The strong savings patterns of Kiwis seen during the early days of the pandemic are being quickly reversed, while the value of household assets is falling, according to new data out from Statistics New Zealand.

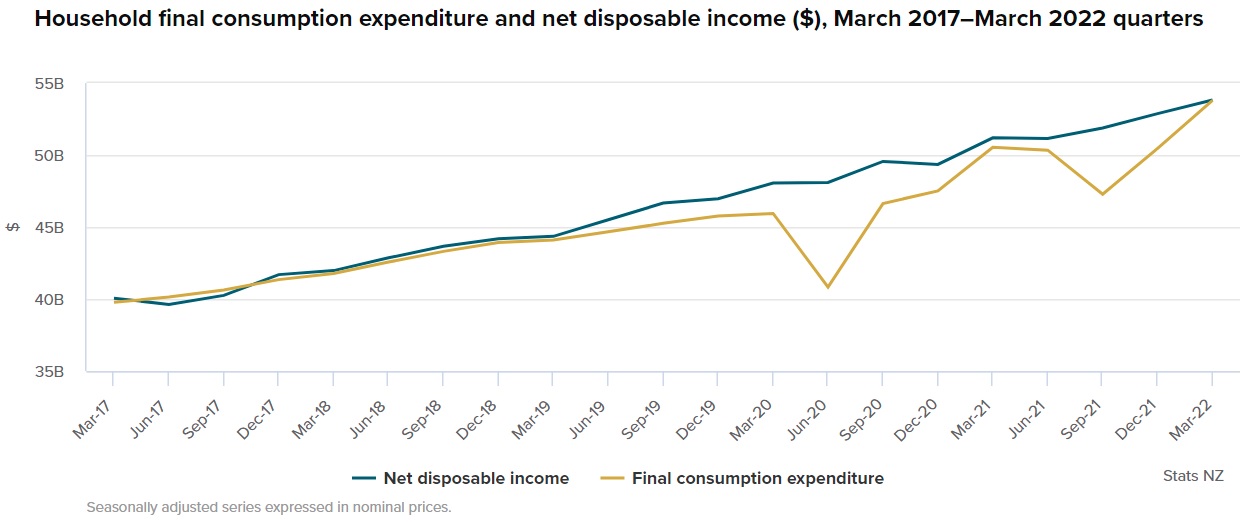

Stats NZ says in the March quarter this year Kiwis spent nearly every dollar of their income "as the ratio of saving to disposable income approached zero".

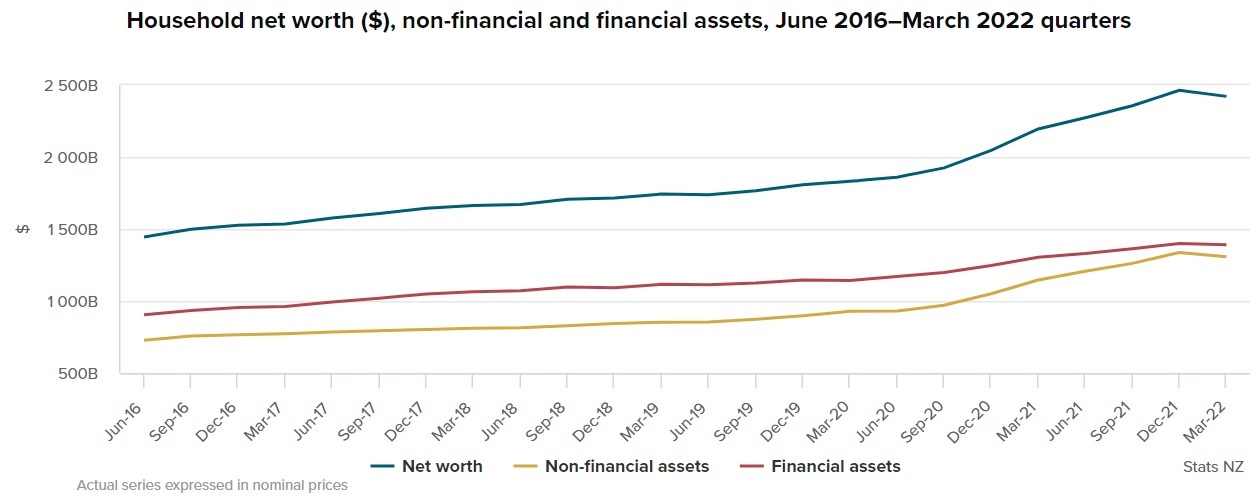

Also, household net worth fell in the March 2022 quarter by $42.3 billion, or 1.7%.

This is the first quarterly decrease in household net worth since a fall of 0.3% in the June 2019 quarter.

In terms of the household spending, Stats NZ said in the March quarter a rise in disposable income was "outpaced" by continued growth in household spending. This resulted in a return to the level of saving seen before the pandemic.

The March 2022 quarter saw household disposable income increased by 1.8% to $53.8 billion - but at the same time consumption spending increased by $3.3 billion (6.6%) to $53.8 billion.

Stats NZ's national accounts institutional sector senior manager Paul Pascoe said in the earlier stages of the pandemic, household saving was relatively high.

"Limited access to shops and services decreased household spending. At the same time, government subsidies supported household incomes.

"Saving decreased in the March 2022 quarter as household spending surged,” he said.

In terms of household net worth, Stats NZ measures this as the value of all assets owned by households less the value of all their liabilities, or what they owe.

Household net worth fell in the March 2022 quarter by $42.3 billion, or 1.7%. The impact of falling house prices can be seen.

The value of total household assets fell $38.2 billion while liabilities rose $4.1 billion, both contributing to the overall decrease in net worth.

Stats NZ says households have both financial and non-financial assets. For the household sector, non-financial assets are mostly a mix of residential buildings and land, making up around 45% of total assets.

Combined 'non-financial assets' (IE largely property) fell $30.6 billion in the March 2022 quarter following an increase of $76.1 billion in the December 2021 quarter.

"The fall in the value of non-financial assets represents a decrease of 2.3% this quarter after a sustained period of strong growth. These property valuations include owner-occupied properties only," Stats NZ said.

Household financial assets also fell during the quarter, down $7.7 billion. Equity and investment fund shares led the fall, down $6.8 billion. This asset class includes shares held in listed companies, investment fund shares, and equity in unincorporated New Zealand businesses. The latter includes the ownership of rental properties as equity, that is, the value of the properties less the mortgages held.

Households also experienced a $3.5 billion fall in the value of their insurance and pension assets in the March 2022 quarter. Partly offsetting falls in household financial assets was an increase in currency and deposits (such as term deposits), up $2.6 billion. This is the only financial asset class to record an increase from the previous quarter.

Household financial liabilities like housing loans, consumer loans (credit card debt), and student loans grew 1.5%, continuing a relatively steady increase in recent quarters.

80 Comments

Well the wealth effect might have been a short lived bonus - like giving drug addicts a hit so they can avoid rehab for another week.

This comment instantly made me Spotify Amy Winehouse - Rehab.

If someone could sneak a boom box into a public RBNZ meeting and play this song, I will, on my mother, give you $100 (not inflation adjusted so is a time sensitive request).

The RBNZ itself laid out in a 2019 study that reverse wealth effect has bigger economic loss implications than the economic boost from wealth effect.

So Orr knowingly risked the entire economic stability in pursuit of small temporary gains.

successive governments and agencies have had that mindset for the last 20 years and now its all coming to an end as we always knew it would.

Ponzi is over for now, but im sure they will roll out the money printing machine again once the situation gets extremely serious, out of pure desperation!

And people really didn't like folk calling out the fact we've been living beyond our means at a cost to the next generations. Yet now we're seeing the consequences of that greed mentality.

You're right - policy positions in NZ have only been about stimulating aggregate demand.

Lagging infrastructure, stagnant productivity, exports & R&D shrinking as a % of GDP, taxing labour and consumption hard, huge current account deficits - all borne out of an import, borrow and spend economic mindset.

All underpinned by the stupidity of housing. Rents and mortgages required to support speculation driven values is sucking the spare cash from households in favor of record banks profits, 86% of which is exported to Aussie owners. A huge boon to the Banking industry and all under a multi term Labour govt. Is this the greatest sell out of political values in the NZ's short history...?

This is what grates me so much about the "rising property prices are good for the economy" brigade.

Was having this exact discussion the other day with a REA I know (he's a nice guy on a personal basis, just disagree with him completely). He was whinging that taking steps to lower house prices will mean people feeling poorer, and then not going out to spend so much.

The problem is that wealth effect spending seems to be based primarily around borrowing against the increased value of your property or property portfolio. That new $150k BMW M3 isn't all that bad when it's "offset" by your home and IP portfolio having gone up by $500k in the past year.

He simply didn't seem capable of understanding that higher housing costs (both big mortgage repayments - which are about to get a whole lot bigger - and high rents) suck spare cash out of the economy like a black hole.

Imagine waking up tomorrow and having a mortgage or rent payment 50% smaller than it is now. What would you do with that money? Plenty of people would be out spending that cash (not borrowed money against rising asset prices) at shops, cafes, service businesses etc.

But no, it's much better that the average Kiwi is crushed under increasing mortgage and rent payments so that a smaller section of society can feel up to the arduous task of borrowing money and splashing it about.

....you mean all under the mainstream political parties of Nat and Labour.

I'm not sure what else one expects when you let a couple of silly buggers play silly buggers with fiscal and monetary policy.

Well this is it. The sheeple would be better off not being nudged to load up to the gills with debt. Arguably it would be better for people to have lower house prices and a rainy day fund than a property bubble with everyone living paycheck to paycheck.

All a bit too late to think about that trade off now.

is it just me or are the current world leaders just the most incompetent bunch of dimwits in all history

Just look at this list

Joe Biden (demented and has no understanding of the oil industry)

Kamala Harris (word salad queen, would be surprised if she graduated Kindy)

Boris Johnson (lets have another party)

Justin Trudeau (Truckers are racists and misogynists if they don't agree with me)

Recep Erdogan (what inflation)

ScoMo (urgh)

Jacinda (I refute everything)

Grant Robertson (Nothing to see here)

European Leaders (we are going to sanction Russian Oil and Gas that we are massively reliant on)

I am not expecting any common sense solutions to anything any time soon...

And the one notable recent example - a 1980s serial conman who managed to get many Americans and even Kiwis to hitch their identity to his cult of personality. Remarkable times.

Social media has exacerbated all the above. I watched something the other day that said the last 10 years of human history have been the dumbest (as in simple and meaningless, with profound far reaching negative side effects) in history as far as content traded & discussed goes.

We've basically nailed using no or empty calories to make ourselves dumber. Rather than mastering excess calories to generate specialists. A sort of social and intellectual anti-evolution or devolution if you will.

I feel almost offended by the fact that you didn't mention Mario Draghi, current italian prime minister.

He used to be the head of the ecb for a while.

I don't think things have got worse. Very few leaders from the past were excellent. Imagine if Jacinda was as drunk as Muldoon! Constant media just makes us more frustrated with them.

How old are you brock. You post a lot and keen to attribute your perspective to a generation / life stage

Technically millenial

We're usually double blue voters but have to take our hats off to GR & co for the 40% increase of our financial & non-financial assets, much of which is in property. I know it's starting to head south, but we don't have any exposure to Wellington, thank God, apart from sending our taxes there.

What’s going to stop the rest of NZ from catching up to the level of Wellington’s house price values? If we all fall in value it makes it easier for those born after you and me. We have just been lucky not clever.

It's a certainty. -30% by Christmas.

Brock, I once thought your predictions were worst case scenario, but now I have to admit that I think 30% is best case - you've nailed it!

They really did narrow the philosophical gap to National, on supporting housing wealth.

As NZ runs current account deficits this only leaves the government running budget deficits as a source of net financial assets to increase our savings. Banks cannot increase our savings overall as assets and liabilities cancel each other out.

Economist Wynne Godley explained this with his sectoral balance accounting identity (S-I)=(G-T)+(X-M).

Time to wheel out the MMT paradigm to steady the ship ya reckon. I guess it's inevitable. But to be frank, what scares me about MMT is that it will simply heighten the power and importance of the bureaucrats even more. Remember, they're largely responsible for the mess the Western world is in right now. Don't want to sound alarmist or conspiratorial, but the MMT framework sits nicely with the WEF and people like Ardern and Robbo. I find that to be more than just a little troubling.

Nope, those responsible are bankers, the big creditors (the 1%), speculators, the greedy (RE industry), politicians and their major donors (the 1%), rampaging colonizers and their forebears who've reaped ill gotten gains, bankers, bankers and bankers.

MMT describes how our monetary operates here and now, it is not a policy that you adopt. The biggest problem is that mainstream economists don't understand it.

MMT describes how our monetary operates here and now, it is not a policy that you adopt. The biggest problem is that mainstream economists don't understand it.

I know. Descriptive not prescriptive. But as I suggested, assuming that it was mainstream thought, its associations with technocracy would be undeniable.

It seems that accountants have a better grasp of our financial system than do economists.

https://www.nzae.org.nz/wp-content/uploads/2017/01/Keith-Rankin.pdf

The problem with MMT is political....if the 'great unwashed' are offered an unrestrained supply of 'money' what does any realistic observer think is going to happen?

It would bring new meaning to the term 'chaos theory.'

Very political. I can envisage a small number of 'very smart people' with much control over the money supply. In some ways, not that much different to now. But I fear that the control of socio-economic affairs would be overbearing.

People already have an almost unrestrained supply of money via bank lending. Commercial banks create new money when they lend and and in vastly greater quantities than through government deficits. This is what causes our boom bust cycles and unaffordable housing.

https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creati…

It may appear so to you, but the availability of credit is tightly curated.....that does not mean sensibly curated.

You dont get to vote (or majority rule) on bank lending decisions.

There is very little control on bank lending other than through interest rates, banks can always raise more capital and the central bank will always supply more reserves to keep the system operational. Trying to steer the economy using monetary policy has got us in the mess we are in.

Who gets that credit and for what purposes is what is curated.

The wife asked me what I'd like to do for my birthday ... I said I'd like to go somewhere expensive ... so we spent the afternoon in the dairy section of the local New World ... sweeeet ...

My wife loves me even more. I got treated to the produce section.

.... wow , true & everlasting love , Brock ...

I'm off to TradeMe ... see if I can pick up a small block of cheese in the secondhand dairy products section ....

Mmm... pre-loved cheese...

my wife took me to the petrol station :)

mine took me to the cleaners

I am hoping to try some of those $22/kg courgettes for my birthday

Go on. Treat yourself with avo on toast. You only live once.

That's why young Kiwis can't afford houses, not the stupid economic policy and resulting prices.

Exactly. It's also the reason why we have superannuants struggling on our pittance of a pension they so rightly deserve more of.

One elderly couple feel "ripped off" while they struggle in retirement, dipping into their small pool of savings to get by.

We can't have people dipping into their savings when they retire......

https://www.nzherald.co.nz/rotorua-daily-post/news/seniors-on-superannu…

Nice. You two should consider a Caltex or Z forecourt if you're looking to splash out even more next time.

Also, household net worth fell in the March 2022 quarter by $42.3 billion, or 1.7%.

This is the largest quarterly decrease in household net worth since a fall of 0.3% in the June 2019 quarter.

1.7% is a lot more than 0.3%. What are Stats NZ on about?

When reporting on data, there is no need to add subjective modifiers unless they have meaning. For ex, 'significant' should only be used for the statistical meaning of the word.

"Kiwis are burning through their cash - AND the value of household assets is falling"

Prefect receipe for disaster though house value falling does not affect average home owner as are staying in their home but this is for Speculators - polite word will be Investors.

Prefect receipe for disaster though house value falling does not affect average home owner as are staying in their home but this is for Speculators - polite word will be Investors.

Sorry to burst your bubble (ignore the pun) but it affects everyone in some way or another. That is why property bubbles in particular are bad. The ruling elite should understand this by now, whether it's Antonia Watson, Robbo, Kaumatua Orr, the list is endless.

Combined 'non-financial assets' (IE largely property) fell $30.6 billion in the March 2022 quarter following an increase of $76.1 billion in the December 2021 quarter.

There's a lot of asset inflation to be unwound and not a lot to time to get it done. In retrospect quantitative easing clearly went way too far.

And here is where I was making exactly that point about quantitative easing a little over two years ago. At the time I wondered why I seemed to be the only person writing that way. You cannot create $53 billion of QE without setting off major inflation. NZ was not the only country doing this - it became standard economic policy in western countries with Central Banks behaving as a herd.

KeithW

Spot on as usual Keith. Unfortuantely, the central banks are slaves to their own dogma. Rinse and repeat. And in the case of NZ, I have the feeling that the finance minister is trying to run his side like someone non-mechanically minded or gifted reading from a car manual.

Well, it worked in the financial crisis but that was predominantly driven by a severe miscalculation of risk rather than a real economic problem like shutting down businesses.

That said it's becoming increasingly clear that wage inflation is a feature of demographic changes accelerated by the pandemic.

The GFC manifested as a liquidity crisis and hence there was a logic to QE in one form or another.

But the COVID crisis could have been managed by leaving Treasury bonds in the market place, and with very little QE.

KeithW

"Path of least regrets" leads to regret.

I wonder if a sizable chunk of that 50 % who voted Labour in the 2020 election are having serious regerts about it now ...

I wouldnt have minded if that $ 53 billion had been effectively applied to medicine , education , scientific research , a new bridge at Tinwald ...

... remind me , where the heck did it go ... anywhere useful , tangible .... accountable ...

Fooooof ! ... we just blew our children's future ...

I wouldnt have minded if that $ 53 billion had been effectively applied to medicine , education , scientific research , a new bridge at Tinwald ...

Yes. It's hard to tell what their thinking is because they don't explicitly state what they think. My hunch is that if they support the bubble, then that provides the capital base for SME's. So indirectly they're letting the private sector work its magic. Only time will tell if the bet pays off.

Their key aim was to lower interest rates. But interest rates were not an important constraint to productive investment at that time. Indeed it largely skewed investment into non productive-endeavours.

KeithW

The cantillion effect occurred. The money was pumped into assets, since it was essentially money pumped into banks, who used it to lend in larger quantities at lower interest rates. The inflation didn't reach ordinary goods simply because it had to go through the banks to reach ordinary people.

The madness of dropping interest rates in response to imported deflation (cheap asian goods), creating asset bubbles...

is as crazy as...

Raising interest rates in response to imported inflation (energy/food), destroying asset bubbles.

There must be a better way. e.g. limited debt creation to a certain percentage of GDP growth or similar to remove the speculative behaviour? i.e. the quantity of debt created is supported by the actual performance of the local economy and not the productivity of foreign workers on slave labor wages (e.g. cheap goods feeding into CPI).

Jfoe - can you write some new policy for central banks to operate by that ends this insanity? We should team up and give it a go...

Idle interest bearing bank reserves (assets) sitting on the RBNZ's liability ledger.

It was said at the time, unless it went into producing something productive it was always going to end this way. Many on this site expressed these views, so what has happened has not surprised some people. It was just a shame, GR and Orr etc etc expressed the opposite view and sucked a lot of people into taking on huge amounts of debt, and that we were only ever in for a soft landing if it turned pear shape.

Here - specifically the commentary from the random punters on Interest - is the only place where I haven't felt like a raving loon for thinking that massive QE into an ongoing speculative frenzy was a bad idea. Also the only place where, for the last 5 years, it's been acceptable to speculate that we might be in a once-in-a-century housing bubble completey unmoored from fundamentals.

That is because interest is the only place in the New Zealand media that really lets people comment. People are not that dumb, sure there are some. The media is bought by advertisers and industries. Too scared to offer a differing opinion.

There is also the cry of listen to the experts, the fact is all experts have been trained (brainwashed) in the same schools so are going to agree. I also don't buy the argument that the experts know more. If most times I hire a plumber to fix my bathroom tap and every time I turn it on the kitchen tap starts running, I will no longer have any confidence in plumbers. The same goes with economists, "experts" can only get it wrong so many times before people stop believing them.

if it just government bonds that are being repurchased then it is in no way "new money" any more than when a bank repays your term deposit. It is money that belongs to whoever purchased the bonds and is being returned to them, while bank reserves also increase but banks don't lend reserves anyway. It's main purpose is to lower interest rates which the Reserve Bank itself stated. Just as bond sales are an interest rate mechanism and not a financing operation, they control the levels of reserves in the banking system.

if it just government bonds that are being repurchased then it is in no way "new money" any more than when a bank repays your term deposit. It is money that belongs to whoever purchased the bonds and is being returned to them, while bank reserves also increase but banks don't lend reserves anyway. It's main purpose is to lower interest rates which the Reserve Bank itself stated. Just as bond sales are an interest rate mechanism and not a financing operation, they control the levels of reserves in the banking system.

The MMT argument that QE is not 'money printing' is technically correct, but it's a bit of a cop out in my opinion, particularly in the Anglosphere. For ex, in the U.S., broad money is about 3.7x as much as base money. In Japan, broad money is about 1.8x as much as base money.

And why is this? Japanese h'holds and firms have been paying down debt and not taking debt on. The mentality in the West is akin to drunken sailors on the town. And we know exactly where that money is being spent.

Why don't you tell Keith Woodford that he is wrong then instead of always arguing with me? You seem to like to argue with me just for pleasure of it rather than discounting what I say. You have admitted previously that you think that MMT is correct. If politicians can't be trusted with the truth then that is a different matter but I think that it is orthodox economics that causes most of our problems.

I have mixed feelings about MMT for the reasons I have stated. But primarily I have issues with how it relates to the value of money.

You should be very critical of commercial banking then. How much does it take to buy a house now? Where has the value of that money gone to. The money that is held in bonds is the low risk investment of the finance and retirement industry, they are not going to go out and spend it, they may do no more than leave it in the bank when it is returned. Talking about the LSAP (QE) as being inflationary is largely nonsense.

March quarter huh. 1.7%.

June's gonna be something to look forward too.

It has been said many times and I have said it myself, we will look back on these times and think “What the f were we thinking!”

Many of us here @ interest.co.nz will look back on these times and wonder " what the F were they thinking ! "

... " they " being Robbo & Orr ...

I look back and think........what the f### has happened to our media? Instead of our leaders and decision makers being drawn over the coals at 7.00pm every night to answer to the public, we get trivia.... a you tube clip instead some debate.

It turns out that dumbed down news gets way more views than the proper old news reporting.

Makes it easier for the politicians who dont ahve to deal with all those tricky questions.

Nothing wrong with a spot of optimism. 3000 skiers hit the slopes today at Mt Hutt. Tough times all right.

school holidays and a decent dump of snow, I'd be up there if I was in the SI. Sometimes you have to pause stressing and go carve some powder

I could never figure out what Mr Orr was thinking when he lowered the OCR to the point where savers were barely making 1% on their savings. I remember reading an article by him saying that believed savers would put their money in the stock market instead.

The problem is that changes to the OCR affect stock prices

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.