BNZ has raised some term deposit rates today (Wednesday), not by huge amounts, but notable all the same.

This continues the recent trend of rising rates on the savings side, even as home loan rates dip down somewhat unexpectedly.

The new BNZ six month rate is now 3.00% which is the highest of any main bank for that term, and a +15 basis points rise from them. Most challenger banks had already risen to 3% or higher, but this is new ground for main banks.

All other rises from BNZ just match their main rivals.

Among main banks, there is a substantial 100+ bps jump from three or four months of about 1.90%, to the 3% now available at six months.

There is another +30 to +40 bps jump to more nine month rate offers. And there is a further +70 to +100 bps jump to the 4.00% offers prevalent for a one year term deposit.

Among the challenger banks, there are further premiums on top of those.

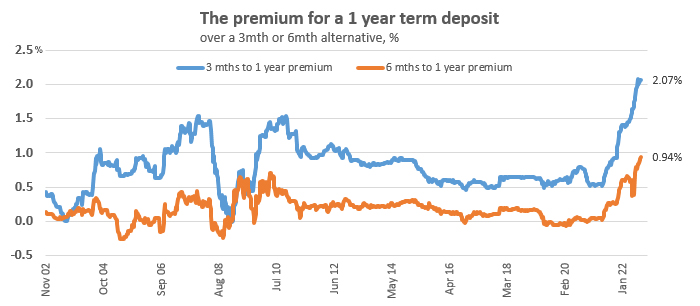

This is a steepish rate curve at the shorter end of the term deposit market ('shorter' being one year and less). Our data of all bank averages shows the premiums for a one year term deposit have never been greater since we started recording this data in 2002.

The six month premium over the 90 day offers are now back up to levels we last saw (quite briefly) in 2008.

These overall movements may seem a little odd, especially in the light of a number of banks actually reducing some home loan rates over the past week or so. The logic of rising TD rates and falling mortgage rates at the same time is hard to see and suggests one of these trends wont be sustainable.

Wholesale interest rates have been inching down over the past week or so, so it might be the term deposit rate rises that are exposed to an adjustment soon.

Of course, the other important factor that will come into play in the next week is the Reserve Bank's Official Cash Rate review on Wednesday, August 17. And as this is a Monetary Policy Review as well, it will come with much more commentary and forecasts about how this regulator is thinking about our economy. These have the potential to be very influential on where term deposit rates go from here. Continuing to lean hard against inflation, even at the risk of recession, is likely to steepen the short end of the rate curve further. A wavering might ease things back.

An easy way to work out how much extra you can earn is to use our full function deposit calculator. We have included it at the foot of this article. That will not only give you an after-tax result, you can tweak it for the added benefits of Term PIEs as well. It is better you have that extra interest than the bank (and especially if you are in the 39% tax bracket - PIEs are taxes at 28% flat).

The latest headline rate offers are in this table after the recent increases.

Update: Please note that this table has been updated with subsequent Kiwibank changes which were not in earlier versions.

| for a $25,000 deposit August 10, 2022 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 1.90 | 2.85 | 3.30 | 4.00 | 4.05 | 4.10 | 4.20 |

|

AA- | 1.90 | 2.85 | 3.30 | 4.00 | 4.05 | 4.10 | 4.35 |

|

AA- | 1.90 | 3.00 | 3.30 | 4.00 | 4.05 | 4.10 | 4.35 |

|

A | 1.90 | 3.10 | 3.30 | 4.00 | 4.10 | 4.20 | |

|

AA- | 1.90 | 2.85 | 3.20 | 3.90 | 4.00 | 4.10 | 4.30 |

| Other banks | ||||||||

| China Constr. Bank | A | 2.70 | 3.55 | 3.85 | 4.15 | 4.20 | 4.40 | 4.60 |

| Co-operative Bank | BBB | 1.80 | 2.85 | 3.00 | 3.90 | 4.00 | 4.10 | 4.30 |

| Heartland Bank | BBB | 1.80 | 3.60 | 3.45 | 4.20 | 3.80 | 4.10 | 4.20 |

| HSBC | AA- | 1.85 | 2.85 | 3.00 | 3.80 | 4.05 | 4.10 | |

| ICBC | A | 2.50 | 3.50 | 3.85 | 4.05 | 4.05 | 4.30 | 4.40 |

|

A | 2.30 | 3.50 | 3.55 | 4.15 | 4.05 | 4.35 | 4.55 |

|

BBB | 1.90 | 3.00 | 3.30 | 4.10 | 4.00 | 4.15 | 4.40 |

|

A- | 1.85 | 3.05 | 3.00 | 3.90 | 4.00 | 4.10 | 4.30 |

Term deposit rates

Select chart tabs

Term deposit calculator

39 Comments

So if you had a grand.

And put it away for a year.

12 months time, free combo from Macca's. Maybe even a McFlurry, if inflation hasn't run away.

Sound a good deal?

.or take the risk of putting into (take your pick) and have even less. A conundrum for sure.

Beats a lot of gross rental yields according to the tables Interest produce, and you don't have to worry about the bank only giving back $900 of your $1000 at the end of the year.

OBR says 'maybe'.

If someone gave me a grand, I'd probably just put it towards my annual lump sum payment on the mortgage.

$1000 @ 5% = $50 saved. Hell, if in 5 years time TD rates are 5%, then no doubt mortgage rates will be higher (7%???) so I'll save $70 in interest instead of making $50 before tax.

No tax to pay on the savings either, you'd need a term deposit of ~7-8% to beat a 5% mortgage lump sum.

Only disadvantage is the money isn't as easily available once it's gone into the mortgage.

This is what offset mortgages are for

Good point.

Any additional lump sum payments to the mortgage are generally surplus to needs. I have a credit card for any money that is needed for any emergencies/short notice.

I think you need to scale up your amount invested. 5% rates now by February, its looking pretty good to me. No tenants to worry about wrecking the place, no falling house price with that overleveraged mortgage still to pay. Sounds like a good deal to me.

So say I've got one million dollars *puts pinkie finger to lips*

If I give it to someone for a year

They'll give me enough for a second hand Japanese car.

Does that flick someone with a million bucks' buttons? Just asking for a friend.

If you look at the longer end of the curve, you can just about recreate the life style a full time minimum wage job gives you with $1 million invested. So long as you don't think too carefully about inflation and protecting that luxurious lifestyle into the future.

No problem having some money in TDs, but in most cases people can expect to be better off diversifying into other asset classes rather than sticking it all on the slow steady depreciation of their capital.

No, but what are some better options? Say, with a rental, you have to work (maintain premises, deal with renters, pay bills, etc) and then, with the current market, almost certainly have something of less value in the foreseeable future. If your 'friend' isn't retired he could buy a business if he wants. For most people close to retirement, they want to work less, not more. I'll take 4% thanks and put it into Kiwi Bonds if things get risky.

Yes. For a while now the real business model of rental has been capital gain. Worked well.

Then things changed. That doesn't work.

The six month premium over the 90 day offers are now back up to levels we last saw (quite briefly) in 2008.

True for TDs but Kiwibank and Heartland have 90 day Notice Saver rates of 2.85% & 2.95% respectively. The rate can change during the term of course but probably more likely to go up than down in the next 90 days.

Seems like the banks are favouring locking in funds for at most a year given the differential out to 5 years is only around 40 to 50bps. Points to lower interest rates in around a years time.

Worth noting that interest income for banks is 3.2 times higher than interest expense according to the latest data (March 22). This ratio peaked at 3.9 in Sept 2021 - the historic norm is about 1.5. Banks are making an embarassing amount of money - I guess they can't give it all out in dividends and bonuses and continue to get away with it?

Gift it to their Aussie shareholders you mean?

Cements the idea in my head that Australia farms NZ and that we an expendable piece of effluent in their eyes.

"Cements the idea in my head that Australia farms NZ"

Yeah probably, but it's by our own hand. Bank with a foreign-owned bank, watch $$ go offshore.

Yes. New Zealand is farmed. We chose it to be that way. We really don't understand ownership.

Yes. New Zealand is farmed. We chose it to be that way. We really don't understand ownership.

I am going to have a(for me) substantial sum in my account by the end of the month. At 77 and conservative by nature, where should I go? I already have a significant share portfolio.

Now, I could get 4.75% for a 5 year TD from Rabobank, or 4% for 1 year, so what do i believe will happen to interest rates? I already have several short-term TDs-from 6 months to 1year- and since I believe that while the OCR will certainly go higher, long-term rates will continue to trend down. That can be clearly seen from NZ and US Treasury stock with the latter showing an inverted yield curve.

I intend to buy 5 year NZ stock, a 5 year TD and some higher-yielding defensive NZ shares. I would go to 10 year stock, but with stage 4 cancer, a shorter term is more realistic.

Where should you go? A top notch holiday at the beach resort of your dreams would be my first recommendation!

Top advice, I was going to say the same. If you still have your health Linklater, then enjoy your life now, you may not be able to travel in your 80's

Yvil,

Thanks. I do feel pretty good most of the time, but having been lucky enough to do lots of long-haul travel, i am happy to stay closer to home now. There's a lot of NZ still to see plus regular visits to Melbourne will do me.

Jfoe,

I have never enjoyed sitting on a beach for any length of time. I would rather be active, but sadly, I can't go tramping now. I can however get on a bike.

E-MTB for the win. Lots of amazing 1-3 day trails around NZ. All the best for your health and longevity linklater01

Ha! Same. I can't stand beach holidays - although I used to like watching my kids enjoy them when they were young. Nowadays, I am happy anywhere with trails and scenery.

Hi sorry to learn of your illness. I wish you all the best.

Can you tell me alittle more about the 5 & 10 year NZ stock. I dont know the first thing about investing in that. Where can i go to learn more?

Cheers

Dave

Davos777,

Do you know a sharebroker? If not, Investopedia is quite good source of information. If i was say 10 years younger, i probably wouldn't buy Government stock, but now, it's risk-free nature appeals to me. However, I will still have some 35% of my total assets in the stockmarket and several short-term PIE TDs.

I have no interest in non-income producing assets.

Thanks, i will check it out today. Appreciate it.

Dave

I wonder why Kiwibonds rates are at 3% for 6 months, but banks aren't beating this. Aren't kiwibonds guaranteed by the government, but banks aren't?

OK, hear me out..........or have a good laugh at my expense, I am easy any way.

How is the logic in this?

Joe and Harry are neighbours. Joe has a million in cash reserves sitting in the bank earning 4.0% on a 1-year fixed term.

Harry also has 1 mill which he is investing at the same rate for the same term.

At the end of the term, Joe does not roll the loan over and he buys a house up the road for 1 million cash.

Harry is unaware of Joes purchase and re-invests his million for another 12 months at 4.0%.

A year goes by, and Joes new house has devalued to a point to where it has a valuation of $825k.

He has rented it out and earned roughly 30k from that. That is sad, but this is not about Joe really.

Harry on the other hand, decides to take his 1 million off deposit and 30K interest and buy a house also.

He purchases one for 1 million which 12 months earlier was valued at 1.2 million.

In affect Harry has a net gain of 200 thousand dollars by waiting a year. In effect he may have possibly waited a further year and made another 100k as well.

Now I realise that he doesn’t have the 200 k in his pocket but surely, he is better off to the tune of this amount and his purchasing power is tangible. If he wanted to, he could have purchased a better house for the same amount as he could a year ago, then that is a tangible asset and that has a value. In the same way that is buying power has increased. There is no way around this for me. I realise it is all relative, but you have to admit that this is correct and seems strange mostly because we are living/buying/selling in unique times.

If you have trouble grasping this, then consider this: A really bad situation financially occurs, and the houses drop 50% over 3 years. Unlikely but 30-40 % possible. In this scenario, Harry can now buy 2 houses for his million. I am convinced that is a tangible net gain in his wealth.

Has Harry actually made 200k?

Yep problem is you cannot guarantee what will happen in the housing market but you can pretty much guarantee the 4% TD payout. Some will argue that the money in the bank is not secure but lets face it you have a higher chance of winning lotto than all the banks folding.

Put money in a 2yr PIE TD at 4.10%. PIR is 28% instead of 39% normal tax rate. Right now it’s what will lose me least than outright gains.

Do you think this is as far as we go TD wise . (peaked)

This is crystal ball stuff or at least what you are hoping ? There are no gaurantees but with houses, its an asset , you can only go wrong if you have to sell.

Given the trending TD rate rises and recent 1/4 declines in other markets (nz shares -10% BTC ..lol) TD's are a shimmering light on the current highway of economic uncertainty . The longer term rates are not yet as appealing as some might ponder. I wouldnt be in a hurry to jump in over a year as there might be more upward curve to come. Nothing wrong with promoting good savings habits as it might even help reduce household debt levels if it catches on . The downside of course is that it if folk start saving it will probably impact consumer spending . The upside however is it would likely put some pressure on the CPI as well. So for those that cant figure out why TD rates are trending but mortgage rates seem out of whack with that trend, the likely answer is its a fingers crossed anti inflation policy . My guess is it will be hard to wean folk off credit and rates will need to appeal to make a meaningful impact. The flow on if it does all take take hold is that it will likely reduce wage pressure. So credit users, jump in and start saving money it will put pressure on inflated prices and is an easy way of reducing your household debt. Maybe the RB isnt as 'whacked out' as many think. Promoting savings is strengthening . What would happen to inflation if you started offering 10% TD'S.... my guess is debt levels would dramatically start to decline...and markets elsewhere would tighten.

NZ national median savings account of around 3k but Southland and Gisborne savers are not even close to that figure. 40% of NZers have savings of less than 1k (stuffynz 25.01.2022) We have a nation of propertied twats that dont have 2 pennys to rub together...lol .Even Kiwisavers average of 29k (Dec31 2021) is pathetic... Folk need to start saving more ,yes buy the house but realise that saving is what keeps the wolves from your door.

The GOVT seems to hand over money like it’s no tomorrow yet cannot subside tax for savings - TAX on already taxed money. If there was a better alternative, they wouldn't be buying houses to flip

The GOVT seem to hand over money like its no tomorrow yet cannot subsidize tax for savings

So TAX on already taxed money.

If there was a better alternative , they wouldnt be buying house to flip

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.