Consumer spending is the meat-n-veg of economic growth but doesn't get the attention it deserves because of the cameo performances regularly put on by the likes of the housing market and dairy product prices.

The Reserve Bank and the economic forecasters in general are predicting that consumer spending growth will slow over the next year and not improve thereafter.

This view is the result of an excessive focus on the fall in dairy farm incomes and insufficient focus on the boost to consumer spending from the fall in interest rates and the surges in immigration and net migration.

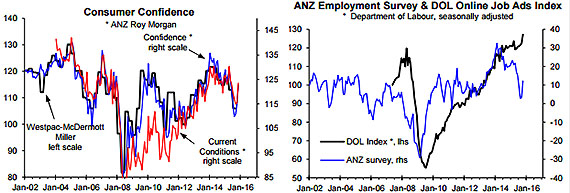

Sound and balanced analysis of the drivers of consumer spending points to stronger not weaker growth ahead, with this view starting to get support from the leading indicators, like the ANZ Roy Morgan monthly consumer survey.

If the Reserve Bank and economic forecasters in general can't predict consumer spending growth reasonably accurately, they can forget about being able to predict the likes of the unemployment rate, inflation and interest rates.

Even the Reserve Bank has an atrocious track record at predicting interest rates.

The economic forecasters are too pessimistic about consumer spending prospects

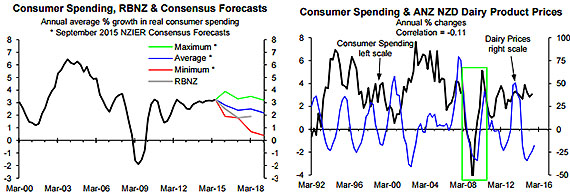

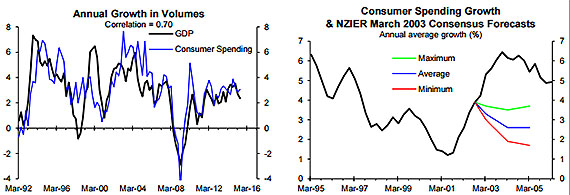

Once a quarter NZIER surveys nine of the economic forecasters including the Reserve Bank and most of the bank economists and supplies the results in the Consensus Forecasts report (see the link below for the latest edition). The consensus or average view of the nine economic forecasters surveyed by NZIER is that consumer spending growth will slow from 3.1% in the 2014/15 March year to 2.8% in 2015/16 and 2.4% in 2016/17, improve marginally to 2.5% in 2017/18 and then slow to 2.2% in 2018/19 (see the blue line in the left chart below for the consensus or average predictions for consumer spending growth).

The left chart shows annual growth in the volume of consumer spending (e.g. growth in the number of TVs and pork chops sold) as opposed to growth in the value of spending. Consumer spending includes spending at retail stores by individuals (not businesses) plus spending by individuals on a wide range of other non-retail goods and services (e.g. insurance, healthcare, travel, etc.). NZIER also releases the maximum and minimum forecasts for each of the March years by any of the nine forecasters (see the green and red lines, respectively, in the left chart below that also includes the Reserve Bank's forecasts from the September Monetary Policy Statement).

The economic forecasters and especially the Reserve Bank, that is more pessimistic about consumer spending growth prospects than are the nine forecasters on average, are assuming the fall in dairy farm incomes will make a sizeable negative contribution to consumer spending growth over the next year. In general they expect the fall in dairy farm incomes to more than offset the stimulus from a sizeable fall in interest rates, the surge in net migration that is adding almost 70,000 to the population per annum and house price inflation that should remain well above 10% next year.

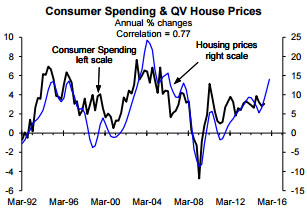

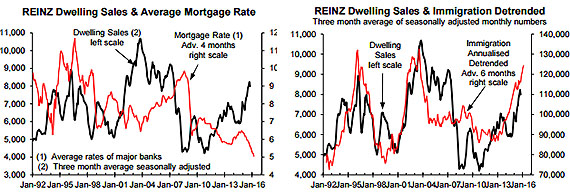

By contrast, the reasonably high positive correlation between consumer spending growth and house price inflation shown in the adjacent chart starts to shed light on what the key drivers of consumer spending growth are. Interest rates and immigration are the major drivers of cycles in existing house sales, as shown in the two charts below. The left chart shows the average mortgage interest rate offered by the major banks advanced or leading by four months, with interest rates being the most powerful driver of cycles in the number of house sales. The right chart shows immigration advanced or leading by six months to be an important secondary driver of house sales. Immigration is secondary in the sense that if interest rates and immigration point to different outcomes for house sales, house sales will head in the direction interest rates are predicting, but major cycles in immigration still have a sizeable impact on house sales.

The 1 October tax changes and the 1 November tightening of lending restrictions for Auckland investors may temporarily offset the stimulus in the pipeline from the fall in interest rates over the last four months and the resumed surge in immigration. But my best guess is that there will be resumed upside in house sales early next year, while house price inflation follows the number of house sales and hasn't fully reflected in the increase in sales so far, as covered in the Housing Prospects reports.

My point isn't that house prices are the key driver of consumer spending, but rather that interest rates and immigration (or net migration that also includes the impact of fewer Kiwis emigrating currently) are the key drivers of both house price inflation and consumer spending growth. So even if the tax changes and LVR restrictions slow national house price inflation temporarily/slightly, the fall in interest rates and stronger population growth should overpower the negative impact of the fall in dairy farm incomes and drive stronger growth in consumer spending. This is an idea that has lots of support from the historical experience and is starting to gain support from the leading indicators (see the rebound in the ANZ Roy Morgan monthly consumer surveys in the left chart below and the improvement in the leading indicators of employment in the right chart below).

My assessment of the key drivers of consumer spending leads me to expect growth to improve not slow below average as the economic forecasters are predicting and my view is starting to gain support from the relevant leading indicators. If you want valuable insights into prospects for consumer spending and the economy more generally rather than some of the half-baked ideas the economic forecasters come out with too often, you need to read our monthly economic reports.

Implication of awakening the slumbering giant

Relative to the contribution it makes to economic activity or GDP (59% in the 2014/15 June year), consumer spending doesn't get enough attention. The left chart below shows a reasonably high correlation of 0.70 between consumer spending and GDP growth since 1992, but the correlation is much higher at 0.86 over the last 10 years compared to a maximum possible 1.0 (i.e. 0.86 is like getting an 86% mark in an exam). Consumer spending is a bit like the slumbering giant of the economy. It doesn’t do the cameo performances the housing market and dairy product prices are renowned for and that get them lots of media attention, but it is the meat and vegetables of economic growth. Consequently, if the economic forecasters can't predict consumer spending reasonably accurately they can forget about being able to forecasts GDP growth, the unemployment rate, interest rates and the exchange rate.

The analysis in our housing and economic reports points to reasonably strong parallels between 2016 prospects and what happened in 2003 when consumer spending and GDP growth last performed strongly. The strong growth in 2003 was preceded by a sizeable fall in interest rates, high immigration/net migration and a large fall in dairy product prices (i.e. there are strong parallels between the performances of the key drivers of economic growth leading up to the strong growth in 2003 and what they have done recently). And just as the economic forecasters are currently predicting slower growth for consumer spending, in March 2003, on the verge of strong growth, the economic forecasters surveyed by NZIER were on average predicting slower growth for consumer spending (blue line, right chart below). Even the most optimistic of the forecasters surveyed by NZIER in March 2003 wasn't predicting the sharp improvement in consumer spending growth that occurred during 2003 (green line, right chart), which is also similar to the current situation (see the green line, top left chart on page 2).

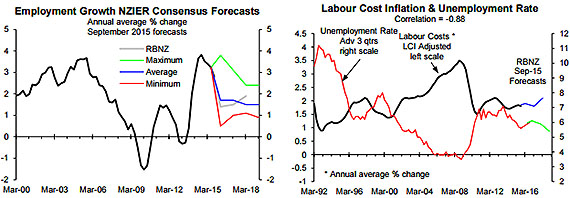

If consumer spending and GDP growth turn out to be significantly stronger than the economic forecasters are predicting (setting aside any temporary setback from drought this summer), employment growth will be stronger than they are predicting (see the left chart below for the consensus and Reserve Bank employment growth forecasts). The unemployment rate will fall significantly more than the Reserve Bank is predicting and productivity-adjusted labour cost inflation will increase more (right chart below).

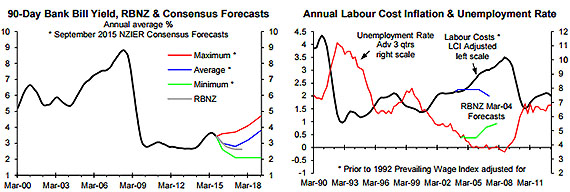

And interest rates will increase more and earlier than the economic forecasters are on average predicting (blue line, left chart below for the latest consensus forecasts), while the Reserve Bank's interest rate forecasters will prove to be well off the market again (see the gray line in the left chart below for the Reserve Bank's latest predictions for the 90-day bank bill yield, which are effectively OCR predictions).

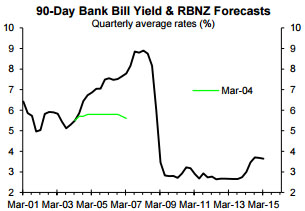

Every now and then my old employer the Reserve Bank likes to remind us that it has a more accurate forecasting track record than the forecasters in general, but this is like a 3/4 rotten apple skiting about being ripe for eating. Back in March 2004, after Governor Bollard delivered the first of 13 OCR hikes, the Reserve Bank was predicting upside in the unemployment rate and downside in the productivity-adjusted measure of labour cost inflation, when the opposite happened (right chart below). The Reserve Bank was also predicting almost no further upside in the 90-day bank bill yield, which means it was predicting no more OCR hikes on the eve of massive upside in interest rates (2nd left chart below).

At the moment it is encouraging to see some divergence in views on interest rates prospects from the bank economists (i.e. Westpac and ASB, bizarrely based on my analysis, arguing for several more OCR cuts, while ANZ and BNZ are urging against another cut this year). But what is missing are predictions that the OCR cuts are misguided because they are based on an excessive focus on a factor of no relevance to medium-term inflation prospects (i.e. the fall in dairy farm incomes), meaning there is a real risk the OCR cuts will end up being more than reversed (i.e. a repeat of the experiences in the 2000s and 1990s).

It is nothing new for me to be a lone voice in warning that economic prospects are materially different from what the Reserve Bank and economic forecasters in general are predicting. This isn't because I am inherently contrarian or counter-culture. It is because my analysis, that has much better foundations than the economic forecasting models used by the likes of the Reserve Bank, leads to different conclusions. If you want quality insights as input into your business and/or investment decisions, I recommend you try one of the trial subscriptions we are offering to celebrate our 10th anniversary and get the full story.

----------------------------------------------

*Rodney Dickens is the managing director and chief research officer of Strategic Risk Analysis Limited.

22 Comments

Sorry , am I missing something here , maybe its my simplistic view of the world , but I always saw spending as consumption , whereas milking cows and building houses as production .

Consumption can surely only follow production , unless of course you are borrowing to consume , and that's a different thing altogether .

I have never been able to spend willy-nilly without producing income first

We have $200 billion in consumption capacity sitting in term deposits doing little. The lower interest rates go on savings, the greater the incentive to spend it (consume it). If we can't spend it on locally produced goods we will spend it on imported goods. Will show up in increased GDP, increased Trade Deficit, reduced GDP per capita. While there is no incentive to save, people will eventually spend and enjoy it. Meanwhile, there is no correlation between production and consumption

No , we are just lending it very cheaply to Aussie banks to pour into the housing market as loans, baby boomers can't afford to spend it yet at Dick Smith etc, we will spend it on opshop goods when we stop working. Or crack up and give some to a fund manager(could be a fund decimator)

I don't think so. Australian banks can find much cheaper wholesale funding than from NZ. You're not making sense. Interest rates are similar of higher in NZ compared to Australia,

So what do you think the aussie banks(BNZ ASB Westpac National) are doing with the 200 bill??, they can't be lending it all @20% on credit cards to smartphone buyers??

Wrong. They need to have a certain level of local funding to meet the regs. The returns aren't goings to savers, they are going to shareholders. Returns for savers are not commensurate with the risk, and if you look at the real level of inflation, which includes housing inflation - savers are not only going backwards at a great rate of knots, they are also inadvertently absorbing the credit risk for Aucklands housing bubble.

My personal view is the RBNZ should have lifted rates years ago. The currently policies are disingenuous - favoring one group (Investors) over another. With the mantra that the policies are creating stability in the marketplace.

I would argue that they are smoke and mirrors.

One man's spending is another man's production. Production without a buyer doesn't get you anywhere. Right now the narrowest point in the cycle is in end-point demand so it wouldn't be surprising if this factor has more impact than others in the current economic environment

Did I not see a recent newspaper piece stating NZers have gone back to their old habit of spending more than they earn !!!

If'n I read the article correctly, Rodney D is suggesting that there is a group-think aspect to economic forecasting in GodZone.

In fact, He seems to come close to suggesting that forecasting over the longer term is a classic clusterflock....

Rodney's theoretical and analytical approach supports what Robert Schiller said about the wealth effect of rising housing prices.

The economy is simply people earning saving and spending or consuming.

That is why we have such high immigration at the present time.

The country needs people so they can consume hence create an economy.

Rodney has got himself lost in his charts and forgotten what it is all about. If we all cashed up the assets and spent it at Harvey Norman, GDP would go up sure, but we would all then be poor and miserable, not able to get into the kitchen because of the 12 fridges in there.

The size of the economy is one thing, people having good lives is another, and much more important.

Collapse In US Manufacturing Sparks Buying Panic In Bonds... And Stoc

http://www.zerohedge.com/news/2015-12-01/collapse-us-manufacturing-spar…

Gold bugs so want everthing to 'collapse', it gets tiresome. I counsel avoiding reading Stockman, Zerohedge, Alhambra, et al (and they are almost all American). If you believe any of that relentless doom you will end up doing nothing and feeling permanently miserable. They are the peak oil of economics.

Couldn't agree more. Can't help but feel a lot of these sites/ readers discount human ingenuity. For example, shale oil is now at break even at $55 per barrel on average. As opposed to $75 a year ago. Peak oil is a myth unfortunately !http://www.forbes.com/sites/judeclemente/2015/06/25/how-much-oil-does-t…

Peak oil is the point in time that the maximal rate of oil production is reached (primarily through geological constraints). Essentially you are saying that oil production will increase each year forever into eternity. That sounds like a very logical argument when discussing a resource for which there is a finite quantity. The timing of this event, or whether a substitute will emerge prior to it's occurrence are more rational and valid debates.

As an aside, have you perhaps considered the possibility that the tight oil break even price has reduced due to drilling having been concentrated in the profitable core regions of the plays in response to low prices? Lowest hanging fruit and all....

so we on a flat earth then?

I don't agree. I've owned gold ETFs since 2005 and I don't want the economy to collapse. However, the different between you and me is that my time in the 2000s was spend working in the consumer electronics manufacturing sector where the the correlation between "feel good bubble activity" and CE sales is largely positive. Manufacturers have to be constantly on guard because of the persistent need for bubble activity to boost economies.

It's not about "relentless doom"; it's about taking care of yourself when bubbles seem to emerge regularly and the individual ultimately carries the can (not the banks, central banks, or political leaders)/

gold bugs would have seemed to want hyper-inflation so their gold holdings would have shot up in value. Now you say they want collapse?

The other side of the peak oil curve will be relentlessly downwards. I am sure some will be unable to cope get depressed even top themselves. Many of the rest will be asking why they were not warned, why they were lied to, some will want to get even.

gold bugs will do well in either hyperinflation or economic collapse, BUT not in the stalemate controlled economy that exists today.

Here's a Greek view of the global economy from ex Greek finance minister,quite long but some interesting ideas.https://www.youtube.com/watch?v=MEUWxNifJJ8

I agree Tim. I'v held a good portion of my investment portfolio in gold since 2007 and have done reasonable well with it in NZD terms since then. Either way its been a nice safeguard, diversification and comfort in holding it, and will do for a long time I suspect. I certainly don't want a collapse or hyperinflation as it wouldn't be good for my other investments, but if it that ever did come to bear, I'd be much more comfortable with the gold holding than not. Risk management is what gold is all about.

Agree Grant, risk management is what it's all about. That's what scares me about the world economy, investors see bubbles as never popping because endless credit and money printing means there's no risk?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.