Personal Finance

/ opinion

After gold's disappointing 2022, the bears are out to play in 2023 and gold gets its highest monthly inflows of demand, and near its all-time high price. Growing systems risks add to gold's case, say the World Gold Council

7th Apr 23, 9:32am

by

The following is a re-post from the World Gold Council. The original is here.

Quarter in review: gold’s all-time-high in sight

- Gold gained 9% in Q1 2023, but see-sawed on bond market volatility

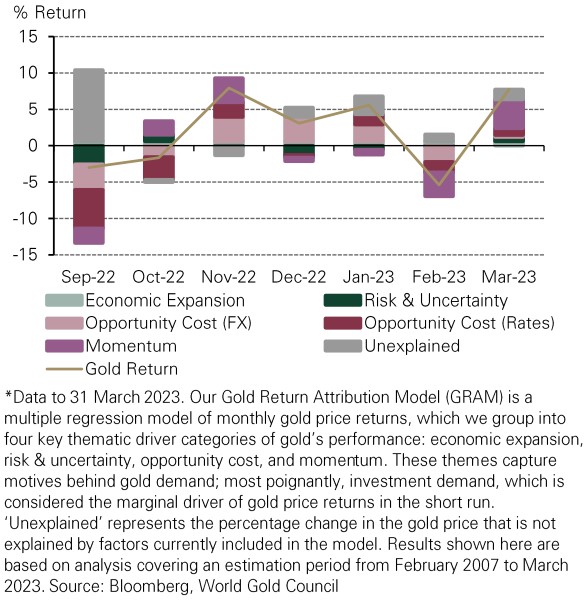

- A surge in March to record the highest monthly inflows since 2019, reversed two weak months for global gold ETFs and futures investment

Looking forward

- Gold’s ‘mere’ resilience in 2022 may have been a disappointment to some. Despite crosswinds from unprecedented monetary tightening and spiking inflation, no real crisis materialised. But the risk of one is growing now

- Unprecedented rate hikes have started to break things, most notably in small US banks and the commercial real estate sector. While contained for now, it represents an increasing risk of systemic escalation

- With a US recession still on the cards, growing systemic risk adds to gold’s case.

Gold’s ATH in sight

Gold rose by 9.2% during Q1, to US$1,980/oz, propelled by fears of an economic crisis and simmering geopolitical tensions (Table 1). While the sudden banking mini-crisis triggered by the collapse of Silicon Valley Bank (SVB) drove gold higher towards the end of the quarter, yields (level and volatility) and the dollar remained ever-present drivers.

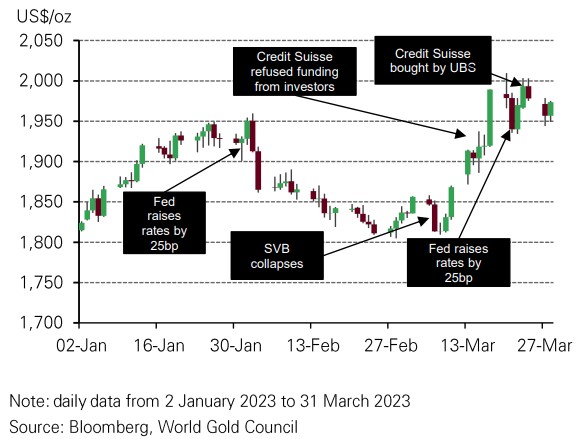

Chart 1: Gold seesawed on bond volatility and a mini banking crisis

Towards the end of the quarter, gold was unsuccessful in sustaining momentum above the US$2,000/oz level, which it hit on three separate occasions in March (Chart 1). As concerns over the banking crisis eased, gold fell back somewhat as tactical demand for safe havens abated and gold fell back somewhat.

On a quarterly average basis, gold jumped to US$1,890/oz, just 1% off the record high seen in Q3 2020 (US$1,911/oz). This was against a backdrop of increasing confidence that the cycle of monetary tightening may soon end.

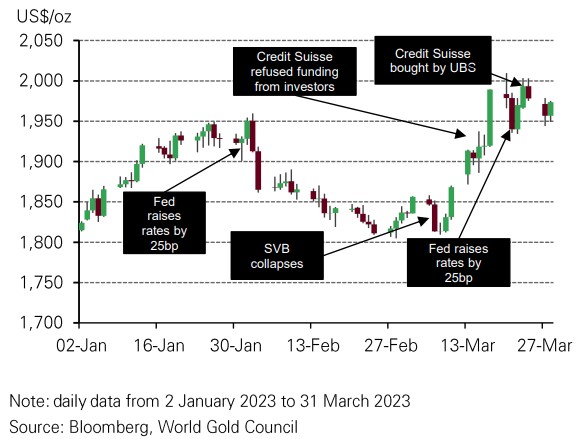

Using our Gold Returns Attribution Model (GRAM), gold found support from lower yields and, to a lesser extent, a weaker US dollar (Chart 2). It was a tumultuous quarter for yields, with a spike in interest rate volatility as rate expectations were repriced in response to the SVB event.

Yields on US 10-year Treasuries fell by 40 basis points, boosting gold’s performance.

We believe that focus should also be placed on the unexplained component of the model which was positive in each of the first three months.

This could, in part, represent the continued strength in central bank demand for gold. Using the rule of thumb from our Qaurum model that it takes c.30t of gold demand to move the price 1%, a 4.8% cumulative residual suggests a figure of about 140t gold, which coincidentally is close to that already reported by central banks so far.

Table 1: A solid quarter for gold in all major currencies

Gold price and return in different periods across key currencies*

| USD (oz) | EUR (oz) | JPY (g) | CAD (oz) | CHF (oz) | RMB (g) | AUD (oz) | |

| 31 March 2023 price | 1,980 | 1,826 | 8,456 | 2,676 | 1,812 | 437 | 2,961 |

| March return | 8.5% | 5.9% | 5.9% | 7.5% | 5.4% | 7.5% | 9.2% |

| Y-t-d Return | 9.1% | 7.8% | 10.6% | 8.8% | 8.1% | 8.8% | 11.2% |

*Data to 31 March 2023. Based on the LBMA Gold Price PM in local currencies

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Chart 2: Opportunity cost was the biggest driver in Q1 but momentum factors played a big role in March*

In contrast, global gold ETFs have had a much tougher start to the year. Echoing this was net positioning in COMEX gold futures, which remained relatively subdued for much of the quarter. But March saw combined inflows unmatched since June 2019 (Chart 3).

Chart 3: Strong accumulation of both global gold ETFs and futures net longs in March

Crisis, what crisis?

- For some, gold’s ‘mere’ resilience in a challenging 2022 was disappointing, but gold held up because it has diverse sources of demand and 2022 was not a crisis year for growth assets

- But cracks from unprecedented monetary policy are beginning to show, most notably in small US banks and their intertwined commercial real estate sector, although these look controllable for now

- The case for an economic slowdown remains. Gold is handy in a recession as dry powder given that a weakened economy is more exposed to these financial cracks becoming systemic

Gold closed 2022 in resilient fashion, buttressed by central banks and retail investors as rates and the US dollar soared. The first two months of 2023 started in a similar vein.

But gold’s ‘mere’ resilience has been a disappointment to some. The last twelve months of heightened geopolitical tension and a 40-year high in inflation should have been an environment in which gold could thrive, and a flat year left many asking “should gold not have done better?”.

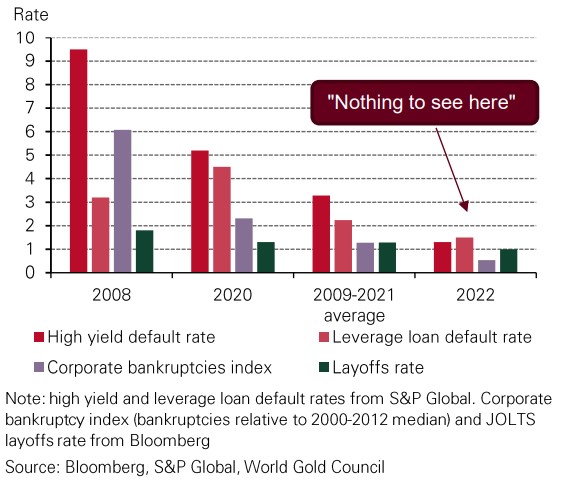

But if this had been the case, the impact on other corners of the markets would have likely been far worse. Although bonds had one of their most dire years for decades, it was barely a ‘bear market’ for equities.1 And 2022 experienced neither recessions, defaults, bankruptcies or large scale layoffs (Chart 4).

Chart 4: Crisis indicators have been benign in the last twelve months

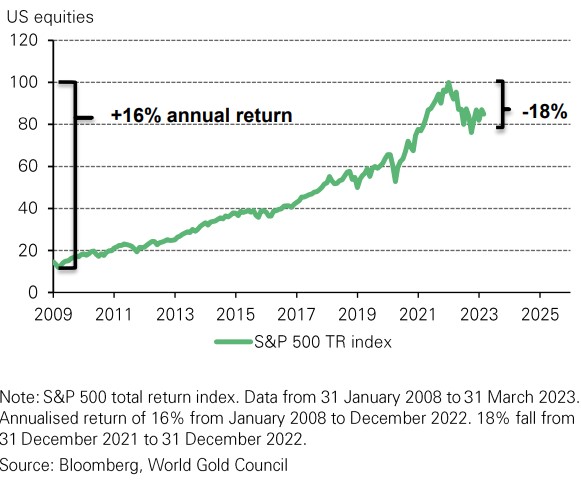

Furthermore, unless you were unfortunate enough to have bought at the beginning of 2022, the drop in equities would have been cushioned by stellar prior returns (Chart 5).

Chart 5: No equity capitulation and a good buffer for long-term holders

The first cracks appear

But during March provided the first cracks in the US economic armour appeared with several small bank failures. It’s not surprising that after such an unprecedented pace of hiking, something had to give. The problem with banks is that they are inherently part of a fragile system. Fractional banking works well until it doesn’t.

For now, the focus is on small banks and the sector they are intrinsically wedded to: commercial real estate (CRE). 2 No doubt, the devil will be in the details and, as yet, the outcome of this mini-crisis episode remains unknown.

But for now, the Fed and other central banks’ initiatives have prevented an escalation of deposit-flight woes at banks and a full blown CRE doom-loop crisis also looks contained (Figure 1).

- The most visible distress, is evidenced by over supply of office space, largely a consequence of remote working. This is a relatively small part of the CRE sector and represents about 4-5% of debt that needs to be refinanced in 2023 3

- Valuations across the CRE sector are lofty, but lofty valuations, unlike defaults, are not in themselves a systemic issue. The CRE sector remains cushioned for now with loan to value ratios at manageable levels. 4

Figure 1: The dreaded doom loop is not here, yet

Source: Bloomberg, World Gold Council

Note: CRE loans represent 70% of small banks lending. CREs recieve 60% of their loans from small banks. Tighter lending standards may force CREs into insolvency, in turn raising lending controls by banks and so on.

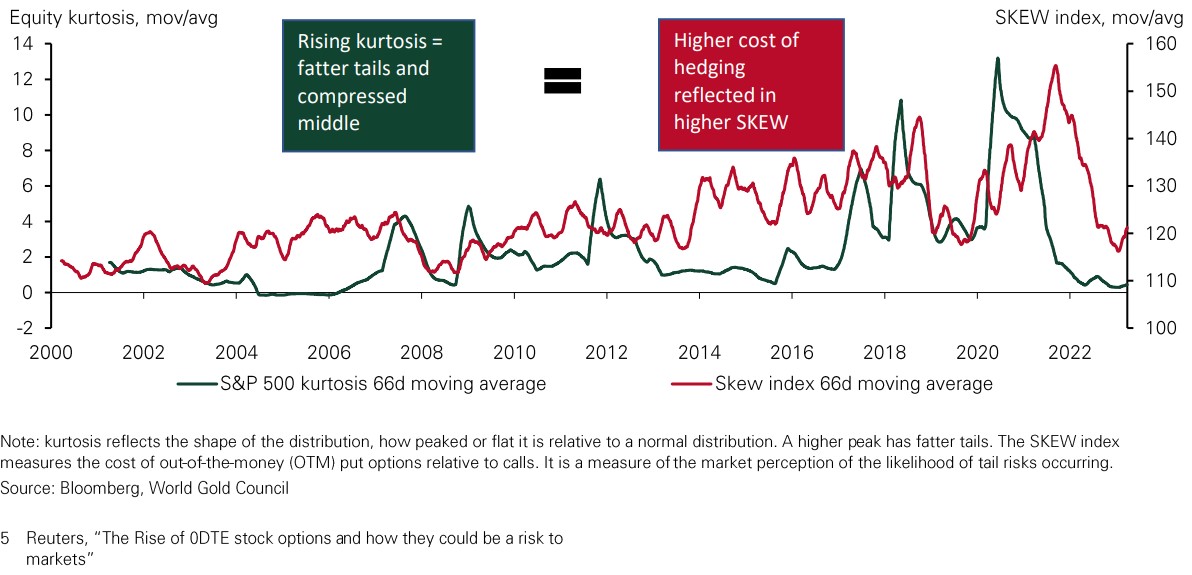

Markets aren't positioned for a tail event

And despite the increasing proliferation of tail events over the past two decades, there has been a a lull in the last twelve months.

Market complacency about such risks, judging by the SKEW index which measures the market expected likelihood of tail events, is a worry (Chart 6). Sitting with put options in the event of a big drop is an increasingly expensive endeavour. This may explain the rising interest in 0DTE options which let investors avoid the cost of exposure during the calm of normal markets and potentially profit from big moves on specific market risk days, such as CPI releases or Fed meetings.

The share of these options has risen from 19% to 44% of average option volume in a year. 5 Although effective as single-day event risk hedges, they are likely insufficient should something more material transpire and can pose a risk themselves as a proportion of these are not being hedged by market makers.

In summary

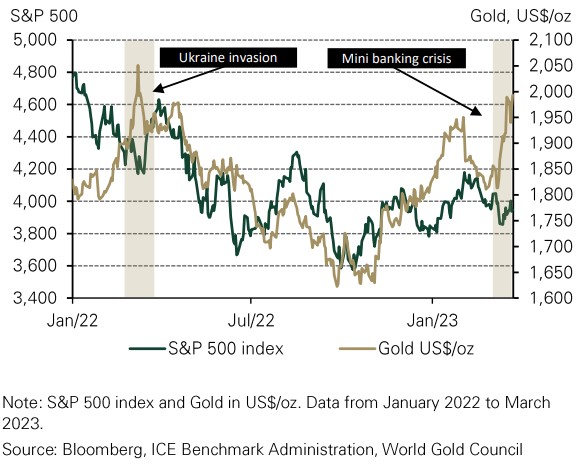

A bit of complacency, faith in central bankers and equity market resilience makes for an uneasy cocktail in the event of a full-blown crisis. But since such crises are almost impossible to time, a strategic holding to gold makes sense. Gold has historically responded well in such scenarios, as it did recently during the Ukraine invasion in February last year and the Silicon Valley Bank collapse in March (Chart 7) - a pattern that is historically proven for gold during such times of volatilit

Chart 6: Equity volatility events tailed off in 2022; tail risks have been priced out, but may now be returning

Chart 7: Gold and equities were jointly heavily influenced by rates and the dollar in 2022 but diverged at crisis points

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

41 Comments

The only thing I own that has increased in value over the last month (an eternity these days) are my gold mining ETF shares.

I am notoriously DGM and expect fiat to go to zero as govt/banks bail everyone out, so gold is where most of my meager savings go. I certainly won't trust CBDCs with savings - they will spit out those chips like there is no tomorrow.

I guess it's time for "gold goes up and down, but the long term is always up"

Not a dig at you, just this whole investor mentality that more and more ordinary people have that, when flipped on its head, is actually an inflation problem.

Not a dig at you, just this whole investor mentality that more and more ordinary people have that, when flipped on its head, is actually an inflation problem.

Fair point. Gold price can go nowhere for 10 years but be more valuable over that period.

by

HW2

|

7th Apr 23, 2:11pm

The rbnz being out of step with most others is still raising a finger to borrowers. Other CBs can see the slowdown in employment etc and backing off. Though I dont see inflation coming back down to earth

by

wingman

|

8th Apr 23, 9:10am

Fiat will not go to zero. How many keep their saving in fiat?...They're in property, shares and govt. bonds. The death knell for fiat has been sounded for hundreds of years, and it's never happened.

The death knell for fiat has been sounded for hundreds of years, and it's never happened.

Nonsense. The fundamental nature of USD changed in 1971.

You can put your kiwisaver in the GDX through Craigs Partners if anyone cares. NFA.

You can put your kiwisaver in the GDX through Craigs Partners if anyone cares. NFA.

Or you could buy it yourself on the ASX. GDXJ comprises juniors. If you're feeling frisky. Approx -75% off its highs in 2011.

Thanks for this article about gold, much appreciated!

Perth house prices measured in gold are down approx -66% from ATH in 2009.

https://twitter.com/AnthonySarich/status/1644098003865845760/photo/1

Bitcoin is up 80% Q1 and has outperformed gold year on year. It's lost to Bitcoin -74% from April 2020 to now.

Gold is a loss, even against inflation. Bitcoin beats it in every aspect as sound hard money.

Let's write an article on Bitcoin?

How is Bitcoin valued? In terms of a fiat currency. Doesn't that defeat the objective?

Now if it was valued in terms of cows, then maybe it has value. But if push comes to shove, and all you have is a gold coin to swap for a cow to feed your family with, then biting a Bitcoin to see if it has value, the same as biting a gold coin might, not get you the swap you want.

(Which is why a gold ETF or CFD might not be the security we all think, and why poster Yvil might want to have a real bar or ten in his safe at home. Trade it, and Bitcoin, if you can pick the direction of the price by all means. But that price will still be valued in most cases in terms of a fiat US$)

Story for you.

A family member was convinced that "Bitcoin is the way of the future!" some years back and after the initial kick decided on a strategy of buying 1 coin, and holding it, as the price increased in $10,000 lots - he averaged in, if you like.

So at $20k he started. And added just one coin at $30k, and $40k and $50k and $60k and his average buy-in price of $40k was looking great at $64,000. Today he still has 5 coins. What should he do? (His strategy, by the way, is the same - he's going to buy another coin at $70k. But it's all about - time)

Out of 4680 days of being in existence, 4060 have been profitable.

If you had bought bitcoin at anytime you'd have a 88% chance of being above your buy in currently.

The 12% loss days have been from December 2020 onwards.

Let's revisit your friend and his situation in 3 years :)

Bitcoin is up 80% Q1 and has outperformed gold year on year. It's lost to Bitcoin -74% from April 2020 to now.

Gold is a loss, even against inflation. Bitcoin beats it in every aspect as sound hard money.

Let's write an article on Bitcoin?

OK. I don't think in such a binary way about gold vs BTC. In fact, I would say that those who have explored why gold has value may have deeper perspective about money than Johnny-come-latelys who own BTC.

I know people who own both BTC and gold. And I am one of those people. If you go "all in" on an asset class, all power to you.

The core bitcoin people understand money well. Gold is great hard money but it doesn't beat bitcoin in most of the aspects of hard money.

I just find it amusing that it's so rarely mentioned on this site but Gold is talked about often. May be just a generational thing or the fear of association.

I just find it amusing that it's so rarely mentioned on this site but Gold is talked about often. May be just a generational thing or the fear of association.

I hear you. If I had replaced all my gold holdings for BTC circa 2013, the returns would be mind boggling. But my conviction was not there and my hours were way <1000. More advanced than the normies but still needed to understand more things.

I suspect most NZers have little or no exposure to gold.

I almost bought Bitcoin when in was $250 per coin, right after the GFC. I set up the account and just never made the buy. At the same time, I was watching gold go up in multitudes and chose gold. I have no regrets, it's just what we choose. Some folks are more futurists, and some prefer to go by what history has taught. Bitcoin is new and Gold is over 5000 years old. I like history.

Gold is a crap investment. Even in times of high inflation it’s useless, currently worth less than Q3 2020 and worth much less in real terms. If Q3 2020 was a bad time to buy gold, when is a good time?

Gold is a crap investment. Even in times of high inflation it’s useless, currently worth less than Q3 2020 and worth much less in real terms

Possibly. But that's also a simple way of thinking. Depends on what you perceive an "investment" to be.

From the early 70s to early 80s, NZ house prices went nowhere. The gold price in USD 18x'd over same time period. Most people would have had zero gold holdings. In your perception, gold would not have been a 'crap investment.'

Sure it can be ok if you cherry pick the timespan. It took about 30 years after 1980 to get back to that 1980 peak, it was a terrible investment then!

it’s amazing how volatile it is looking at some charts, it’s all over the place.

I think most people don’t view hold as an investment. It’s more of an insurance policy.

Absolutely, most people holding gold (and perhaps Bitcoin) would not be holding it as an effective hedge against inflation. Since 1971 the world has functioned with the $US as the reserve currency, but with the $US not backed by gold or anything other than the US military. The gold price has been managed since then to remove any threat to the $US. The precious metals could be considered insurance in case the $US based financial system gets in trouble and the NZ banking system is collateral damage.

An article presented by the World Gold Council will not discuss the real reason why gold has underperformed over time – due to the control by the bullion banks of the LBMA and COMEX (paper) futures markets.

In the last year the US govt has applied sanctions to Russia after the Ukraine invasion and frozen the $US reserves of the Russian central bank. Other countries have looked sideways at this and now Russia, China, Saudi Arabia, Brazil and others have started to introduce trade using their own or the Chinese currency.

The details of how this plays out isn’t clear but the central banks are increasing their levels of insurance/diversifying their reserves.

https://uk.investing.com/analysis/central-banks-bought-1136-tons-of-gol…

by

wingman

|

8th Apr 23, 3:25pm

Which central banks bought gold? Mostly failed states, tyrants and dictators.

Warren Buffett

by

wingman

|

8th Apr 23, 9:58am

An insurance policy against what?

... against a complete financial armageddon ... worldwide bank failures , a great depression ... some people are perennial gloomsterisers ...

by

wingman

|

8th Apr 23, 1:16pm

In the event of financial Armageddon the last thing you'll need is a chunk of metal. You'll need an unencumbered house, a car with a good supply of petrol, maybe some land and livestock, plus a gun and ammo.

You can't eat gold. Both sets of my grandparents lost their houses and businesses in the Great Depression because they had debt.

... exactly ... my little bag of brown rice will be worth a fortune to survivors ...

Whereas the investors with their OTT multi $ million houses & gold bars ?

Them poor saps would starve ... luckily for them , armageddon is a < 1 % chance ...

Yes. I cherry picked the timeline to counter the prevailing narrative. 100%.

"Of all the contrivances for cheating the laboring class of mankind, none has been more effective than that which deludes them with paper money.” Daniel Webster (1782-1852)

Well , I've just exited the Golden Bear ( Mapua ) ... and the best gold is the old fav , a pint of Smoking Otter , followed closely by the Seismic ...

... if you must buy gold , buy beer ... it's a positive affirmation that the capitalist system is alive & thriving , whereas buying the metal gold is for the negative Nellies , the DGM's who believe the sky is falling ... good luck with that ... but regardless of wars , famines & pandemics , the human race picks itself up / dusts itself off / and resumes its inexorable technological advances ...

by

wingman

|

8th Apr 23, 9:41am

The WGC has a vested interest in selling gold. They ignore the fact that it has no income and new equipment like satellites, drones and modern earthmoving machinery can gear up and mine gold at a faster rate than any other time in history. Worldwide gold production is going exponential, something gold salesmen don't like to discuss.

You'll notice that gold is never priced in inflation-adjusted terms. Inflation-adjusted, the gold price in 1980 is over US$9,000. Do we discuss house prices in non-inflation-adjusted terms?

When interest rates rise investors get a better return on their investment - gold doesn't have a return, can you imagine punters buying gold when they can't pay the mortgage? Gold is being mined at a faster rate than the world population is increasing, so unless people keep buying more gold the price will inevitably decline.

Yes but they cant mine Gold as fast as the FED prints money!

by

wingman

|

8th Apr 23, 9:54am

Printing money doesn't cause inflation, because it it did Japan would have hyperinflation. They print more per head than any other nation. I'm not discussing failed states like Zimbabwe or Weimar Germany because they're different situations. Japanese don't go to the shops with a wheelbarrow of cash.

Printing money doesn't cause inflation, because it it did Japan would have hyperinflation. They print more per head than any other nation. I'm not discussing failed states like Zimbabwe or Weimar Germany because they're different situations. Japanese don't go to the shops with a wheelbarrow of cash.

No. Japan does not print money and hand out it to citizens.

Their money supply grew more slowly than just about any other country over the past 20 years. Corporate debt reduction offset monetized government deficits, resulting in 3% annualized broad money growth.

Japan has the lowest price inflation in large part because it has the slowest broad money supply growth in the world over the past 25 years.

https://twitter.com/LynAldenContact/status/1479185418314731522

The PBoC expanded its official gold holdings in March to 2,068 tons, worth about $130 billion at current prices. With $3.2 trillion in reserves, gold officially represents a little over 4% of PBoC reserves, although there are many who believe the PBoC may have more gold than they have reported. Given that China has been intervening indirectly through state banks, its total reserves are almost certainly much higher than reported, and it wouldn't be surprising if its gold reserves were too.

China nonetheless holds a lower share of gold in its reserves than most other countries. According to the BIS, gold represented about 7.4% of reserves for developing countries in 2020 and 19.9% for advanced countries (14.6% for the world). About one quarter of all gold reserves are held by the US, for whom gold comprises nearly two-thirds of reserves. Because the Fed rarely, if ever, intervenes, it's level of reserves overall is very low, equal to roughly 3% of US GDP.

https://www.bloomberg.com/news/articles/2023-04-07/china-expands-gold-r…

by

wingman

|

9th Apr 23, 10:01am

Japan has been printing...exponentially. No one cares how much gold any country has...only goldbugs. Most countries don't own any gold at all, and the ones purchasing gold are mostly dictatorships and tyrants.

https://www.youtube.com/watch?v=pw7E2b3fBaE

Japan has been printing...exponentially.

You don't know what you are talking about.

Over the past 20 years, the annualized rates of broad money supply increase per capita:

- United States: 6.2%

- Euro Area: 5.5%

- Japan: 2.9%

This is nothing more than an advertisement-the Gold council spruiking gold, so why is it allowed here?

I have no objection to articles on gold or any other commodity from knowledgeable commentators who present a rounded picture, but not this. I object.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.