Barfoot & Thompson's latest monthly update made me chuckle when I read there was a "strong performance from the Auckland housing market as it heads into the year end."

This and other comments in the report reminded me of the comment in the Now You See Me movie: "The closer you look, the less you see." Here is the YouTube video of the relevant part of the movie.

Being the time of year to let one's hair down a little I decided to comment on Barfoot & Thompson's assessment of the strength of the Auckland market by putting it in the proper perspective.

The conclusion of my independent assessment is that the Auckland market is weaker than average especially in terms of the performance of prices. The demand-supply balance shown below doesn't justify much if any upside in prices in the near-term and the analysis in our pay-to-view reports suggests this won't change much in 2019.

"The closer you look, the less you see" may also apply to the housing market

Barfoot & Thompson (B&T) provides a useful service with monthly updates of the company's sales in its housing market updates as well as providing other insights each month.

The recent report presenting the November insights was titled: "Strong performance from Auckland housing market as it heads into the year end" and went on to say:

"The Auckland housing market is ending the calendar year strongly with sales numbers in November their highest in six months, and with the average price at its highest in 12 months."

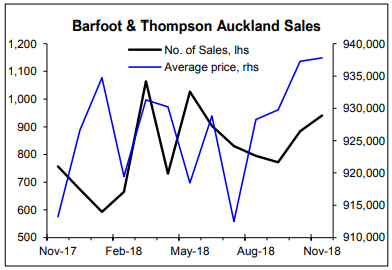

The chart below shows the number of sales and average house prices reported by B&T for the last 12 months. November sales are the highest in six months and the average November sale price is the highest in 12 months. But to call this a "strong performance" is a bit of a stretch.

When put in the proper perspective the Auckland market is weaker than average

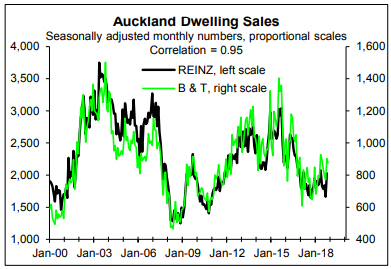

The next chart that takes in the big picture in terms of monthly sales reported by B&T and REINZ for Auckland put things in proper perspective. It also uses seasonally adjusted numbers that is important when comparing over periods like six months as done by B&T. House sales experience a strong seasonal pattern, generally increasing in the months leading up to November before tumbling in December.

B&T sales at 874 seasonally adjusted in November were still a bit below the average of 904 since January 2000. In November sales were marginally weaker than average rather than "strong" (chart below). The seasonal adjustment was done using a reasonably basic package.

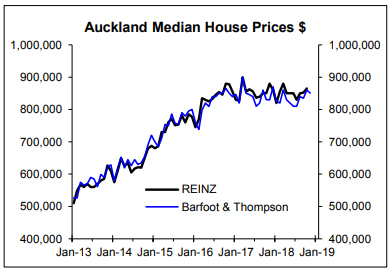

Monthly average house prices get kicked around lots by changes in the composition of sales so should be largely ignored even when comparing movements over 12 months. Median prices are better but still get kicked around quite a bit by changes in the composition of sales which is why REINZ now produces monthly house price indices that adjusts for changes in the composition of sales.

In the context of the median Auckland house prices reported by B&T and REINZ the recent increases most likely reflect changes in composition of sales with the general picture being little change in prices since the peak in late-2016 (next chart).

Over the last 12 months the B&T median price increased 2.5% vs. an average annual increase in the REINZ Auckland House Price Index since 2000 of 7.2%. 2.5% versus 7.2% suggests the Auckland market is much weaker than average in terms of house price performance; definitely not justifying the recent performance being labelled strong.

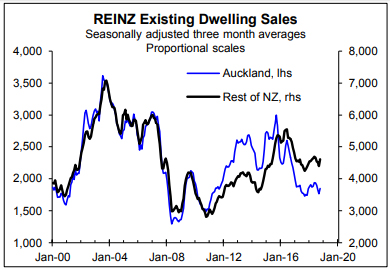

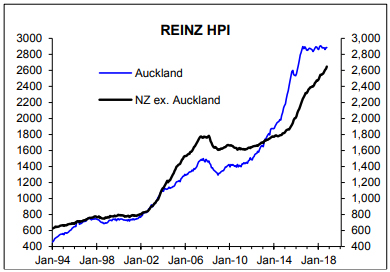

If the Auckland market is "strong" the rest of NZ must be in a mega-boom based on the relative level of sales (next chart) and the same for house prices. But we shouldn't blame B&T for putting a positive spin on the state of the Auckland market given the tough time it has had and largely continues to have.

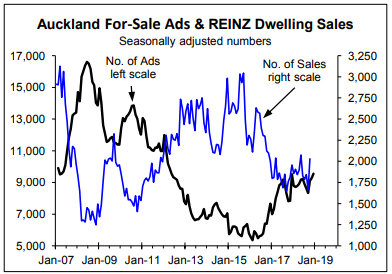

Important to put things in perspective and get quality, independent insights

This little episode reinforces the value of viewing things in a full or proper perspective and getting independent insights. In our Auckland and national housing reports we quantify the demand-supply balance in the Auckland market using the following chart; one of two we use. It shows the level of sales reported by REINZ vs. the level of for-sale listings on www.realestate.co.nz; both seasonally adjusted to better show the underlying picture. Sales largely reflect demand and for-sale listings largely reflect supply. At the moment the Auckland demand supply balance struggles to justify much if any upside in prices. And consistent with that the REINZ Auckland House Price Index has been bobbling sideways (top right chart).

Consistent with a much stronger demand-supply in the rest of the country on average the REINZ NZ ex. Auckland HPI has been increasing solidly.

55 Comments

"we shouldn't blame B&T for putting a positive spin on the state of the Auckland market given the tough time it has had and largely continues to have."

The trouble is MOST New Zealanders don't know it's spin! It's taken as Gospel, and any dissenting view is dismissed as Doom and Gloom when in fact it's a reality.

When was the last time you saw a view like this article on, say, TV1 6 pm news or Mark Richardson admitting as such on TV3 in the morning? Never! They choke at having to report lower dairy prices, but property prices falling - sacrilege!

It was hard enough for Hillary Barry to admit that riding a bicycle on the footpath is against the law here, but she did. But property? Silence....

BW, I most certainly agree that the Auckland housing market is not "strong". The problem I have with some comments is when they make false claims, like "the housing market is continuing to fall" when it is actually not falling. It may or may not fall in the future, that is speculation, but for now the property values are not falling in NZ

Quite right. But unless New Zealanders are given a balanced view, how can they decide for themselves what to do; decide what may happen in the future? It's all one way - 'Property always goes up!' and if it falls or even flattens, it's not reported, and if it is 'it's temporary'.

You have a view on what might happen; I do, and each of us is/has done something about it, but most New Zealanders? They believe the spin that B&T puts out, and it's always one view....and Kiwis are heavily exposed - on both sides of the equation.

NZers like to think of themsives as pragmatic, rational people. So it's important for them to explain or provide a rationale as to why prices always go up. They would object to any claim that much of their thinking about house prices is driven by emotions and feelings.

Clearly house prices always go up because house prices always go up. You don’t question why the sun rises in the morning or why dogs chase cats. This is just the way of things.

All you DGMs point to London, New York and now Sydney to show that corrections do happen. What you fail to see is that these places aren’t Auckland. Auckland is so amazing that prices will never fall because people will always want to live there.

Not only will prices not fall but following a pause, which we are clearly in, prices will double, then pause again. You just have to be in for the long term. Leverage, buy, hold, leverage - this is all you need to know.

Housing as a commodity is an extremely important part of the New Zealand economy. That’s why the RBNZ are investigating the potential impacts of Climate Change on Housing. Not on Agriculture, Manufacturing or Tourism, but Housing.

Hardly - Very bold statements but true ! The DGM's won't like it !

The DGMs are the flat earthers of New Zealand. House prices haven’t dropped here since the 1970s. The 1970s is forever ago, basically there were the pyramids, a few years and then the 70s. Basically nothing between them. Whereas we’ve had the springbok tour, the rainbow warrior, Australia has had 15 prime ministers, what seems like three decades of Trump, etc, etc. What I’m saying is the fact that house prices fell in New Zealand in the 1970s doesn’t count. It was too long ago. Just like moustaches were never cool. The 1980s doesn’t count because it’s almost as long ago as the 70s. So yeah, house prices never fall in New Zealand so take that DGMs.

You're wrong there. Mustaches are now cool. So clearly things can/do change.

I think you need to clear out your sarcasm filter, its blocked.

Maybe it's yours that is blocked. Shoreman is trying on the old "double-sarcasm-whammy".

Nah, i'm not buying that.

LOL i have seen cats chase dogs,

NZ house prices have fallen for months, years in some patches of our history, we have solid stats to back that up.

if you are looking long term then yes they go up, but so does everything its called inflation and that is normally the rate at which things increase.

for housing it used to rise slower than inflation for a big portion of our history until the last twenty years when we have had a lot of factors come together to push them up faster.

those factors are retreating one by one i.e easy credit, open market, favourable tax laws (neg gearing), ultra high immigration, and the big one interest rates.

i expect the prices to bubble along for quite a number of years until wage growth can bring them back in line with a more substainable DTI

So which is it flat or falling?

"Auckland is so amazing that prices will never fall because people will always want to live there."

Contrary to your belief. I am dealing with a group of researchers (and an upcoming documentary) at this very moment who will quite happily and easily prove this statement as incorrect and very one sided. In fact, all of the interviewed "people" no longer want to live in Auckland because they cannot make a real living here, but they are stuffed, because auckland is where the work is at and there are not a lot of other options out there.

Is this satire? I can't tell. Auckland is so amazing that prices will never fall? Auckland is amazing but market bubbles are market bubbles, and they burst. History has taught this again and again and again and...

Quite right. But unless New Zealanders are given a balanced view, how can they decide for themselves what to do; decide what may happen in the future?

If you are dumb enough to base your investments on what TV news says, then quite frankly you deserve financial ruin.

Having just finished reading Bayleys property insight report for December, they do seem to be giving the whole truth. Publishing REINZ data for the previous 3 months they've said West Auckland prices are up 4%, South and East Auckland are up 1%, however North Shore is down 11%, with the central City down 15% in apartments and 3% for homes.

Looks like they fired that editor and got one that would stick to the script for the Jan 2018 edition.

Complete with advice on multiple ways to get the bank of Mum'ndad to finace your property speculation.:

"Tap into the Bank of Mum and Dad. If they’re well-off or feeling generous they may tip in a six-figure deposit with no strings attached (that is you don’t have to pay them back)."

"4. Setting up a limited liability company and selling shares in that entity.

Under this scenario, you become a CEO/managing director of a property company. You can then sell off shares in that company – which brings in the option of investment by the Bank of Mum and Dad.."

Maybe I’m speculating but cbd and north shore is where our mates from the orient come from amirite

*THERE IS AN AUCKLAND HOUSING BUBBLE - GET OUT NOW!*

We are in unprecedented times facing tremendous world economic woes, in a matter of weeks this could cause Auckland house prices to rapidly decline by 50% within a year. If you need or want to sell.......get out now, if you want to buy.......hold off

Agree with Rodney Dickens.

The Auckland housing market is hardly strong.

B & T are adopting a rather curious mix of commercial license and poetic license.

Being a real estate agency, B & T probably thinks it's legitimate to do so.......

But people like me remain highly sceptical of the ways and means of real estate agents. They seem very adept at feathering their own nests.

TTP

Agent TTP, dissing your ilk won't prevent you waking up as an RE Agent tomorrow ;-) Nice try.

classic "fake news" organisation and message.

In a matter of weeks Auckland house prices will decline 50% within a year? Aye? Which one is it - weeks or a year?

a) 50% drop in a year would be a consequence of something like a 2nd Great depression world wide. the problem is if in the housing market and you cash up you have with the OBR almost no where to hide.

b) Such a drop would be heralded by huge job losses ie inability of (FHB in particular) ppl to pay the mortage this I would suggest would give considerable warning.

Now I do agree on a drop and in fact I suspect its more like 75% but really this will be going on amongst other significant and terrible events......

Housing markets really don't drop that quickly. It's more likely to be 30%-40% over 2.5-3.5 years, not counting the flatlining we've had already, and it would hit share markets as well. Sydney, another massive bubble. is up to -10% over more than a year but the decline is accelerating now to about 1% a month. -20% over a year is possible but that would be very fast.

Its his job to be a cheerleader.

What a great piece of analysis. I’d like to see an update 3-6 months down the track.

According to Homes.co.nz report dated Oct 2018, properties in 50 Auckland suburbs are worth less than their 2017 CV. Adjusted for a 1.5% CPI, property is indeed falling; https://www.stuff.co.nz/business/107694820/auckland-christchurch-proper…

If you worship the muddy reporting of the REINZ median derived from a property specific buyers market, it's a cherry pickers prerogative. Once the effects of the OZ slump reach our shores, it will be impossible to spin any upside.

Today's market is is not what 40% of Auckland based Speculords (who IRD say are negative geared) would have expected. It's a ticking time bomb.

Hi R-P,

It's not REINZ that cherry-picks. REINZ''s analysis is based on the WHOLE Auckland region.

It's YOU who's guilty of cherry-picking - according to a subset of suburbs that fits with your own personal agenda.

In any case, REINZ's analysis can be cross-validated with that of QV. The results/figures correlate.

Before criticising REINZ's data (or QV's data) you need to come up with a better data set......

We are waiting.......

Further, we're mindful that you have recently conceded that your own prediction about Auckland's median house price was completely wrong.

TTP

Agent TTP, I don't need to produce an alternative Auckland dataset as there's ample evidence of widespread weakness. Googles your friend too.

REINZ median dataset is murky reporting at its finest. Its derived from fewer buyers cherry picking specific properties while leaving the rest. Right now, the Auckland market is highly vulnerable and weak.

TTP: Are you suggesting that all suburbs will rise or fall at the same rate? Are you telling me Hobsonville Pt has to drop by the same percentage as Ranui before you'd acknowledge there's any issue, even though they are fundamentally different suburbs that appeal to different types of buyers?

You're cherry-picking criteria and saying that prices in Massey have to behave the same as prices in Remuera or every other part of Auckland. Suburbs are different, and whereas before they were all rising, now many are not.

RP - The 'Tyranny of Reason' is very limiting.

Great article (obviously I’m going to say that!).

All I’m trying to do is look at the market – and what it’s doing and pointing to – it’s not a gloom and doom thing – it’s simply the market.

Analysing where we've been and where we currently are is fine, especially when short and sweet as above – it’s where we’re going that’s a bit more challenging.

Auckland – so Rodney sees little change over the next year or so – I see further softening (HPI has hinted at such already.)

I might end up being totally wrong – but now at least I can point to some 3rd party rationale behind my prediction rather than just my own occasional posturing.

I think everyone would agree the housing market is stronger than any of us expected. This is the down part of the cycle ( sorry RP I no you don't believe in cycles !) The market is stable which is a good outcome for this stage of the cycle.

Shoreman and Agent TTP, why repeatedly out yourselves as naive and in denial? "the official outlook for New Zealand's economy remains solid with GDP growth expected to stay safely north of 2.5 per cent. But these kind of forecasts will mean little if the world heads into a serious financial crisis. This IMF speech is just the latest reminder that we may need to batten down the hatches in 2019" ; https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

RP - Yes the NZ economy appears to be going ok and yes there are problems in other economies around the world but whats new ? As we all no every 10 years or so ( there's a cycle ! ) the world economy has a economic wobbly and you encourage people to believe that the end of the world is coming. The world deals with problems as they occur and over dramatising what may happen is silly. Sure be prudent but peoples lives continue and if people want to start a business or buy a house if they have a healthy deposit and satisfy the bank they should do it . Would you suggest people hold off having children ? Analysis paralysis is what you do ! Based I'm sure on some resentment that others have moved foward and made decisions and now benefit from that. Read Tony Alexanders lastest column it's very factual it may help you be less negative. A Quote from Napolean Hill - 'Don't wait ! the time will never be right !

The market is great....

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12176018

You bet me by 0.01 seconds.

So the sale is marked in the stats at the higher price.

maybe its the street name, imagine getting asked where you live "lili chen"

i know we name our streets especially in south auckland after famous people but?

wheres that ? whats that?

https://en.wikipedia.org/wiki/Chen_Lili

You actually mean "the market is now desperate "

Not yet.....but OZ is ahead of us....

You have to understand that B&T are in the business of Marketing,

There headline is intended to show potential sellers how positive they are about the Auckland market and that you should list with them.

Does B&T truly believe the Auckland market is performing strongly??? Of course not!!!

Clearance rates at their auctions have been around the 30% mark for the last year or so and sales volumes consistently the lowest or 2nd lowest since 2011/2012. which reiterates the fact that the market is still pretty weak.

You cant really blame them for "talking it up", anything else would be business suicide

“Lili Chen Way” ...unbelievable.

When someone signs on the line for that deal we have reached peak stupid. I want to know the name of the bank that writes the mortgage. In case I have any money entrusted to them. Because I will be wanting it back. I drive past that develoement sometimes on the way to work and think to myself who is going to buy those. Uncle Phil should wait six months and go and offer them $700 K cash for each house. They will take it. Instant Kiwibuild.

The housing market is strong, but only up until the point it takes a fall. I think from this point however the longer it remains "Flat" the higher the chances of change will be an increase in prices not a decrease in prices when it does move. Another year or even two of the current situation will see prices increase. TPP has stated prices going up in 20/21 so that is entirely possible.

check the current breaking news ticker....

Personally I think that the risk of drops far bigger right now. Just watching the contagion of blood letting that is the US stockmarket for one over the last few weeks. The rallies look like the greedy buying in thinking its bargain time on stocks that are over-valued and hugely so. However Trump is having a p*ssing contest with the new democratic congress over the border wall and this is just the start.

The Fed stopped it's QE program and last year started to unwind it's balance sheet, The ECB announced that it will do the same (last night announcement) but will start to unwind it's balance sheet after another year , so another source of cheap credit has been liquidated. The Bank of England seems to be still on track with it's QE program. So, if high Auckland property prices are driven by cheap credit , then it received another hit just overnight. It really will depend on RBNZ , depends on it's LVR's and OCR or perhaps "climate impact investigation" (or whatever they call it) outcome. One question that everyone needs to answer to oneself - the average human being given the choice to by the house in LA, Sydney or Auckland for the same price - where would he buy ? and what will change if price is lower elsewhere?

Cheap foreign credit? its a big "if" or money being hidden / made safe? more likely IMHO ie when you look at the world's other housing markets say Vancouver as another example there seems to be multi-million $s properties with a decent % of foreign (chinese) owners. These at the top will lift prices all down the chain I would think.

The impact of climate change will be huge but the future in-ability to buy property only applies if you need a mortgage from a domestic bank right now anyway.

These are not average human beings, the top end ie the rich are quite probably buying in multiple countries or at least multiple properties. "lower elsewhere"? not iMHO, I think the world is awash with cheap cash looking for a place to hide.

"Cheap foreign credit? its a big "if" " so , you believe NZ banks get credit only from RBNZ? I found previously couple of opinions that the foreign cash is about 30% of borrowings. It would be nice to have official number.

" I think the world is awash with cheap cash looking for a place to hide" - that was my point , QE has stopped in the US and more importantly the balance sheet has been unwound for about one year already. The ECB did the same last night and will unwind it's balance sheet a bit later.

Unwinding balance sheet = cash has to go from banks back to central bank , so cash becomes more expensive. In this particular case we are talking about foreign cash. which means if RBNZ want's to keep house prices high in NZD terms - there will be implications such as lower NZD rate , => higher fuel and all other prices . Which means the average newzealanders (including our kids) will pay for this indirectly via general inflation over the years. But for what ??? for the fact that someone speculated on buying/selling houses ??

By the way - RBA clearly stated that they do not see falling house prices a critical issue at the moment, which means their views are more real long term

"Banks’ reliance on offshore funding has decreased since the GFC. New

Zealand banks currently source 22 percent of their funding from abroad,

down from 31 percent in 2009 (figure 3.2). In addition, the average

maturity of banks’ market funding has increased, reducing the proportion

that would need to be replaced during a market disruption (see chapter

4). "

Page 17 of https://www.rbnz.govt.nz/-/media/ReserveBank/Files/Publications/Financi…

Luckily they wrote this on p.19 of the report

"In New Zealand, monetary policy is not expected to tighten for some

time, which has been reflected in the stability of our long-term interest

rates. However, global inflation could be higher than expected, causing

monetary policy overseas to be tightened more quickly. The anticipated

impact of this on New Zealand’s economy could put upward pressure on

domestic long-term interest rates and borrowing costs"

so they will rise OCR after "some

time", which sounds promising for NZD but not for Auckland house prices

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.