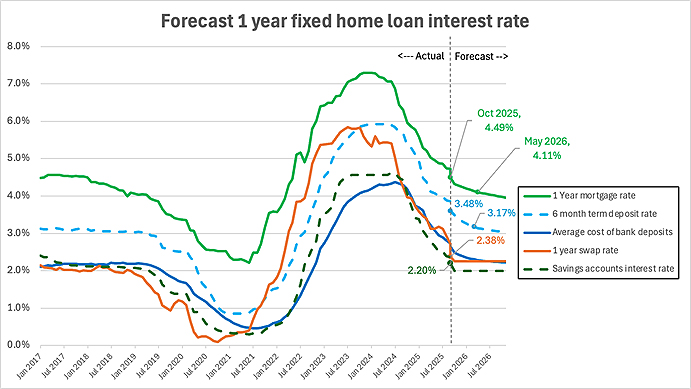

If the OCR eases to 2.25% in late November, it’s likely we’ll see the one-year fixed mortgage interest rate fall to (just) below 4% in early 2026.

This conclusion is based on Squirrel’s modelling of Reserve Bank-sourced retail and wholesale interest rates over the last eight years[1].

The catalyst for further reductions will be the banks continuing to lower their term deposit interest rates, and the gradual flow-through to lower overall bank funding costs.

The model forecasts the one-year fixed home loan rate will decline to around 4.1% in early 2026. Our experience indicates that, sooner or later, a bank won’t be able to resist offering a headline rate of 3.99%.

How looking back can help us to predict the future

You have to remember that, in New Zealand, our banks are answerable—first and foremost—to their (largely) overseas shareholders.

The ultimate goal is always maximising profits.

Now, if there’s any upside to that at all from a customer perspective, it’s that it makes the banks fairly predictable in terms of how they respond to movements in interest rates. At the end of the day, they’ve got to protect their underlying margins.

As a rule, they also always tend to move together (which is typical of an oligopoly)—although there will be leads and lags, of course, which vary depending on whether interest rates are going up or down.

Using historical wholesale interest rate data from the Reserve Bank, spanning the last eight years, we’ve built an AI model to help us predict where retail interest rates might end up in the event of future OCR cuts.

Looking backwards—the outputs of the model are pretty consistent with what we’ve seen in reality, in terms of how wholesale rates fluctuations have flowed through to actual mortgage rates in market.

Looking ahead—and assuming economists (and the wider market) are right in thinking the OCR will drop to 2.25% in late November—the model shows that we’re likely headed for a sub-4% one-year fixed mortgage rate sometime early next year.

How do we know?

There are a few key factors which play into what happens with the one-year fixed home loan rate.

Firstly, there’s the one-year wholesale interest rate a.k.a. the swap rate.

Since it’s quite short-term, it essentially reflects what the markets expect the average Official Cash Rate (OCR) to be over the next 12 months. As this one-year swap rate rises and falls, the one-year fixed home loan rate typically follows suit.

Secondly, there’s the cost of deposits that banks hold from households and business customers.

The banks, rather than the wholesale markets, set these rates, but they’re always heavily influenced by both the OCR and other short-term wholesale interest rates (from 3 months up to 12 months).

These bank deposits fall into three categories:

- Transaction account balances—currently at $130 billion, with $40 billion from Kiwi households (and generally earning zero interest).

- Savings account balances—currently totalling $115 billion, with $80 billion from households, most of which is earning between 0.05% and 2.5% (and earning an average of 1.7% before our latest 0.5% OCR cut).

- Term deposit balances—approximately $230 billion today, with nearly $150 billion from households. These deposits have fixed terms, mostly ranging from three months to one year. The interest rate is locked in, so it takes some time for the entire portfolio of bank term deposits to ‘reprice’ — i.e. to adjust based on a higher or lower OCR.

Term deposits are the biggie in this mix, making up about 50% of bank deposits, and the interest rate usually moves in line with wholesale interest rates.

Over the past eight years, data from the RBNZ shows an average margin of +0.7 % between wholesale interest rates and the six-month term deposit rate.

This means that banks, on average, pay retail customers more than they pay wholesale customers.

Back to the modelling

What we’ve done is input all those historical actual interest rates and forecast wholesale interest rates—based on a 2.25% OCR in late November—and asked our AI model to predict what will happen with savings account interest rates, term deposit rates, and the overall cost of bank deposits through to December 2026.

Then we’ve taken the overall cost of bank deposits and the one-year swap rate, and forecasted where the one-year fixed home loan rate will land.

The answer is a one-year fixed home loan rate just above 4% in early 2026.

So why is 3.99% our pick?

Like many retailers, banks love a price that ends in “.99”.

It’s a psychological tactic called ‘charm pricing’—which says that, at a glance, 3.99% sounds like a far better deal than 4.00%.

We reckon that if the one-year mortgage rate drops close to 4.00%, sooner or later one of the banks will want to claim bragging rights to a rate below 4.00%.

And then, before you can say ‘oligopoly’, every other bank will follow

As for the term, although several banks currently offer both one- and two-year fixed interest rates at 4.49%, we believe that if the OCR is cut to 2.25% in November, economists will start to worry about when the Reserve Bank might raise the OCR.

This will keep the two-year rate higher than the one-year rate.

We saw this post-COVID when the one-year fixed home loan rate got down to a low of 2.1%, while, at the time, the two-year rate was 2.5%.

A sub-4% mortgage rate will be good for the economy

The New Zealand economy has been pretty stuffed for the last two years. And that’s putting it mildly.

From a global perspective, it’s lonely having a shrinking economy. Most western countries have managed to remain in positive economic growth territory even as they’ve fought (and won) the battle against inflation.

Squirrel’s view is that the Reserve Bank seriously overdid things in hiking interest rates in order to get inflation back down to its target band, and we’ve been vocal with that view for more than two years.

What the Reserve Bank lacked was patience, and in doing so, they pushed the OCR too high without allowing time for the OCR increases to flow through to the real economy.

Would a sub-4% mortgage rate re-ignite inflation?

Our view is no. Instead, we’d argue that it would create the environment for a steady economic recovery.

Three years ago, Kiwi homeowners were paying an average rate of 3% on their mortgages. Even with the forecast changes in interest rates, the rate in 2026 will still be nearer 4.5%.

That’s not low enough to ignite a mad dash to spend, and push up inflation in the process.

It might sound strange coming from a company like Squirrel—where the housing market is our bread and butter—but the best scenario for our country is one where we aren’t constantly (and completely) obsessed with interest rates and house prices.

A bit of stability is just what we need—giving us all room to go about the business of rebuilding our battered economy.

[1] The forecast was derived using an ARIMAX(1,0,0) time-series model trained on historical periods of falling interest rates, with the average cost of bank deposits and the 1-year swap rate as exogenous predictors.

David Cunningham is the chief executive of the Squirrel Group ("Chief Squirrel").

22 Comments

I've said it before, house prices will resume to rise in 2026. Most don't realise the long lag between rate cuts and their effect on house prices.

It's due to the triple effect of;

1) lower borrowing costs to buy houses

2) a negative return after tax and inflation for term deposits, some of which will therefore flow into RE

3) an overall improving economy by 2026 due to the roughly 3% drop in intetest rate from peak.

Sellers do not push prices up, buyers pull them up.

Right now, there are not enough buyers to pull anything up, way too many sellers wanting to sell who keep lowering their prices towards the few buyers. Yvil where are you cashed up buyers going to suddenly come from?

Or do you think the sellers will have a change of mind and withdraw their listings.

I said "house prices will resume to rise in 2026", to which you replied "Right now, there are not enough buyers". Notice the difference it timeframe.

ahhhh, buyers will grow suddenly on the magic buyers vine

got it, your belief is based on magic and juju sticks

ahhhh, buyers will grow suddenly on the magic buyers vine

got it, your belief is based on magic and juju sticks

Sounds like senior management at Rockit apple

if sent apples, make cider

Did you say the same thing about 2025?

I agree with you by the way. But only if immigration picks up (which it probably will if economy improves)

Housing will be come trendy again... wait & watch the sheep follow each other into the auction rooms and pump prices.

the bleating will not help nifty you need more sheep and in NZ sheep numbers are declining

You are dreaming mate!!!

The NZ housing Ponzi is Poked. Belief in its magic money making powers is shot to pieces and had its day.

Expect lower prices in 2026 and then a flat few years ........ the ponzi punters have been hoodwinked by the past 40 years, upto 2021..... but I think you are buggered now

.

The NZ housing Ponzi is Poked. Belief in its magic money making powers is shot to pieces and had its day.

That's as contrarian as you can get at every BBQ across the motu. To suggest the Ponzi has had its day is challenging everyone from the ruling elite to academia to the pointy heads at the central bank and bureaucracy right in to the suburbs.

Nope, I did not say that house prices will rise in 2025, because it was obvious they were not going to. Commenters who ridicule me like ITG and Gecko will have to ear their words in 2026, but they probably will not want to remember today's posts.

I fear you're right and hope for the sake of society that it's just a gentle 2-3% rise and nothing silly.

I refix in Jan. 3.99% would be about 0.5% better than I was expecting a few months ago.

will you rush out and buy a second house on the back of this windfall....

safe as houses you know

Nope, will just increase the principal. But maybe I will when its paid off quicker.

That is exactly the play. I will be doing the same.

I won't be at all surprised if mortgage rates end up back at Covid levels if we don't see some economic traction soon.

Yes but it was easier to fan the fire during Covid then try to restart a fire after RBNZ poured water all over it,

with 5.25% ocr all over the fire. Diesel is great to keep a fire burning, but crap when trying to light a fire.

Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than on a mathematical expectation, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits – of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities - Keynes

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.