Bankers are very good with money; they certainly know how to make it.

However, they want to be seen as 'responsible'. So they counsel others to 'be good with money'.

Recently, their lobby group put out a press release saying the New Year is a good time to assess your financial situation and to work to a plan. This is sound advice.

Their advice used statements like:

- set short and long term goals

- plan a budget

- grow your savings, and

- manage debt.

But the 'manage debt' exhortation sounded odd coming from them. Specifically, they say "make it your goal to be debt-free" and " be debt-free fast" and "avoid ‘dumb debt’" and "only ever borrow what you need" and "pay it off as quickly as you can".

All excellent advice, but you can't help wondering whether they want this advice to fall on deaf ears.

After all, they made $7 bln in profit last year by encouraging clients to take out more (and more) debt, most of which was not paid off and certainly not paid off quickly. Clients who are debt-free are of no use to any banker.

In reality, they don't want you to avoid 'dumb debt', they want you to take out more of it. Think credit cards and the growth of interest-incurring balances. Bankers set a honey-trap of "0% balance transfer interest" in the sole hope of charging you 20%+ when the balance transfer enticement ends in 6 or 12 months.

The overall fact is that housing debt grew more than +6% last year while other consumer debt grew +5%. These growth rates involved consumers adding +$13.1 bln to their obligations to banks.

New Zealand households now owe them $221 bln. (Businesses, farms, and our governments and their agencies are in hock to them for another $150 bln or so.)

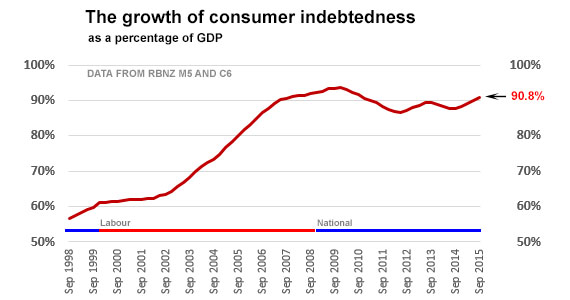

However, to see whether this consumer debt is excessive, we need to look at it in terms of the size of our economy.

Nominally, GDP grew +2.7% in the same period.

So in 2015 bank clients have been adding debt at more than twice the rate our economy has been growing.

Yes, it does call for the type of restraint the NZ Bankers Association is calling for. But I doubt they really mean it.

Relating the growth of consumer debt to the growth of our economy over a long period is how we should really look at this problem.

And that shows some surprising trends. Surprising to me anyway.

Firstly, for the past seven years we actually haven't been moving the dial much.

The GFC restrained us; we deleveraged just a little bit.

But maybe over the past year we are starting to feel good again and worry less about debt, which is why debt growth picked up in 2015. Perhaps we long to party like 2003-2007 again.

That earlier period was when the addiction started.

And as you can see, once you put on debt-weight, it is very hard indeed to take it off. The dieting we did from 2008 onwards has done little to roll back the impact of the earlier splurge.

We are now carrying around a lot of ingrained debt weight.

Perhaps readers can remind me what it was in 2002 that generated such an appetite for the addictive 'sugar' of debt.

If we need a sugar tax, perhaps we also need a debt tax. We certainly need some spur to change our behaviour.

Oh, and for the record, bankers do pay tax on their profits. Collectively they paid $2 bln or 28% which is the corporate rate in New Zealand. At least they have stopped their dodgy avoidance schemes. (Now we need to focus on insurance companies who use profit-shifting techniques to run much of their real profits through low-tax jurisdictions. But that is another story.)

38 Comments

It suits the banks, and compliant governments, to keep people confused about money and debt.

Money, which is earned, is frozen desire. It is a moment, an entity, of restraint.

Debt, which is unearned, is desire melted. So it's a means of overcoming restraint. But desire released has a cost. Which is - or used to be - real money. Payback.

In a world where payback is increasingly illusory, debt is largely meaningless. Except for everyday consumers, in lives where money is increasingly harder to find.

What’s money? What’s debt? Are they really the same thing? They're serious questions for the contemporary world. The current system, which is debt fueled, is a means of avoiding an answer.

Yes, and economic thinking think such as MMT is starting to filter through to the general population. The great thing about MMT is that it provides a soothing justification for the levels of debt and how debts equal assets. What it doesn't really account for is the externalities involved with debt.

There's still a lot of people that don't think about budgeting or the actual impact of the interest involved. Even people taking up payday loans don't care when they're told that there's a 2,500,000% APR in the UK. It's meaningless to them.

I help a few people online who have realised that their minimum payments have become a big problem. The occassional one is in serious trouble. Some do dig their way out with 0% credit cards as there are a lot available in the US. However, some will charge full interest, as if it was not 0%, if the whole card is not paid off in the 12 months. Far worse than here.

It's only once people take an interest in where their money is going that they are receptive to learning anything financial. MMT while interesting won't solve poor decision making and a lack of impulse control in the population. Poor people getting into unsustainable debt has been a problem for 5000 years so that's never going to change.

One of the issues I see is the low-tier lenders and big department stores who are encouraging people to take loans out for all sorts of things from paying back existing debts to purchasing new laptops and televisions. This is adding to the amount of consumer debt and targeting the low socioeconomic parts of society. These "sharks" need to be stopped, especially in today's market where house prices are becoming increasingly un-affordable.

Store cards are particularly horrible in their terms.

Check out the gem visa terms that go with store cards. http://www.gemvisa.co.nz/ The charges that go on the cards are surreal, and a lot of people I've helped out have store cards with similar terms.

A financial disincentive to put us off getting into debt? Isn't that called "interest"?

We have a economy that is fuelled by debt. Off course there is good debt and bad debt. This article seems to be talking about consumer debt which is probably bad debt. If we were to magically stop all consumer debt and require it's repayment, there would be a large dislocation in our economy, in fact probably a significant recession. In a sane economy, holding debt constant would neither boost or depress the economy and nobody would be any better or worse off. If we were to magically remove all debt (or carefully and gradually eliminated it) and people lived within their income, then they would be better off to the tune of the interest that they currently pay to the banks. Apart from the funny money world of the banks the economy would be better off because more money would be available to be directed to buying real goods. i.e. more real consumption/production/employment. Unfortunately the way we seem to be operating is on the basis of ever increasing debt and even holding debt constant may have recessionary implications. In other words we are living well beyond our means in an economy that is relying on unsustainably ever increasing debt. Unfortunately this will eventually come crashing down and even more unfortunately it will be the few frugal savers that will be the biggest losers.

Yes, as a saver, I feel like a fool. However, I still don't feel comfortable with following the critical mass, despite what the media tells me and even what the govt appears to be saying. My focus is now ROI where the O is "of" instead of "on."

Based on my experience with P2P lending in 2015, some people are taking the opportunity to remove themselves from the yoke of private debt at more agreeable terms and costs.

Most CC's are already 20% or more? HP is typically 25%? just how much of a tax do we need? another 5~10%. Drawing down the ATM that is the house is 6%, do we make that 30% as well? Who keeps that %? If it works what does that do to our already struggling retail sector?

A tax won't work. As David has pointed out, banks are very good at creating conditions that supports their client base being in hock to them, whilst still appearing to be responsible sources of credit. This is evidenced by mortgages out to 30 - 50 years. They are banking on the continuing inflation of house prices and the ability for people to bequeath their debt to their offspring. A tax would just lead to them adjusting their business in some way to enable them continuing to do what they do. At the retail level this is also a sign of the equity gap, where the lack of real growth in wages is compensated for by increasing debt. Again a tax will only make the situation worse. The train to the melt down is continuing to accelerate. The longer it takes to the crash the more blood will be spilt.

Debt Tax !! I certainly do not advocate debt unless for business/family house however currently we have

created conditions(in Auckland at least) where most of the disposable income is spent on servicing mortgage which leaves little for anything else, then to tax debt on top of interest rates which incidentally in NZ are one of the highest in developed world. Great way to transfer wealth to already "filthy rich".

How else do we get positive economic growth in times of trade deficits?

Arrange policy to encourage more household debt.

We've been doing it for decades and it shows up here:

http://www.rbnz.govt.nz/statistics/key_graphs/household_debt/

And why wouldn't we borrow to the max ? Savers try to maintain the value of their money and get whacked with tax on its depreciation ( interest ). Also they have been set up to take an OBR hit to prop up banks if required. No such worries for borrowers who are putting said borrowing into tax free and taxpayer subsidized capital growth areas.

Loans are made, and interest is charged, on the assumption that the overall 'cake' will always be bigger in the future.

The 'cake' cannot always be bigger because resources are finite. And now that we have passed peak net energy, the 'cake' is getting smaller by the day. Ascribing positive values to negative activities, as the GDP system does, helps obscure reality and in doing so makes matters worse.

Manipulating the value of money and manipulating interest rates -ZIRP and NIRP- can also obscure the big picture in the short term but cannot rectify the basic predicament of running out of the easy-to-extract energy and resources that allowed the present system to reach the present, unsustainable giddy heights.

The unravelling of the present Ponzi scheme, which has already commenced, will be very messy and very painful for a lot of people. .

I understand what you are saying, AFKTT, but not all resources are finite. Human intellect - in its abilities in thought, creativity, inventiveness, problem solving, rearranging of things, etc - is not finite. It may not be infinite but, unlike tangibles, it is not finite. In an expanding and largely unknown universe, it is not even clear that matter or energy are finite.

Policy in Japan may offer an interesting example of the shift in thinking from tangibles to intangibles. A society that has had a culture of mass-consumption, and few natural resources and, moreover, appears to be tiring of new 'things', is now focusing investment in the discovery and development of intangible products - in social, scientific, community and human resources areas. See Japan's Innovation 2025 Strategy - there are papers available online.

Here is my statement on your subject. "The answer to a shortage of resources in not more complexity"

To expand on that, the thought, creativity, inventiveness, problems solving, rearranging of things, largely takes idle time to do nothing but think. While you are thinking you are not productive. But non productive people are a luxury born out of a surplus. How many truly productive jobs are in New Zealand? How does that compare to a historical average? How long can the surplus of calories to feed the non productive be maintained?

10 years....

a) The laws of thermodynamics cannot be changed.

There are some finites,

b) We are on a finite planet, that cannot be changed

c) We have exponential growth, that can be changed, but we do not yet recognise it has to.

d) The resources that do matter and the one that matters above all else is energy and right now that is fossil fuel energy that is finite.

e) Invariably man's intellect makes things more complex which makes things more energy intense/dependent.

steven, I would rank potable water as a pretty important resource, (maybe more so than fossil fuel).?

Very interesting article from you David, a hint of biting the hand the feeds. I hope there is a part II.

"Perhaps readers can remind me what it was in 2002 that generated such an appetite for the addictive 'sugar' of debt."

Greed and irrationality. And the cargo cult that selling each other houses makes for a first world economy. We have transcended work and innovation as sources of prosperity. Aren't we clever?

I never understood why 'interest earned' was ever taxed. Wrong incentive. Tax 'interest paid' instead.

Simple change in the bank computer and there it would be.

No more with holding tax charge on your statement. A new charge would show (say 15%) on top of your mortgage interest bill.

The landlord classes will express outrage, but would get over it in a few years when they had built equity.

Very clever people work at banks. Banks are able to pay top prices for talented individuals. They are able to influence the academic world via sponsorship and are able to put forward very compelling arguments that are in their interests directly to the highest levels of society. It's called shaping the debate.

Government, banking and property owning interests are something of a mutual society.

My guess is that taking away the ability to deduct interest as an expense plus putting GST on interest paid would fundamentally change our society but exactly what other rorts would be created is not clear.

Thanks for picking up on the GST thing Roger. Tax on interest paid is indeed a 'consumption' tax which I certainly favour. Actually there is a case for ceasing income taxes entirely.

No it isn't. If you taxed borrowing then you would decrease investment and there the demand for cash and you would get less in interest anyway. If people stop spending the economy would crash. If you take the tax off interest earned you have to take the tax off all income earned. You are basically asking for GST on everything you pay out and no tax on income at all. That would move the tax burden towards the poor while the rich would get richer as they consume less of their income than the poor. Sounds like you voted for the civilian party last time as they had a policy to tax the poor so they don't want to be poor anymore and become rich.

Imaginative ! LOL.

Hardly!! Controlling the demand for money by changing the cost of borrowing is what the RBNZ does along with many other central banks around the world.

If you don't tax income from money in the bank but tax dividends from shares and other investments it discourages investment in those areas. Once you make those tax exempt you really can't really tax income at all without it being grossly unfair to people that have to work for their income.

Dave. I floated the idea that it is not necessary to tax income. Your problem with that is some income will not be taxed. Not exactly an argument. Bit circular that. Try extending your thinking a bit.

I find the idea that it would hurt poor people is speculative at best.

Try this one. A high income person is miserly - lives under a bridge etc - thus pays nearly no tax. What essentially wrong with that.

Another scenario. High income / lives the high life. Pays a wallop. Your view is ?

Or: European farmer. Pays no income tax. No need for annual accounts. Runs the business like you run your family home. But every bit of grocery or new tractor she pays GST.

Accountants will cry for sure. But ?

It hurts the poor because they have virtually no way to save any meaningful amount out of their income and would pay tax on almost all of their income. GST works here because of the exemptions for housing (mortgage/rent) which acts like a tax free threshold. If that was to be removed, the poor would be worse off. It also works because it is simply applied to pretty much everything. Go to Australia and you can buy chicken with or without GST at the same store depending on whether it is cooked or not or 'prepared' etc.

A wealthy person would be able to choose how much they consumed and given there is no tax on income their saving/investments would increase at a higher rate, making them even richer.

As for high income saver vs spender scenario, there needs to be a balance. The extreme saver is basically hording resources and if all wealthy people did that the economy as we know it would collapse they could also go overseas and spend up and still pay very little tax. The spender is effectively sharing the wealth around and creating jobs etc. If everyone went on a big spending spree things wouldn't be great either as it would cause inflation and people wouldn't be able to survive if they lost their jobs or retire comfortably etc.

Savers shouldn't be penalised by a wealth tax like Gareth Morgan wants. If 2 people earn the same then they should pay the same tax. You shouldn't tax the one that didn't spend it again.

As for your farmer scenario you are talking about a sales tax like they have in the US. The accountants will still have a job as the farmer will have to charge the tax on sales and pass it on to the government. They will still need annual accounts to prove they passed on the tax collected and depending on whether they are selling to a reseller or not they would need to deal with exemption numbers etc because it is an end use tax. The tractor only attracts the tax once but the difference is that businesses pay if they are the end user.

Not so sure about taxing all interest paid but there is one glaring anomaly in the Interest/tax system.

Interest paid is tax deductible despite the fact that the real value of the debt is depreciating and conversely interest earned is fully taxed despite the fact that the real value of the loan is depreciating. This is then a powerful incentive to borrow against assets like property and benefit from the depreciation of the money owed. Similarly it is a powerful incentive not to save. Accordingly I believe that interest paid should only be tax deductible above the inflation rate and interest earned should only be taxable above the inflation rate.

Not a bad idea - but it's heavily regressive - that's the first hurdle you need to jump

I have never been convinced Icon that GSTis regressive. As a high income family GST captures us more effectively than any income tax. And in the basics such as food and energy, given our consumption pattern, it's clearly progressive, comparing families with similar membership.

beautiful - you must be consuming your family's entire high annual income and not saving any

It is if you make it completely universal. The exemptions give the poor a break. Anyone which is able to save a decent chunk of their income or spend it overseas is winning.

It is if you tax all spending. The poor get a bit of a break under the current system because housing doesn't attract GST. Since the poor spend a higher percentage of their income on housing, they don't may as much as a percentage. The super rich don't spend much of their income and would be able to spend it overseas as that would become a cheaper option.

Of course, debt is encouraged by the NZ tax settings. Debt (eg on rental properties) is tax-deductible; however the resulting capital gains aren't taxed. So increasing your debt is the only rational behaviour.

The Economist had a major article on this a while ago, they pointed out that all developed countries implicitly encourage debt. This encourages long-term imbalances and instability.

Hi David.

2002, that's when the the first 'recovery' signs were appearing due to Central Banks reflation of (bank) assets impaired by the NASDAQ and Dow Jones share market bubbles, which had burst after Y2K.

That was accompanied by low global interest rates and lowest ever loan qualifying requirements.

Nearly anyone could get a loan for near anything, anywhere.

'Got a pulse, sign here....... approved.'

Personally, I think the jury's still out on the actual sustainable success of that policy.

Wake up NZ, your country is less yours than you think.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.