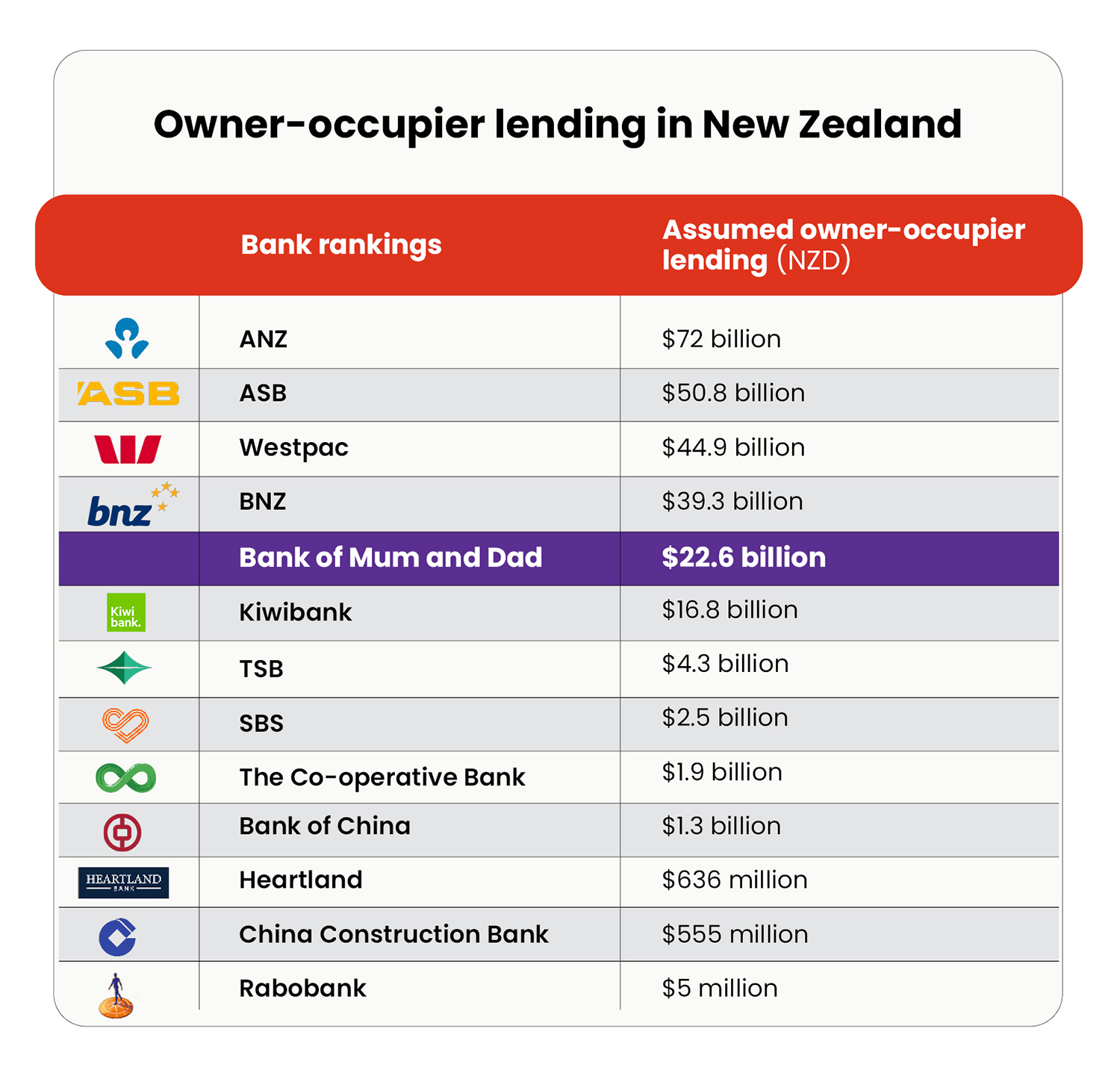

The so-called Bank of Mum and Dad is a major lender in the housing market, ranking fifth after ANZ, ASB, Westpac, and BNZ in terms of loans to owner-occupiers, Consumer NZ says.

The consumer lobby group estimates the Bank of Mum and Dad (BOMD) has lent $22.6 billion worth of home loans.

*Note: Results may add up to more than 100 as some parents offered multiple forms of assistance.

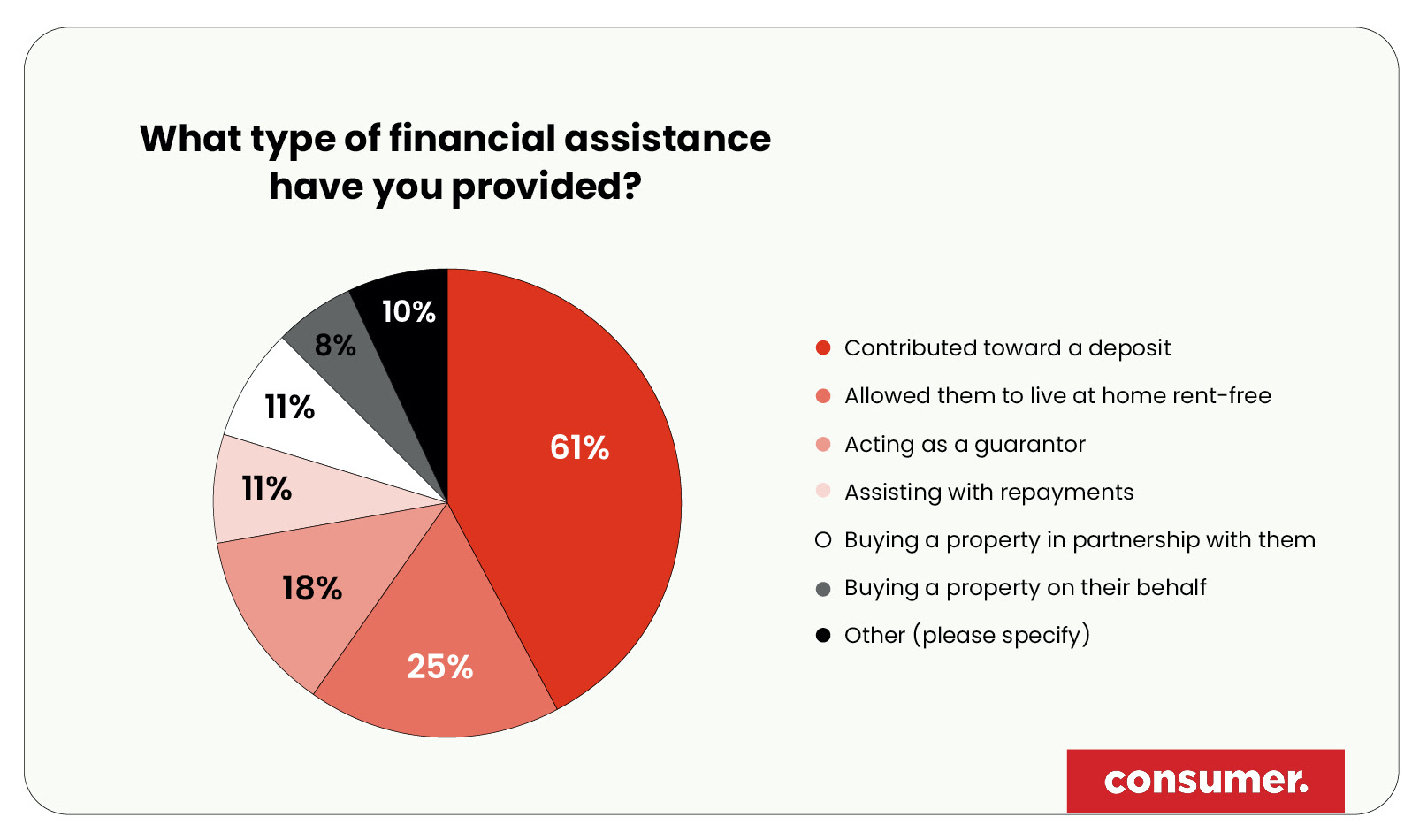

According to Consumer NZ research, 14% of New Zealand families have supported children financially to buy a property, with the average contribution $108,000. This equates to roughly 208,638 parents. The most popular form of assistance is contributing towards a deposit, with 61% of parents assisting this way. Consumer NZ says three out of five parents don’t expect to be repaid.

In 2002 when the average NZ house price was $186,000, this was equivalent to six times the average income of $29,432 per year. Twenty years later in 2022, the median house price is $890,000, which is more than 15 times the median income of $56,836.

“We’ve reached a point in New Zealand where it’s no longer enough to do all ‘the right things’ to buy your first home – to get a job with a good income, save furiously and cut back on the ‘nice to haves’,” says Gemma Rasmussen, head of campaigns and communications at Consumer NZ.

“The role of the Bank of Mum and Dad is more pivotal in the first home buying process, but it also means that we’re seeing a greater social divide of who gets to buy a first home and who does not."

“The overwhelming majority of parents (87%) either offered to or were happy to help get their children on the property ladder. There is recognition that a first home purchase isn’t as straightforward as it was 20 years ago, which is why many parents are so willing to help," Rasmussen says.

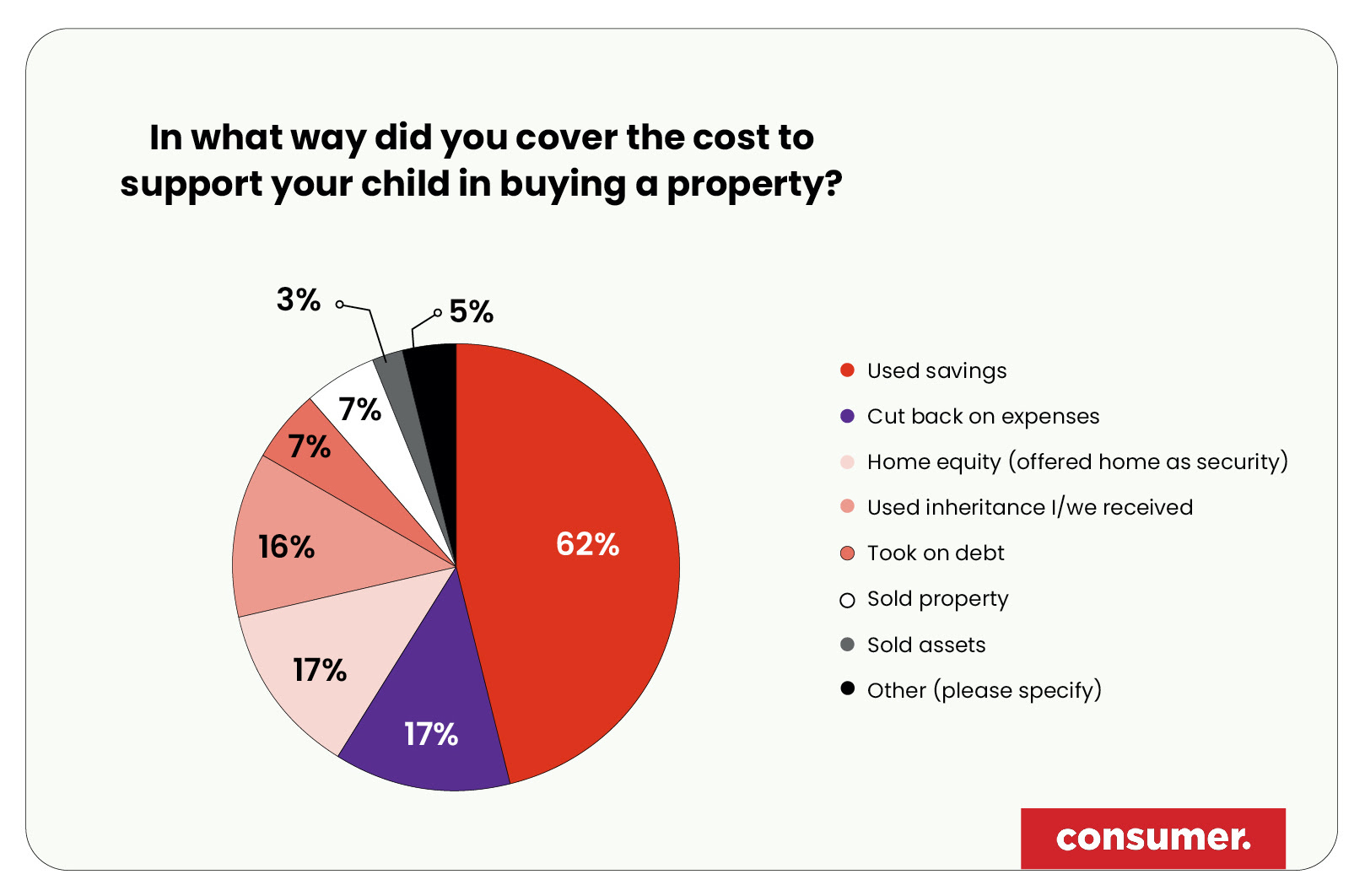

Consumer NZ goes on to say the majority of parents, 62%, dipped into their own savings to help with a home deposit, but nearly one in four reduced expenses to make their contribution possible.

"With home ownership becoming a more remote dream for many New Zealanders, some parents are pinching finances in an effort to get their children on the ladder. That said, 61% of parents said it was ‘no financial strain’ to help their children."

"The most popular form of parental assistance was contributing towards a deposit, with more than half (61%) of BOMD parents helping in this way, but many parents helped in multiple ways. This isn’t to say that some parents’ offer of assistance didn’t come without strain. For one in 10 parents, their financial contribution put them under moderate to serious financial strain," Consumer NZ says.

“Our research found that more than half of New Zealanders who don't own property consider themselves to be ‘locked out’. The most common issue cited is that the deposit goalpost keeps shifting. You’re saving, and then overnight the property price jumps up tens of thousands of dollars,” Consumer NZ says.

Survey of the NZ general population

Fieldwork dates: Consumer Sentiment (n=92) (1-9 February 2022), General Population Booster (n=302) (25 March to 6 April)

Total number of eligible respondents (i.e. those who have financially supported their children aged 18+ to buy a property): n=394 out of n=2810.

Maximum margin of error: +- 4.94%

117 Comments

I wonder what level of stress testing the BOMD have been using before approving their loans?

... depends on how much stress it is to still have them at home ... dirty laundry on the bathroom floor ... empty milk containers in the fridge ... ... their mates " dirty Dave " and " slick Rick " hanging around all day , after a hard night ram raiding the local dairy for cigarettes ...

Well that's a gross generalisation.

more likely personal experience

... any of you guys hearing the Bayleys real estate ads on the radio ... they keep spruiking their international contacts & " platforms " which will getcha a better sales price ...

Weren't foreign investors mostly exterminated from buying in our market ... Oz & Singapore excepted ... ??? ...

Yep, apparently, they have all these buyers lined up, but will still want you to pay them to take it to Auction.

That way they get the sales commission, paid some advertising revenue, and get you to pay for their branding.

Sweet.

As somebody with no hope of help from "The Bank of Mum and Dad", it was was always disheartening turning up to open homes and seeing fellow young people hiding behind their parents.

Not that I begrudge people wanting to help their children. But I can see how inter-generational wealth issues compound.

I do begrudge those parents helping out using all the capital gains from their other properties though. Another kick in the teeth for those of us who had to "get ahead" through productive means.

In my view, what is worse, is Mum and Dad's who have been buying up rental properties for the children so they can gift it to them later in life.

All that is doing is adding additional demand in the present, for properties required in the future...just creates even higher prices and even more debt/financial instability. And the kids probably learn nothing if they know Mum and Dad are going to do everything for them....like buying their house for them and paying for it....

A colleague recently was talking about their parents looking to sell their rental for a tidy $500k profit to help their children. All I thought was whose debt is it that you're gifting to your children... plot twist, it's not selling.

It ain't a profit till the money is in the bank.

They might find that the 500k "profit" disappears like a thief overnight.

Yet I completely understand why some people would.

I have two young sons and have been wondering whether I should do this in a year or two at the height of the OCR.

Otherwise, they may never afford a home.

Not in Auckland anyway.

Food, clothing, shelter.

I realise it's completely selfish but a necessary evil this day and age.

I wish it wasn't the case.

You might be able to find a good buy on a hillside desolate, somewhere.

I would rather not go, back to the old house.

"I can see how inter-generational wealth issues compound."

Take away the huge advantages and incentives for flippers looking for tax-free gains under the guise of 'property investment' and BOMAD becomes less of an issue, and BOMAD are less on the hook for deposit equity that for many, may well vanish in the coming months.

It's almost like there were very few winners by blowing out an essential living cost like housing for a quick buck.

Can you please enlighten me how flippers net tax free gains? I have a property that I bought 2 years ago and my understanding is that if I 'flip it' I pay capital gains tax?

The Brightline Test is an extremely recent development. Until then it was relatively easy to just sell investment properties and bank the gain. The Brightline removed the burden of proving intent to make a gain from the IRD and just assigned it.

This problem has been brewing arguably ever since the GFC, where there was a degree of delayed blood-letting, so there was a long time between then and the Brightline coming into force during which some people did very well, at the expense of young Kiwis and people who weren't in on the grift.

Interesting OIA question/response here -

In the 2018-19 tax year there were 28,552 property sales that happened within the Bright-

line period.

Of those, 9,126 were potentially taxable based on the information we had at the time. The

remainder were mostly excluded from the Bright-line Test because they were main homes

inherited or sold by developers or property dealers who pay tax on those sales in other

ways.

For those 9,126, we can see an appropriate amount of income being included in Other

Income for 33% of them, which leaves 67% where income may not have been properly

included.

Mum n Dad should be looking after their retirement but being parents are unable to see the plight of their childern are forced by action or inaction of Orr and Jacinda to support their childern.

If married childerns on two wages are unable to afford a home by themselves, it reflects wellbeing budget of Labour government.

Hello Patrick Star. Housing affordability has been a problem for nearly an entire generation.

Property-owning aristocracy. We may as well add titles that parents can pass on to their kids to go with the house equity. Maybe every property owner can use "Baron".

There are a few posters on this site who would quite like a title like that....it would stroke the ego quite nicely.

or you could just name them Barron like Donald did

You probably can't in NZ. 'Baron' was declined in 2021, and I don't think the extra 'r' would help you get away with it.

https://www.newshub.co.nz/home/lifestyle/2022/01/new-zealand-s-declined…

... or " Barren " ... as in , the box where Labour keep their good policy statements ....

National opened theirs last week and a moth flew out...

It'll be interesting to see how this changes if higher interest rates persist into the future, will the bank of mum and dad be helping out with the mortgage repayments as well?

Nah ShoreThing....it will be just like the 1980's to now where the mortgage gets easier and easier to pay as interest rates fall from 20% to 0%...from an already very low debt/income lending base. (extreme sarcasm).

How has Rabobank lent $5k total to owner-occupier lending?

I thought the same. Must be a typo: thousand = million. Even then it's not much.

I think those thousands should be millions lol

Ditto Heartland - is there just one person in the whole country with a Heartland mortgage? Stand up Trev!

Heartland specialise in reverse mortgages. Maybe they are classified differently? Anyone know?

.. " luckily " for the bank of Dumb & Mad , the recession we have to have is coming ... house prices rose like a sky rocket , and should full just as fast ... the only thing moving faster next year will be the PM , abandoning ship prior to the 2023 election ... off to the U.N. ... leaving our economy in dire straits ... crippled with debt and red tape ...

or like Key after his monumental deficiencies that entrenched this whole mess... hes off to Hawaii

Being a keen fan of spoonerisms, I will use that one!

It is infantile to ask your parents for money.

... it is , when you're 5 ... but , it's a sound strategy when you're 25 ...

Fine, if infantile isn't sufficiently strong moral language, how about anti-meritocratic? Hard-working people from poor families can miss out in the market to people with wealthy parents, but who don't actually merit support.

So as not to discriminate, couldn't we just all put the money into a big pot and it can just be given to complete strangers.

Oh, that's right, we already do, I think it is called tax.

Stupid comment. What you will find in most cases is you do not need to ask for it, it is offered to you and I can tell you its life changing like winning Lotto. What makes the difference is someone giving you the deposit not buying you the whole house and it now looks to be far more common than I imagined. Without that deposit its simply not possible to get on the ladder, house prices have gone up faster than you can save.

I agree, also gifting is nothing new. I'm sure some people have had to do it without help in the past, and people don't have help today (see an earlier comment on this post), but gifting and inheritance has been a driving economical factor since forever. The inverse of this a main reason why poverty is inter-generational.

Hard times make easy times, easy times make hard times. If you've had it hard, someone else has likely had it easy. If you have it easy right now, well... maybe have a think about the people out there enabling that easy life.

Where it may look like gifting etc from my experience its usually a loan to get around bank rules. E.g the parents take out a $150k top up ‘gift’ to their child, sign form saying its a gift then the child pays the loan payments on the $150k as well as their actual home loan. 100% lending effectively, scary.

Anyone who purchased in last two years will be looking at losing deposit and could be in negative equity soon.people paid way over value and will probably regret jumping in at top of bull market. Let’s hope mum and dad has more money to waste.

... good point ... theres no point being dogmatic and using the past as a template ... times have changed ... if the kids need a boost , and if its affordable , just do it ...

totally, the landed gentry have to make sure their place is cemented ad infinitum...and we can always send the ones without any bread to Aussie like we did back in the Empire days...

This has been a huge contributor to house prices sky rocketing... it's always interesting attending an open home and seeing the young couple with their parents and grandparents - you know where the money's coming from & they almost have an open book to secure the property. There's nothing quite like the competition of a few parents in an auction room bidding up prices to try and get their little Bobby and Sally to win a property...

Blaming parents for helping their children is missing the point to a degree. Where does the root cause lie of unaffordable housing and inequality? Is it with the parents? No it is with elected officials in the Beehive over many governments. Some issues in no particular order:

1) Woeful state housing scheme across the board. Inadequate innovations to assist lower income Kiwis to own their homes such as state partnered buy to let schemes.

2) RBNZ / Robertson tag teaming on superheating the economy while leaving housing uninsulated to the effects of a low OCR. DTI etc should have been implemented before emergency OCR moves were made not now. This is the straw that will break the camel's back rather than isolated economic mismanagement and a footnote to the previous neglect of managing housing affordability while looking after other economic metrics.

3) National's immigration influx in 2010's without protecting existing housing stock / limiting property purchasing to new builds only.

4) Abandoning apprentice trade schemes leaving NZ vulnerable to a lift off in labour costs in construction.

5) A vacumn of attractive tax deductible investment vehicles to give the only show in town (housing) some meaningful competition.

There are many many more.

a couple you missed...the absurd building rules and unchecked councils. My house doesnt have wall cavities and is warm and dry.

And the banks wont lend on a do-er upper so kids cant have a go(well they need all the money in the bank to do it up)

pathways have been removed by bureaucrats and insurance companies

Hmm, not sure about that one. New Zealand has some of the slackest standard for housing standards anywhere in the OECD, stuff that wouldn't get approved as a shed or garage in the UK is approved for housing. The leaky homes is a good example of what happens when you cut red tape and let the private sector loose.

My wife & I have been both the BOMAD & the recipients of the BOMAD in that order. We have helped both our children onto the property ladder, one officially, the other in a round-about way. We paid both deposits [$50K and $60K if I remember right - back in the day] with the final contribution being my fathers inheritance which we used to pay off the mortgage on my sons house. My son got on better with my father than I did, so I thought it appropriate the funds went to support him.

Those up against family generational support in buying houses in today's market should consider this. Family wealth is supposed to be generational. That's how families get wealthy, over generations. Work on your family relationships & keep your family together & you too could be the beneficiary of family wealth.

I don't think you mean it to sound this way, but the advice to 'work on your family relationships' is pretty insulting. There are plenty of people who have great relationships with their family, including great relationships with their parents, who won't inherit anything or get any help with the deposit. No amount of 'working on family relationships' can turn back time and give you parents wealthy enough to help with a deposit. It also misses the point - it used to be that someone without wealthy parents had a decent shot at buying their own place off their own hard work. Sure, it might not be as flash as the house their mate bought with help from Mum and Dad, but a couple of teachers or nurses or cops could buy a decent family home if they weren't spendthrifts, plus afford a couple of kids. Now for they most part they can't, and that's a bad thing for NZ.

This weird aspiring to a time of intergenerational family wealth being the key to living is diametrically opposed to any notions of meritocracy too.

I had a group of 11 year olds recently, out of 12, 7 did not sleep in a bed...on the sofa, mattress on the floor...you can tell pretty quickly which ones will get finance from mum and dad...but we know the large middle class has been leveraged up or unleveraged down over the past generation or so and the BOMAD is just another lever

The problem with the bank of Mum and Dad and letting people borrow more money and letting people withdraw money from KiwiSaver and just giving people money, is it’s an arms race. If I get an extra $10,000 and you get an extra $10,000 then the house goes up, and not just $10,000 but often multiples of that. And now we have even more overpriced houses and nobody, not even the person who got the ‘help’ is better off. They may be worse off as they have been ‘helped’ into more debt.

I completely understand the logic of the bank of Mum and Dad and I would probably be that bank for my child. But it’s making the problem worse.

Yup. It's the same problem Warren identified in the two income trap - if there are enough households with two incomes, all that does is bid up the price of housing such that housing now requires two incomes.

I think that problem can easily be sorted. We should all sign a petition to get the law changed so I can have two wives and I can then move to a three income family. This sounds great financially and has definite fringe benefits.

yeah but two wives includes more in-laws

I tend to disagree, it's the competition over homes that is the driving factor. If there were two houses in this scenario, I doubt we'd both be pouring multiples of $10,000 into each house respectively just for the sake of paying more. Where the competition comes from, I'll leave that up to interpretation but it's not FHBs fighting only FHBs out there...

Secondly, and I've seen this multiple times on this site, Kiwisaver is mainly driven by personal contribution. That's the highest driving factor. The returns leave a little to be desired, and the employer contribution wanes the higher you go. To suggest that peoples savings driven investment shouldn't be used to purchase homes is a little bewildering. Not only that, but for young people who are highly leveraged, it's more lucrative in the long term to be putting their 3%, 8% whatever into an offset savings account to reduce interest than to invest in Kiwisaver. At the moment for the FHB, $10,000 in kiwisaver would need to yield minimum of 5-6% to make it a more inviting financial investment than having $10,000 offsetting the mortgage, and given the risks in the market and the rising interest rate, having your savings in kiwisaver is looking less and less inviting by the day.

Not entirely. The house only goes up if you've gone out of your way to totally gimp supply and won't do anything to reduce the cost and timeframes involved in adding more of them. Or adding a stack of people and keeping wages low. Or all of the above.

I mean is it pouring fuel on the fire? Arguably, but the real problem is the fact that the political class had sealed all the exits, and the inflationary pressure should have just burned itself out if we had actually address all the safety valves that would have mitigated the flow-on effects.

I’m not against people withdrawing money from KiwiSaver. They should be able to withdraw what they put in otherwise it’s a disincentive to contribute. I don’t think they should be able to withdraw the employer part or the government contributions.

I agree re increasing supply/reducing demand - that is why the measures any government takes should be focused on building more houses and reducing speculative demand - something that is finally working and I hope isn’t screwed up by a change in government.

The employer part is still the employee's salary, just slightly obfuscated. Why shouldn't it be possible to withdraw it? Ditto with the government contribution—it's a tax credit, it's still part of the (gross) household income.

More confirmation that the egalitarian dream of NZ, partial myth and partial reality, has been totally destroyed.

We have really become a society of the haves and the have nots.

So BOMAD has just used a lot of their home equity and cash to help their kids buy at the peak of the market which means they are going to take a hit as well...

Me thinks gift/inheritance taxes would slow this down a bit... currently we have neither, encouraging inequality as time goes on.

Ah yes, inheritance taxes. "Sorry your dad died. Hey, I can see he left you *sentimental object*. Please cough up because we stuffed up property reform that you're already incurring costs on due to the extra financing costs you had to bear to get a family home in a market we blew the top off."

I say this now on behalf of every Kiwi who is already paying for this through a blown out mortgage: Over my dead body.

The Government has even less right to your late family's property than you do. Why should we bear another tax to fix a problem they created? Are the people who oversaw this bullshit going to pay back the wages we paid them specifically to not cause this problem? Didn't think so.

The government needs to raise a certain amount of money to fund the state, I'd much rather pay some of my share after I'm dead than while I'm alive. I can see the appeal of no inheritance tax for those who are wealthy and don't believe in their children's ability to make it on their own, but personally I believe some kind of meritocracy should exist rather than people being rich just because Daddy was, or Granddaddy, Great Granddaddy....

Inherited income is such an obvious example of unearned income that it should be a no-brainer that it is taxed heavily.

It's only a no-brainer if you assume that government has a first right to every red cent you earn over and over again, with little moral obligation to the taxpayer to provide actual real value for money to the country. There would need to be a massive, massive restatement of the social contract for the government to have any more right to my estate than my children do.

That money was already taxed when it was earned. At some point you are taking the piss. Government ministers are paid extremely well, better than I ever have been. I fail to see why it should be my children's problem that they took the easy way out to keep their own arses in their well-lined chairs. Given our governments have tended operate a knotch or two above a failed state when it comes to tax, regulation, migration and planning reforms, I fail to see why I should go on paying for their failures even after I am dead.

So not such a no brainer, in that what you're saying is 'unearned' is in many cases, already earned and already taxed. Kiwis already pay through the nose while they are alive - student loans, GST, excises, ongoing living costs caused by government stuff-ups. That there could be any moral justification to helping themselves after you've carked is absurd.

But inheritance taxes don't necessarily mean your children end up paying more tax overall. They could be a way of broadening the tax base, and so reduce the proportional burden on wage and salary earners. In the imaginary scenario where I was in line for an inheritance, and you offered me the choice between lower PAYE tax now plus an inheritance tax, or higher PAYE tax and no inheritance tax, I know which one I would prefer.

Sounds like you are heading for libertarianism. Certainly the government handles many things poorly, but it's our right to criticise them, change it ourselves by being in politics and voting them out. The price for keeping everything up however is taxes, it's the price of having relatively stable environments with strong institutions.

Nothing wrong with inheritance taxes, particularly when we have a population who is so anti capital gains taxes. It's a way to pick up the bill at the other end, from all the speculation as a result of not having a broader tax base. Most of the wealth impacted would come from untaxed capital gains in property etc, which is leveraged on top of being unearned. Ranting about it being double taxes (income taxes twice) doesn't apply in this scenario. And no need to set them very high at all, blanket 10-15% or in line with GST would make it very effective.

Many of your arguments seem to be against tax in general rather than inheritance tax specifically.

Tax was paid by the parents, not the inheritor. If my parents die and give me money, I have done precisely nothing to earn that money and the case for taxing it is much more clear cut than me paying tax on my income or capital gains earned by putting my capital at risk.

Any argument against inheritance tax is against equality of opportunity - inheritance is a big hand up to those who are blessed by rich parents who have likely given them an expensive education and opportunities already.

Not necessarily. One could have a large estate to bequeath because of skimping (for want of a better word) on one's children. i.e. you _could_ have afforded private education, but didn't. That results in a larger bequest. I tend to be anti-inheritance and anti-capital-gains tax in general. The money was taxed on the way in; that it has done well since is a credit to the owner of the capital, when it could have easily been squandered.

That's all good as long as the tax rates on the wealthy are high enough to ensure that kids who do not have rich parents are not disadvantaged. Tax like the Scandinavian countries and provide equivalent state services and there is less of a case for inheritance tax.

That would require some objective scrutiny about what our state services are providing relative to what we are paying for it, which is increasingly more and more and getting less and less.

But it's part of the answer, realistically the key would have been a) not letting house prices blow out by taxing capital receipts on investment properties by changing the Tax Act years ago when this first became an obvious issue (early 2000s) and the flow on effect is that people would have lower living costs in order to support a better equipped state, possibly though higher relative taxation - which I'm sure many would be fine with if a basic standard of living wasn't getting further out of reach and getting by wasn't becoming so difficult.

At the moment, I am being asked to accept the need for a death tax so something something poverty, housing or climate change, by a government who is making fundamentally no progress that it can measure or show on any of these issues, despite grabbing more and more of people's take him pay by virtue of taxing inflation. Not only did they get us into this mess, they seem unequipped to get us out of it, and totally disinterested in being accountable to the electorate - even weighted against their own campaign promises.

Until that social contract is reset, then the government has no moral jusification for anything like an inheritance or wealth-tax.

":Any argument against inheritance tax is against equality of opportunity" and I could say something equally as meaningless as "Any argument for inheritance taxes is grave-robbing" but political sloganeering makes for crappy tax policy so I shall not.

The problem with your analogy is that it proves my point. It isn't 'earned' income; there's no step other than someone simply having died. It's not like GST where someone has spent the money on something tangible. There simply isn't a transaction there unless you have a vested interested in deciding one has occurred.

I have no issue with paying tax on my earnings or when I spend it on certain things because those are things I have chosen to do, and I am happy to support the state as a result. The problem is that not only are you taxing my actual income while I'm alive, you're then going to take it again from someone who was simply the object of natural love and affection. There is no intentional transaction to tax, and dreaming one up because soft governments have pissed away the huge amounts of money they already taken from us while I was channeling a huge % of my income before living costs (supposedly to fund those so important things that are so important they don't actually fund already) is not a sufficient reason to tax Kiwis even after they've clocked out for the final time.

Grave robbing is different - we're talking about taxing the assets that aren't buried with the deceased, but happy for you to come up with some appropriate slogans or to argue against mine. It wasn't intended as a throwaway slogan - I have generally found that everyone is for equality of opportunity and claims that we have it in our society, but untaxed inheritances make a complete mockery of this. How do two children have the same opportunity if one of them is gifted a million dollars and the other isn't? And it's immoral for the state to step in and partially level the field?

Again, the tax is explicitly not against the dead. It's levied against the person receiving the income which they have done nothing to earn. If you don't want your money to be taxed after you have died there are generally exemptions for charitable giving.

Arguments against the quantity of tax raised are irrelevant here - I'm interested in the method of raising a given amount of tax.

I have no issue with paying tax on my earnings.

Neither do I. But I do have an issue with paying more tax on money I've actually earnt by my hard work so someone else can get an even larger windfall than they would have got. I really don't understand why you are so keen on keeping the tax burden on wage and salary earners. Why is it so much better to tax earned income than it is to tax an unearned gift?

It was earned and taxed at the time it was earned. If your estate is entirely made up of accumulated savings from a salary, then guess what? Someone earned it and paid tax on it. We're not talking about untaxed capital gains here. This is a distinctly separate concept that is being willfully linked to another for pure ideological purposes.

Anyway, like I have said, if you have a vested interested in assuming a transaction has taken place, you won't accept that there hasn't been an intention to enter into a transaction that should give rise to a taxable event. And in almost every other jurisdiction that has inheritance taxes, they kick in at huge thresholds or offer rollover relief for the exact reason that ordinary people who aren't plutocrats passing on their estate aren't the source of the world's woes.

But no, of course in NZ, we try to slug every man and his dog with as much of a hit as possible. Appealing to the me on the grounds that 'salary and wage earners would keep copping' it is illogical, given the government could have chosen to rein in property investment, resource the IRD to collect revenue based on existing tax legislation or aggressively enforce the Brightline rules. All of this would have reduced the burden on salary and wage earners as well.

The fact they did not is not my children's problem, and I will not accept the government dipping further into my pocket to make up for the civil service failures that directly result from them taking the easy way out.

The money I pay the guy who mows the lawns was taxed at the time it was earned. If you are going to argue that if someone has already earned and paid tax on money it shouldn't be taxed again, then my lawn guy shouldn't pay tax on what I pay him by that logic.

It is not illogical to hold that inheritance taxes would reduce the burden on wage and salary earners because there are other ways this could also be done. And one thing an inheritance tax definitely is not is the government dipping into your pocket. You're dead if you are leaving an inheritance!

Always great to see the tall poppy syndrome is alive an well in NZ.

Strange comment - the current system is that we primarily tax the potential tall poppies as they earn. I am proposing reducing taxes on the living (making it easier to become a tall poppy) and instead taxing after the poppy has died. Absolutely nothing about this proposal punishes an individual's success, quite the opposite.

Or do you mean the tall poppies who weren't able to achieve that status themselves and relied on inheritance to stand above their less fortunate peers?

Exactly - all the folk who made NZ into a place primarily funded by income tax are just envious of those who have the skills and smarts to attract better salaries. It's a jealousy tax led by those who would chop down tall poppies and want to freeload off them.

Not worried about your ability to compete in today's knowledge economy?

The government is us. Part of their job is to protect the interests of the majority. If a minority start taking too much of the share of the pie leaving others to starve it's the government's job to redistribute the pie a bit. This is the essence of government. If the government doesn't do this well you get a revolution where the hungry kill the rich and eat their pie.

Exactly.

According to the report over half of these contributions aren't loans at all. This article is very misleading.

'Repayments

Three out of five parents didn’t expect their contribution to be paid back.'

Nationally representative research found that more than half (58%) of New Zealanders who don't own property consider themselves to be locked out. A common issue facing one in four home buyer hopefuls was that they were saving for a deposit but couldn't catch up.

Deposit issues could be solved overnight by removing the temporary LVR restrictions or providing an exemption for first home buyers.

Crocodile shedding tears?

If this is a suggestion of low deposit for FHB, that only causes high debt. With all the talk of DTI and rising interest rates I don't think providing FHB with an "easy in" low deposit would really help them at all, it would likely consume them - death by 1000 rate hikes. This kind of lending was happening all over the show immediately before the GFC in the US for example.

Could all be avoided by making it illegal for first home buyers to take out mortgages I suppose. That way they wouldn't have any debt.

LVR's are there to stop you getting hurt....removing them is like taking the speed limits of the roads and letting the idiots kill themselves and the innocent parties around them as well.

LVRs are there to stop the banks getting hurt, not the borrowers.

I think the banks can look after themselves. LVRs are there to protect us from the banks.

Banning loans on houses, lending money for non business purposes be great. Totally non starter but it would push the default house price to what is now a deposit and cut out the parasites. Saving the country $billions.

Just a dream.

Hahaha good one.

It's all unravelling in Welly. Latest Lowe & Co vid. Good stats and graphs. "Prices back to where they were a year ago"... "more listings than anytime since 2015". I've advised my FHB son to sit on his hands for a bit longer. Deposit is only one of the issues. Affordability is the killer. https://www.youtube.com/watch?v=9noW2JbNI3c

Wow.

"Prices are declining, advice for buyers is to GET AMONGST IT DO NOT WAIT FOR CONDITIONS TO GET ANY BETTER."

I had to turn this off, it's sickening.

... I keep hearing stuff like " it's more affordable now " ... " grab a bargain " ... " it's a buyers market " , and I think what utter twaddle ...

Houses are still double where they ought to be priced ... and the mother of all recessions is roaring straight at our economy ...

... the Reverse Bank have blundered badly , and are still deeply in denial ...

they have made a mess but to be fair it is all of the desk jockeys to blame...banks, councils, ministers, and of course the PM who chose political survival over effective decisions...

Nah, can't blame anyone but ourselves. Anyone who bought a house in the boom is partly responsible

Lowe and Co are shitty even by realtor standards

If the camera panned down in that video. Would he be trousers down on the toilet. Because he is full of

How lowe can they go.

Long may it continue, we need those lines to keep at the -5% for about 10 months...

OK here's an interesting case study for those familiar with how out of whack things have become in Dunedin of late.

19 Font Street, Kaikorai:

Homes estimate: $665,000

https://homes.co.nz/address/dunedin/kaikorai/19-font-street/KLPQG

Realestate estimate: $638,000

Sold 14 April 2021: $580,000

Renovated, relisted 22 Feb 2022 $635,000

https://webcache.googleusercontent.com/search?q=cache:kBILFZeAH8MJ:http…

Withdrawn, relisted with different agent 27 April 2022 $540,000

https://www.realestate.co.nz/42152670/residential/sale/19-font-street-k…

Good to see. A little s-box like that should be worth <250k, in a sane world.

Many sites like homes.co have popped up while the property bubble has been inflating. Their algo's that have been written during times of inflation to calculate the "estimated prices" or whatever. I have a suspicion that the people in those businesses now are quickly trying to figure out how their algo's should work during times of deflation, because it seems to me, they aren't cutting it at the moment and are in "hold prices up" mode instead of dropping them with the market.

homes and re.co.nz will simply be a presentation of data from a big data platform such as Core Logic. Their estimates are computer driven based off similar sales that have happened in the past so there is no guess work. This is how to value a nations housing en mass. If people have been relying mostly on this information to make a purchase decision, then that's a real issue. Banks can require an independent valuation before committing to a mortgage.

A week or so ago a comment on this site mentioned agents required to inform vendors of other recent sales in the area to give some indication however they were finding it difficult to then talk them down from that price to something that would realistically get a sale over the line.

Same thing.

"Past performance is not indicative of future results"

Interested to see if that survey asked the parents to distinguish between loans and gifts. The bank always gets the parents to sign a declaration saying the money is a gift and is not expected to be repaid, but the way the article talks they're suggesting bank of mom and dad require repayment in some shape or form.

BOMD solves the LVR issue for FHB. But not the DTI issue. Banks could turn a blind eye in a rising market. If everything went tits up the bank could force a sale and likely not lose any money. Just wipe out the deposit. Now Johnny and Sarah earning a combined 160 K gross need to service their 700K mortgage at 5% instead of 2.5%. That's another $18750 per year ($360 a week) they need to find to service yearly interest cost. Johnny and Sarah need to find another 30k of gross annual income if they don't want to lower their living standards. Heaven forbid if they want to have a child at some stage. Back to the BOMD for a weekly stipend?

Because I am one of the boomers who have been able to do so I have helped my children with their tertiary studies, overseas travel, vehicles and first homes. I make no apology for it. They are both professionals and work hard. I respect them both. Currently I am helping one of them to upgrade to a better home as they now have a child. Why would I not do that. I have more than I need to live the rest of my life in comfort. They win and my wife and I win. Too many people get their kids to wait until they die to get an inheritance and when they die there is a stupid amount of capital lying around unspent. When my wife and I are dead we hope we don’t have stupid amounts of capital lying around. As we get older we will need less money to live on. Why not help our children, grandchildren , nieces and nephews before we kick the bucket.

Ex agent did your parents do the same for you...and would you class your children as resilient and independent (or do you rush in to help at any sign of trouble)?

None at all as too many kids and they did not have the resources. Both of my kids are both big earners. They both budget and they had bank loans. They are resilient and they have never asked for help. We just want to help them. I have friends who are lawyers and believe me there are kids out there dreaming about and already spending their inheritances. Money does not make me happy. Having a nice relationship with my children, grandchildren and friends makes me happy.

Thank you - well from a family of six kids I worked for everything I have today. I am surprised they said yes as are big earners - probably that's the point you still need Mom/Pop and earning big dollars to have kids and own a home these days in NZ?

I know the penny has not dropped for most people, but it's not firstly about BOMAD, interest rates, or immigration, etc.

Because prior to 1993, historically we still had all these things, and houses were only 3x median income.

And in jurisdictions where all these things still exist, houses are still only 3 to 4x median income.

All these other things ONLY MATTER, if you have dysfunctional land use and housing policies.

I really feel for the person who killed both their parents when they wouldn't buy them a house and then tried to get leniency on the grounds they were an orphan.

Immigration was really low in the 1980s. And interest rates were high.

Yea we added like 20% of our population in the last twenty years, why do people pretend this doesn't have an impact in a place like Auckland, where land is limited and we can't supply the market with new construction fast enough even with the borders closed?

You confusing something physical like land, with something intangible like land policy.

As Auckland has grown beyond the constraints of the isthmus, then more land has opened up, not less, and it is only the land use policy that has tried to constrain the growth within the isthmus.

And Auckland had a net population loss over the last 12 months, and yet the building rate, which is based on a countercyclical cycle, is building as though it was 2 years plus ago.

Immigration was about average in the 1980s compared to the decade both before and after. But housing was still 3x median income, which was maintained in spite of the high-interest rates because we also saw a corresponding inflationary rise in incomes, plus two-income families.

As long as the relative difference is kept, then these other things have very little effect. But the relative difference was lost once we introduced restrictive land policies that have allowed the demand and supply cycles to become countercyclical when with the correct policy the two cycles almost lie on top of each other.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.