Here's my Top 10 links from around the Internet at 10:00 am today. We now have a new Monday-Wednesday-Friday schedule for Top 10.

Bernard will be back with his version this Wednesday. We will have a guest posting on Friday.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

1. Calm before the storm

Nouriel Roubini doesn't buy that Europe is on a sustained path to recovery. Dr Doom says the signs are evident they may be in for another rough period.

Actually, Mario Draghi at the ECB seems to agree.

Last Thursday, he said: "The risks surrounding the economic outlook for the euro area continue to be on the downside" in the press conference after the ECB's 'no change' decision.

Given Roubini's track record, his warning is worth more than a passing note. More at Project Syndicate:

The ECB is unwilling to be creative in pursuing policies – like those embraced by the Bank of England – that would ameliorate the credit crunch. Unlike the US Federal Reserve and the Bank of Japan, it is not engaging in quantitative easing; and its “forward guidance” that it will keep interest rates low is not very credible. On the contrary, interest rates remain too high and the euro too strong to jump-start faster economic growth in the eurozone.

In the meantime, austerity fatigue is rising in the eurozone periphery. The Italian government is on the verge of collapsing; the Greek government is under intense strain as it seeks further budget cuts; and the Portuguese and Spanish governments are having a hard time achieving even the looser fiscal targets set by their creditors, while political pressures mount.

And bailout fatigue is emerging in the eurozone core. In Germany, the next coalition government looks set to include the Social Democrats, who are pushing for a bail-in of the banks’ private creditors, which would only exacerbate balkanization of the eurozone’s banking system; and populist parties throughout the core are pushing against bailouts for banks and governments alike.

So far, the grand bargain between the core and the periphery has held up: the periphery continues austerity and reform while the core remains patient and provides financing. But the eurozone’s political strains may soon reach a breaking point, with populist anti-austerity parties in the periphery and populist anti-euro and anti-bailout parties in the core possibly gaining the upper hand in next year’s European Parliament elections.

If that happens, a renewed bout of financial turbulence would weaken the eurozone’s fragile economic recovery. The calm that has prevailed in eurozone financial markets for most of the past year would turn out to be only a temporary respite between storms.

2. Artificial limits

If you want to see the politics of artificial supply at work, you need only look at the politics of the Auckland Rural-Urban Boundary. If it wasn't the Auckland Council involved, the Commerce Commission would have a slam dunk case for anti-competitive behaviour.

But politics is involved. Those who bother to vote will be the NIMBYs who want to protect these gains, gains it must be said resulting from regulatory arbitrage. If you make silly rules, it isn't surprising that some people move to profit from them.

Take a look at the areas Auckland Council is proposing to open up - over the next 15 years. They are tiny in the context of what could be made available. But land prices would be risked, resulting in voter ire. In the meantime, we are pushing down the track for outcomes like #9 below.

3. Uncertainty bad for gold?

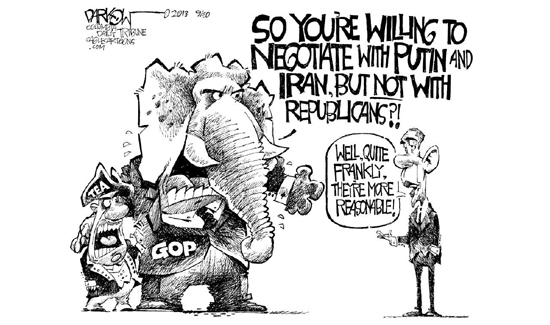

I must admit, I am a bit puzzled: with the stupid hostage-taking attempts by none other than the US House of Representatives, you would think that would be considered by markets world-wide as highly risky and unsettling. After all that is what Tea Party Republicans are trying to do - create a crisis.

But assets that benefit from uncertainty - like gold - are falling in price, not rising. Why? Izabella Kaminsky tries to answer in FTAlphaville:

Why is gold falling in that context? Probably because it’s the surest sign of all that the economy isn’t actually what they think it to be. That the problem isn’t so much debt or Obamacare but rather an abundance of overly hierarchical claims over the economy relative to the actual productive capital they represent.

And on that basis, if the John Galts of America were to up and leave, who’s to say they wouldn’t be doing the US a favour? It’s a bluff they simply cannot win, largely because default doesn’t hurt those lower down the chain half as much as it hurts those at the top.

Furthermore, if government payments were to be suspended, people wouldn’t think ‘wow, we must buy all the gold we can’. People would much more likely liquidate assets (for paper dollars) to buy the products they need until this fiasco is resolved. It might, consequently - shock, horror - even be marginally uplifting for the economy.

4. Today's raw market data ...

A quick new-week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8307 | 0.8292 | 0.7987 | 0.8175 |

| NZ$1 = AU$ | 0.8818 | 0.8827 | 0.8682 | 0.8039 |

| TWI | 77.15 | 76.83 | 75.48 | 72.97 |

| Gold, US$/oz | 1,310 | 1,316 | 1,390 | 1,774 |

| Dow | 15,071 | 14,962 | 15,058 | 13,561 |

| Copper, US$/tonne | 7,148 | 7,216 | 7,192 | 8,183 |

| Volatility Index | 16.74 | 17.67 | 15.63 | 15.11 |

5. Rumour vs fact

Conspiracy theorists got very excited the other day when it was reported in the South China Morning Post that China had bought an enormous area of land in the Ukraine - supposedly 3 million hectares, and area the size of Belgium.

Only problem is that its not true. Firstly, it was 3,000 hectares (!), and secondly there is to be no sale of land - it's against Ukrainian law, it seems. But the story got wide currency, mainly because people want to believe "the Chinese are taking over the world" and can't be bothered fact checking - perhaps because that would undermine their bias.

6. Essential or inimical?

Reuters analyst Zachary Karabell has penned a thoughtful piece on the risks of a US Federal government debt default:

What’s going on in the United States has nothing to do with insolvency. This would be a default of choice, not of necessity. The reason why U.S. bonds are so attractive may in part be a false sense of security, but it is also a reflection of genuine U.S. economic strength compared to almost anywhere in the world. The output and consumption of the United States is largely not a product of the U.S. government, and would not radically change because that government made the monumentally odd and foolish calculation to default on debts that a small portion of the government does not respect.

Even with a dysfunctional government, it’s a good bet that the U.S. will generate sufficient growth compared to the rest of the world. The amount currently required to service the debt of the U.S. government is in fact lower than at any point since the 1980s, because interest rates are so low. And there is no question that the economic output of the country allows for that debt to be serviced, regardless of whether Washington is functional.

That is why the consequences of a default may not be what we imagine. Yes, such an event would likely trigger a financial market panic, and yes, rates would spike in response, forcing a series of consequences as those holdings were marked down to reflect changed market prices. But very quickly, another reality could take hold: because the crisis is purely self-inflicted, the ability of the United States to generate sufficient output to meet its obligations would not have been altered.

What would also quickly become clear is the disjuncture between government on the one hand and “the economy” on the other. For now, we have a tendency to conflate the two, and assume that government is either essential to economic growth (a classic Democrat stance) or inimical to it (a typical Republican approach). A default, or even the threat of one, might expose the degree to which government is one factor among many in the complicated world of economic affairs, and not nearly as powerful a factor as enemies or advocates believe.

It would, of course, be foolish to rest on the argument above and dismiss the risks. But it is wrong to assume the worst just because the worst is so easy to assume. Tea Party nihilism will lead us nowhere good, but the conviction that the actions of Washington are the primary pivot of both the global financial system and American economic vitality is both incorrect and limiting. If any good comes from this crisis, the waning of that conviction would be welcome indeed.

7. We know what you like

Potato and corn chips have been around for quite a while, so it is natural I suppose that at least one manufacturer did some intensive research into what makes a product people want to buy. All the same, the savvy nature of the research is impressive. More from the NYTimes: (HT Bernard.)

That melting sensation

When fat-laden snacks melt in the mouth, the brain thinks that the calories have disappeared, too, in what food scientists call “vanishing caloric density.” This tends to delay the feeling of fullness.

The feeling of fat

Mr. Witherly says that to maximize the pleasure in snacks, the goal is to deliver half the calories through fat, and Nacho Cheese Doritos hit this mark precisely. Scientists say fat is experienced not as a basic taste like sweetness or bitterness, but rather as a sensation, with a mouth feel that has all the power of sugar or salt. Fat in food is detected by the trigeminal nerve, which conveys the signal straight to the brain’s pleasure center.

8. Job gains

Small business in the US is doing the business, it seems. In September, firms with fewer than 20 employees added 54,000 new jobs. Firms with fewer than 50 employees added 74,000 new jobs. These are increases. In the absence of official data, we are going to have to rely on other surveys like the ADP one to get a fix on American employment trends.

To get a sense of how much that is, the last official Non-Farm Payrolls report had a jobs gain of about 170,000 over the whole economy, all firms.

The Fed may be uncomfortable with relying on non-official data however. More from the WashingtonPost who reported on the whole ADP survey (for small, medium, and large firms).

“While job growth has slowed, there remains a general resilience in the market,” Mark Zandi, chief economist of Moody’s Analytics, which helps generate the report, said in a statement. “Job creation continues to be consistent with a slowly declining unemployment rate.”

Once again, it was service-providing firms, as opposed to those producing goods, that continued to buoy the economy last month, adding 147,000 jobs compared to 19,000 added by goods-producing businesses. Nearly half of those services-sector workers were hired by small businesses.

9. Trapped with no hope of buying

This is why we should not follow British planning models. They are left with 'affordability' meaning micro. Now offshore investors are rushing in to supply apartments smaller than one third of a squash court to 'generation rent'.

If you constrain land supply, you end up with stupid consequences. We are taking more steps toward that with 'affordable' meaning social housing - which in turn means all other ratepayers/taxpayers need to pay more to fund it. We desperately need 'affordable' to mean 'there are houses 25-29 year olds can afford to buy'. If we stay on our English-centric model, we can see the future there. Reading this Channel4 story is frightening.

Generation rent is downsizing. And as demand for smaller, cheaper accommodation grows, investors and entrepreneurs are rushing to cash in.

"We basically take a property from a landlord, pay him a long-term guaranteed rent and then sublet it on a room by room basis. That’s how we make our margin," Kim Stones explains.

Kim’s strategy is to adapt living spaces in order to maximise profits when the property is sublet. He rents three bed properties from landlords and sublets them as five individual rooms by turning sitting rooms and lounges into bedrooms. He is at pains to point out that he follows all relevant regulations.

"We’ve got 23 rent-to-rents," says Kim. "Our target is a minimum £400 a month profit on any property, and we do have properties that make £1000 net profit a month."

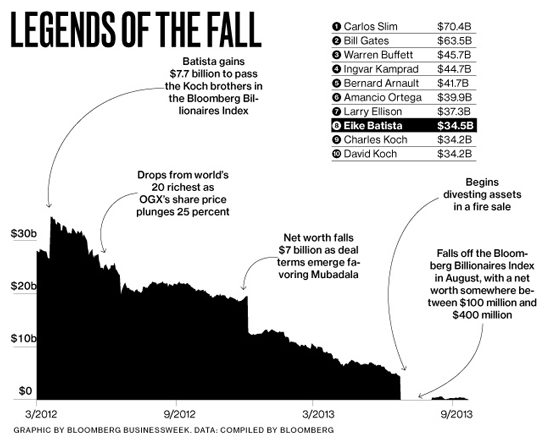

10. How a Brazilian lost US$34.5 billion - in one year

Brazil has had its own 1984/1987/1989 experience. A new president ("Lula" opened up the country after years of stifling central control, and 'things boomed'. A young and connected Eike Batista become unbelievably wealthy investing in gold and then other resources. By 2012 he was worth US$34.5 billion. Today he may be dead broke. BusinessWeek has the story, and it is quite a story:

Brazilian growth slowed in 2012, and Batista’s fortunes followed. On June 26, OGX announced that well pressure at the Tubarão Azul field had faded and that “ideal” production at its first two wells would be about 5,000 barrels a day—75 percent less than expected. It was a number that could not be spun. Shares fell about 45 percent in two days, and OGX bonds began a free fall as analysts cut ratings.

It only got worse. OGX brought in a new CEO who hired U.S. oil-field services company Schlumberger (SLB) to review the mountain of data from its drilling campaign, says a person who helped set up the contract but isn’t authorized to comment on it. An eight-month study, says this person, showed the wells were basically duds. With that knowledge, OGX would announce it was abandoning a group of fields, turning back some of those expensive leases to the government. The well that started at 15,000 barrels a day would be shut in 2014. If OGX fails to pay off its $3.6 billion in bonds it would be among the largest corporate defaults in history.

11. Today's quote

"Someone stole all my credit cards, but I won’t be reporting it. The thief spends less than my wife did." - Henny Youngman

12 Comments

A lovely rant by David Stockman, much better than the usual pap about the US:

http://www.zerohedge.com/news/2013-10-05/david-stockman-explains-keynes…

"Some other things were rising smartly during the last quarter century, too. The Pentagon budget was $450 billion in today’s dollars during the year in which the Berlin Wall came tumbling down.

Now we have no industrial state enemies left on the planet: Russia has become a kleptocracy led by a thief who prefers stealing from his own people rather than his neighbors; and China, as the Sneakers and Apple factory of the world, would collapse into economic chaos almost instantly---if it were actually foolish enough to bomb its 4,000 Wal-Mart outlets in America.

Still, facing no serious military threat to the homeland, the defense budget has risen to $650 billion----that is, it has ballooned by more than 40 percent in constant dollars since the Cold War ended 25 year ago"

and

"So we can summarize the last quarter century thus: What has been growing is the wealth of the rich, the remit of the state, the girth of Wall Street, the debt burden of the people, the prosperity of the beltway and the sway of the three great branches of government which are domiciled there---that is, the warfare state, the welfare state and the central bank.

What is flailing, by contrast, is the vast expanse of the Main Street economy where the great majority has experienced stagnant living standards, rising job insecurity, failure to accumulate any material savings, rapidly approaching old age and the certainty of a Hobbesian future where, inexorably, taxes will rise and social benefits will be cut."

and this, hello RBNZ, are you there?:

" Certainly it did not involve worrying whether the inflation rate was coming in below 2 percent---the current inexplicable target of the Fed which Paul Volcker has rightly pointed out amounts to robbing the typical laboring man of half the value of his savings over a working lifetime of 30 years."

From the latest census , it is reported that the NZ population has grown by 214 000 since the previous census , 7 years earlier ...

... and given the current state of the housing market , has the nation not built enough extra houses to cater for this small increase , over 7 years ?

For the politically minded , this population increase has necessitated the introduction of at least one new electorate seat ( probably in Sth Akld ) in the 2014 election ..

Stats nz have also released changes in population by current electorate boundary.

#9 - inevitable - it's been the staple of the hotelling industry for a decade or more:

- the wotif's and lastminute's of the world buy 10-40% of your cheapest and most unattractive rooms for a given day. Your REVPAR goes up, manager happy.

- wotif and lastminute then spruik the rooms to any old lodger via the Interwebs. There is, mais naturellement, a Margin involved.

- risk is all outsourced.

- To the extent that those rooms remain untenanted, you as the hotel save on R&M and immediate costs.

- you as hotel happy. Wotif etc happy. Buyers none the wiser. Everyone happy.

I suspect this is called 'Capitalism'. It's actually a wonder it hasn't happened sooner.....

#2 - Glad to see you taking a swipe at the zonerators and plannerizers and the untold economic harm they wreak. Reading the delicious Q+A on the linky, It strikes me that a leetle Alternative Answer series is in order:

Q My land is located inside the RUB investigation area. What does this mean?

A - You are gonna be Seriously rich if'n yez play your cards right, little landowner. Depending on your tax arrangements, you can expect a Rural-to-Urban price multiplier of at least 10, perhaps tax-free. Furthermore, your newly minted 'wealth' has now instantly transmitted to all adjacent existing land prices, because your 'new' land price is now the floor under everything contiguous. You've just made a Lotta folk (as well as yourself) Richer. Give yerself a Big Hug. You've Earned it.

Q. My land is located outside the RUB investigation area. What does this mean?

A. Stiff bikkies, little landholder. You are condemned to Rural Rustication for another decade or two, while you watch your esteemed neighbours just over the fence who are in the RUB Investigation Area, get Seriously Rich (see Q1, above). Patience is a Virtue, and you'll need plenty of that if yer wanna change things.

Q: When will land within the RUB be released for development?

A. Whenever the landowner gets around to it. After all (see 1) above) with prices inflating at 15% per annum, they only haveta hold on to it for another 6 years and it will have doubled. Why wouldn't cha' wait?

Q How will infrastructure be provided to accommodate this level of growth?

A. through Structure Plans and a whole lotta Council overhead, funded by Development Contributions, Levies, Fees, Charges and other not-rates cost imposts on the landowners, developers, and anyone else silly enough to walk into our financial snares (See Development Contributions Policy. Take a lawyer). Oh, you mean, who Eventually pays for all this? Gosh, we don't know, actually. We have their money, we've spent it, we expect the free market to come up with affordable houses, and a pony for every deserving youngster. Their problem, not ours.

Q. How many people are expected to live in these areas?

A: "The scale of Auckland's growth challenge is huge. Auckland is projected to need 400,000 new dwellings by 2040 to accommodate an additional million people.

In the greenfield investigation areas in the south we are investigating opportunities for approximately 55,000 new homes in the greenfield areas, and in the north and west, 35,000 dwellings that will be contained in a new 30 year Rural Urban Boundary."

I kid thee not: Auckkand needs 400K houses within 27 years, and we supply 90K in this Plan. That's why we employ all these expensive Plannerizers and Zonerators. Who else can tackle this Advanced Mathematics?

Rethink - seems there aint gonna be no million more people in Auckland in the foreseeable future. Will that mean that there will be demand for yet more migrants, god I hope not, it's time for a cup of tea and a discussion about how many people this country needs.

What is interesting is how a discussion about "basically" the same topic in NZ and AU takes such different forks in the road

A proposal now gaining traction is to charge a $50,000 entry-fee to migrants with immediate focus on asylum seekers who pay huge amounts to people-smugglers to come in the back door - read the article

http://www.theaustralian.com.au/national-affairs/policy/senator-elect-d…

The state government in WA is cracking down on 457-visa workers working in the mining industry, starting from January 1 2014 will charge these temporary migrants $4000 pa for each child for their education. One Irish lady was on the radio complaining bitterly that it will cost her and her husband $20,000 a year for their 5 children.

Tell ya. They are toughening up over here

But read the additional within the link above where asylum-seekers are lobbing in via boat, go through a 10 day medical check, at no cost, and the women are demanding breast enhancements and IVF treatment and dental work, etc on taxpayer-funded medicare

#9..another symptom of the global property ponzi scheme. Essentially the younger generations are being held hostage by the 'entitled generation' that have the numbers, the vested interests and the political suppression to continue to hold a boot against their necks and demand monopolised rentier payments for basic human shelter.

It's a financial apartheid if you will and we have to sit at the back of the bus.

To add insult to injury the misallocation of capital away from productive sectors further disenfranchise the younger generations from meaningful employment and community integration. If you're 'lucky' you get to buy the housing equivalent of a rusty, hand built Humber Eighty health hazard and spend the next 30 years paying for it unless you can flip it to the next greater fool before it falls over in the next earthquake.

From Dr Michael Hudson's website, The Global Property Ponzi Policy. Interview begins at the 12 min mark:

http://michael-hudson.com/2013/10/global-property-ponzi-policy/

The UK housing policy ‘Help to Buy’ – a 15% underwriting of loans under £600,000 is a technique to re-inflate land prices. A 15% rise will bail out the bad loans UK banks have made. Meanwhile the tax dodging continues globally as property speculation is ignored.

No doubt the property spruikers and their enablers will now howl in protest and espouse their own magnanimous benevolence towards generously at housing the tax paying 'proletariat' and justify their subsidies, handouts and tax free capital gains while they sink a generation and an economy.....no doubt because you deserve it? True champions.

The simple answer is just to put interest rates up. Trouble is this is very hard on those who have just bought. The effect of higher interest rates is higher cost of borrowing but lower house prices. Falling house prices just upsets everyone who owns a house and causes governments to fall. There is no easy answer.

Whoever overwrote the photo in '2', wasn't a journalist. I hope. One presumes a spin-doctor of some hue?

I don't see any 'land-bankers'. They are folk who hold land to be high-density filled, at some later date.

Those bigger properties look to be built-on, used, and much more future-resilient than the sardine-sprawl.

Looks like a different kind of bank there too, a topographical one, but what the hey, if you think in flat-earth terms, it probably looks flat to you too. You have to be in denial to support being in denial, to........... starts to look stupid, after a while.

9 - you've had enough here, David, to know that ebvery house has a bigger footprint that just itself. If you are going to make statements about 'land supply', you can't claim ignorance of what I've put up. You have to identify the displaced land and activity, and guarantee future sustainability of that which you propose. This is a finite world, and country. Sorry about that.

#9. UK. Microhousing !!!! Much more of this and they will need to sleeo standing.up ! Only real answer is to have fewer people there. Here too.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.