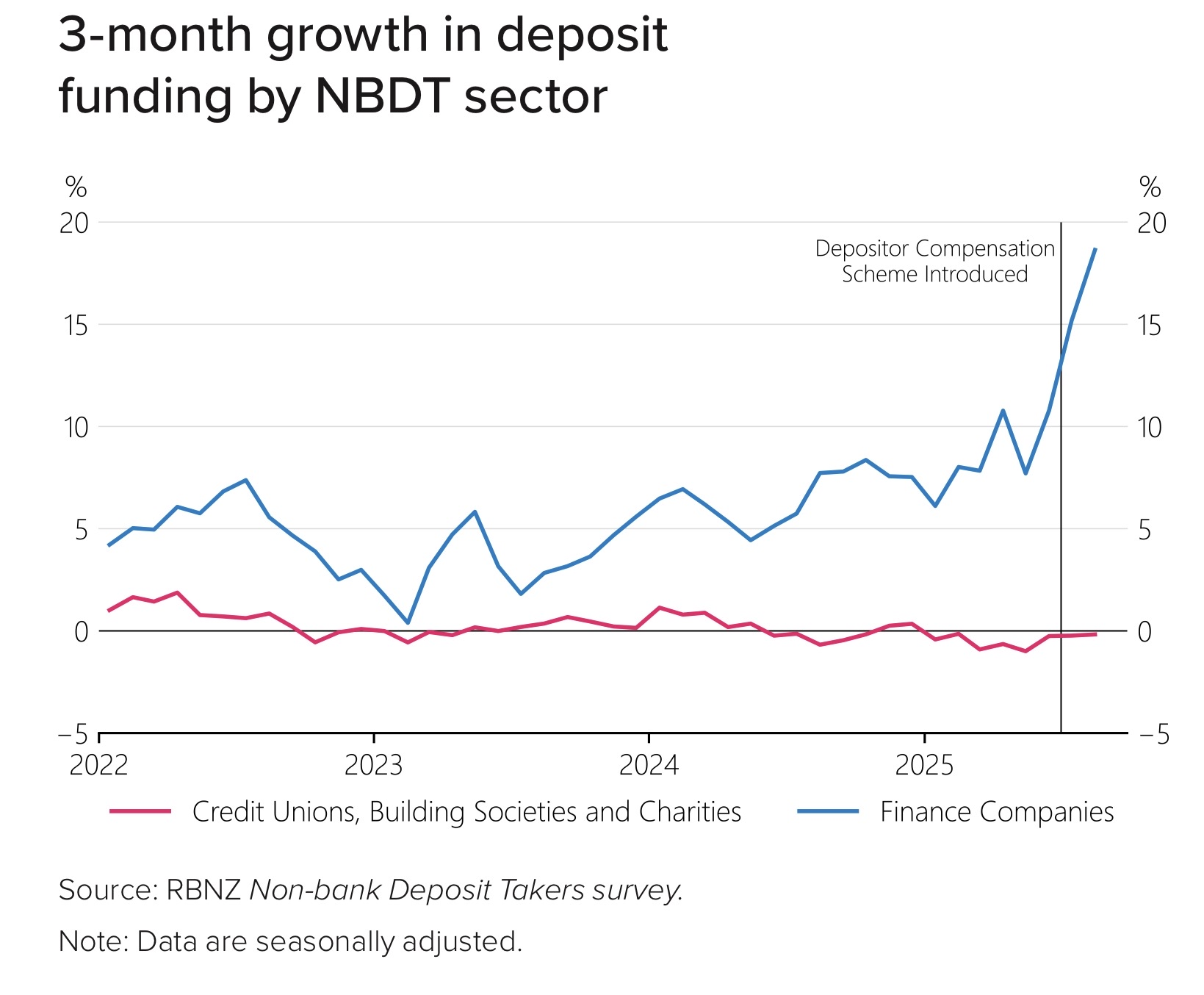

The Reserve Bank's noticed that some non-bank deposit takers (NBDTs) have had both an increase in deposits and in the amounts they lend out for mortgages since the Depositor Compensations Scheme (DCS) was implemented.

The DCS, introduced on July 1, protects eligible depositors' funds against losses of up to $100,000 per institution. The banks are included in the scheme, but so are NBDTs as well.

In its latest six-monthly Financial Stability Report the RBNZ said the implementation of the DCS had not materially affected bank deposit flows or their pricing behaviour so far.

However, some NBDTs have reported an increase in deposit inflows, as depositors spread their deposits to maximise their coverage.

"This has also coincided with a sharp reduction in the differential between their deposit rates and bank rates. We remain at an early stage of the DCS and will continue to monitor developments," the RBNZ said.

The central bank said that the spread between term deposit rates offered by banks and NBDTs had narrowed because the premium that NBDTs need to offer to attract funds has decreased.

Finance companies have used the extra deposits to expand low loan-to-value ratio (LVR) mortgage lending.

The RBNZ report notes New Zealand’s NBDT sector consists of building societies, credit unions, and deposit-taking finance companies.

"With a total lending of $2.3 billion or 0.4% of total bank lending, the sector is very small relative to the banking sector, but provides services to a relatively large and diverse customer base.

"Lending by finance companies has continued to grow over the past six months. These entities tend to lend in areas where there is less active competition from banks. In contrast, growth in lending by credit unions and building societies has been subdued for the past three years, reflecting weak economic conditions, competition from banks, and the previously high interest rate environment."

'It was something the RBNZ expected'

Aske about the growth in deposits, and increased mortgage lending by the NBDTs since implementation of the DCS, RBNZ Governor Christian Hawkesby said the development was something the RBNZ had expected to happen given the broad range of deposit takers that have coverage.

"We were expecting to see some flows from those larger deposit takers into smaller deposit takers who are providing a higher interest rate as people spread their risk but also spread their exposure to the scheme. So that is something that we did expect to happen, something that we have been monitoring.

"It is reasonably small scale in terms of when you think about the size of the deposit market in its totality. It's a reasonably modest flows that are happening at this point."

Hawkesby said "what you want to watch out for" in those situations is where small deposit takers have so many deposits coming in they don't know what to do with them and they end up lowering their lending standards "and therefore creating more risk than they can manage".

"What we've actually seen is a relatively conservative approach. So, the deposits are coming in, they are expanding their lending - but to low loan to value mortgages and not high loan to value mortgages and putting their money into other assets such as government bonds," he said.

"We'll continue to monitor that closely just as part of our surveillance of the transition into this new world."

At the moment, as part of work on the Deposit Takers Act, to support competition in the deposit-taking sector, the RBNZ is consulting on the proposal to authorise all licensed deposit takers (including NBDTs) to use restricted words such as ‘bank’ or ‘banking’ in their name.

"Our preferred option is to authorise all licensed deposit takers to use restricted words in their name or title. Combined with the DCS, this proposal supports a more competitive playing field for deposit takers of different sizes," the RBNZ says.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.