Are we feeling less well-off? Well, apparently we are. Some $88.9 billion less well-off, in fact.

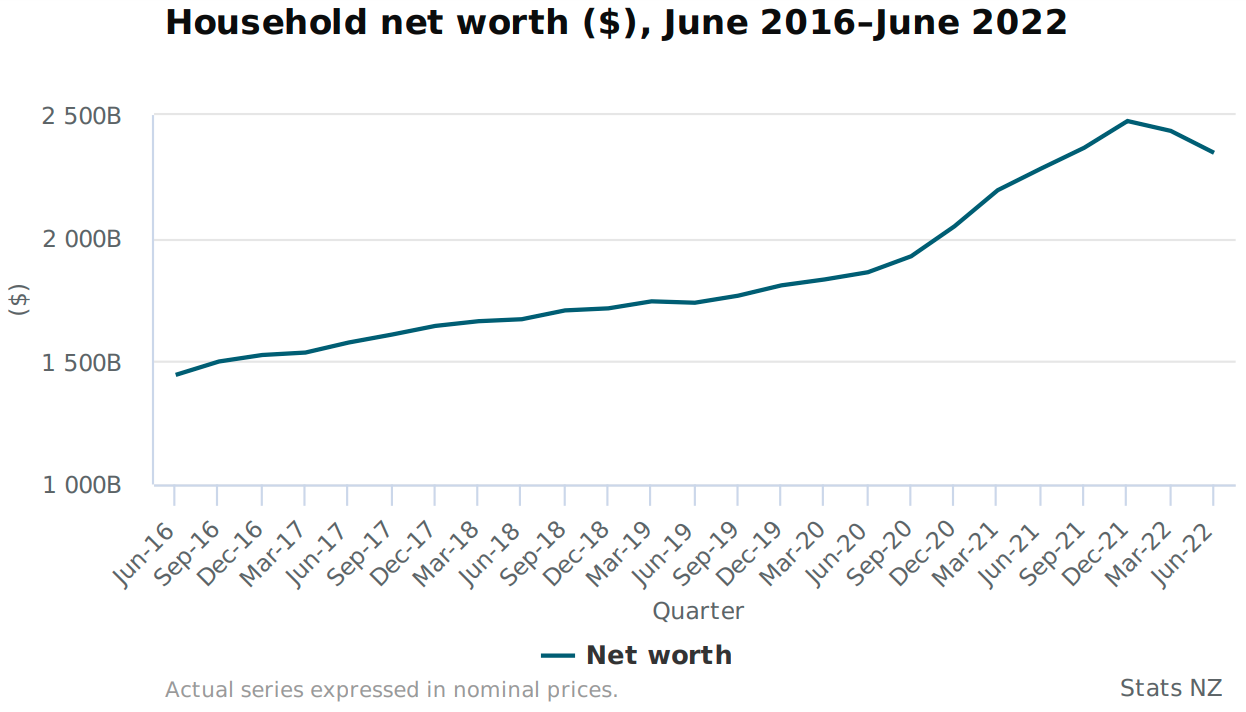

Latest figures from Stats NZ show that in the June quarter the net worth of New Zealand households fell $88.9 billion (3.7%).

This followed a $40.1 billion fall in the March 2022 quarter and means that household net worth - the value of all assets owned by households, less the value of their liabilities - shrank by $129 billion, or 5.2% in the first half of the year.

It's of course mainly due to the falling house prices.

And the two consecutive quarters of falling worth follow 10 consecutive quarters of some quite spectacular gains - again mainly driven by house values.

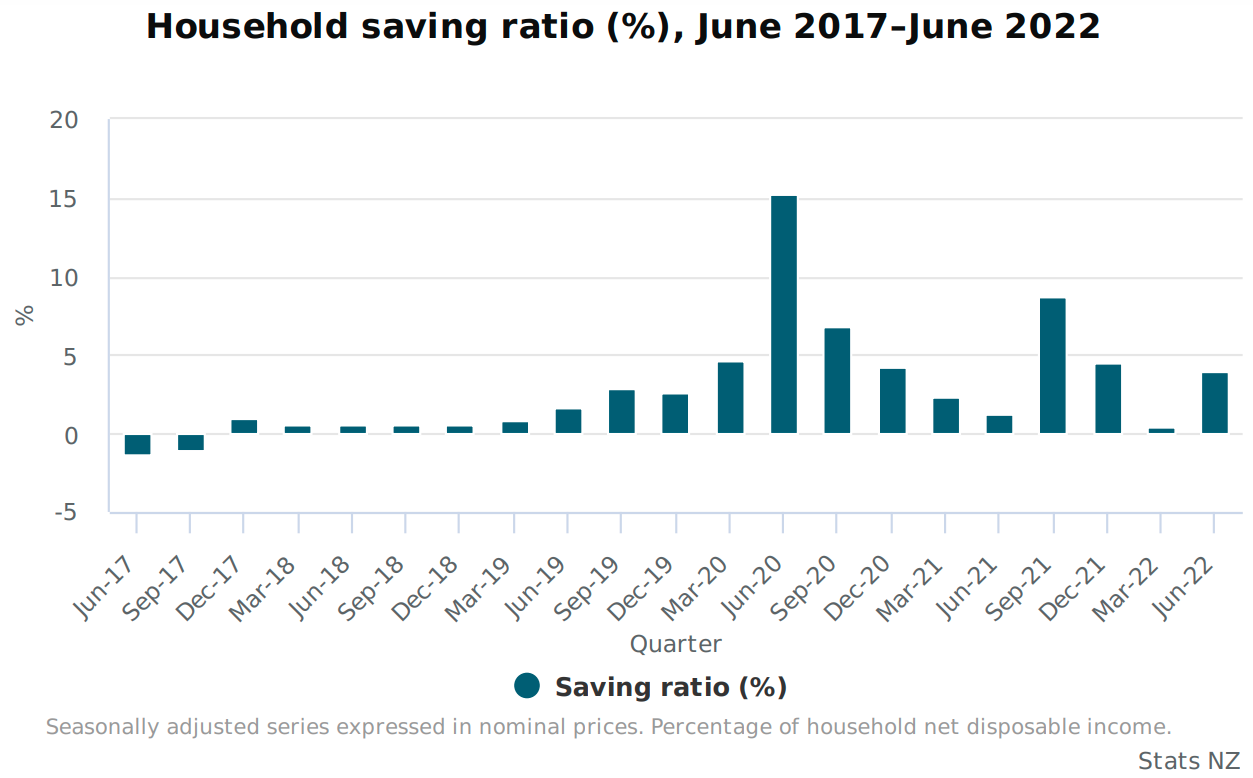

But while that's all been going on, in the June quarter household saving increased to $2.1 billion after it had dropped in the first quarter to just $230 million. Household spending was reduced by around $1 billion in the June quarter (to a touch under $52.8 billion) - some belt tightening perhaps.

On the net worth figures, Stats NZ's national accounts - institutional sectors senior manager Paul Pascoe said household net worth had increased $427.6 billion in 2021.

"Despite the last two quarters’ falls, household net worth of $2,347.0 billion was still higher than the level at December 2020 of $2,048.3 billion," he said.

While the falling asset values were mainly about houses - they weren't all about houses. Dipping KiwiSaver and sharemarket values get a mention too.

Pascoe said over half of the $88.9 billion fall in household’s net worth in the June 2022 quarter fall was driven by falling property values for owner-occupied property, down $48.4 billion, or 3.7%.

Household financial assets fell $37.5 billion (2.7%) during quarter. These assets included ownership of shares, rental properties, investment funds and pension schemes including Kiwisaver, and deposits. Falls in the New Zealand stock exchange and falling land values contributed to the decline. Meanwhile, households continued to increase the level of their currency and deposits, up $3.2 billion (1.4%) during the June quarter.

Pascoe said New Zealand households spent less in the June 2022 quarter, while also experiencing steady income growth. Household spending decreased 1.9% to $52.8 billion, following an increase of 6.6% in the March 2022 quarter.

"The decrease in household spending partly reflected reduced purchases of durable goods, such as second-hand cars and electronics," he said.

In the June quarter household incomes grew 1.6% to $54.9 billion, following a 2.2% increase in the March quarter. Wage and salary increases were the largest factor contributing to income growth. However, increased government assistance (such as benefits and tax credits), and income of self-employed business owners and partnerships also contributed.

103 Comments

This is worth posting again:

https://twitter.com/wallstreetsilv/status/1582556167682723840

New Zealand has had an exceptional housing bubble and it's now bursting...

No need to be so dramatic

New Zealand has had an exceptional housing bubble and it's now deflating...

Just a tiny bit of negative sideways consolidation...

Just a tiny bit of negative sideways consolidation... [Brock Landers]

It's not "tiny" but simply a much-anticipated correction.

Someone gets inebriated with the exuberance of their verbosity.

TTP

by tothepoint | 27th Aug 21, 10:22am

Better to have an "eye-watering amount of debt" at a young age - than an old age.

We can't blame younger people for seeking a foothold on the housing ladder. The sooner they do so, the better.

TTP

This doesn't sound like anticipation. It sounds like a crook already convicted of deceptive and illegal business practices luring young people into financial ruin. Nothing much has changed there over the last year.

Harsh. Reminding Tim in such a callous manner.

How would you of said it bw ?

Its said well with13 thumbs up and counting....

As always, first-home buyers will continue to do well in the longer run.

The DGM conveniently forget (or ignore) that it's not just about house prices but also the savings made through avoiding paying rent - or suffering the plethora of detriments (both tangible and intangible) associated with being at the mercy of a landlord.

Within a few short years, those who bought their first home (or second, or third home) in the current market will feel proud (and relieved!) they had the initiative to do so.

And remember, even Jacinda acknowledges the continuing shortage of houses in Auckland.

TTP

P.S. Much more productive to spend your time searching out a good buy than sitting around here counting DGM "thumbs up". That's better left to little kids learning arithmetic.

FOETL : Fear of exiting too late ...

"And remember, even Jacinda acknowledges the continuing shortage of houses in Auckland"

Its a shortage of affordable housing or otherwise known as a surplus of overpriced houses. You're twisting it around to suit your sinister agenda.

You don't need to count the thumbs, you just need to be able to read the numbers on the page.

TTP I notice that you frequently throw around loose comments, but I don't often see any figures to support the claims...

Let's have a think about some hypothetical FHB's:

Couple A followed your reckless advice and bought a $1M house with 20% deposit @4% interest rate. $800k mortgage, right at the peak in Auckland. Prices have dropped 20%, so the $200k deposit is wiped out. They didn't "waste" their money on rent though, as they were paying off a mortgage! But, unfortunately, the $45.8k they paid on the mortgage, $32k went on interest and only $13.8k went against the principal. So, all up, they have a mortgage for $786k against an asset worth $800k. So, $13.8k of equity and facing much higher interest rates plus a low equity rate if they move banks...

Couple B thought that perhaps it was peak mania and realised that it might be smart to wait. They rented their place for $750/week and "wasted" $39k on rent. They kept their $200k deposit and let's say they only put the difference between the mortgage cost and their rent away and saved another $7k, so they now have $207k.

Couple B buy the identical property next to Couple A for $800k. They have a big equity advantage and they have a mortgage of $593k on the same asset. Interest rates have shot up to 6.0%, so Couple B are paying $821/week on their mortgage, but Couple A are paying $1,087/week on theirs.

Fortunately, both Couple A and B managed to get decent pay rises, so Couple B decides to pay the same as Couple A on their mortgage. This will mean that Couple B have paid off their mortgage in ~17 years, rather than the 29 years that Couple A still has ahead of them.

Both Couple A and Couple B receive a $10k bonus from their employer and will likely receive one every year. They put this as a lump sum payment against the mortgage, which goes straight against the principal amount.

- $10k = 1.25% of an $800k mortgage, 1/80th.

- $10k = 1.7% of a $593k mortgage, 1/59th.

Here you go, Tim:

Ultimately, the wealth inherent in a security [asset] is the future stream of cash flows it will deliver to its holder(s) over time. Price fluctuations don’t change those underlying cash flows. They just provide opportunities for the transfer of savings between investors. High valuations favor the sellers. Low valuations favor the buyers. Investors have never paid higher prices for those future cash flows, or accepted prospective returns so low.

Put simply, the bubble hasn’t changed the wealth, and a collapse won’t change the wealth. What will change is the market cap. I suspect that the erasure of market cap in the coming years, and possibly the coming quarters, may be brutal. Still, no forecasts are required, and our own attention will remain on observable valuations, market internals, and other factors. Meanwhile, even if an investor sells at these extremes, the only thing that will change is who holds the bag. Link

... the equity disappears faster than a fart through a colander ...

But , the debt remains the same ...

Put simply, the bubble hasn't changed the wealth, and a collapse won't change the wealth. What will change is the market cap.

That is the quote of the day right there Audaxes.

Excellent graphic - should be compulsory viewing for any contemplating buying a first home (don’t do it yet!). For existing homeowners looking to move its different, but I’d definitely sell and settle (then wait if poss) before buying

Boats for sale on Trade me has risen by 10% in the last 15 days since 5 October RBNZ decision. Off loading of those nice to have assets is ramping up now.

The 2nd happiest day of a mans life is the day he buys a boat..

The happiest is when a crippling rise in his mortgage rate and declining home equity forces him to sell it at a loss to an Interest.co.nz commenter.

Boats for sale increasing as we come out of winter?

Don't go looking too hard for Armageddon kids.

What's the happiest ? The day the divorce comes through ?

The day he sells it.

Yes, same thing for Jaguars

The 2nd happiest day of a mans life is the day he buys a boat..

Let me guess, the single most happiest day of a man's life is when he sells that boat..............in order to buy a better boat for an absolute steal off someone who took financial advice from their RE agent 18 months ago and loaded up on cheap debt to buy everything they ever wished for???

"A boat is a hole in the water into which you pour money"

...watching and waiting. I'm patient. One for summer be nice.

Beach houses will be next.

That's what I thought when covid hit... until they rolled out the interest free loans, mortgage holidays and lvr reductions.

Never underestimate the will of the RBNZ and govt to needlessly prop up the price of holiday homes.

Turned out it wasn't so much a free market as a welfare scheme for the older generations.

It was a totally corrupt, sticky, delusional, stinking mess that has just hit the fan, and is about to blow back into their faces.

They should have just let the market sort itself out in 2020.

Lots of very nice guitars being listed for sale on TradeMe of late - cash is king but I think I will wait some ...

There are some good deals, yeah. Plenty of time, though.

Ooh nice. I was just thinking about getting one, too.

When all is said and done, the NZ housing bubble will be looked back on as second only to Japan in the 80's. This unwind has a long way to go.

When all is said and done, the NZ housing bubble will be looked back on as second only to Japan in the 80's. This unwind has a long way to go.

That's a big call. But here's a basic profile:

At the peak of its equity and property bubble, Japan's total residential land value to GDP was approx 3x. H'hold debt to GDP was approx 70%.

At this point in time, NZ's total residential land value to GDP is approx 5x and h'hold debt to GDP is closer to 100% (up from closer to 20% when Japan's bubble was collapsing in the early 90s).

So based on these directional benchmarks, the NZ bubble is arguably bigger than the Japan bubble.

That the problem when trying to make comparisons.

In the 80s, Japan had around half the top 20 most valuable companies on earth.

Today, they have 1.

So really you would also have to determine that the NZ economy (so like, the value and outputs of its businesses) is going to plummet like Japan's. Their bubble was more than housing.

In the 80s, Japan had around half the top 20 most valuable companies on earth.

Today, they have 1.

i'm not claiming the NZ property bubble is worse than the Japan bubble. I'm suggesting that it possibly is.

Japanese company valuations at the time were also in bubble territory. Regardless, many of those companies were wildly productive and generating income for the nation. In fact, it would support relatively high asset prices as Japanese h'hold income growth was strong.

Many parts of the world have not experienced house price rises under low interest rates like we have seen post Covid in certain markets.

The fundamentals for property in Japan include a rapidly aging and declining population. They have some migration, but as a homogenous culture they are less inclusive than a new world country.

How many more people do you think our governments (present and future) will pack into this place, assuming there's demand?

The fundamentals for property in Japan include a rapidly aging and declining population. They have some migration, but as a homogenous culture they are less inclusive than a new world country.

Japan's demog profile was well understood in the 80s. Never prevented the bubble from occuring. Similarly in China.

Demogs also doesn't explain why countries like NZ, Aussie, and Canada are not potential bubble.

Isn't your argument supporting the fact that NZ's property is worse?

Given Japan had a clearly productive, export-oriented economy producing tons of stuff that the world wants, their housing bubble was only 3x GDP.

On the other hand, NZ's is at 5x...whilst producing...milk, beef, lamb and honey? Maybe world-class education. That should do it.

Only a few weeks ago Bernard Hickey was claiming house prices would increase. He was telling young people to borrow as much as possible to purchase housing.

Dose he have some insider knowledge of an upcoming credit expansion? Let us know Bernard, let us know.

Only a few weeks ago Bernard Hickey was claiming house prices would increase. He was telling young people to borrow as much as possible to purchase housing.

Wonderful journo. But I think that his belief in the power of the NZ govt and the magic potions of Kaumatua Orr are somewhat misguided. I think Bernard suffers from a bit of the ol' Kiwi exceptionalism thinking.

But perhaps he's right. Only time will tell.

I like Bernard too..

I can listen to him talk and nod along.. yet he always blows it in the end with a pinko and/or climate take.

He's a GREAT source of information, just terrible at coming to conclusions.

I can listen to him talk and nod along.. yet he always blows it in the end with a pinko and/or climate take.

Yes, the pinko stuff is possibly because he needs to spend time lstening to vocies from the public sector with all their pie-in-the-sky promises and imagery (rainbows, bicycles, European-looking lifestyles, etc).

Property prices are still not back to pre covid levels. I welcome much deeper declines over coming months.

The large increases in rentals and the rise in boats for sale (?seasonal) are likely signs of behaviour changes as the cost of servicing debt increases. Perhaps the canary down the mine and signs of things to come.

I'd welcome any stats on the amount of unsecured loans in NZ and any trends over the last 3-4 years - I can't find any. That may put a new twist on how ugly the QE dismount may get.

NZ exceptionalism on full display. We're special and there's no negative consequences for our huge numbers of our young being priced out of housing. They just weren't working hard enough.

Now we're special and there's no consequences for those who managed to get a ridiculous deposit are now seeing their net worth vapourised. They'll just have to work harder.

The only exceptional thing here is how we've managed to generate crappy outcomes no matter which way house prices went.

The dildo of consequences rarely arrives lubed

And yet if you warned against what was playing out when discussing the issue with large parts of society, you were belittled and silenced as a 'doom gloom merchant'.

Perhaps it's a case of you reap what you sow. Lessons that we will need to collectively learn the hard way instead of preventing them when we had the opportunity to do so.

Depends, are the people who caused the problem going to be the ones on the receiving end? Or are they going to be able to rush towards the exits and compound the misery for those merely trying to live an ordinary life in NZ?

Probably the latter while also still feeling entitled to garnish young folks' wages to fund their pensions and rental yield subsidies.

Rhetorical question?

Yes, the people who caused the problem will mostly be in the receiving end. They will see their younger family members emigrate to better economic opportunities. There will not be enough people to look after them in their old age and they will have to spend increasingly large proportion of their gains on private medical care as the public health system collapses under the demographic strain of not having enough working people to pay for medical professionals.

The demographic gap will be plugged by poorly paid imported labour who will be a sort of underclass who will not assimilate well into Kiwi culture as they will know they are being exploited. It will not be enough and right-wing governments will be voted in on the promise of sound fiscal management which in reality means running down public services further and allowing high earners to keep a higher proportion of their pay. Social cohesion will fragment further.

All this has already played out in other countries similar to NZ, we're just about a decade behind.

I was a DGM when house prices were rocketing upwards ... look at Rotorua , all the homeless relocated to motels there ... folks unable to afford a rental or a mortgage ... priced out by the greed of rich speculators & land bankers ....

$ 1 Million/day us taxpayers are stumping up , via the government , to house people in motel units ...

Taxpayers paying with borrowed money. The grandkids can pick up that tab.

I feel their pain..

Super cheap auto must be Super busy selling waxes and polishes... trademe will be a buzz with posh cars, boats and luxury mobile homes

Yep lots of stuff will be for sale next year but I'm not going to wait. Just put an order in for a new car before this government either bans or cranks the tax on everything you put petrol in through the roof. Probably not the most logical timing but things are so all over the place that does logic even apply anymore?

Things are so fluid, what seems to be logical today may seem otherwise in a couple of months..

Mate bought a new diesel highlander earlier this year and is regretting today

The price of fuel has yet to change the driving habits of double-cab ute operators - they are always in a hurry ...

The first R in Ranger always does seem a little redundant, based on the driving.

Haha yes - i don't envy the economists and fortune tellers these days. Exciting times.

Toyota Highlanders are USA model so no diesel option.

Anyone else thought of buying heaps of RUCs for an old bomb in view of getting it deregistered and claiming credit at normal rates once the levy goes back to normal in January? Or any other means of getting some yeild on this temporary deduction?

You're loaded right Carlos? Buy an EV, it will be worth more in a couple of years time and you will not be hit by increasing fuel prices.

I don't think we really need anymore cars in this country but if you're going to buy one at least make it electric.

Too boring mate I like old school stuff. If your "Loaded" you don't give a rats about gas prices and not interested in resale either its all about the fun of an actual drivers car and that's not currently an option with electric. Hopefully at some point they will produce some decent 100% electric good looking sports cars but in the current climate the two don't go together at a price anything close to "Affordable".

The Wealth Effect is all of its hideous glory.

Most New Zealanders should not be missing, what they never had. But they were convinced of the immutable Law of Wealth; that it was never ending, and so made that one tragic mistake - they borrowed and spent against what they no longer have.

True, it will be interesting to see how many became over-indebted (fools - and their money). more than a few people and businesses will likely get caught out in the next few months and years... good opportunities to buy cheap assets from people (business and houses) then though.

I am thinking a business selling remotely delivered services or software to overseas clients might be the next most profitable business direction. Budgets will be very strained here anyway and $kiwi will get more and more hammered -> but local costs will end up very low compared to overseas and we will be able to charge less for first world services. All with good local surf, skiing and windfoiling - and what a wonderful exchange rate for exporters.

Always good opportunity in the chaos

If you are reeling from this reported loss in wealth, chances are you're in the game for all the wrong reasons to start with🎱🎲🎰

You're nothing more than a Johnny-come-lately to a crumbling Pyramid.

A smarter guy than me once gave me some good advice ' when the man in the street starts investing in property, it is time to get out'. Same for most markets i think.

That time was a decade ago...it was just impressive how much longer the governments and the Reserve Bank looked to prop it up for.

26 Mortgagee sales listed on TM

check out this one :

https://www.trademe.co.nz/a/property/residential/sale/auckland/auckland…

What did they do to that villa? That should be a crime.

So that monstrosity is fine but try and build a few townhouses and it will ruin the character of the suburb!!!

Amen. Pull that monstrosity on the side down and it would be a marketable package.

Puke.

Geez they must be in debt - could not afford to furnish all the rooms for the marketing campaign. I guess the real estate agent will say it is a blank canvas waiting for the imagination of the new owner to put their own stamp on it.

Emergency housing ..govt will snap it up.

check out this one :

Coincidentally I know the agent. Good guy.

No link. Or did it sell already?

Too much money in circulation and still a while before any meaningful correction.

Networth drop is only on paper.

You never lose or profit until you sell. Only money on the books, when I was a kid you could only dream of being a millionaire now if you own a run down house in Auckland on paper you have made it. This time next year we’ll be millionaires Rodney.

53 Billion added to total mortgage debt in NZ. June 20 - June 22. How much of that now exists as cash in the bank (of sellers)? How much was ploughed back into property and other assets by those sellers which have also depreciated?

Total funds on deposit with NZ banks grew 35 billion.Aug 20 - Aug 22.

So is it too simplistic to say we evaporated 18 billion in cash so far?

A reasonable guess.

My gut feeling says we are headed for 2017/18 price levels as a floor. The run up in 20/21 is not real IMHO and represents a blow off top.

Nominal or real?

I feel like real may be lower than 2017/2018...

Well, $18b in cash is probably the share that went offshore to the overseas vendors?

If you want to control inflation, the best way is to:

1) Open borders to new immigrants who want to make a new life in NZ. Have an easier pathway for them to gain citizenship. This will solve your labour market issue where you will have a strong immediate workforce ready to go.

2) Immediately control budget spending and rapidly solve your deficit. The govt spent a lot of useless money during COVID times (when they didn't need to), and now it's time to take back that unnecessary spending.

3) NZ is a small country with a relatively small population. Now's the time to re-invent the country and rely more on ourselves than on others. Global inflationary pressures will continue to persist (and we all know this). So now's the time to really rethink and see how we can rely on ourselves more and learn how to fish (instead of always buying the fish ourselves).

4) Do not further increase interest rates, as that seems like the easiest solution right now, it's not the best long term solution as there is a bull whip effect which you will regret down the line in 2-3 years time when the FULL impact of the interest rate hikes really hit the economy and the citizens of NZ and their jobs.

5) Stop making stupid and brash decisions. If you haven't learned from the silly COVID rash decisions yet, then now's the time to learn them. Think things through before you do them, and stop making rush decisions just to get an outcome. Just because you make fast decisions doesn't mean you will get your desired outcome. Take a balanced approach and be pragmatic.

-7

Tell me you are a bagholder without saying you are a bagholder. Unfortunately, no one will be there to bail you out. And you should be happy - I thought you wanted to buy more investment properties in another post?

The RBNZ 100% needs to increase the OCR to protect the currency, the NZ's reputation and its economy. Or risk turning it into a full 3rd world country with its laughable currency and no one that's actually talented will want to come.

Or stay

Yeah he was a FHB about 12 - 18 months ago who after 3 months decided he was going to ride a wave of house price appreciation and leverage the gains into investment property. Have noticed his comments these days are generally gripes, it's quite clear he's not happy with how things have panned out.

Play stupid games. Win stupid prizes.

I love how you vest so much time in analyzing users past posts. I feel so loved and appreciated.

I actually don't live in NZ anymore (moved around half a year ago) once COVID restrictions were being lifted slowly, however I do still own my property that I had purchased as a FHB. I recently just paid off the entire mortgage as I make my salary in USD and the USD/NZD is just too favourable for me to not pay the break clause (more than 20% devaluation). I've switched it to a rental property now to make passive income. Didn't end up buying another property since I moved :(

When life gives you lemons, make yourself a lemonade. Please continue to monitor my posts as I do now have a vested interested in NZ and wish the country all the best. But I can tell you at this rate, they are only making it worst. History repeating.

-7

✈️ ✅

by 7jai | 16th Jul 21, 10:15am

There's simpler ways to tackle your issue of home ownership. Restrict # of house purchases per citizen. Easy as. But of course, no one will want to make those types of bold moves.

Singapore has proven with a sound government that every citizen can own their own home and still have appreciating assets. Don't need one or the other. But of course no one wants to do the hard work.

by 7jai | 4th Aug 21, 12:17pm

Hope prices continue to rise. As part of a big cohort of FHB who were able to buy these last few months, I would like to see my only asset appreciate in value.

by 7jai | 3rd Feb 22, 5:18pm

Happy to see the news on house prices dropping. I am looking forward in purchasing a few investment properties since borders are now opening and people will rush into NZ to get the easy citizenship/residency and they will need a place to stay.

-7

by 7jai | 16th Mar 22, 2:11pm

Those wishing for a housing crash, I'm telling you, it won't happen. I fell into this trap too many times for the last 20 years. Every year after the next, someone said "wait, it will crash", and all it did was keep going up.

Maybe a small pricing correction/adjustment, yes perhaps. But in the long run, it will just keep going up. I learnt the hard way, while many others have surpassed me in terms of wealth accumulation. Especially now that borders are finally opening up and there is a huge back log of people trying to get in, it's going to get even tougher to buy later on I feel. High demand, low supply - that's essentially inflation right? and that is exactly what is happening across the world.

Once again, sharing my own personal experiences. I'm sure there are many on this comment section will disagree, and that is okay. Not here to start a fight.

-7

Bless your soul LOL.

1) Your story doesn't sound believable given your past posts and what NZDan has shown in your previous posts.

2) If your current story is true, you are a real bagholder. You went to pay off your mortgage in full. No wonder you are heavily vested in keeping prices up. Because if prices correct any further, you are (or could be potentially) left holding the bag since you paid off everything in cash. You got the mortgage game wrong dude - you are supposed to let the bank hold the bag and not hold it yourself! And let me guess - if you make your salary overseas, no bank will lend that to you today to buy another house so you cannot remortgage the property to get that cash out.

You are the true king. You win.

He's the master at spinning a yarn, not sure who he is aiming to impress on here though? I guess some people seek comfort in role playing online, it's about as close as they will get to actually living their aspirations.

Give it 12 months, if the property market tanks 50% his story will change and he will tell us how he was clever enough to sell his property at the market peak.

Oh, bless. I'm sure the herald will be writing stories about how he leveraged his first home into a property empire in no time.

Sounds stretched.

A couple of units were built around the corner from me on an old vacant section. The project kicked off quite a while back, i.e. back in the good ol days when money was cheap, house prices doubled every 10 years etc etc.

They have just gone on the market, straight to a mortgagee sale.

Meh. While net worth may have dropped, you couldn't buy a soy latte with the capital gains locked up in your property before the prices started tumbling, so unless you are realising those gains by selling, it's just numbers.

As for The Economist's take: we are not alone in a property slump, and it is likely time to worry if a lot of one's wealth is tied up in property.

Odds on systemic change to stop houses here being a speculative commodity rather than homes? Who knows.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.