm. Henry, if Fonterra is paying $7.92 to farmer shareholders for their shares and selling them to the fund as units at the current price of $7.60 isn't it taking a bath of 0.32cents per share? Or is this countered by launching the fund at $5.50?

Are we seeing unit investors not understanding what they have bought in to and being spooked by what they may see as farmers wanting to divest some of their (farmers) interest in Fonterra? Or would this 3%+ drop have been expected?

I was a bit surprised by the over subscription, but then my network doesn't involve any of the really big players or those with tight financial situations.

Here is something from brokers:

http://www.craigsip.com/~/media/Files/Fonterra%20Documents/Fonterra-TAF…

and from The Press:

http://www.stuff.co.nz/business/farming/dairy/8720983/Farmers-keen-to-s…

The success of the offer does not mean more units in Fonterra shares will be available for sharemarket investors.

The offer will not increase the current size of the NZX and ASX-listed Fonterra Shareholders Fund.

Fonterra has previously said it would purchase the units in the farmers' shares that arose from the offer and would redeem them for Fonterra shares.

As we understand it (having gone back to pencil and paper):

This is reversing the (warehouse) transaction that provided shares that were used to back units that were used to start the fund (they were new 2012 shares, Fonterra issued shares, become units, rec'd $),

now Fonterra has payed $ for economic rights, not the fund.

So now most Fund units are backed by sale of economic rights from shares owned by real farmer suppliers.

hence the limit on $ value that can be paid out (cause its the $ raised by fund that is buying shares now)

(Adding shares and units together) Its like a share buyback (but only to some), value transfer seems $7.92 less (number depends on who you are), but unit holders would not be happy as they offered no similar transaction for units (in volume)....

- we are happy for others to check the answer...

Motivation, Farmer suppliers we hear of funding (avoid penalty O/D rates...) and take what seems a high price now. Asset/LVR-wise Synlait an example of several we understand..

Fonterra happy for it is allowing suppliers to get cash, or is funding that, with out paying cash/oprational capital ...

We await the season change over/farm sale with shares...

We still hear of the one figure for land and shares... So the figure attributed for shares on the transfer will be interesting (and for $ per Ha values).

As always Henry - thanks for your comment(s). :-)

Waikato University agribusiness professor Jacqueline Rowarth said many farmers would have sold into the offer because they were cash-strapped.

"They have high feed costs and two years of low payout. A lot are feeling the impact of costs around sustainability - they're getting money out to put in feed pads and upgrade effluent ponds, rather than go to the banks."

- refer Mist's postings on such.....

Rowarth predicted the strong share price could present Fonterra with a supply risk. Farmers would switch to processors that offered a higher payout and did not require them to buy shares. Fonterra shareholders were "gritting their teeth" hearing about their company's investments in China and its programme to provide milk to schools, which would cost each farmer $2000 on average a year, while all the time the price they were being paid for milk was below the cost of production, she said.

http://www.stuff.co.nz/business/farming/dairy/8723201/Response-delights…

while all the time the price they were being paid for milk was below the cost of production

I seriously question that comment.

The elephant in the room for Fonterra shareholders is how much is it going to cost us to set up plants/joint ventures to process the milk in China, when they decide to do so? Silence is deafening on that one.

while all the time the price they were being paid for milk was below the cost of production

I seriously question that comment.

Therefore I can assume that the dairy industry cohort are paying their fair share of income tax which reflects the collective need of the nation's wellbeing.

I am sure the industry is paying tax as required by the IRD, Stephen. Added to the tax Fonterra farmers pay you can add in the $19m extra that Fonterra and Sanitarium will be spending on free breakfasts for schools, and don't forget to add in the current costs of the programme either. ;-)

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10886696

Hhmmm - don't get me started on Sanitarium - it is no doubt feeling the heat to meet it's charitable status obligations - not that others believe they do - Fonterra's tax status is beyond me - will someone enlighten me? Read article

Nevertheless, Fonterra accepts applications to supply milk from registered charitable trusts.

Mr Easton said the take-up of the original offer last year was very low but, given shareholders now had the ''clarity'' of a $7.92 share price, it made it much easier for them to decide. The Fonterra units were issued at $5.50.

''This is $500 million that's going to hit the New Zealand economy in one form or another. I guess it shows the flexibility TAF is offering Fonterra shareholders that they didn't have in the past and it's also something of a vote of confidence for the system.''

Given that there was scaling, there might be more liquidity in the market as those that really needed the cash - drought-stricken farmers - sold whatever shares that they had available, Mr Easton said.

http://www.odt.co.nz/news/business/258737/taf-will-put-500m-economy

''This is $500 million that's going to hit the New Zealand economy in one form or another...

Henry_Tull, the economy is awash with liquidity and nobody is willing to soak it up for profitable endeavour.

AMP made this comment in an article you linked on another thread.

Synlait Milk's announcement is the latest in a raft of technology companies signalling intentions to list, including SLI Systems, Wynyard Group and Serko. Mobile advertising company Snakk Media joined the NZAX earlier this year, while the Mad Butcher franchise has joined via a back door listing through Veritas Investments.

Last month, AMP Capital Investors (New Zealand) head of equity Guy Elliffe said there was a glut of capital raisings coming to market which would likely mop up a string of corporate and government bond redemptions.

NZ government debt redemption amounted to ~NZD 8.2 billion back in 15 April - there was nowhere to place the money so the foreign investor segment sold $KIWI via NZD/USD etc.

Hence our banks are making desparate offers of low borrowing costs.

Stephen, there are multiple millions of dollars needing to be spent by farmers nationwide in environmental infrastructure upgrades/policy requirements. Add to that the costs of feed as a result of the drought and increased overdrafts/borrowings. So it will be soaked up by banks and the farming servicing sector. Wether that is 'profitable endeavour' or not depends on your perception of it.

Is it coincidence that the 20% figure of farmers selling up to 25% of their wet shares, is also what is often spoken of as the percentage of dairy farmers who are in financially straightened positions?

So it will be soaked up by banks and the farming servicing sector. Wether that is 'profitable endeavour' or not depends on your perception of it.

CO, surely you do not expect the agricultural segment of this data release to explode over the next twelve months towards the NZD 60 billion level?

If more sheep farmers convert their farms debt will likely increase, as with increased irrigation uptake etc. One certainty I can give you is that I will not be contributing to any increase in ag debt figures. :-)

CO - why not see it as 'work needed doing', rather than 'dollars needing spent'?

It would be a win/win if young folk without skills did your riparian planting, and you fed/ boarded them while they gained skills, became part of society rather than becoming marginalised.

What would stop that, now. Let's see; Fear of the youngsters? Fear of being 'ripped off'? (by those with nothing?). Fear of rule-breaking?

Last time I checked, fear can be overcome by bravery. We have young folk through here all the time (wwooffers, admittedly more likely to start up the skill ladder a tad) and it's one of the good things.

Personally, we have always seen it as work needing doing, but it also does require dollars spent in order to comply with RC policies, especially effluent infrastructure that in SOuthland has to be designed by qualified engineers. Environmental work on dairy farms is not just about riparian plantings - that's the easy stuff. It is not what I am referring to - perhaps I should have clarified that. It is effluent infrastructure I was referring to. Over the years we have had the whole gamut of people help out- conservation corps, wwoofers, folks sentenced to community service, community groups etc. No fear here at our farm pdk.

Most farmers know major expenditure relating to effluent is coming up so budget for it. $150,000 for a starting price is something most farmers have to budget for. Though for some that will be harder than others.

#11 the guy obviously needed one of these....though the hole may have been a challenge...

http://www.youtube.com/watch?v=cDoRmT0iRic

Re 9 Denser living

Following the links it appears

The Manhattan development has 250-370 ft2 = 25-37 m2 units. Not really what I would call acceptable family living. The Broadway Stack development is 38,000 ft2 and contains 28 units = 135 m2 per unit, that is getting closer to something reasonable. Remember that we have in Auckland a lot of three betroom house just over 100 m2 that are grossly crowded. Eg an example that I came across recently- a three bedroom house occupied by 2 grandparents, mum dad and 5 kids plus an Auntie - 10 people. This sort of things is not uncommon. Walk round the subburbs and see how many garages are converted to extra sleeping or living areas. These families need a 5 or 6 bedroom house at least, probably well over 200 m2. There is no evidence in NZ that dense apartments are delivering this at a price affordable to this demographic. If we go down this path on the basis of the examples offered and past performance, we are headed for some shocking vertical slums.

Who ever said it was for families?

Apartments aren't for families.

Many chinese one child families live in an apartment.

regards

Many Chineese also live in 240m2 houses with their parents, children and a couple of nephews. Can't see them doing to well in a shoebox either.

Sure there is ideal and there is what you have. I think there is a "confusion" on expectations here.

regards

So where is a familly of 2 parents and 3 kids going to live in the brave new Auckland?

Wherever they choose and can afford. You can't legislate that every family of 5 must live in certain sized accomodation anymore than you can outlaw single people living in big family houses (like many do).

Some might choose a smaller cheaper apartment, some a big expensive apartment, some a fringe cheapo, some an expensive inner suburb, some Hamilton.

That's 2 more choices than they currently have in most areas.

#9 is of course a no-brainer. Factory produced housing components have been around since the 1870's (look at early Kauri Timber Co catalogues....) but the transition to producing sections is painfully slow (roof trusses, some pre-built simple walls, some exceedingly simple modules).

Benefits of real production-volume and high-design-quality builds of this sort would be:

- Real QC. On the factory floor. Instead of which we get 'Inspections' on site by underpaid, ratty, barely competent TLA staff, who do however have the fulll power to halt the job until that weather seal of bracket or widget is tweaked, adjusted, or otherwise have Yet Mo' Cost sunk into it. And the Next 'Inspection' will be by a different minion, with different ideas, but just as much Power to Obstruct.....

- Real assembly, by staff who can be closely supervised, timed, who use highly automated tools, and a whole lotta CNC wizardry. Instead of the slapped together on site approach, by drug-addled hammer hands, loosely supervised, but of course wearing HiVis, and wearing Approved Safety Hats (tin-foil lined on Karamea and Waiheke jurisdictions) and Steel-capped Boots. Talking around with earthquake repair guys, it seems that having floors 30-40mm out of level, gibbing ceilings that are the same out of square, etc, is par for the course in new on-site builds....

- Real design. Conduits and designated ducts for all services (black/grey/potable water, electrics of various voltages (solar, 12vDC for marine-style LED's, 400V or 230V AC for appliances, workshop etc), gas, refrigerant (for heat transfer from fridges, driers, hot water etc to where it's needed) and so on. Maintainability is just so poor (because not designed in) in most current housing. Doesn't need to be this way.

- Real cost advantages. High-volume, yet customised production lines. Low, but highly skilled, labour requirements. Low margin possible if enough volume passes through. Possibility of deals with financing to provide an end-to-end type cover, and cut out the plethora of middle layers (ranging from the TLA Pre-Consent Discussion session (un-needed), through architects (replaced by CAD design, imported electronically), quantity surveyors (replaced by a BOM), and of course those Hammer Hands (and their local Tinny House or Corner Dairy).

But this approach will be thwarted, obstructed and outright blocked by the usual suspects:

- TLA's and employee guilds, who are not gonna let the real 'inspection' pass out of their clammy ineptocratic hands, into whole-product factorys' certification....

- TLA's who see a luvverly lucrative revenue stream, produced by demanding Extra Time Everywhere at an Exorbitant Hourly Rate, threatened.

- Building Standards wallahs, who will have about as much to do with eventual housing quailty as happens with vehicles or boats (Peter Cresswell's favourite example)

- The materials cartel, who have a really nice lock of the individual-component market, and who will find ways to either take over or block any such real 'competition'

- I'm sure eager common taters can thinka more along these lines. I had a slightly different take on a similar topic, here.

So I have a confident Prediction.

Nice thought.

Won't Happen.

#9 "....but all the same no-one advocating density has yet shown that it can address the affordability issue except when the floor plans are tiny."

What exactly do you mean by "tiny"? What is the cutoff where people should no longer be able to chose what they live in? How does other peoples choice to live in something smaller and cheaper actually affect you?

Mighty River Power shares down to $2.39, this afternoon!

No need to wait 2 years for 4% bonus shares! Buy today and you will have got over 4% discount to list price!

Don't panic. By the time the real jewel Meridian is about to be flogged off, the market (ie. institutional investors with favoured status) will have been 'encouraged' to ensure the MRP share price is in good health.

That doesn't mean to say that this entire partial sell off of SOE's is not headed for the scrapheap unless of course, political ideology rather than financial acumen continues to have the ascendancy. Any rational investor has alarm bells ringing at the increasing risks related to energy stocks in NZ. Caveat emptor.

Indeedy. Every time Normal Russian opens his yap on the subject, or Shearer talks about the 'Lab-Green' approach to - well, anything, really - it just reinforces:

- the scary thought that we are headed for unapologetic political control of a major chunk of the economy - after all, as PDK et al like to remind us all - man-made energy lies at the root of a lot that we do. Yes, yes, I know that Crony Capitalism can be quoted as 'Just as Scary'. But being as how it's based on People who Actually Know how to run businesses.......

- the public perception that, electorally, there is no daylight between Labour and the Greens.

Vote Labour - Get Free Greens!

waymad,

I think you've made my case for me.

Mighty River Power has the same management running the company as they did two weeks ago, other than they are now paid a lot more between them. Their objectives now will unashamedly be to enrich the management first, and the shareholders second. Under the old model, lip service in theory had to be paid to consumers, although as we have learned, the companies gamed the system to charge all electricity at the most expensive price level of any unit of production. That system remains in place.

And its for an absolutely essential resource, as you note.

I do agree, that a market model should ideally be in place. See a note below on simple principles of how they may apply in my opinion.

It's probably a good thing when we have governments that don't believe that they know how to run things!!

An incompetent person is too afraid to make big changes, an arrogant person is too stupid to realise what they are doing is wrong. The don't you know who we are National party are clearly a reckless mix of both!!

National needs more sensible sheep farmers, with fewer bankers and treasury hacks on their ranks (less school teachers too? - they are never useful outside the classroom).

I wonder how Contact energy's shares will track up to Meridian's sale time...glad I sold my shares.....(or indeed might power).

Hopefully Labour and the Green's will come out with a more concrete policy around the "new" regulatory environment for when they win the election and the shares will be worthless.

regards

steven,

Will repeat for those who may suspect otherwise; that I am neither connected to the Labour or Green parties. However, it is fairly clear they do not wish to trash these companies at all. They don't seem to have agreed to Winston's buy them back strategy either. (I could go either way). They seem to have a couple of choices in principle on the generating side, in establishing a more functioning market than we currently have.

1) Determine a reasonable capital base for what the companies currently have, preferably without the bookkeeping revaluations Stephen Hulme has alerted us to. Allow a standard opex cost per ggw. Set a buy price allowing a return of capital of x%, where x is probably 6-8 ish if the companies are managed well.

2) Have a tender process for the volumes, times and geographies electricity is required. Lowest price wins. Hydro must be supplied unless a good reason not to.

Each version probably needs some exception management for circumstances like Tiwai Point or market mix; or an agreed extra payment for higher cost generation required to underwrite the no outages requirement. None of that is too hard.

I imagine on the retailing side; they would offer the electricity at largely their buy prices plus a trivial margin; and then let the retailers-existing and new- set their retail prices accordingly.

Either of these models should still deliver pretty good cashflow to whichever model- albeit almost certainly at a lower level than they have been used to over the last few years. I imagine the MRP float price already factored something like this in. The latest share price drop is likely to be foreigners generally getting out of Australia and NZ equities- I believe the two countries are now out of fashion.

MRP $2.37, went as low as $2.36... big losses in a just a few weeks considering everyone paid $2.50 for it!

Now the mum and dad's know why they never invested in shares before!

Brings back memories of Trust Bank's float...

#3

Read an article a while back. Talked about running water pipes under the tar seal and using the heat in the pipers to heat houses.

Also buildings above railways. The heat from the station is used to heat the buildings above.

I think there were more uses but can't remember off the top of my head

You have to be careful doing the math. I shunt heat around this place (4 optional flow-paths, all thermosyphons) but the EROEI is marginal when you start shifting heat further afield. Built areas are always ambiently warmer than the bare ground they were founded on, black-roof induction would probably be better......

Some proposals are just kook; there was one which envisaged cars spinning vanes on the middle of the highway, and generating off that. Two seconds though tells you the energy came from the tankful of gas, and was a mighty inefficient way of tapping it.

Since the California Democrats got the supermajority and could actually pass legislation altering the tax system, their problem is now the economy is doing too well and the state government is getting too much money (the risk being to splurge today rather than save for tomorrow).

http://www.theatlantic.com/politics/archive/2013/05/californias-new-pro…

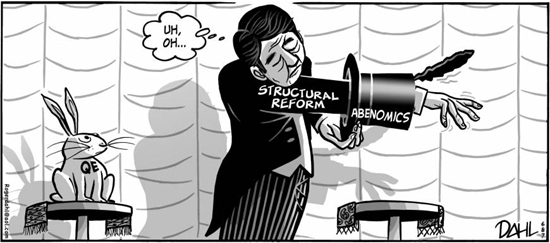

"Japan has painted itself into the mother all corners"

http://www.marketoracle.co.uk/Article40611.html

Excellent Top 10 David.

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.