Ask anyone what they think might be the most popular fixed interest rate term for a mortgage and I would suspect the most common answer is 'one or two years'.

And that would actually be right.

But new data just produced by the Reserve Bank shows that preferences actually move around more than you might imagine - or certainly have in the volatile past two years.

For example there was a period during that time when three-year fixed rates came close to being top of the pops. And very recently 18 month terms are having a good run.

All of which suggests that new mortgage customers are alert to what might be seen as the best offers at any given time.

A new data series from the RBNZ covers new lending or facilities actually loaded (IE taken up by the customer) in the reporting month and highlights the amounts of money taken up each month on the various fixed rate terms. This is different to some of the other data the RBNZ produces which reports mortgages from the time they are committed to - rather than the time they are drawn down, as per this latest series. See also this key points summary from the RBNZ.

It's part of a strongly expanded range of data the RBNZ has been producing in recent years. And for this observer, it's all good stuff enhancing the picture of what's going on in the mortgage market.

The data in this series begins from April 2021, with the latest month being for April 2023. It's now going to be issued monthly.

So, what we've got captured in this first data release is basically the start of the big run up in interest rates. The RBNZ's separate statistics recording the monthly average 'special' mortgage rates shows that the low point in the previous interest rate cycle was June 2021, after which the rates began a rapid ascent.

At the start of 2021 the one-year fixed mortgage rates were at an average of 2.37%, which by June of that year had dropped to 2.21%. These were the lowest rates, so, unsurprisingly were the most popular.

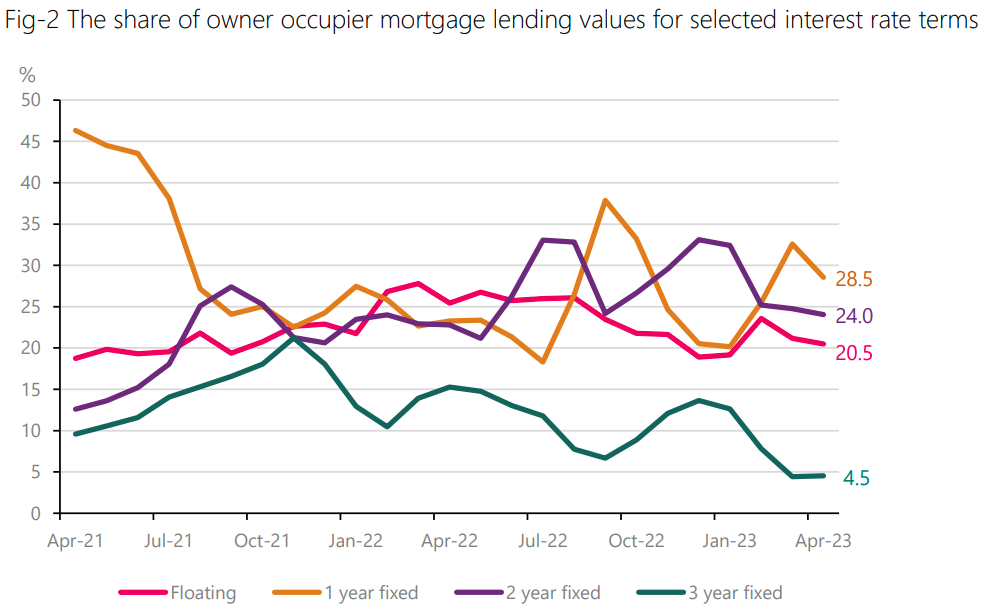

According to the new RBNZ data between April and June 2021 the amount of new mortgage money that was fixed for a year was in each of those months well over 40% of the total amount of mortgage money advanced. So customers clearly had an eye for the 'cheapest deal'.

However, with the glorious advantage of hindsight, it's well worth pointing out that that average fixed rate for five years during the early months of 2021 was only just above 3%, while three-year terms were offering under 2.75%.

It's probably I think fair to say that few people saw higher rates coming and even when the first very tangible signs started emerging in May 2021 that rates were going to rise there was public scepticism that this would materialise.

But certainly a reasonable number of new mortgage holders started to get the idea reasonably quickly.

As we got into the second half of 2021 and interest rates started to climb quite quickly (actually ahead of the first RBNZ hike to the Official Cash Rate, which was not till early October) then so more people did start to look for those more favourable longer rates.

Three-year fixed rates were still under 4% in October 2021 and they did suddenly gain in popularity. A bit of a crunch of the numbers shows that in April 2021 under 10% of the mortgage money that month (a little over $600 million) taken up by owner-occupiers for new mortgages was on three-year terms. By November 2021 that percentage had risen to 21.2% (worth $1.3 billion), which was actually the same percentage as for the two-year terms that month and only slightly less than the most popular one-year term with 22.5%.

Subsequently the three-year terms have fallen well out of favour and now with people anticipating that interest rates may start to fall again in the perhaps foreseeable future (very open to debate of course) the three-year terms as of April 2023 had been taken up in respect of just 4.5% of the $3.7 billion advanced to owner-occupiers for new mortgages that month.

As mentioned further up the article, when we went into this rising interest rate cycle owner-occupier mortgage customers were heavily favouring one-year terms, with over 40% of the monthly mortgage money advanced being for this term.

However, by the middle of last year and with the rising tide of rate rises, the amount being advanced for one-year terms had slipped below 20%. In July last year about a third of the mortgage money was on two-year fixed rates, which is the highest level for this duration seen in the data.

Subsequent to that, however, the banks started trimming some of the shorter durations and in response the one-year term became more popular again, with mortgage money on one-year terms rocketing back up to 38% in September 2022.

So, where are we now? Well, the data shows that in April 2023 there was $3.7 billion advanced to owner-occupiers for new mortgages. Of this 28.5% was for one-year fixed, while 24% was for two.

Interestingly, the long-avoided 18-month term has suddenly come into vogue. Through most of the past two years less than 5% of the total has been advanced on this term, but the term's having a surge and hit a new high of 17.9% in April. This has corresponded (presumably not coincidentally) with rates in the early part of this year at times being lower for 18-months than for one-year.

For me these figures are actually demonstrating quite a good awareness by the new mortgage customers of where the interest rates are, but crucially where they might be heading. It will be very interesting to see how trends develop over coming months, particularly with the RBNZ having now signalled at least a 'pause' in its OCR hikes.

One point of interest for me will be to see whether the move by some of the banks recently to have a three-year rate appreciably lower than the one and two year rates sees that duration become any more popular. As noted above, just 4.5% of the mortgage money advanced in April was for this term.

It will all depend, I suppose on where people think rates are heading and when. The eternal 'how long is a piece of string?' question.

20 Comments

when ....tangible signs started emerging...that rates were going to rise, there was public scepticism that this would materialise.

So nothing has changed then! And the irony is, it's probably just as obvious today that prevailing rates will look just as 'cheap' in the future as the 2021 look to us now. (NB: Let's remember that we were tempted with the notion that "Mortgage rates are going negative!" back then. And the same thinking applies today. Something about not using a bargepole to touch the best rates on offer)

I find it interesting that there isnt more appetite for the 6-month term. Its almost a floating rate mortgage, but priced 200 basis points lower.

I went for it a couple of weeks ago . It was 100 basis points above the one year , and I figured mortgage rates would have dropped at least a couple of hundred basis points in 6 months time.

but my main reason for taking short terms is the opportunity to pay down the motgage if possible regularly.Plus my uncertain circumstances over that period.

Small but very important correction ...

The RBNZ said it could take the OCR negative.

Nobody said "retail interest rates" would, or indeed could, go negative. These are like absolute zero or the speed of light - you may get close but they'll never be reached. Extreme pundits thought 0.25% was a possibility ... But think what that would have done! Can anyone - for one moment - think a for-profit bank will pay you to take a loan with them? The notion is rediculous.

quelle surprise

It turns out borrowers (and lenders) haven't been looking at affordability, risk, or long term servicing. They have been focused on maximising the amount borrowed by taking the cheapest rates they could get.

With nearly everyone maxed out at the start of the loan on the record low interest rates. I wonder what will happen next?

They will have to keep double incomes going by delaying/having less kids.

Delay kids? They will need more of them to go out and work to cover the mortgage.

Indeed. Perhaps to many are listening to TA and have an expectation that rates are going to drop back to emergency panic levels after the election.

Noncents, you're missing the point of this article, it's not about how much borrowers have borrowed, it's about them actually being reasonably savvy in choosing their fixed rate terms.

The header to this article clearly suggests the low hanging cherries of yesteryear were laced. The naive must now put up and swallow.

Or get bailed out like our friends in Hawkes Bay?

How? By lowering interest rates? Do this now will cause our dollar a freefall. Inflation will take off causing even higher interest rates in the longer run. It would invite chaos.

Wow the uptake in 3 year fixed mortgages was really really bad even when the writing was on the wall, still even if you did get on one it will probably be rolling over within the next 12 months. Anyone who managed a 5 year will be saving a massive amount of money every week now.

Fixed til May 2026 here. Pretty much the only outgoing that isn't skyrocketing right now.

I know people who refixed 3 years last year.. they're happy with the 'savings' except that all their other bills have continued to grow...

They have no excess cashflow, and if things turn bad, they can "sell a house and be mortgage free" - not realising that if others are in the same boat, that house might be a) difficult to sell, and/or b) worth a lot less than they thought - unlike the mortgage[s].

Zwifter, I fixed for 3 years at 2.89% in August 2021.

Sorry about that its 14 months to go not less than 12 months. Still pretty obvious now that 5 years in the low 3's was the better option.

Given the pay demands that are in the offing, here and across The Tasman, how likely is it that CPI won't keep going up? Not very, and the RBA acknowledges that:

We will get ourselves into trouble if we accept the premise that all workers need to be compensated for inflation. If we accept that premise, inflation at 7% and wage rises match that, what do you think inflation will be next year? It will be higher again and then we will have to have higher wage increases again. We are in a difficult position where society wants to protect the lowest paid workers but we have got to make sure that the higher inflation doesn’t translate into higher wage outcomes for everybody because if that happens, the inflation persists and we will be in the world... that we’re trying to avoid.

Subsequently the three-year terms have fallen well out of favour and now with people anticipating that interest rates may start to fall again...

That's essentially been the case from the beginning. Transitory inflation went from a few months, to a few quarters and to now a few years. What we are actually seeing is that few people have any insight into the origin and nature of inflation, just as few had any insight into deflation in the decades prior to Covid-19.

For me these figures are actually demonstrating quite a good awareness by the new mortgage customers of where the interest rates are, but crucially where they might be heading

I was thinking the same whilst reading your article, I was a bit surprised but I think that's very good.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.