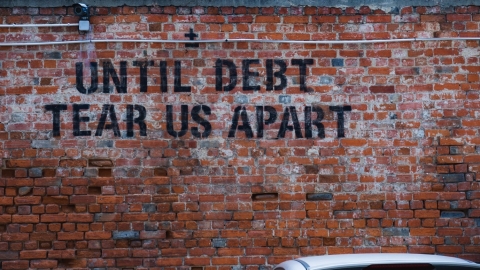

Household Debt

Economists at NZ's biggest bank lift their forecast OCR peak by 75 basis points, also see neutral OCR well up on RBNZ's last estimate

17th Sep 22, 7:56am

191

Economists at NZ's biggest bank lift their forecast OCR peak by 75 basis points, also see neutral OCR well up on RBNZ's last estimate

Institute of International Finance cautions on hidden debt in emerging markets as global debt hits new highs

19th May 22, 12:38pm

17

Institute of International Finance cautions on hidden debt in emerging markets as global debt hits new highs

Credit bureau Centrix says business debt demand is starting to rise, suggesting improving business confidence

3rd May 22, 5:00am

8

Credit bureau Centrix says business debt demand is starting to rise, suggesting improving business confidence

[updated]

Consumer NZ says the Bank of Mum and Dad is the fifth biggest owner-occupier lender in New Zealand

28th Apr 22, 8:26am

117

Consumer NZ says the Bank of Mum and Dad is the fifth biggest owner-occupier lender in New Zealand

ASB's Vittoria Shortt sees 'clear' impact from credit contracts & consumer finance law changes, says there's no moral attachment to lending decisions

10th Feb 22, 8:12am

88

ASB's Vittoria Shortt sees 'clear' impact from credit contracts & consumer finance law changes, says there's no moral attachment to lending decisions

Will changes to credit contracts and consumer finance laws lead to a government-induced credit crunch or protect borrowers from predatory lending?

16th Dec 21, 5:00am

69

Will changes to credit contracts and consumer finance laws lead to a government-induced credit crunch or protect borrowers from predatory lending?

ASB economists calculate that every one percentage point increase in mortgage interest rates would add $3.3 bln to NZ's household debt servicing costs

23rd Sep 21, 2:05pm

22

ASB economists calculate that every one percentage point increase in mortgage interest rates would add $3.3 bln to NZ's household debt servicing costs

Gareth Vaughan on the danger from African Covid variants, Deutsche Bank's 'pot, kettle black' moment, Elizabeth Warren v Wells Fargo, household debt on the march & the buyers of long-term NZ government debt

17th Sep 21, 10:08am

28

Gareth Vaughan on the danger from African Covid variants, Deutsche Bank's 'pot, kettle black' moment, Elizabeth Warren v Wells Fargo, household debt on the march & the buyers of long-term NZ government debt

Aussie parents of NZ's major banks prepared to lend mortgage borrowers up to seven times gross income, which is more than UK, Canadian, Swedish and US banks will lend

14th Sep 21, 6:13pm

2

Aussie parents of NZ's major banks prepared to lend mortgage borrowers up to seven times gross income, which is more than UK, Canadian, Swedish and US banks will lend

Institute of International Finance's Global Debt Monitor shows global debt down slightly in the March quarter

15th May 21, 9:23am

2

Institute of International Finance's Global Debt Monitor shows global debt down slightly in the March quarter

Institute of International Finance says unprecedented increase in global debt means it's not clear how the global economy can deleverage without significant adverse implications for economic activity

19th Nov 20, 9:00am

42

Institute of International Finance says unprecedented increase in global debt means it's not clear how the global economy can deleverage without significant adverse implications for economic activity

Alison Brook says while Covid-19 is unlikely to signal the end of the office, if working from home can improve productivity then this could be a rare positive arising from the crisis

16th Sep 20, 12:57pm

25

Alison Brook says while Covid-19 is unlikely to signal the end of the office, if working from home can improve productivity then this could be a rare positive arising from the crisis

Alison Brook asks if, in the context of our already high levels of household debt, we are relegating ourselves to a tepid, low-growth recovery

3rd Sep 20, 8:57am

101

Alison Brook asks if, in the context of our already high levels of household debt, we are relegating ourselves to a tepid, low-growth recovery

Boss of credit bureau Centrix surprised by volume of borrowers in arrears not seeking a mortgage deferral, says credit demand fell across country when Auckland moved into new lockdown

19th Aug 20, 10:45am

20

Boss of credit bureau Centrix surprised by volume of borrowers in arrears not seeking a mortgage deferral, says credit demand fell across country when Auckland moved into new lockdown

Alison Brook argues the COVID-19 crisis offers the opportunity for New Zealand to reorientate to a 'new normal' that will enable it to shrug off the decades of poor productivity and create sustainable growth

13th Aug 20, 12:33pm

38

Alison Brook argues the COVID-19 crisis offers the opportunity for New Zealand to reorientate to a 'new normal' that will enable it to shrug off the decades of poor productivity and create sustainable growth