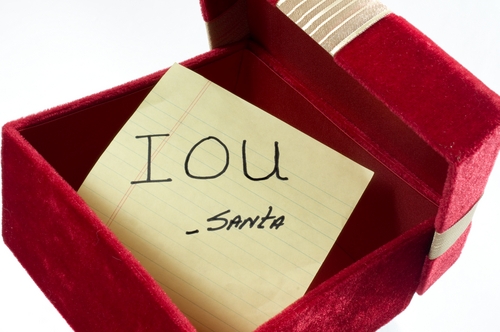

Be careful how much you spend on presents for the nearest and dearest this Christmas - because chances are they're being very careful, nay parsimonious, about how much they plan to spend on you.

The monthly BNZ-Nine Rewards Consumer Trends Survey threw in an extra question this month about whether people were planning to spend more or less on Christmas presents than last year.

BNZ's chief economist Tony Alexander said that of the 550 responses, 86 said they intended spending more, 177 less, and 287 same, making a net 17% planning to spend less this Christmas shopping period than last year.

"This result suggests that retailers need to be cautious in their expectations for sales this year and especially take care when listening to daily or weekly reports on electronic transactions numbers and values as December progresses. These data have a historical tendency to over-state what is really happening," Alexander said.

Elsewhere among the survey results, Alexander said it had found a continued high level of optimism about the economy going forward and firm spending intentions "in what is probably a seasonal jump".

"A net 30% of the 550 respondents are optimistic about the economy, little changed from 35% last month and 29% in October. A net 47% plan boosting spending in the coming month. This sounds strong, but of course heading into Christmas it is only natural that consumers will plan to spend more than they spent in November."

Meanwhile figures released today by payments provider Paymark, which processes around three-quarters of NZ's electronic transactions, showed spending through the Paymark network over the first seven days of December increased 8.6% on the same time last year. This followed a 6.8 per cent annual growth in spending between November 2013 and November 2012.

Paymark Head of Customer Relations Mark Spicer said the increase in spending showed that momentum was building towards the final Christmas countdown.

"Anecdotal commentary from retailers suggests the figures are supported and Kiwi’Kiwis are beginning to get out and about to collect their Christmas supplies. However, there is still a way to go before the big Christmas rush sets in." Spicer said.

And in anticipation of the Christmas spending rush, the body representing the banking industry is warning about the potential dangers of fraud and scams over the summer season.

"Don’t let fraudsters spoil this special time of the year. Whether we’re shopping or away on holiday, it pays to take care,” New Zealand Bankers’ Association chief executive Kirk Hope said.

The association gives the following tips:

Card safety:

· Guard your card. Treat it like cash. Don’t leave it lying around. Make sure you know where your card is at all times. · Protect your PIN. Never tell anyone your PINs or passwords – not even the Police, bank staff, friends or family. · Cover up. When entering your PIN number at ATMs and EFTPOS terminals, shield the PIN pad with your other hand. Criminals may ‘skim’ your card details by attaching a device to the card reader, and then ‘shoulder surf’ or use hidden cameras to record your PIN.

When shopping and banking online:

· Logon to internet banking by typing in your bank’s full web address. Do not use links that appear to take you to your bank’s website. · Check you have a secure connection, which is shown by a padlock symbol somewhere on the page, and that the website address starts with ‘https://’. The ‘s’ stands for ‘secure’. · Avoid public computers and public Wi-Fi for internet banking, e.g. internet cafes, libraries or hotels. · Protect your identity information and only provide it to trusted people and organisations. This includes your date of birth, address, driver’s licence number and passport details. · Shop with trusted retailers. Before you provide personal information make sure they will protect that information. · Keep your anti-virus and firewall software up to date. If you use your mobile phone for banking:

· Only download apps from trusted sources · Keep device operating systems up to date, and update apps when prompted · Use your phone’s password lock feature · Shield your passwords from people around you · Change your passwords periodically, and make sure they are not easily guessable · If available, use anti-virus software · Contact your bank immediately if you lose your phone.

“If you’re planning to travel overseas, it’s a good idea to tell your bank. That way, transactions you make in another country won’t surprise your bank. It’s also important that your bank has up-to-date contact details in case they need to get hold of you,” Hope said.

Hope also cautioned people to be aware of so-called “phishing” scams.

“Online scammers use a range of ways to trick people into handing over personal information, usually by phone or email. Once they have that information, such as your account number, log-in details, or password, they can access your identity and your money.”

How to avoid phishing scams:

· Don't give out account details over the phone unless you made the call and you trust that the number you called is genuine. · Don’t reply to, click on any links, or open any files in spam emails. Don’t call any numbers in spam emails. · Never send your personal details or accounts or passwords in an email. · Check your statements. Advise your bank immediately of any unauthorised transactions. · If you suspect you’ve been taken in by a scam, contact your bank immediately.

“As well as protecting yourself from financial crime, you can also help keep others safe by reporting anything you know about frauds and scams to the Police or anonymously through Crimestoppers,” Hope added.

Crimestoppers is an independent charity that allows anyone to report crime anonymously by phone or online. More information is available at http://www.crimestoppers-nz.org/.

1 Comments

In our household we were discussing the Xmas Gift issue........

We came up with a small list of what we thought provided a beneficial Xmas gift ideas.

Principal payment on your kids mortgage - depends on how they are structured.

Rent Payment/s

Power account payment/s.

Grocery vouchers.

We felt any payments on this list provided many benefits.......

A reduction in any basic daily payments is practical as the receiver of the gift is free from spending their money on the particular basic item or mix of items.

The receiver if they have other goods or servicers that they really want can use their money to purchase or save towards the goods or service they really want as one of the basic items has been taken care of.

Money is not wasted on some trivial goods or services due to the need/desire to give at Xmas.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.