By Peter Redward

The Reserve Bank of New Zealand holds its next Monetary Policy Statement this Thursday.

At present the Overnight Index Swap market is pricing a 25bp rate hike, bringing the Official Cash Rate up to 3.25%.

We expect the Reserve Bank to hike the Official Cash Rate in line with the OIS but then to signal a pause, resuming the rate hiking cycle from the December Monetary Policy Statement, at the more leisurely pace of 25bp per Quarterly Statement.

In the 24 April News Release accompanying the Reserve Bank’s decision to hike the OCR, Governor Graeme Wheeler outlined the rationale for normalizing policy settings.

Activity is expected to remain strong, supported in part by construction [Christchurch] and aided by robust net immigration, leading to pressure on capacity and upward pressure on the price of non-tradable goods and services.

Overall inflationary pressures remain moderate, due in part to low import price inflation and the strong New Zealand dollar, but as the Reserve Bank’s staff believe that the exchange rate is at an unsustainable level, at some point the disinflationary effect of the strong New Zealand dollar will ease.

Consequently, it is necessary for the Reserve Bank to “raise interest rates towards a level at which they are no longer adding to demand.”

However, the Reserve Bank also opened the door to a potential pause in the tightening cycle by adding that “the speed and extent to which the OCR will be raised will depend on economic data and our continuing assessment of emerging inflationary pressures, including the extent to which the high exchange rate leads to lower inflationary pressure.”

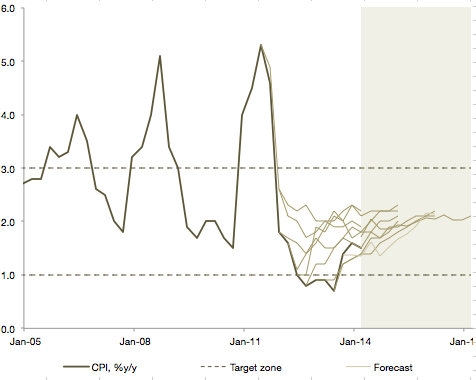

Much has changed since the Reserve Bank finalized the forecasts contained in the March Monetary Policy Statement on 26 February. Inflation has undershot the Reserve Bank’s expectations while indicators suggest that the peak surge in activity is now behind us and the tailwinds supporting growth are dissipating. Over the past three years the Reserve Bank has regularly over-predicted CPI inflation.

The Reserve Bank’s forecast errors have been largely attributable to weakness in the price of internationally traded goods and services, coupled with the ongoing strength of the New Zealand dollar. This proved to be the case yet again in March. Headline CPI inflation rose by just 0.3%q/q (1.5%y/y), below the Reserve Bank’s expectation of a 0.5%q/q (1.7%y/y) gain.

At present, the Reserve Bank is projecting a rise in the CPI of 0.5%q/q in June, bringing inflation to the mid-point of the Reserve Bank’s target zone of 2%y/y. However, the forces that drove CPI inflation down in March have, if anything, intensified, with international prices for goods and services weak and the value of the trade weighted New Zealand dollar some 2½ per cent above the Reserve Bank’s projections on an average basis this quarter.

Consequently, we see scope for inflation to yet again under-shoot the Reserve Bank’s forecasts, rising by just 0.1%q/q, bringing the annual rate of inflation to just 1.5%y/y. Probably the most significant economic development since the last Monetary Policy Statement has been the 25% plunge in global dairy product prices. The sharp fall in international dairy prices, compounded by the strong New Zealand dollar, has led Fonterra to cut this season’s payout 20c, to NZD 8.40/kg, and to announce an initial payout for the 2014/15 season of NZD 7/kg.

At face value this will withdraw up to NZD 2.3bn (1% of GDP) from the economy, although due to increasing production this probably over-states the drag on activity. Along with weaker dairy product prices, the economy is now contending with a meaningful rise in the cost of capital.

Since the end of 2013, floating rate mortgages have risen 0.4%, to 6.24%, while the one year fixed rate mortgage rate has risen 0.33%, to 5.75%.

Should the Reserve Bank hike the OCR by a further ¼ per cent at this month’s Monetary Policy Statement, our back-of-the-envelope calculations suggest that policy tightening will withdraw roughly NZD 1bn (0.5% of GDP) from households over the coming year, with perhaps somewhere in the region of NZD 0.5bn (0.25% of GDP) withdrawn from agricultural and corporate borrowers.

Should the Reserve Bank hike rates by 2% over the coming two years, in line with comments made in the March Monetary Policy Statement, our back-of-the-envelope calculations suggest that this could pull somewhere in the region of NZD 4.6bn (2.1% of GDP) in spending from the economy.

While the near-term impact of tightening in monetary policy is being mitigated to some extent by a shift in the structure of the household mortgage book towards short-dated fixed rate loans, the shape of the yield curve leaves borrowers with nowhere to hide as the Reserve Bank pushes rates higher.

In light of weakness in near-term inflationary pressure we believe that the Reserve Bank has the option to pause to allow the economy to digest the recent decline in dairy product prices and the rise in interest rates.

However, we agree with the Reserve Bank’s assessment that the New Zealand dollar is unsustainably strong and as it starts correcting – most likely driven by a re-assessment of ultra-loose US monetary policy settings – the benefit of disinflationary pressure from international goods and services prices will dissipate.

In order for the Reserve Bank to stabilize headline CPI inflation near the mid-point of the inflation target and prevent the economy from undergoing a more pronounced boom-bust cycle, it is likely that any pause in hiking interest rates will be temporary and we expect the Reserve Bank to resume its tightening cycle before year-end.

Peter Redward is Principal at Redward Associates.

5 Comments

And here's another view;

"Ahead of the Reserve Bank’s Monetary Policy statement (MPS) being released tomorrow, PwC Director and economics expert Chris Money says, “We expect the RBNZ to hike the OCR by another 25bps (to 3.25%) but revise lower its GDP and inflation forecasts allowing it to also revise lower the pace of future hikes.

“The March MPS was extremely ‘aggressive’ in regards to its projected OCR track. Those forecasts helped to fuel a materially stronger NZD than the RBNZ expected. Independently, dairy prices have dropped without any material adjustment in the currency. The divergence between these two is extremely important due to the impact they can have on rural incomes. Lower rural income/spending and investment suggests lower GDP growth (and related demand-side inflation).

“The higher dollar has also helped suppress inflation and so these forecasts should also be revised a touch lower (see charts below). Taken together, less imminent inflation and inflation pressures (albeit due to a strong NZD) may not require as many OCR hikes as they previously indicated.

“From a market perspective, short-term swap rates have fallen below a level we believe is economically/fundamentally justified when considering the likely path of the OCR in coming years.

“Accordingly, short-term swap rates could actually rise after the meeting; however we expect a reasonably limited reaction in interest rate markets. The more interesting reaction to watch will be the currency given the RBNZ’s discomfort with the NZD’s level now that dairy prices have decreased. The RBNZ want a lower currency and we are looking for them to give this some ‘air time’,” concludes Mr Money.

What is a neutral OCR in the post GFC1? http://www.nzherald.co.nz/personal-finance/news/article.cfm?c_id=12&obj…

or should that be in the pre-GFC2 era?

Another one of kimy's one-liners

What were the clear deflationary signs everywhere? I missed them. I must've blinked.

The GFC is now 6 years old. The low interest rates safety-net in the Northern Hemisphere is still in place. EU has gone into over-drive. They are so terrified of deflation (the financial elites don't want to take a haircut) they continue to pump their economy up and up and up trying to generate inflation. Well, believe it or not, there hasn't been any deflation in New Zealand that I have seen, so no need to reach for air-hose here

The opposite

The single largest sector of the New Zealand economy is the property sector, where inflation is running in excess of 10% per annum. That's not deflation. It does show where the power structure is and who the powerful are

The inlfation rate is 1.5% currently.

What would we want this reduced to? 0.7% ?

What about 0% inflation? Would that be a good thing?

Economists soften their stance

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11271427

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.